Value added tax is a mandatory payment to the state budget, an indirect tax of federal significance, which is levied at each stage of production of a product, and in fact represents a premium on the price of the product (Chapter 21 of the Tax Code of the Russian Federation). Russian tax legislation provides for situations of VAT refund to business entities (exporters, construction companies). Since this process can take 3-4 months, you can speed it up with the help of a bank guarantee.

Bank guarantee VAT

(Free)

- Selection of a bank in 24 hours

- Minimum package of documents

- In full compliance with the Federal Law

- Experienced specialists will help you at all stages

or call (toll-free within the Russian Federation)

What does a bank guarantee for VAT refund imply?

The VAT refund process includes several difficult stages, which determines the length of the procedure.

- Conducting a desk audit of the VAT return, and in particular the amount of tax payment indicated therein (from 3 months);

- Drawing up a decision of the Federal Tax Service on the return of VAT to the company (7 working days);

- Sending a notification to the regional branch of the Treasury of the Russian Federation (1-3 business days);

- Transfer of VAT amount to the payer’s account (from 5 days).

In this situation, the taxpayer can receive the tax amount no earlier than in 3-4 months. The sooner the funds return to the company, the higher their real value, the more resources can be purchased with them.

A bank guarantee for VAT refund is a document that indicates that in the event of failure to return the excess tax returned to the budget, this obligation will be assumed by the bank servicing it (guarantor).

The advantage of issuing a bank guarantee is the possibility of VAT refund within three weeks. In this case, the company issues a VAT guarantee from the bank and submits it to the tax authorities along with an application for tax refund. Tax authorities, certified that the taxpayer has fulfilled his obligations, promptly conduct a desk audit and return the funds to him.

Reference! The time frame for VAT refunds is being shortened, since now the tax authorities will not have to accurately calculate the amount of tax - the amount can be clarified later, and the payer will return the excess, guided by the terms of the bank guarantee.

Provisions on application

To begin with, let me remind you of the general provisions for applying the application procedure for VAT refund. It implies that the company will receive funds no later than the twelfth day after submitting the relevant application. If the deadline for returning the tax amount is violated, interest is charged on this amount for each day of delay. In this case, the interest rate is taken equal to the Central Bank refinancing rate in effect during the period of violation of the repayment deadline (paragraph 3, clause 3, article 176.1 of the Tax Code of the Russian Federation).

As a general rule, VAT is subject to reimbursement only after auditors have carried out a desk audit of the declaration (and this can last up to three months), however, the application procedure allows you to receive a refund before the end of the control period (Clause 1 of Article 176.1 of the Tax Code of the Russian Federation).

In accordance with paragraph 7 of Article 176.1 of the Tax Code of the Russian Federation, firms that have the right to apply the application procedure for VAT refund must submit a corresponding application to the inspectorate no later than five days from the date of filing the declaration. It is necessary to indicate the account details for transferring funds. In the paper, the payer undertakes to return to the budget the amounts received in excess by him in the application form, including interest, if paid. He also undertakes to pay interest accrued on the specified amounts if the decision on compensation is canceled in whole or in part.

The inspection, within five days from the date the company submits the application, verifies the organization’s compliance with the requirements of paragraphs 2, 4, 6 and 7 of Article 176.1 of the Tax Code of the Russian Federation, as well as whether it has arrears on VAT, other taxes, debts on relevant penalties or fines. After this, the auditors make a decision to reimburse the tax on an application basis or a decision to refuse it (clause 8 of Article 176.1 of the Tax Code of the Russian Federation). Inspectors are required to inform the company about the decisions made in writing within five days from the date the decision was made in person against registration or in another way confirming the fact and date of receipt, for example, a letter with a notification of reading.

On a note

The credit institution must ensure the fulfillment of obligations to return to the budget in full only the amount of tax declared for reimbursement, without taking into account interest accrued on funds received in excess of the application.

Who needs a bank guarantee for VAT refund?

