What determines the amount of vacation pay?

Each day of vacation is paid based on the employee’s average salary. The higher this indicator, the more impressive the amount of vacation pay will be.

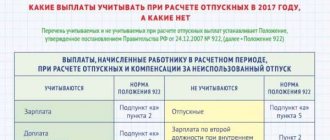

Average earnings are determined taking into account all payments provided for by the remuneration system of a particular employer.

When calculating average earnings, payments not related to wages are not taken into account: material assistance, payment for the cost of food, travel, etc. (Part 2 of Article 139 of the Labor Code of the Russian Federation, clauses 2-3 of the Regulations, approved by the Decree of the Government of the Russian Federation dated 12/24/2007 No. 922).

An important indicator that influences the amount of average earnings is the time actually worked by the employee for the 12 calendar months preceding the vacation (billing period).

If during the billing period the employee was sick or was on a business trip, when calculating average earnings these periods and the amounts accrued during this time are excluded (clause 5 of the Regulations, approved by Resolution No. 922).

Do I need to index vacation pay?

Earnings are clear, but is it necessary to index vacation pay when increasing salaries? With such indexation, the average earnings are also recalculated. Article 139 of the Labor Code of the Russian Federation states that the amount of average earnings for a certain period is the basis for calculating vacation pay. This means that after increasing remuneration for work, vacation payments are also indexed.

But the Regulations, which were approved by RF PP No. 922 (clause 16 of the Regulations), indicate that average earnings are adjusted if the salaries or tariffs of absolutely all employees employed in the institution are indexed. If the tariff rate or salary, and therefore the final remuneration of at least one employee, were not indexed, then the average earnings are not subject to adjustment (Letter of Rostrud No. 5920-TZ dated October 31, 2008, Letter of the Ministry of Health and Social Development No. 22-2-176 dated January 30. 2009).

IMPORTANT!

If average earnings do not increase, then vacation pay does not increase.

Formulas for calculating average earnings for vacation pay

In most cases, annual paid leave is calculated in calendar days, although in some situations it is necessary to calculate vacation pay based on working days. Let's consider both cases.

Calculation of average earnings to pay for vacation provided in calendar days

In this case, average earnings are determined by the formula (clause 9 of Resolution No. 922):

Average daily earnings (ADE) are calculated according to different rules depending on whether the employee has fully worked the pay period (clause 5, clause 10 of Resolution No. 922, Letter of the Ministry of Labor dated May 18, 2020 No. 14-1/B-585):

Calculation of average earnings for vacation pay provided in working days

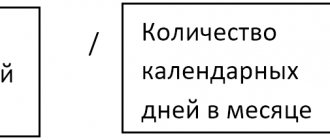

In this case, the calculation of average earnings includes not calendar days, but working days:

For employees who are granted annual paid leave in working days, a special procedure has been established for calculating average daily earnings. It is used, for example, when calculating vacation pay for seasonal workers or persons who have entered into employment contracts for a period of up to two months (Articles 291, 295 of the Labor Code of the Russian Federation).

In this case, SDZ is calculated according to the formula (clause 11 of Resolution No. 922):

If the company has a 5-day working week with two days off, the calculation of average earnings should still be made according to the 6-day working week calendar.

Example 1

An employee hired under a fixed-term employment contract to perform seasonal work (from February 1 to April 30, 2022) goes on regular leave from April 19, 2021 for three working days.

Settlement period: from February to March 2022.

Payments for the billing period: 56,000 rubles.

The number of working days in the billing period according to the calendar of a 6-day working week that fall within the time worked is 49 days.

Average daily earnings for vacation pay:

SDZ = 56,000 rub. / 49 days = 1,142.86 rub.

Amount of vacation pay: RUB 1,142.86. x 3 days = 3,428.58 rub.

Basic algorithm for calculating vacation pay

Vacation is guaranteed by the Labor Code of the Russian Federation.

