The peculiarity of transport tax tariffs is that they are individual for the constituent entities of the Russian Federation. That is, the size of the transport tax rate is determined in accordance with local legislation. However, both owners of prestigious cars and drivers whose vehicle is not used at all must pay funds for the use of vehicles.

It is worth noting that taxation is provided not only for cars for personal use, but also for a number of other vehicles.

Vehicles for which you must periodically pay a fee include:

- motor vehicles;

- cargo vehicles;

- airplanes and other vehicles moving by air;

- jet skis and other vehicles moving on water;

- snowmobiles.

The amount of tax deductions depends on several factors, largely dependent on the characteristics of the individual or legal entity.

According to accepted standards, the size of the tax rate depends on the following features:

- the subject's salary and standard of living;

- vehicle power;

- car category;

- the total number of vehicles owned by the person.

Less powerful cars require a lower transport tax rate. This is largely explained by the state's environmental policy: high rates should encourage drivers to purchase more environmentally friendly small cars.

Local authorities are still limited in their ability to set tariffs too high or low for the population. According to federal legislation, regional laws cannot provide for a rate that would differ from the basic rate by more than 10 times. In this case, the difference can be both smaller and larger.

Who should pay transport tax

The tax is paid by organizations and individuals, including individual entrepreneurs, for whom cars or trucks are registered with the State Traffic Inspectorate.

Also, transport tax is paid by companies and individuals (including individual entrepreneurs) who own registered self-propelled vehicles (tractors, excavators, tractors), helicopters, motor ships, boats, yachts, motor boats and other water and air vehicles. Fill out and submit your transport tax return for 2022 for free online

IMPORTANT

As for water transport, non-self-propelled (towed) vessels - barges, platforms, floating docks, etc. are also subject to tax. But in relation to trailers for land vehicles, there is no need to pay tax, even if the trailer is equipped with a motor necessary for the operation of the equipment installed on it (letter of the Ministry of Finance dated 02.16.11 No. 03-05-05-04/03).

Do I have to pay tax on quadcopters? It all depends on the maximum take-off weight of the aircraft. According to subparagraph 1 of paragraph 1 of Article 33 of the Air Code of the Russian Federation, official registration is required if the specified mass of the “drone” exceeds 30 kg. Unmanned civil aircraft with a maximum take-off weight from 0.25 kg to 30 kg inclusive are not subject to state registration, but registration (clause 3.2 of Article 33 of the RF Civil Code).

This difference in terminology is significant for transport tax purposes. As mentioned above, only registered vehicles are subject to it. Therefore, in relation to “drones” with a take-off weight from 0.25 kg to 30 kg, there is no need to pay transport tax (letter of the Federal Tax Service dated 02/11/19 No. BS-4-21 / [email protected] ).

ATTENTION

Evasion of registration of a vehicle (vehicle) will not relieve its owner from the need to remit transport tax (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/07/12 No. 14341/11).

Fill out waybills indicating the route and mandatory details in a special service

Major changes in transport tax for 2022

Let us remind you: from 2022, organizations have a new responsibility. They must report to the Federal Tax Service about available benefits for transport tax using a special form (approved by order of the Federal Tax Service dated July 25, 2019 No. ММВ-7-21/ [email protected] ; see “Approved application form for benefits for organizations on transport and land taxes ").

Previously, such a statement was not required - all information about benefits was reflected directly in the tax return. The Federal Tax Service clarified that applications need to be submitted only for tax periods starting from 2020. For previous years, as well as for periods during 2020 (for example, if the company was liquidated or reorganized), a separate application for benefits is not required (letter dated 09.12.19 No. BS-4-21 / [email protected] ).

ATTENTION

There is no deadline for applying for benefits. But, obviously, it is better to do this before the date of tax payment or the first advance payment on it. Therefore, if an organization has a tax exemption (advance payments) for 2022, then it is advisable not to delay submitting the application. Although, we note that the Federal Tax Service does not object to a later filing of the application (in 2022), that is, after paying the tax and receiving from the Federal Tax Service a message about the calculated (without benefit) amount of tax (letter of the Federal Tax Service dated December 3, 2019 No. BS-4- 21/ [email protected] ; see “The Federal Tax Service told how organizations can apply benefits for transport and land taxes from 2022”).

Apply for benefits online Apply for free

There is no need to submit a transport tax return for 2020 in 2022. It was canceled by Federal Law No. 63-FZ dated April 15, 2019 (see “Amendments to the Tax Code of the Russian Federation on “property” taxes: cancellation of declarations on transport and land taxes, new rules on benefits for individuals”). This is precisely why the introduction of a separate statement of benefits is connected.