The need to issue a VAT bank guarantee in Svobodny is worth considering for those companies that meet two conditions:

- Their type of activity gives them the right to a VAT refund;

- They cannot wait for 3-4 months for funds to be transferred to the account.

The use of bank guarantees for value added tax allows you to optimize the company’s relationship with the tax authorities, return funds to circulation as soon as possible and, thereby, improve the process of economic activity.

Accounting with the principal

The principal is obliged to record related expenses both in tax and accounting.

Accounting

The cost of a guarantee includes the value of the asset it backs. The postings will be as follows:

- DT76 KT51. Transfer of remuneration to the guarantor.

- DT08, 10, 20, 41 KT76. Obtaining a guarantee of payment under the agreement.

Accounting complies with the general principles of cost formation for inventory items.

Question: How to reflect in the organization’s accounting the sale of goods and the receipt of the amount of the bank guarantee that the buyer, under the terms of the contract, provided as security for the obligation to pay for the goods? The buyer did not pay for the goods within the period established by the contract. According to the agreement, the selling price of the goods is 540,000 rubles. (including VAT RUB 90,000). The actual cost of goods sold according to accounting data is 400,000 rubles. and is equal to the purchase price of the goods according to tax accounting data. To ensure the fulfillment of the obligation to pay for the goods by the buyer on the day of conclusion of the contract, an independent guarantee issued by the bank (bank guarantee) was provided in the amount of the contract price of the goods, including VAT. The buyer failed to fulfill the obligation to pay for the goods within the period established by the contract. The organization submitted a demand to the guarantor bank to pay the appropriate amount of money. The guarantor bank transferred the guarantee amount due to the organization on the same day. In tax accounting, the organization uses the accrual method. View answer

Example

The company enters into a deal to purchase real estate in the amount of 10,000,000 rubles. The decision was made to purchase BG. The reward amount is 3% of the transaction amount. That is, it will be 300,000 rubles. The BG will be valid for a month. On the payment date stipulated by law, the participant did not receive any money. The bank paid the amount according to the guarantee. The principal has a need to repay the debt itself in the amount of 10,000,000 rubles. In this case, these postings are made:

- DT76 KT51. Transfer of remuneration to the bank (300,000 rubles).

- DT08 KT76. Including the amount of remuneration in the initial cost of the item of non-current assets.

- DT08 KT60. Acceptance of real estate under a transfer deed in the amount of 10,000,000 rubles.

- DT01 KT08. Acceptance for accounting of fixed assets in the amount of 10,300,000 rubles (transaction amount + remuneration to the bank).

- DT60 KT76. Recognition of a regressive claim of a banking institution in the amount of 10 million.

- DT76 KT51. Payment of obligations to the institution in the amount of 10 million.

Attention! All transactions must be supported by primary documentation. This could be a transaction agreement, an agreement with a bank to purchase a guarantee.

VAT

Purchasing bank guarantees is a banking transaction. Therefore, it will not be subject to VAT on the basis of clause 8 of part 1 of article 5 of Federal Law No. 395-1, clause 3 of article 149 of the Tax Code of the Russian Federation.

Income tax

Expenses for paying the guarantor are taken into account in the structure:

- other expenses associated with production and sales (clause 1 of Article 264 of the Tax Code of the Russian Federation);

- non-operating expenses as expenses for work not directly related to production and sale (clause 1 of Article 265 of the Tax Code of the Russian Federation).

Which category should expenses be included in? Everything depends on the will of the company. The right to independent determination is granted by paragraph 4 of Article 252 of the Tax Code of the Russian Federation.

Purchase of bank guarantees as part of a supply agreement

Acceptance for registration of a product intended for resale is carried out on the basis of Article 320 of the Tax Code of the Russian Federation. The purchase of a bank guarantor is associated with the purchase of products, and therefore associated costs can be included in its price. The acquisition cost is classified as a direct expense. She participates in the formation of the income tax base. The method of determining the purchase price must be recorded in the accounting policy on the basis of Article 320 of the Tax Code of the Russian Federation.

Guarantees for long-term debts

The remuneration for the transaction with the BG relates to the time the guarantee is issued. The term may include several periods if the bank guarantee is issued for a long-term obligation.