At the same time, while the employee is on vacation, he retains his job and average earnings (Article 114 of the Labor Code of the Russian Federation). There are several types of vacations:

- the main leave provided and paid to the employee every year is 28 calendar days;

- extended paid leave - provided in accordance with federal laws (for example, teachers);

- additional paid leave - provided every year to employees with harmful or dangerous working conditions;

- study leave, etc.

For any type of vacation, vacation pay is calculated according to a single formula (with the exception of administrative leave - without pay, which is not paid, and parental leave, which is paid according to different rules).

IMPORTANT! The formula for calculating vacation pay was approved in Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

To calculate vacation, as can be seen from the formula for calculating vacation pay, it is important to correctly calculate the average earnings per day.

To calculate the average vacation earnings per day, use the formula:

We wrote how to pay personal income tax on vacation pay in the article “What is the procedure for paying personal income tax on vacation pay in 2021. ”

Special procedure for accounting for bonuses when calculating vacation pay

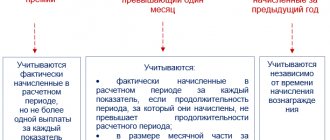

There are different types of bonuses: based on the results of work for the year, monthly, one-time for anniversaries and holidays, and others. When calculating vacation pay, they are taken into account in a special manner (clause 15 of Resolution No. 922).

If the time falling within the billing period was not fully worked or there were excluded periods (according to clause 5 of Resolution No. 922), bonuses are taken into account when determining average earnings in proportion to the time worked in the billing period. Exception: bonuses accrued for time actually worked in the billing period (monthly, quarterly, etc.).

Bonuses are taken into account based on the amounts actually accrued, if the employee worked part-time for which bonuses are accrued, and they were accrued in proportion to the time worked.

For example, bonuses for an anniversary or holiday. They can be taken into account when calculating vacation pay if two conditions are met simultaneously:

- the bonus is provided for by the remuneration system;

- the premium is accrued in the billing period.

Such bonuses are taken into account in full when calculating vacation pay (clause 15 of Resolution No. 922, Letter of the Ministry of Labor dated 03.08.2016 No. 14-1 / OOG-7105).

Coronavirus non-working days when calculating vacation pay

Coronavirus has its own impact on the calculation of vacation pay - paid non-working days due to coronavirus and payments for them are not taken into account when calculating the “vacation” average earnings if the employee did not work on these days (letters from Rostrud dated July 20, 2020 No. TZ/3780-6 -1, Ministry of Labor dated May 18, 2020 No. 14-1/B-585).

Example 2

Employee of Ritm LLC Kulikov M.P. from May 20, 2021 he goes on vacation for 17 days. The billing period is from 05/01/2020 to 04/30/2021. During the specified period, he was not on sick leave or on vacation, but did not work on “coronavirus” paid days (06/24/2020 and 07/01/2020).

Payments for the billing period: salary - 691,015 rubles, payment for two non-working days - 3,998.12 rubles. In the billing period, 10 months—293 days—were fully worked. (10 months x 29.3).

Number of days for calculating vacation pay:

- for June 2022 - 28.32 days. ((30 days – 1 day)/30 days x 29.3);

- for July 2022 - 28, 35 days. ((31 days – 1 day/ 31 days x 29.3)

———————————————————————————-

Total number of days worked in the billing period: 349.67 days. (293 + 28.32 + 28.35).

Base for calculating vacation pay: RUB 691,015. (excluding payment for non-working “coronavirus” days).

Average daily earnings: 691,015 rubles / 349.67 days. = 1,976.19 rub.

Vacation pay amount: RUB 1,976.19. x 17 days = 33,595.23 rub.

If an employee worked on the specified “coronavirus” days, the salary accrued for them must be included in the base for calculating vacation pay, and the days themselves must be counted as worked.