Another change will affect owners of expensive cars. When calculating the tax for 2022, they must take into account the new list of cars for which increasing coefficients are applied (see “The list of expensive cars for calculating the transport tax for 2022 has been published”).

IMPORTANT

Organizations independently calculate advance payments and taxes at the end of the year and enter them into the budget within the established time frame. Starting from 2021, tax officials also determine the amount of tax (based on the information they have) and send out messages to organizations in the form approved by Order of the Federal Tax Service dated July 5, 2019 No. ММВ-7-21 / [email protected] .

The message is sent no later than 6 months after the tax payment date. If the taxpayer believes that the inspectors calculated the tax incorrectly, he can express his disagreement. In this case, you need to send explanations and supporting documents to the Federal Tax Service. Receive notifications from the Federal Tax Service about the amount of transport tax and generate payments in one click Generate for free

Transport tax table

There is no single rate for transport tax. Each subject of the Russian Federation has its own rates (but in most cases they cannot differ from the rates established in the Tax Code of the Russian Federation by more than 10 times). The rate depends on the type of vehicle (land, water, air), whether it has a motor and its power.

Information on current transport tax rates in a particular region can be found using a special service on the Federal Tax Service website. To do this, you need to indicate in the appropriate fields information about the tax period (the year for which the tax is paid) and the region. After this, you need to click the “Find” button and follow the “More details” link (located opposite the information about the regional law that appears).

Transport tax: general provisions

Transport tax was introduced in Russia in 2003. The economic meaning of this tax is compensation by owners of cars and other vehicles for damage caused to the environment and the road surface. A similar function is performed by:

- excise taxes on fuel and car production;

- tolls;

- fee for negative impact on the environment, levied on organizations and entrepreneurs.

In this regard, the issue of abolishing the transport tax has been repeatedly raised. However, in 2018-2019 it is still valid. The latest changes on it are collected in this publication. Whether the transport tax is planned to be abolished in 2018-2019, find out here.

There are several points of view on how the procedure for collecting transport tax can be reformed and made more fair. We talked about one of them in the article “Is transport tax included in the price of gasoline?”

Transport tax is regulated by Ch. 28 of the Tax Code of the Russian Federation, revenues from the collection of taxes are sent to the budgets of the constituent entities of the Russian Federation. The Tax Code of the Russian Federation determines:

- object of taxation;

- algorithm for calculating the tax base and the amount of tax payable;

- tax period and maximum rates.

Under the jurisdiction of the legislative bodies of the constituent entities of the Russian Federation in accordance with the provisions of Art. 363 of the Tax Code of the Russian Federation are:

- determination of the size of rates - their increase (decrease) within the limits established by Art. 361 Tax Code of the Russian Federation;

- payment terms;

See: “Procedure and deadlines for payment of transport tax in 2018-2019.”

- procedure for submitting reports and tax benefits.

For the largest taxpayers at the federal level, a separate procedure for filing a declaration is established (Article 363.1 of the Tax Code of the Russian Federation).

Transport tax is subject to:

- cars, motorcycles, buses;

This article talks about the transport tax on cars in Russia in 2018-2019.

- airplanes, helicopters;

- air, sea, river, towed vessels;

- other transport specified in Art. 358 Tax Code of the Russian Federation.

The tax base for transport tax depends on the type of vehicle:

- For cars and other vehicles whose power is measured in horsepower, the tax base will be equal to the number of horsepower according to PTS data. If the power of the taxable object is measured in kilowatts, then for calculating the tax, 1 kilowatt is equal to 1.3592 horsepower.

- For airplanes, the tax base is kilograms of thrust.

For more information on how to calculate the tax base for the purposes of paying transport tax in different cases, read this article.

IMPORTANT! In some constituent entities of the Russian Federation (for example, the Kaluga region), the tax is not levied on electric vehicles, and owners of cars with a hybrid engine (gasoline plus electric) will pay tax only on “gasoline” horsepower.

The tax period for transport tax is a calendar year. How to calculate the tax period in case of sale of a car or its theft, read our article “Tax period when paying transport tax (nuances)”.

Increasing coefficients for calculating transport tax

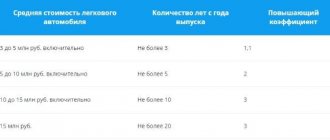

The tax on expensive cars is calculated taking into account the increasing coefficient (clause 2 of Article 362 of the Tax Code of the Russian Federation). It amounts to:

- 1.1 - for passenger cars worth from 3 million to 5 million rubles. inclusive, from the year of manufacture of which no more than 3 years have passed;

- 2 - for passenger cars worth from 5 million to 10 million rubles. inclusive, from the year of manufacture of which no more than 5 years have passed;

- 3 - for passenger cars worth from 10 million to 15 million rubles. inclusive, from the year of manufacture of which no more than 10 years have passed, as well as in relation to passenger cars costing from 15 million rubles, from the year of manufacture of which no more than 20 years have passed.