The Letter of the Ministry of Finance No. 03-03-06/1/4 dated January 11, 2011 states that it is recommended that expenses for the guarantee be taken into account evenly throughout the entire time during which it is valid.

Documents for issuing a VAT bank guarantee

If a company decides to declare the need to return VAT to Svobodny, it must prepare an extensive package of documents to submit to the bank for issuing a bank guarantee:

- Constituent documents – constituent agreement, charter, etc.;

- Financial statements by quarter for the last year;

- Registers of accounting accounts for counterparties and fixed assets.

Since VAT refunds may apply not only to organizations, but also to individual entrepreneurs on OSNO, they will need to prepare:

- Statements reflecting cash flows at the cash desk and in the company's current account;

- Book of income and expenses, as well as management accounting data (for individual entrepreneurs);

- Certificate of registration of the company.

Important point! In addition to the standard package of papers, the taxpayer must prepare confirmation of his right to a tax refund, as well as an application.

The period for consideration of documents by the guarantor bank is about 7 working days. The main criterion for providing security is the stable financial position of the company.

Accounting with the beneficiary

Let us remind you that the beneficiary is the one whose interests are ensured by bank guarantees.

Accounting for bank guarantees

The rules for accounting for financial statements are given in the Chart of Accounts established by Order of the Ministry of Finance No. 94 of October 31, 2000. This regulatory act states that these accounts are used to summarize information about the financial statements: 008 and 009. Let us consider in more detail the use of these accounts:

- 008. Recording of received BGs and collateral taken for products issued to other companies.

- 009. Issued guarantees.

The recorded amounts are written off as the debt is paid off. Analytical accounting will be maintained for each BG, regardless of whether it is issued or received.

The BG is provided by the bank, not the principal, and therefore it must be recorded in off-balance sheet account 008. If the BG amount is not specified in the guarantor, it appears in accounting based on the information contained in the agreement.

The accounting regulations “Company Income” PBU 9/99, established by Order of the Ministry of Finance No. 32n dated May 6, 1999, indicate that the moment of transfer of rights to products is the receipt of revenue. It is recorded at CT count 90.

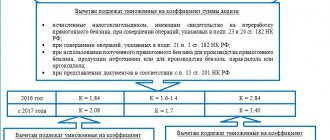

VAT

Sales of products are subject to VAT on the basis of paragraph 1 of Article 146 of the Tax Code of the Russian Federation. The moment the taxable base is established is the date of shipment of the products. The corresponding provision is given in paragraph 1 of Article 167 of the Tax Code of the Russian Federation.

The tax base is the cost of products determined on the basis of prices. The latter are calculated based on Article 105.3 of the Tax Code of the Russian Federation. If the goods are excisable, excise taxes are taken into account when determining the cost. The tax is not included in them on the basis of paragraph 1 of Article 154 of the Tax Code of the Russian Federation.

In accounting, VAT must be recorded on DT account 90 (subaccount 3) and CT account 68.

Income tax

Income is considered to be proceeds from the sale of products. The latter can be produced both by the enterprise itself and by suppliers (Article 249 of the Tax Code of the Russian Federation). Revenue will be recognized in the period in which it arises. It does not take into account when the money for the transaction actually arrived.

The time of receipt of income is the date the product is sold. It also does not take into account when the money was actually received (based on Article 271 of the Tax Code of the Russian Federation). Expenses taken into account for tax purposes will be recognized in the period to which they relate.

Example

The organization entered into an agreement for the supply of goods in the amount of 586 thousand rubles. This amount includes VAT. The real cost of the product is 312 thousand rubles. A guarantee was purchased to secure the transaction. The BG agreement specifies the cost of products under the agreement. The company received the money under the contract on time for delivery. On the date of sale of products, the following postings are made:

- DT62 KT90/1. Fixation of revenue from product sales.

- DT90/2 KT41. Write-off of actual cost.

- DT90/3 KT68. VAT accrual on sales in the amount of 89,390 rubles.