Calculation of vacation pay after maternity leave

Maternity leave and subsequent parental leave introduce some adjustments to the usual procedure for calculating vacation pay:

- maternity leave is included in the vacation period;

- parental leave is excluded from the calculation period for calculating vacation pay;

- to calculate vacation pay for an employee who has just returned from maternity leave and is going on annual leave, the calculation period will be 12 months preceding the month the employee went on maternity leave;

- Vacation pay is not calculated and vacation is not granted if the employee is on maternity leave and simultaneously works part-time - the law does not allow being on two vacations at the same time.

Example 3

Employee Karavaeva P.N. was on maternity leave from January 23, 2022, and then on parental leave. In September 2022, she returned from maternity leave and wrote an application for annual paid leave lasting 15 calendar days.

Calculation period for calculating vacation pay: from September 1, 2022 to August 31, 2022. Since during this period Karavaeva P.N. was on maternity leave and child care leave, the calculation period will be 12 months that preceded the month the employee went on maternity leave.

Payments in favor of P. N. Karavaeva for the billing period - 428,630 rubles.

Calculation of vacation pay: RUB 428,630/12 months. / 29.3 x 15 days = 18,286.26 rubles.

A woman has the right to go on annual paid leave before or after maternity leave. She can do this regardless of how long she has worked for a given employer.

How to calculate vacation pay in 2021-2022: online calculator to help the user

In order to calculate vacation pay for each employee individually, it is no longer necessary to carry out scrupulous manual calculations.

Automation has also affected this area: the online calculator will calculate vacation in 2021-2022 faster than any accountant, and in addition, the human factor in the calculations is eliminated. This means that errors in calculating the amount are reduced to zero. The vacation calculator will allow you to calculate the amount of vacation pay, taking into account whether the employee has worked for more or less than a year in a given organization. The vacation days calculator will also allow you to take into account the changing number of days in months for each year.

In order to calculate vacation pay online, the user just needs to enter the following into the vacation pay calculator:

- vacation start date;

- date of hire (if the employee has not worked for a full year);

- number of vacation days;

- monthly salary amount for the last 12 months (if the employee has worked for a full year) or for the period actually worked (if the employee has worked for the organization for less than a year);

- the number of days not included in the calculation, separately for each month.

Please note that in order to correctly calculate vacation pay, the online calculator will require you to enter the monthly salary amount with the exception of the following amounts:

- paid during the business trip;

- vacation pay for the last vacation;

- sick leave;

- maternity benefits.

All exceptions from the salary amount are specified in clause 5 of the Regulations approved by Decree of the Government of the Russian Federation No. 922 of December 24, 2007.

According to the same paragraph, the following days should be excluded from the billing period when entering data into the online vacation calculator:

- the employee is on a business trip;

- being on sick leave;

- being on leave without pay;

- the period when the employee received maternity benefits.

Based on the entered data, the online vacation pay calculator will instantly calculate:

- average daily earnings of an employee;

- the amount of accrued vacation pay.

Vacation pay for less than six months of service

Upon their request, the employer must provide certain categories of employees with leave for the first year of work before the expiration of six months of continuous work: women before or after maternity leave, minor workers, in other cases provided for by federal laws (Part 3 of Article 122, Article 123 , Article 286 of the Labor Code of the Russian Federation).

In such cases, the billing period for calculating average earnings is determined according to special rules. It is equal to the number of calendar months from the date of entry into force of the employment contract, including the month preceding the vacation.

Example 4

The employee was hired on January 25, 2021 and goes on vacation for 28 calendar days from June 28, 2021.

Settlement period: from January to May 2022. The amount of accrued salary is 138,000 rubles.

Calculation of the number of days for calculating vacation pay:

- for fully worked months (from February to May) - 117.2 days. (4 months x 29.3);

- for January - 4.73 days. (5 days x 29.3 / 31 days).

———————————————————–

Total number of days worked in the billing period: 121.93 days. (117.2 + 4.73).

Average daily earnings: 138,000 rubles / 121.93 days. = 1,131.80 rub.

Vacation pay amount: RUB 1,131.80. x 28 days = 31,690.40 rub.

