What is 6-NDFL?

You must report for withheld and transferred personal income tax.

To do this, every quarter employers submit a 6-NDFL report. Until 2022, we also submitted an annual 2-NDFL report, which included certificates for all employees. Now the separate 2-NDFL report has been cancelled, and the data from it is included in the 6-NDFL report for the year. In addition to employee salaries, personal income tax must be paid on other income that individuals receive from you:

- remuneration under civil law contracts,

- dividends,

- interest-free loans,

- gifts, the total value of which exceeds 4,000 rubles during the year.

If the physicist received income from you at least once during the year, you need to submit 6-NDFL.

In the report, indicate general data for all physical entities. persons who received income from you. Provide information about each employee in the appendix to the annual report 6-NDFL.

Submit 6-personal income tax in Elba in a few clicks: this opportunity is included in the trial period of 30 days.

Report form 6-NDFL

Rules for filling out 6-NDFL

Data to be reflected on line 140 (formerly line 040) 6-NDFL

According to Art. 210 of the Tax Code of the Russian Federation, tax is calculated as a percentage of the tax base. In this case, the tax base is the total income of the taxpayer, reduced by the amount of deductions provided in accordance with the Tax Code of the Russian Federation.

The main interest tax rates for residents currently in effect are as follows:

- 13% - this may be salary, remuneration under civil partnership agreements, income from the sale of real estate or some other income;

- 15% - rate on income over 5 million rubles;

- 35% - from the amount of savings on interest when receiving borrowed funds in terms of exceeding the established amounts.

Our section “Personal Tax Rate” will help you understand the general picture of personal income .

The calculation formula for calculating tax by a tax agent is simple:

(Individual's income - Deductions provided) × Tax rate for this type of income

It is this amount that will appear in line 140 (previously 040) of the 6-NDFL calculation. That is, in relation to the report it will look like this:

(Page 110 – Page 130) × Page 100 / 100 .

If the calculated indicator does not coincide with the specified amount, this will not always be an error. The tax is calculated in full rubles. According to rounding rules, the tax amount is less than 50 kopecks. is discarded, and 50 kopecks. and more is rounded to the nearest ruble (rounding error). A discrepancy in any direction of up to 1 ruble is acceptable. for each individual.

For example, if on line 120 “Number of people” you have 54 people indicated and during the reporting period income was paid 3 times, then the amount on line 140 for the 1st quarter may be 162 rubles. differ from that calculated by the formula (54 × 1 × 3).

IMPORTANT! But if the discrepancy exceeds the maximum error, then the tax authorities will consider that the amount of accrued personal income tax is underestimated or overestimated. This will result in a letter asking for clarification and an adjustment calculation.

How to do this, see our article “How to correctly fill out the clarification on form 6-NDFL?” .

After filling out lines 100–155, you can move on to line 160 (previously page 070), which will summarize the withheld tax.

IMPORTANT! The amounts of calculated and withheld taxes (lines 140 and 160, respectively) may not coincide. This is possible if some income has already been accrued, the tax on it has been calculated, but the income has not yet been paid. For example, in a situation where salaries are accrued in one quarter and paid in the first month of the next quarter.

Let's compare the tax calculation dates and the withholding dates.

| Income | Tax calculation deadline | Tax withholding period |

| Salary | Last day of the month worked | On the day of payment in cash |

| Payments upon dismissal | Last working day | On the day of payment |

| Sick leave and vacation pay | On the day of payment | On the day of payment |

| Dividends | On the day of payment | On the day of payment |

| Travel expenses (not documented, “extra daily allowance”) | Last day of the month of approval of the advance report | On the day of salary payment for the month in which the advance report is approved |

| Income in kind | On the day of transfer of income | On the day of payment of the next income in cash |

Thus, we see that the dates for tax calculation and withholding do not coincide quite often. This means that inequality between lines 140 and 160 is common.

More information about the dates of receipt of income is described in the article “Date of actual receipt of income in form 6-NDFL”.

To learn how to reflect dividends in 6 personal income tax, read the article “How to correctly reflect dividends in form 6-personal income tax?”

Deadlines for submitting 6-NDFL

6-NDFL should be submitted once a quarter:

- for the 1st quarter - until May 4,

- for half a year - until August 1,

- 9 months before October 31,

- for a year - until March 1 of the next year.