- DT90/9 KT99. The financial result of the operation is 184,610 rubles.

- DT008. Receipt of BG in the amount of 586 thousand rubles.

On the date of payment for products, these entries are made:

- DT51 KT62. Receipt of money from the operation.

- KT008. Write-off of the guarantee after fulfillment of obligations.

In the example considered, the money was transferred according to the agreement, and not paid by the bank.

Stages of issuing a bank guarantee for VAT

If the taxpayer decides to take upon himself all the arrangements for issuing a bank guarantee, then he will have to face a considerable number of difficulties. Initially, you will have to choose a commercial bank that will have to meet the following requirements:

- Have a license from the Bank of Russia to issue guarantees;

- Have a stable financial position;

- Differ in the right to issue guarantees, which are accepted by government agencies.

Reference! A list of banks that have the right to issue bank guarantees to individuals and legal entities can be found on the website of the Russian Ministry of Finance.

Once the financial institution has been identified, you will need to collect documents, prepare them correctly, submit them for review and wait for the decision of the banking commission. At the same time, the bank does not always unconditionally provide a guarantee document.

To eliminate the possibility of refusal, it is worth using the services of intermediary organizations (credit brokers), who will promptly issue a bank guarantee within 5 days and eliminate the possibility of refusal even for small, new companies. How to use their services:

- Submit an online application indicating a contact phone number;

- Discuss with the intermediary’s representatives the conditions for obtaining a bank guarantee and commissions;

- Submit documents to brokers;

- Receive the finished document.

Important point! The bank guarantee is valid for 8 months - during this period the company needs to obtain a VAT refund, otherwise the document will have to be re-issued again. Only if the payer transfers the excessively returned tax payment to the treasury over several months in equal payments will the guarantee be valid until the end of this process (Article 378 of the Tax Code of the Russian Federation).

If during a desk tax audit errors are discovered in filling out VAT documents, the bank guarantee will be cancelled. In this case, the payer is given 5 days to correct the identified inaccuracies.

A bank guarantee for VAT is a document that allows the state to be guaranteed to receive an excessively refunded VAT, and a company to speed up the tax refund process up to 3 weeks and to inject funds into circulation, increasing the efficiency of the production process. The percentage of payment for such a banking service is 2-8%, and the amount of commission to the broker is from 0.5 to 5%.

Banks in Svobodny where you can get the service: Bank guarantee for VAT

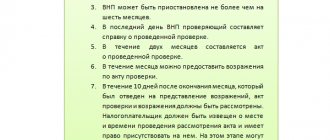

Warranty coverage

If violations are detected during the inspection, the auditor will draw up a report in accordance with Article 100 of the Tax Code of the Russian Federation. This document and other materials of the control event, as well as the objections submitted by the company, will be considered by the head of the inspection that carried out the inspection or his deputy, and will make a decision in accordance with Article 101 of the Tax Code of the Russian Federation.

If the amount of tax refunded by application exceeds the amount of VAT subject to refund based on the results of the audit, the inspectorate will decide to cancel the decision on refund. The decision to refund (in whole or in part) the amount of tax or the decision to offset the amount of the fee that is not subject to reimbursement based on the results of the control event will also be canceled.

If Federal Tax Service officials, based on the results of the audit, determine that the company unlawfully declared the amount of VAT in the declaration, the organization will have to return this money. In addition, for the use of budget funds, penalties will be charged at double the refinancing rate of the Bank of Russia. The calculation will be made from the moment the company receives money into its current account or from the moment a decision is made to offset the refundable VAT amounts against arrears.

After the auditors have sent the above decisions to the company and the requirement to pay the amount of refunded VAT subject to refund and penalties, it must comply with this order within five days from the date of receipt of the demand.

Within ten days after the bank fulfills its obligation to pay the amount under the bank guarantee, the tax authorities will send the organization a clarified request for a refund indicating the amounts payable to the budget (clause 22 of Article 176.1 of the Tax Code of the Russian Federation).