How is vacation calculated? What types of vacation are there and how are they paid?

According to the Labor Code, every employee has the right to rest, and one of its types is vacation. Types of leave differ in the reasons for their receipt, availability of payment and duration. Lawyer Valeria Belova has compiled a short guide to vacations and talked about their features.

Annual paid vacation

The most common, most famous and most awaited type of vacation. The right to receive it arises after six months of continuous work. But by agreement with the employer, you can go to it earlier (pregnant women, minor workers and others also have the right to do this).

As a general rule, the duration of such leave is 28 calendar days, but for some categories of workers, for example teachers, an extended rest of 42–56 days is provided. Unfortunately, the total number includes not only working days, but also weekends.

Vacation is granted with retention of position and average earnings, that is, during it the average remuneration is paid, and after that you can return to the same place of work.

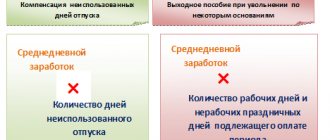

Vacation pay is calculated using the formula:

vacation pay = average daily earnings × number of calendar days of vacation

average daily earnings = earnings for the billing period / (12 × 29.3) *

* Provided that the person has worked for a year without breaks. The amount of earnings for the reporting period does not include bonuses and material compensation.

At the same time, the cost of a vacation day differs from the cost of a worked day due to the fact that vacation pay is calculated by calendar days, and wages by working days. This is especially noticeable in January and May, when there are many holidays and few working days and the cost of one working day becomes very high. By going on vacation in January, you are trading an expensive working day for a regular calendar day.

Let's give an example: in January 2022 there will be 17 working days and 14 days off, and with a salary of 100 thousand rubles, the cost of one working day is 5.9 thousand (100 thousand rubles / 17), while a calendar day costs only 3.2 thousand ( 100 thousand rubles / 31). You can narrow the gap a little if you consider that holidays also include paid days off.

The most profitable vacation months in 2016 are August, September and the rest of December. And in 2022 it will be August, March and October.

It should be noted that the above list is suitable for a five-day work week. If you have a different schedule, then you need to independently determine and calculate the months with the most working days.

Annual additional paid leave

The law provides for additional vacation days for people with non-standard work hours and working conditions. In particular, workers in hazardous industries receive an additional week of vacation, and for irregular days they are entitled to three additional vacation days.

Companies can add vacation days at their discretion. For example, for work experience. This leave is paid, it is calculated in calendar days and is not limited to a maximum limit.

Leave without pay

Sometimes, for family reasons or other reasons, an employee may be granted leave without pay. A written application is required for this. The duration of such a break in work is established by agreement between the employee and the employer.

Moreover, according to the law, up to five calendar days are mandatory for employees upon the birth of a child, registration of marriage, death of a close relative, and in other cases.

Study leave

Working students also have the right to leave during the session. Its size and availability of payment depend on the type of educational institution, form of training and reasons for provision.

When studying in graduate school, postgraduate study or residency through correspondence courses, employees have the right to an additional paid leave of 30 days, as well as one day a week free from work, with payment of 50%. Additionally, employees admitted to compete for the academic degree of candidate or doctor of sciences have the right to take advantage of paid leave of three and six months, respectively.

Master's or bachelor's students of part-time or evening courses are entitled to 40 days of paid leave in the first or second year and 50 days in senior years, as well as four months to prepare a diploma and pass state exams.

Full-time students can only count on unpaid leave: 15 days a year to pass the exam and four months for the diploma and state exams.

In addition, you can take 15 days of unpaid leave to take entrance exams to a university or take final exams in preparatory departments.

For students of technical schools of evening and correspondence courses, 30–40 days of paid leave are provided for the session and two months for passing the final work and exams. Full-time students can take only ten unpaid days during the session and two months during the pre-graduation period.

Evening school students can only count on paid leave to take final exams: after the ninth grade - nine days, after the 11th (12th) grade - 22 days.

