When do people go on maternity leave in general?

A pregnant woman is an object of increased care and attention of the state.

The regulations for taking maternity leave (Maternity leave) are prescribed in labor legislation (Article 255 of the Labor Code of the Russian Federation). If the pregnancy proceeds normally, without complications, maternity leave begins 70 days before the onset of childbirth and ends after the same period after the birth of the child.

When the duration of pregnancy is 30 weeks, the expectant mother receives a sick leave certificate for all 140 days required by law. The procedure for issuing it was approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n.

Not every medical worker has the right to issue sick leave, but only:

- obstetrician-gynecologist,

- general practitioner or family doctor (if there is no obstetrician-gynecologist),

- paramedic (in the absence of previous specialists).

You can find out more about how the B&R benefit is calculated from the articles in the section “Procedure for calculating maternity benefits.”

An example of calculating the number of days of maternity leave in 2022

Let's give an example of how maternity leave is calculated. If a pregnant employee decides not to go on maternity leave in the 30th week because she feels well and would like to continue working, then, having taken leave 10 days before the birth, which occurred on May 21, 2022, she must return to work from leave after 70 days after birth - 07/31/2022. That is, the duration of leave under the BiR will be only 80 days.

Then this employee, having returned to work on July 31, can write an application on the same day for leave to care for the child she gave birth to. At the same time, after going on vacation, she can continue working on a part-time basis.

How long does it take to go on maternity leave in special situations?

If the doctor determines that more than one child is expected, sick leave is opened from the 28th week of pregnancy. The postpartum period in this case will last not 70, but 110 days.

If it is not possible to determine that the child is not 1 before the birth, the leave is increased by 54 days after multiple births.

Those living in an area exposed to radiation are given 90 extra prenatal days by law.

In case of childbirth with complications, only the postpartum period is extended by 16 days.

For those who gave birth before the benefits were assigned in the period of 22–30 weeks, sick leave is immediately opened for 156 days in the hospital where the birth took place.

See also “When they give sick leave for pregnancy and childbirth.”

If you doubt whether you have correctly determined the date for going on maternity leave, use advice from ConsultantPlus experts. Get trial access to the system and check your calculations for free.

An example of calculating maternity leave in 2022

When calculating vacation, no less important is the issue of calculating vacation pay, because leave for employment and parental leave is paid. Let's look at how maternity leave is calculated in 2022.

Important! In 2022, maternity benefits are calculated and paid by Social Insurance. Employers do not do the calculations, but they can help the employee with the calculation so that she knows how much she is owed.

To calculate vacation pay, you will first need to determine the average daily earnings of a pregnant woman, based on accruals for the last 2 years preceding the year of vacation. To do this, the amount of her earnings received at her place of work over the last 2 years should be divided into 730 days (731 if one year in the period was a leap year or 732 days if, when replacing years, two leap years are included in the calculation - FSS information dated January 17 .2013) (clause 3.1 of article 14 of the law “On compulsory social insurance” dated December 29, 2006 No. 255-FZ). If a woman went on sick leave during these 2 years (for 15 days, for example), then from 730 (731 or 732) days the number of days absent from work due to illness should be subtracted (730 – 15 = 715).

When calculating the average daily earnings, it is important to take into account that the amount of earnings received during the year does not exceed the maximum limit of the base for calculating insurance contributions to the Social Insurance Fund. In 2022, this limit was 912,000 rubles, in 2021 - 966,000 rubles.

Then, to determine vacation pay, the number of vacation days should be multiplied by the average daily earnings. Formula for calculating maternity benefits in 2022:

OBR = (D2020 + D2021) / 731 × 140,

Where:

D2020 - total earnings for 2022;

D2021 - total earnings for 2022;

731 - total number of days in the billing period;

140 - the number of days of leave according to the BiR, if the pregnancy is singleton and the birth is not complicated.

The total earnings for each year should be compared with the maximum value of the base for calculating insurance premiums determined by the Government, and if earnings turn out to be higher, then the amount corresponding to the maximum base is taken for calculation. Moreover, if the total earnings for the last 2 years of work are, on the contrary, too small - less than the minimum wage multiplied by 24, then the value calculated according to the minimum wage is taken.

You can learn about the minimum wage in 2022 from this article .

The minimum amount of vacation pay (OBRmin) is calculated using the following formula:

OBRmin = minimum wage × 24 / 730 × 140;

where: minimum wage is the minimum wage in force on the day of the leave under the Labor and Labor Act.

If a pregnant woman has not worked at the enterprise for 2 years in a row before going on such leave, then all the income she received from other employers for this period, from which insurance premiums were calculated, is added up.

If a woman, before going on maternity leave, was on leave to care for her other child, then the earnings she received for the 2 years preceding going on leave for the previous pregnancy must be calculated.

If you doubt the correctness of your calculation of maternity benefits, use the advice of ConsultantPlus experts. Get trial access to the system for free and move on to the Ready-made solution.

How many weeks do they go on maternity leave if it is combined with annual leave?

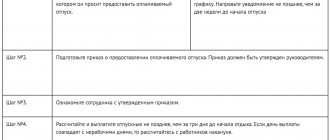

To extend maternity leave, you can first go on annual leave or do it after the B&R leave ends.