If the company fails to pay the amount on time or does so partially, the money specified in the refund request will be subject to collection. This rule applies both to companies that have applied the declarative tax refund procedure without providing a guarantee, and to companies that have received a specified refund request. If it is impossible to send a demand to the bank for payment of the amount under the bank guarantee due to the expiration of its validity period, the obligation to pay tax is also compulsorily fulfilled.

Irina Razumova

, leading consultant on accounting and taxation issues of the DKPO group, adviser to the state civil service of the Russian Federation, 3rd class, for the magazine “Regulatory Acts for Accountants”

Looking for a solution to your situation?

“Practical Accounting” is an accounting journal that will simplify your work and help you keep your books without errors. The publication is also available in electronic form. Get full access to all materials >>

If you have a question, ask it here >>

Bank guarantee in the Civil Code of the Russian Federation

According to Art. 368 of the Civil Code of the Russian Federation, a bank guarantee is a method of ensuring the fulfillment of obligations in which a bank, other credit institution or insurance organization (guarantor) issues, at the request of the debtor (principal), a written undertaking to pay the creditor (beneficiary) a sum of money when they present a demand for its payment.

Thus, at least three persons are involved in the relationship related to the issuance of a bank guarantee: the principal; beneficiary and guarantor.

The guarantor of a bank guarantee can only be a special entity that meets the requirements of the law, namely a bank, another credit institution or an insurance organization.

The principal is the debtor of the main obligation, at whose request the guarantor issues a bank guarantee. The principal can be any person.

The beneficiary is the creditor of the entrepreneur under the main obligation, in whose favor the guarantor issues a bank guarantee. In this case, the beneficiary is a creditor both under the bank guarantee and under the main obligation. The role of beneficiary can be any individual or legal entity, including government authorities, as well as tax and customs authorities.

In other words, the main purpose of providing a bank guarantee is to ensure the proper fulfillment by the principal of his obligations to the beneficiary (Part 1 of Article 369 of the Civil Code of the Russian Federation).

Moreover, in accordance with Part 2 of Art. 369 of the Civil Code of the Russian Federation, the issuance of a bank guarantee is a paid service of the guarantor bank, therefore a fee is charged for its issuance. As a rule, the amount of such remuneration is 1 - 10% of the security amount. It may be paid as a fixed payment or as a percentage of the guarantee amount in one lump sum or in installments depending on the duration of the guarantee.

Thus, a bank guarantee is a banking service. Accordingly, the cost of paying remuneration to the bank for issuing a bank guarantee is payment for banking services.

Actions of the tax authorities upon VAT refund

The main tool of inspectors in the case of VAT refunds is an in-depth desk audit with the mandatory requirement of documents: invoices, delivery notes, contracts, etc.

Other procedures such as interrogation of a witness, examination, inspection of premises and objects are also possible.

Using the ASK VAT-2 program, inspectors will check whether your counterparty has paid the tax that you accepted for deduction. If it turns out that he did not show the transaction with you in his declaration, or set the transaction amount to be less than yours, the refund may be refused.

If the tax authorities do not find convincing grounds for refusal, but suspicions remain, the payer will be reimbursed for VAT and then an on-site inspection will be scheduled.

During an on-site inspection, inspectors have more powers and time, so it may turn out that previously refunded VAT will be canceled and forced to be returned.

Agreement on the issuance of a bank guarantee

An analysis of the provisions of Chapter 23 of the Civil Code of the Russian Federation shows that it is not necessary to conclude a separate agreement between the principal and the guarantor.

However, those banks that want to more precisely define their relationship with the principal include such provisions either in their general conditions or sometimes in a special agreement, which may be called a bank guarantee agreement.

The agreement on the issuance of a bank guarantee may stipulate the following conditions: the rights and obligations of the bank and the principal, the terms for the provision of bank guarantees, the basic conditions under which such bank guarantees will be issued, provisions on commissions and remuneration of the bank, reimbursement of bank expenses, guarantees and assurances of the principal, necessary security for the contract, liability of the parties under the contract, applicable law, procedure for resolving disputes and other provisions.