Maternity leave

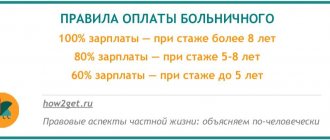

Pregnant women are provided with leave by law - 70 days before giving birth (for multiple pregnancies - 84 days) and 70 after (for complications - 86 days, for the birth of two or more children - 110).

It is calculated in total, that is, regardless of the number of vacation days used before giving birth. And it is paid depending on the woman’s form of employment. For example, for workers - in the amount of 100% of average earnings, and for students - in the amount of a scholarship.

Holiday to care for the child

Leave to care for a child up to three years of age can be granted to the mother, father or other relative who cares for the baby. However, you should understand that only one person can use it at a time (but you can take it one at a time). The amount of benefit until the child reaches 1.5 years of age also depends on the form of employment. Thus, a working person is paid a monthly allowance of 40% of average earnings (for 2016, its maximum amount is 21,554.85 rubles). When caring for a child from one and a half to three years old, compensation is paid, the amount of which depends on the subject, but the minimum is 50 rubles. In this case, the employer can provide additional payments for its employees.

It is important to note that you can obtain the right to a break from work not only upon the birth of a child, but also upon adoption. In many ways, this type of leave is similar to maternity leave, only a little shorter: when adopting one child, the period is 70 days from the date of birth, and two or more - 110. But for a woman (at her request), instead of this leave, there can be maternity leave was provided in a shortened version (70 days - one child, 110 days - two or more).

Vacation pay from the minimum wage

According to the law, the average monthly earnings of an employee who has worked the standard amount of time during the billing period and fulfilled his job duties cannot be less than the federal minimum wage (clause 18 of Resolution No. 922).

This rule must also be followed when calculating vacation pay. The average monthly earnings calculated for the vacation must be compared with the minimum wage in force during the period of such vacation. If it turns out to be less than the federal minimum wage, then vacation pay should be calculated using the formula:

Recalculation of vacation pay: when is it needed and how to do it

It’s good if, after calculating and paying vacation pay, the employee successfully completed his vacation and returned to work. But this doesn't always happen. A vacationer may be suddenly called back to work due to operational needs, or after the start of the vacation, some “salary” events may occur that affect the amount of vacation pay (for example, an annual bonus is accrued). Then you can’t do without recalculating vacation pay.

Recalculation of vacation pay when salaries change

When salaries change (for example, after indexation), vacation pay must be recalculated according to the rules provided for in paragraph 16 of Resolution No. 922:

- recalculate the average earnings calculated for the billing period if the salary increase occurred after the billing period before the onset of vacation ;

- recalculate part of the average earnings from the date of the salary increase if the increase occurred during the vacation period .

Such a recalculation needs to be done only if the increase affected all employees. If the salary of one or two employees was raised, vacation pay is not recalculated (Letter of the Ministry of Labor dated May 12, 2016 No. 14-1/B-447).

Payment of annual bonus

It may happen that the annual bonus is paid to the employee after accrual of vacation pay for the previous year. In such a situation, it is recommended to recalculate vacation pay, although the law does not directly require this.

This takes into account clause 15 of Resolution No. 922, which determines that when calculating average earnings, remunerations based on the results of work for the year, other remunerations based on the results of work for the year, accrued for the calendar year preceding the event, are taken into account, regardless of the time the remuneration was accrued.

Thus, if the average earnings for calculating vacation pay are calculated without taking into account the annual bonus, they must be recalculated and the difference must be paid to the employee.

Increase in minimum wage

Vacation pay must be recalculated due to an increase in the minimum wage if two conditions are simultaneously met:

- the employee’s actual average earnings for the billing period are less than the new minimum wage;

- vacation started before January 1st.

Let us remind you that from 01/01/2021 the minimum wage is 12,792 rubles. (Federal Law No. 473-FZ dated December 29, 2020).