The administration of the enterprise has no right to prohibit this (Article 260 of the Labor Code of the Russian Federation).

If the date for maternity leave occurs while you are on annual leave, further developments depend on the woman’s choice.

She can write a statement and go on maternity leave without waiting for the end of her annual leave, from the date indicated on the sick leave. The employer is obliged to postpone the remaining days of the main vacation, following the provisions of Art. 124 Labor Code of the Russian Federation.

Or you can use the main leave in full, in which case the maternity leave will begin immediately after the end of the main one.

Registration of maternity leave in 2022

If in 2022, in order to go on maternity leave, you had to take a sick leave from the doctor and go with him to management, but now everything is different.

A certificate of incapacity for work for any reason is issued in electronic format. From the medical organization where the woman is registered, the information goes directly to the Social Insurance Fund and to work from the day the document is issued. It is recommended to know the sick leave number, since sometimes the information may not be received in a timely manner to the authorities. In this situation, the decree is issued as before:

- The certificate of incapacity for work must be taken to the manager.

- He will report to the FSS.

- The woman will receive payments.

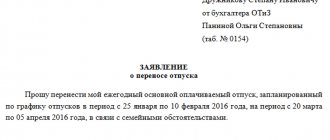

List of documents

The list of paper documentation has been reduced ─ you no longer need to present a sick leave certificate. However, you will still have to write an application for maternity leave, because this is required by the Labor Code of the Russian Federation and you can go on vacation later than the date indicated on the sheet. Therefore, the FSS learns about an employee going on sick leave to care for a child only from the manager. This is enshrined in Part II of Bill No. 2010 dated November 23, 2021, although it has not yet entered into force.

BiR vacation registration kit:

- sick leave certificate signed by the doctor with digital signature;

- request for maternity leave, where to indicate the date, sick leave number, as well as its beginning and end;

- payment request with personal information, method of receiving funds, as well as account number.

Attention! Requests for leave and benefits can be written in free form to the manager.

What time do those who register late go on maternity leave?

It is recommended to register with a antenatal clinic in the early stages of pregnancy (up to 12 weeks), but not everyone does this. Sometimes women, for some reason, continue to work and consult a doctor when the 30 (28) week period has already passed.

In this case, sick leave must still be issued. The doctor will determine the expected date of birth, count back the required 30 (28) weeks from it and open a sick leave certificate from this date.

If a woman refuses to receive a certificate of incapacity for work within the prescribed period (this must be recorded in writing by a doctor), and then applies for it again, the document is issued for all days required by law, but not from the moment of the second application, but as expected, starting from 30 ( 28) weeks.

A woman on maternity leave on maternity leave is entitled to a benefit paid 100% from the Social Insurance Fund. ConsultantPlus experts explained in detail how to correctly calculate the amount of benefits in various situations. Get trial access to the system and review the calculation example.

Article 255 of the Labor Code of the Russian Federation. Maternity leave (current version)

When carrying out an in vitro fertilization procedure, a certificate of incapacity for work is issued to a woman by a medical organization in accordance with a license for medical activities, including work (services) in obstetrics and gynecology and examination of temporary disability, for the entire period of treatment (stimulation of superovulation, ovarian puncture and embryo transfer) until the result is determined procedures and travel to and from the medical organization. In cases where the medical organization that carried out in vitro fertilization procedures does not have a license to perform work (services) for the examination of temporary disability, a certificate of incapacity for work is issued to the woman by the medical organization at her place of registration at the place of residence (at the place of stay, temporary residence) on the basis of an extract (certificates) from an outpatient card issued by a medical organization that performed in vitro fertilization procedures.

3. During pregnancy, women are given the right to receive state social insurance benefits in the amount established by federal laws.

So, in accordance with Art. 11 of the Law on Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity, maternity benefits are paid to the insured woman in the amount of 100% of average earnings.

An insured woman with an insurance period of less than six months is paid maternity benefits in an amount not exceeding for a full calendar month the minimum wage established by federal law, and in regions and localities in which regional coefficients for wages are applied in the prescribed manner payment in an amount not exceeding the minimum wage, taking into account these coefficients.

The appointment and payment of maternity benefits are carried out by the policyholder at the place of work (service, other activity) of the insured person.

If the insured woman is employed by several policyholders at the time of the insured event and was employed by the same policyholders in the two previous calendar years, maternity benefits are assigned and paid to her by the policyholders for all places of work (service, other activities). If the insured person at the time of the insured event is employed by several policyholders, and in the two previous calendar years was employed by other policyholders (another policyholder), maternity benefits are assigned and paid to him by the policyholder at one of his last places of work (service, other activity) ) at the choice of the insured person.

The maternity benefit is calculated based on the average earnings of the insured person, calculated for the two calendar years preceding the year of maternity leave, including during work (service, other activities) with another policyholder (other policyholders).

If in two calendar years immediately preceding the year of maternity leave, or in one of the specified years, the insured woman was on maternity leave and (or) child care leave, the corresponding calendar years (calendar year ) upon her application may be replaced for the purpose of calculating average earnings by previous calendar years (calendar year), provided that this will lead to an increase in the amount of the benefit.