The list of such cars for 2022 is posted on the website of the Ministry of Industry and Trade. When using this list, please note that some of them have additional restrictions. We are talking about the column “Number of years that have passed since the year of issue” of the table. For example, for BMW M240i xDrive cars with a 2,998 cc petrol engine. see, the coefficient is applied only if 2 to 3 years inclusive have passed from the date of issue.

How to determine the number of years that have passed since the car was manufactured? The Tax Code of the Russian Federation does not contain clear explanations in this regard. In practice, two approaches to calculating the age of cars have been developed.

The first is based on the explanations given in the letter of the Federal Tax Service dated 03/02/15 No. BS-4-11 / [email protected] It says that when calculating the transport tax for 2014 in relation to a 2011 car, the number of years that have passed since the year of its manufacture, is 4 years. That is, the number of years that have elapsed since the year of manufacture of the car is determined in whole years. Therefore, the age of a car just released by a factory is one year (for the period before the end of the calendar year in which it was manufactured).

This means that the transport tax for 2022 for an expensive car in 2022 must be calculated taking into account the fact that the number of years that have passed since the year of its manufacture is 1 year. Such a car falls into the category “from 1 to 2 years inclusive” as defined in the list. Therefore, you will have to apply a multiplying factor.

The second approach is also based on official explanations. The letter of the Ministry of Finance dated 06.11.14 No. 03-05-04-01/28303 (brought to the attention of the tax authorities by the Federal Tax Service letter dated 07.07.14 No. BS-4-11 / [email protected] ) states that when calculating transport tax for 2014 year for a 2014 car, the number of years that have passed since the year of its manufacture will be no more than 1 year.

It turns out that for a 2022 car, the number of years that have passed since the year of its manufacture will be no more than 1 year. Consequently, such a car does not fall into the “from 1 to 2 years inclusive” category defined in the list, and when calculating the tax for 2022, an increasing factor is not required.

Unfortunately, there is no arbitration practice on this issue. Therefore, the taxpayer will have to decide for himself which of the above approaches to apply when calculating the age of the car. You can also contact the tax authority at the place of registration with a written request about the procedure for calculating transport tax in relation to a specific car (subclause 1, clause 1, article of the Tax Code of the Russian Federation). Following this clarification will exempt you from tax liability and will become the basis for non-accrual of penalties (subclause 3, clause 1, article 111 and clause 8, article of the Tax Code of the Russian Federation).

Receive requirements and send requests to the Federal Tax Service via the Internet

Procedure for calculating water tax

The rate for the main types of water use is determined by multiplying the water tax rate specified in paragraph 1 of Art. 333.12 of the Tax Code of the Russian Federation, and all coefficients that must be taken into account for its calculation.

Water tax in 2022 is calculated using the formula:

Where:

- volume of water - volume of water within the limit specified in the license;

Attention! If the limit is set for a year, it must be divided by 4. If a daily limit is set, then to determine the quarterly limit, you need to multiply it by the number of days in the quarter (letter of the Federal Tax Service dated January 22, 2015 No. GD-4-3 / [email protected] ).

- rate - base rate, approved. Art. 333.12 Tax Code of the Russian Federation.

- 2.31—increasing factor in 2022.

If water is taken above the limit, then a rate increased by an increased coefficient is applied for water taken above the limit. The formula for above-limit water intake will look like this:

An example of water tax calculation can be found here.

From 2026, the use of the coefficient will also become mandatory for the preferential water tax rate established for water withdrawal for the purpose of supplying the population.

Transport tax benefits

Just like rates, benefits are determined at the level of constituent entities of the Russian Federation. Article 361.1 of the Tax Code of the Russian Federation, which is called “Tax benefits,” establishes only a general procedure for their use. In particular, it says that in order to apply the benefit, the taxpayer needs to submit an application to the Federal Tax Service. However, if an application for a benefit is not submitted, tax authorities must apply it independently based on the data available to them.

IMPORTANT

Individual entrepreneurs pay transport tax like ordinary individuals.