If you paid an individual for the first time only in the 2nd quarter, submit 6-NDFL for six months, 9 months and a year.

Anton is an individual entrepreneur and works alone. In June, he turned to a copywriter who wrote 5 articles for the site. Everything was formalized under a copyright contract. Anton paid 10,000 rubles to the copywriter and 1,495 rubles in personal income tax to the state. In July, Anton needs to submit 6-NDFL for six months, 9 months, and then report for the year.

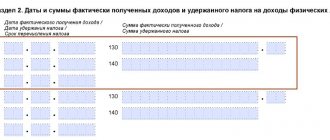

What information does lines 130 and 140 of the 6-NDFL declaration contain?

In lines 130 and 140 of section 2 of form 6-NDFL, information about the total income of the company’s employees is recorded. In this case, the amount excluding withheld taxes is placed in line 130, and the entire tax deducted from this income is entered in line 140.

In the reporting process, it is necessary to remember that the amount of employee income for the month entered in line 130 will correspond to the amount of actually accrued income only if it is completely tax-free. This point is explained in more detail in the Letter of the Federal Tax Service of Russia dated December 15, 2016 No. BS-4–11/.

How to fill out section 1 of the 6-NDFL report?

Indicate only those payments for which the personal income tax payment deadline falls within the reporting quarter, separately for each month.

Line 020 is the tax withheld for the quarter for all employees. This is the sum of rows 022.

Line 021 – tax payment deadline. In this line, indicate the date by which personal income tax must be transferred to the budget. For wages, calculation upon dismissal, payments under GPC agreements and dividends, this is the next working day after the date of payment. For vacation and sick pay - the last day of the month in which they were issued. If you paid an employee’s salary on March 10 and transferred personal income tax to the budget on the same day, then indicate March 11 in line 021.

Line 022 - the amount of personal income tax withheld.

General principles for forming the 1st section of the form

Starting with reporting for the 1st quarter of 2022, a new form 6-NDFL is used (approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] ).

This form is radically different from the previous one: sections 1 and 2 have changed their purpose, and accordingly, the content of all lines of the report has changed. Based on the results of 2022, form 6-NDFL is valid in a new edition. We recommend using the sample from ConsultantPlus. Trial access to the system is free.

In the previous form 6-NDFL, approved. By order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] , line 140 was intended to reflect information about the amount of withheld tax to be transferred to the budget on a certain date.

From the 1st quarter of 2022, line 022 is intended for this, which is an integral part of the information blocks that form the 1st section of 6-NDFL. Each block is intended for entering into the report information about the deadline for transferring personal income tax to the budget and the amount of tax. The structure of the block consists of lines with serial numbering from 021 to 022. Data is posted into the block in a certain sequence:

- first, line 021 indicates the day no later than which the personal income tax shown on line 022 (formerly page 140) must be transferred to the budget (taking into account the norms of Article 226 of the Tax Code of the Russian Federation);

- after that, in line 022 (previously page 140), you must indicate the amount of tax withheld from the payment for which the block is being filled out.

Thus, the indicator for line 022 is interconnected with the characteristics of filling out other lines in each specific report.

ConsultantPlus experts have prepared step-by-step instructions for filling out the new form 6-NDFL. You can get trial access to K+ for free.

How to fill out section 2 of the 6-NDFL report?

Summarizes data for all months of the reporting period - from January 1 to the last day of the reporting quarter.

Line 110: indicate the income of individuals from the beginning of the year - before personal income tax was deducted from income. For the second quarter - salary from January to June, including salary for June, which you paid already in July. Vacation pay and sick leave benefits paid from January to June - it doesn’t matter for what period. Other income that the physicist received from January to June and from which you must withhold personal income tax.

Lines 111, 112 and 113 are responsible for different types of accruals: dividends, payments under employment contracts and under civil servants' agreements. Enter total amounts since the beginning of the year.

Line 120 - the number of people whose income you reflected in 6-NDFL.

Line 130 - the amount of deductions for income from line 110. For example, children's, property, social deductions.

Line 140 - the amount of personal income tax on income from line 110.

Line 141 - the amount of personal income tax only on dividends, if they were paid.

Line 150 - fill in if there are foreign workers with a patent.