Review from vacation

An employee recalled from vacation will receive a salary for the days worked, and it is recommended to recalculate vacation pay for days of rest.

Let us remind you that the unused part of the vacation must be provided to the employee at his choice at a convenient time during the current working year or can be added to subsequent vacation (Part 2 of Article 125 of the Labor Code of the Russian Federation).

Illness during rest

You will not have to recalculate your vacation pay if your vacation was extended due to illness during your vacation. You cannot do without recalculation in the following situations:

- The employee fell ill shortly before the start of his vacation, and his vacation pay was paid based on his full salary for the month preceding the vacation.

Example 5

The employee has been granted leave from July 5, 2022. Vacation pay was paid on June 28 (the full salary for June was included in the calculation of average earnings). But on June 29, the employee fell ill and brought sick leave for three days. In this case, wages for sick days and the days themselves must be excluded from the calculation.

- The employee fell ill shortly before the start of his vacation after his vacation pay was paid and remained ill for more than a month.

Example 6

An employee who had planned vacation on July 5 and received vacation pay on June 28 fell ill on July 29 and was ill for more than a month. He went on vacation only on August 6th. In this case, he needs to recalculate his vacation pay, since the billing period for calculating average earnings will be different: August 2020-July 2022.

Let us remind you that if an employee took sick leave not due to his own illness, but because of the need to care for a sick family member, this does not affect the period of the granted leave (clause 46 of the Procedure, approved by Order of the Ministry of Health dated 01.09.2020 No. 925n, Definition RF Armed Forces dated February 28, 2013 No. APL13-18).

Counting error

If, after paying vacation pay, an error was discovered in the calculation of average earnings and the vacationer received less than he was entitled to, the vacation amounts must be recalculated and paid additionally.

Let us recall that in accounting, additional payment for vacation and corresponding insurance premiums are subject to write-off from the reserve for payment of vacations.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Calculation of vacation pay when indexing wages in the 1C:ZUP program

While an employee is on annual leave, he retains his average earnings. When all employees in the organization increase tariff rates, salaries and other remunerations, the average earnings of employees must be indexed. The indexation procedure depends on the moment at which the salary increase occurred. Indexation is carried out by coefficients, which are calculated by dividing the newly established tariff rates, salaries, and remuneration by the previously established ones.

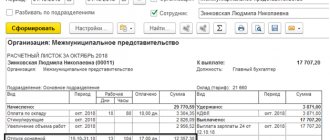

Calculation of vacation pay when indexing wages in the program “1C: Salaries and Personnel Management 8”

Calculation of vacation pay when indexing salaries during the billing period

In the case of wage indexation during the billing period, payments taken into account when determining average earnings and accrued in the billing period for the period of time preceding the increase are increased by coefficients that are calculated by dividing the tariff rate, salary, monetary remuneration established in the month of the last increase in tariff rates, salaries, monetary remuneration, tariff rates, salaries, monetary remuneration established in each month of the billing period, i.e. The payments that were accrued to the employee before the promotion are multiplied by the indexation coefficient.

Calculation of payment for basic annual leave, taking into account indexation

Registration and calculation of an employee's main annual leave is carried out using the Vacation document. Note:

if you plan to calculate wages separately from vacation pay, then you must first calculate wages taking into account the indexation carried out, and then the vacation pay themselves.

You can view the accrual results on the Accrued tab. To analyze the accrual results, you can generate a printed form for calculating average daily earnings by clicking the Print – Calculation of average earnings button.

If during the billing period an employee receives payments that are included in the calculation of average earnings, but are not increased by the indexation factor, then after indexation the amount of payments taken into account when calculating average earnings can be calculated using the formula:

Payments taken into account when calculating average earnings after indexation = Indexed payments before increase * Indexation coefficient + Non-indexed payments before increase + Payments after increase.

A detailed calculation can be viewed by clicking the Print button - Detailed calculation of charges.