This means that they must remit the transport tax based on the payment notice received from the tax office. It will include tax for no more than three years preceding the year in which the notice is sent. Tax authorities receive information for calculations from the authorities that register vehicles. If during the period of ownership of the vehicle the individual entrepreneur has not received a notice of tax payment, it is necessary to inform the inspectorate about the subject of taxation. Generate a payment invoice for payment of tax (penalties, fines) in one click based on the request received from the Federal Tax Service

The Tax Code contains a list of vehicles for which you do not have to pay tax at all. This is not about a benefit, but about the exclusion of a vehicle from the object of taxation (clause 2 of Article 358 of the Tax Code of the Russian Federation). This means that such transport does not need to apply for a benefit - the tax exemption is automatic.

Thus, throughout the entire territory of the Russian Federation you can avoid paying tax if the vehicle is wanted or the search has been stopped. The tax does not need to be transferred from the month the search began. In this case, the fact of theft (theft) is confirmed by a document issued by the police (State Traffic Safety Inspectorate) or information that the Federal Tax Service receives through interdepartmental information exchange (Article of the Tax Code of the Russian Federation). Also see: “When are stolen vehicles not subject to tax?”

Also not subject to tax are tractors, self-propelled combines of all brands and special vehicles (milk tankers, livestock tankers, vehicles for transporting poultry, vehicles for transporting and applying mineral fertilizers, veterinary care, technical maintenance). The exemption is valid if vehicles are registered to agricultural producers and are used for agricultural work.

Submit a free notification of the transition to the unified agricultural tax and submit tax reports

In addition, fishing sea and river vessels, as well as vessels registered in the Russian International Register of Vessels, are not subject to the tax. Organizations and individual entrepreneurs that carry out passenger and (or) cargo transportation do not have to pay tax for passenger and cargo sea, river and aircraft vessels that they own (under the right of economic management or operational management).

Calculation of transport tax in 2022

Tax must be paid only for those months when the vehicle was registered to the taxpayer. In this case, the calculation is carried out monthly and in full months, while registration can take place on any day. In this regard, the following rules have been established.

If the car is registered from the 1st to the 15th day of the month inclusive, then this month is taken as a full month. And if registration took place between the 16th and the last day of the month, then this month is not taken into account when calculating the tax.

When registration is terminated, the situation is reversed. If a car is deregistered from the 1st to the 15th of the month inclusive, then no tax is paid for that month. And if the date of deregistration falls on the period from the 16th to the last day of the month, then the tax will have to be paid for the full month (clause 3 of Article 362 of the Tax Code of the Russian Federation).

Regional laws for organizations may establish advance payments. In this case, at the end of each reporting period (first, second and third quarters), an amount equal to ¼ of the product of the tax base and the tax rate, taking into account the increasing coefficient (clause 2.1 of Article 362 of the Tax Code of the Russian Federation), is paid.

An example of calculating transport tax in 2022

The organization owns two cars. Truck with engine power 300 hp. s., which was purchased and registered on March 16, 2022. And a passenger car with an engine power of 205 hp. s, which was purchased in the previous tax period. This machine is included in the list of expensive ones (cost from 3 million to 5 million inclusive).

Based on regional law, the tax rate for a truck is 100 rubles/hp, and for a passenger car - 50 rubles/hp. With. The tax base is the engine power in horsepower. Regional law establishes advance tax payments.

Let's calculate the tax on a truck.

Since the car was purchased in mid-2022, you need to determine the number of months for which the tax is paid. Since the registration date falls on the 16th day of the month, this means that the month of registration (March) is not taken into account when calculating the tax. And in January and February the organization did not have a car.

Thus, for the first quarter the amount of the advance payment is not formed, since the ownership coefficient (Q) for this period will be 0/3, that is, it will be equal to zero. For the second and third quarters you will need to pay 7,500 rubles (1/4 × 300 hp × 100 rubles/hp). And you will have to pay the same amount at the end of the year, since the annual Kv will be 9/12 or 0.75. (300 hp × 100 rub./hp × 0.75 - 7,500 rub. × 2) = 7,500 rub.

Let's calculate the tax on a passenger car.

Kv will always be equal to one, since the car was in the possession of the company throughout 2021. An “expensive” coefficient of 1.1 must be additionally applied to the amount of tax and advance payment.

It turns out that for each quarter the organization will pay 2,819 rubles. Here's the calculation: 1/4 × 205 hp. × 50 rub./hp × 1.1 = 2,818.75 rub.; According to the rules of paragraph 6 of Article of the Tax Code of the Russian Federation, this amount is rounded up to the full ruble. The tax at the end of the year will be 11,275 rubles (205 hp × 50 rubles/hp × 1.1). Therefore, you will have to pay an additional 2,818 rubles (11,275 rubles – 2,819 rubles × 3).

In total, for two cars the organization must pay:

- for the first quarter - 2,819 rubles (0 + 2,819).