The average earnings, on the basis of which maternity benefits are calculated, include all types of payments and other remuneration in favor of the insured woman, for which insurance contributions to the Social Insurance Fund of the Russian Federation are calculated in accordance with Federal Law dated July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

To assign and pay maternity benefits, the insured woman submits a certificate of incapacity for work issued by a medical organization in the form and in the manner established by the federal executive body exercising the functions of developing state policy and legal regulation in the field of social insurance, a certificate (certificates ) on the amount of earnings from which the benefit should be calculated, from the place (places) of work (service, other activities) with another policyholder (other policyholders), and for the assignment and payment of benefits by the territorial body of the insurer - a certificate (certificates) on the amount of earnings , from which the benefit must be calculated, and documents determined by the specified federal executive body confirming the insurance period. Documents confirming periods of work (service, activity) included in the insurance period are defined in Section. II Rules for calculating and confirming the insurance period to determine the amount of benefits for temporary disability, pregnancy and childbirth, approved. By Order of the Ministry of Health and Social Development of Russia dated February 6, 2007 N 91.

If the insured woman is not able to submit a certificate (certificates) about the amount of earnings from which the benefit should be calculated from the place (places) of work (service, other activity) with another policyholder (other policyholders) in connection with the cessation of activity by this by the policyholder (these policyholders) or for other reasons, the policyholder assigning and paying the benefit, or the territorial body of the insurer assigning and paying the benefit, at the request of the insured person, sends a request to the territorial body of the Pension Fund of the Russian Federation for information on wages, other payments and remuneration the insured person from the corresponding policyholder (the corresponding policyholders) on the basis of information from individual (personalized) registration in the compulsory pension insurance system.

The policyholder pays maternity benefits to the insured person in the manner established for the payment of wages (other payments, remuneration) to the insured persons. If a benefit is assigned to the territorial bodies of the insurer, its payment is carried out in the established amounts by the territorial body of the insurer that assigned the specified benefits, through the federal postal organization, credit or other organization at the request of the recipient.

In accordance with the Law on benefits for citizens with children, women dismissed due to the liquidation of organizations, termination of activities by individuals as individual entrepreneurs, termination of powers by notaries engaged in private practice, and termination of the status of a lawyer, as well as in connection with the termination of activities by other by individuals whose professional activities in accordance with federal laws are subject to state registration and (or) licensing, during the 12 months preceding the day they are recognized as unemployed in the prescribed manner, maternity benefits are paid in the amount of 300 rubles. (taking into account indexation from 01/01/2014, the benefit is 515.33 rubles).

Women undergoing military service under contract, service as privates and commanding officers in internal affairs bodies, in the State Fire Service, in institutions and bodies of the penal system, in authorities for control of the circulation of narcotic drugs and psychotropic substances, in customs authorities , maternity benefits are established in the amount of monetary allowance (Article 8).

Women who register with medical institutions in the early stages of pregnancy (up to 12 weeks) are paid a one-time benefit when granted maternity leave, the amount of which is set at 300 rubles. Taking into account indexation from January 1, 2014, the benefit is 515.33 rubles.

Maternity benefits, a one-time benefit for women registered with medical organizations in the early stages of pregnancy, are assigned if they are applied for no later than six months from the end of maternity leave (Article 17.2).

When applying for maternity benefits after the specified period, the decision on its appointment is made by the territorial body of the insurer if there are good reasons for missing the deadline for applying for benefits (Article 12 of the Law on Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity). The list of valid reasons for missing the deadline for applying for maternity benefits was approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2007 N 74.

The specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, including for certain categories of insured persons, are established by the Government of the Russian Federation (see Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens , subject to compulsory social insurance in case of temporary disability and in connection with maternity, approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375).

The rules for the appointment and payment of maternity benefits and one-time benefits for women registered with medical institutions in the early stages of pregnancy are established in Section. II and III of the Procedure and conditions for the appointment and payment of state benefits to citizens with children, approved. By Order of the Ministry of Health and Social Development of Russia dated December 23, 2009 N 1012n.

4. Maternity leave is counted towards the length of service, including the right to annual leave (see commentary to Article 121).

During maternity leave, women retain a number of benefits that they previously enjoyed. In particular, for women who, before the start of leave, are employed in jobs that give them the right to receive free therapeutic and preventive nutrition, this food is issued for the entire period of maternity leave (subclause “e” of paragraph 6 of the Rules for the free issuance of therapeutic and preventive nutrition, approved by Order of the Ministry of Health and Social Development of Russia dated February 16, 2009 N 46n).

Results

Neither the doctor nor the employer can change the timing of maternity leave at their discretion. Only if she makes her own decision can the expectant mother go on maternity leave for a period longer than 30 (28) weeks.

Regardless of what week expectant mothers in labor go on maternity leave and when they return from it, sick leave cannot be issued for a period of less than 140 days.

You will learn about who, besides the mother, has the right to receive benefits from the article “Is maternity benefit subject to personal income tax?”

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.