Calculation of vacation pay when indexing salaries after the billing period, but before the day the employee goes on vacation

In the case of wage indexation after the billing period, but before the day the employee goes on vacation, the average earnings calculated for the billing period increase, i.e. It is not the payments related to the billing period that are indexed, but the amount of average earnings calculated for the billing period. If during the billing period an employee is accrued non-indexed payments, which are included in the calculation of average earnings, then the indexed payments taken into account when calculating earnings for the billing period should be increased by the indexation factor, not the average earnings.

Calculation of payment for basic annual leave taking into account indexation

Registration and calculation of an employee's main annual leave is carried out using the Vacation document.

You can view the accrual results on the Accrued tab. To analyze the accrual results, you can generate a printed form for calculating average daily earnings by clicking the Print – Calculation of average earnings button.

The method for increasing average earnings depends on whether payments that are not increased by the indexation factor are included in the calculation of average earnings or not.

If there were no payments that are taken into account when calculating average earnings, but are not increased by the indexation factor, average earnings taking into account indexation are calculated using the formula:

Average earnings including indexation = Average earnings without indexation * Indexation coefficient.

If during the billing period an employee receives payments that are included in the calculation of average earnings, but are not increased by the indexation factor, the organization can use an alternative option for calculating the employee’s average earnings taking into account the salary increase. It is not the average earnings that need to be increased by the indexation factor, but the payments taken into account when calculating earnings for the billing period, but on the condition that they are subject to indexation. Then add the received amount with the amount of payments that are not subject to indexation. The program uses this particular calculation option.

Thus, after indexation, the amount of payments taken into account when calculating average earnings for the billing period can be calculated using the formula:

Payments taken into account when calculating average earnings after indexation = Indexed payments * Indexation coefficient + Non-indexed payments.

A detailed calculation can be viewed by clicking the Print button - Detailed calculation of charges.

Calculation of vacation pay when indexing salaries while an employee is on vacation

In the case of wage indexation while an employee is on vacation, part of the average earnings increases from the date of increase in the tariff rate, salary, remuneration until the end of the specified period, i.e. the part of average earnings that falls on the period from the moment the salary is increased until the end of the vacation is recalculated. It is necessary to index the amount of average daily earnings that have already been accrued to the employee.

Calculation of payment for basic annual leave before indexation

Registration and calculation of employee leave is carried out using the Leave document.

Recalculation of vacation pay due to indexation

To recalculate vacation, go to the primary Vacation document and click on the Correct link. In the document being corrected, indicate the month in which the recalculation was calculated. As a result, vacation pay will be recalculated.

You can view the results of accruals on the Accrued tab, and the results of recalculation for the previous period on the Recalculation of the previous period tab. To analyze the accrual results, you can generate a printed form for calculating average daily earnings by clicking the Print – Calculation of average earnings button.

After the indexation, it is the average salary (amount of vacation pay) of the employee that increases, which is calculated using the formula:

Average earnings taking into account indexation = Average daily earnings * Number of vacation days for which average earnings do not need to be recalculated + Average daily earnings * Indexation coefficient * Number of vacation days for which average earnings need to be recalculated.

Note:

if the start date of the vacation coincides with the indexation date, then the entire average salary of the employee increases.

A detailed calculation can be viewed by clicking the Print button - Detailed calculation of charges.

Let's sum it up

- To calculate vacation pay, the number of vacation days is multiplied by the average daily earnings.

- The base for calculating vacation pay includes wages for days worked and other payments provided for by the wage system. Bonuses and salary increases are taken into account in a special manner, and sick leave, financial assistance and other payments for unworked days are not included in the calculation of vacation pay.

- The calculation period for vacation is 12 calendar months preceding the month the vacation begins.

- Paid non-working days due to coronavirus and payments for them are not taken into account when calculating the “vacation” average earnings if the employee did not work on these days.

- Paid vacation pay must be recalculated and the missing amount must be paid to the employee if its amount turned out to be underestimated as a result of a calculation error or other events (changes in salaries, payment of an annual bonus, etc.).