Line 160 is the amount of personal income tax that has been withheld since the beginning of the year. It may not coincide with the amount in line 140. For example, it is not possible to withhold personal income tax until the end of the year, or income was received in one quarter, and tax was withheld in another.

Line 170 is personal income tax, which you will not be able to withhold until the end of the year. For example, personal income tax on a gift worth more than 4,000 rubles to a person who does not receive cash income from you.

Line 180 - fill out if you withheld more personal income tax than you were supposed to.

Line 190 - fill in if tax was returned to employees.

You can submit a report on paper if you have no more than 10 employees. And only electronically - if there are more than 10 employees.

Initial information about line 140: where it is located in 6-NDFL and how to fill it out

In 6-NDFL, line 140 “Tax amount calculated” is located in section 2:

For line 140 the following filling rules apply:

What does the term “calculated tax” mean, for which line 140 is intended in 6-NDFL, and by what rules does tax legislation require it to be calculated, we will explain in the next section.

Rules for filling out lines 130 and 140

It should be kept in mind that line 130 is part of the information blocks of the second section of form 6-NDFL. In order to fully understand the rules for calculating personal income tax and the procedure for reflecting information in lines 130 and 140, you should refer to the order of the Federal Tax Service of the Russian Federation No. ММВ-7–11/.

How to fill line 130

The order mentioned above provides a detailed procedure for entering data into the lines, and also clarifies that line 130 includes all income received by the employee (before deducting personal income tax from it). This income is paid on the day recorded in line 100.

The tax agent must enter in line 130 the generalized amount of income received without deducting withholding tax

Line 130, intended to reflect the income of individuals, is fraught with a number of difficulties for accountants when entering data into it. The fact is that each line 130 present in 6-NDFL was created using machine-readable code, and to reflect the total income of employees there are only 17 cells into which indicators in rubles and kopecks must be entered. Therefore, large companies may have a situation in which the available cells to reflect total income are not enough.

Line 130, like any line present in 6-NDFL, is encoded and designed to reflect special information

Data for line 140

Line 140 of the second section indicates the amount of tax withheld from any payment that exists in the report. This line is also included in the information blocks of the second section of the 6-NDFL form, numbered from 100 to 140. To avoid confusion, the information should be placed there in the correct sequence:

- first, line 100 indicates the day individuals received income payments from the enterprise (taking into account the norms of Article 223 of the Tax Code of the Russian Federation);

- then line 130 shows the actual amount of payment received on the day indicated on line 100 (in full, including personal income tax);

- then in line 110 the day is entered when personal income tax must be withheld from the payment, information on which is entered in line 100 and line 130 (in accordance with the requirements of Article 226 of the Tax Code of the Russian Federation);

- after this, in line 140 you must indicate the amount of tax withheld from the payment for which the block is filled out;

- Finally, line 120 of the report reflects the day no later than which the personal income tax shown on line 140 must be transferred to the budget.

It turns out that the data in line 140 is interconnected with the data in other lines.

Reflection of different types of income

In the process of work, situations often arise when an employee receives different types of income at the same time - this could be:

- payment of part of the salary;

- payment of sick leave.

Then the tax withheld from them is transferred on different dates. In such cases, information about events is entered in lines 100–140 separately.

It is known that document 6-NDFL is drawn up on an accrual basis, however, some information in the report should take into account data for previous quarters. It must be borne in mind that this rule applies only to section 1 of the report. Section 2 contains the amounts of payments to employees that took place exclusively in the previous three months of work.

Line 140 in form 6-NDFL is drawn up as amounts of income and payments that took place only in the previous quarter

What information to provide if tax was not withheld from the payment?

According to the comments of the Federal Tax Service, set out in Letter No. BS-4–11/ dated August 1, 2016, the absence of a direct fact of tax withholding should be taken into account. If it was not there, 0 is recorded for these payments in the second section on line 140.

However, in practice, a situation often arises when it is necessary to reflect partially non-taxable income - such as financial assistance exceeding 4,000 rubles, or, for example, daily allowances exceeding established standards.

In this case, in line 020 you need to enter data on the total amount of accrued income. Further:

- the non-taxable part of income is entered in line 030;

- line 130 records the entire amount received by the employee (including calculated tax);

- line 140 reflects the amount of personal income tax withheld from the taxable portion of income.