- for the second quarter - 10,319 rubles (7,500 + 2,819)

- for the third quarter - 10,319 rubles (7,500 + 2,819)

- at the end of the year - 10,318 rubles. (7,500 + 2,818).

The total amount of transport tax for 2022 will be 33,775 rubles (22,500 rubles + 11,275 rubles).

Tariffs by region

They must be established by local authorities of the subjects. If not accepted, when determining the size, the basic standards are taken as a basis, which are given below (2018-2019):

| Taxable an object | Tariff per liter s., rub. | |

| <100 l. With. | >100 l. With. | |

| Jet ski | 25 | 50 |

| Yacht | 20 | 40 |

| Speedboat, motorboat | 15 | 20 |

The given figures clearly show that the rate increases by 1 hp. twice for engines that are more powerful. Tariffs, as noted above, often differ among the regions and differ from the basic indicators. They may be larger or smaller than them. However, regions cannot produce an increase of more than ten times.

The Arkhangelsk authorities have installed boats with PLM for 1 hp for owners. 52 rubles. That is, with an engine power of 75 “horses”, they have to give the state 3.9 thousand rubles. But Irkutsk residents, with the same power, pay one thousand less - 2.96 thousand rubles, since one horse costs boat owners 39.5 rubles.

However, there are also much more significant differences between regional values and basic indicators. For example, the owner of a motor boat living in the Amur region is obliged to pay the treasury about 10 thousand rubles for an engine of 100 horses. And a resident of the Chukotka region in a similar situation will pay an order of magnitude less. It is not always clear such behavior of local authorities and what motives they are guided by.

Attention! In some regions, for example Moscow and the region, it has already become a tradition to set tariffs at an upper limit. But, unfortunately, in recent years there have been practically no regions that would reduce rates from the base indicator.

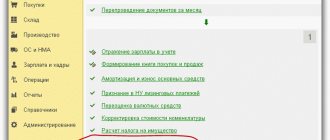

Transport tax reporting in 2022

The “transport” declaration for 2022 needs to be submitted only to those companies that were reorganized or liquidated before the end of this year (see “Tax officials reported which organizations must submit a transport tax declaration for 2022”). “Interim” declarations (calculations) based on the results of reporting periods are not provided.

From January 1, 2022, Article 363.1 of the Tax Code of the Russian Federation, which establishes the obligation to submit a “transport” declaration, ceases to apply (clause 3 of Article 3 of the Federal Law of April 15, 2019 No. 63-FZ). Therefore, there is no need to submit reports at the end of 2022 and later periods.

IMPORTANT

For individual entrepreneurs, no reporting on transport tax is provided.

Fill out and submit your transport tax return for 2022 for free online

Deadlines for payment of transport tax

From 2022, the payment deadline is the same for the entire country: organizations transfer the tax until March 1 of the next year (Clause 68 of Article of the Federal Law of September 29, 2019 No. 325-FZ). This rule began to apply with the payment of taxes for 2022.

Individual entrepreneurs must pay the amount of tax specified in the notice no later than December 1 of the following year.

Advance payments for transport tax are made only by organizations and only in those regions where these payments have been introduced by the relevant law. Starting from 2022, the transfer deadline has become uniform for the entire country - advance payments must be made no later than the last day of the month following the expired reporting period (clause 1 of Article 363 of the Tax Code of the Russian Federation).

Water tax rates

Water tax rates for the main types of water use are established in clause 1 of Art. 333.12 Tax Code of the Russian Federation. They depend on the region of use of the facility, and for water intake, also on its type (surface or underground). The legislation also provides a preferential rate for water withdrawal for the purpose of water supply to the population (clause 3 of Article 333.12 of the Tax Code of the Russian Federation).

Starting from 2015, the water tax rates specified in paragraph 1 of Art. 333.12 of the Tax Code of the Russian Federation, must be applied with adjustment by increasing coefficients, the values of which for the period from 2015 to 2025 are given in clause 1.1 of Art. 333.12 Tax Code of the Russian Federation. In 2020, the increasing coefficient is 2.31.

From 2026, the increasing coefficient will become calculated and will be determined by the actual change in consumer prices for the year preceding the year in which the corresponding calculated coefficient began to be applied. Each subsequent coefficient will be applied to the actual water tax rate for the previous year. The bet calculated taking into account the odds must be expressed in whole rubles.

Annual increasing coefficients must also be applied when calculating rates in cases of mandatory application of other increasing coefficients:

- 5-fold - with above-limit water intake;

- 10-fold - when withdrawing groundwater for further sale;

- 10 percent - in the absence of means of measuring the volume of water taken.

Since 2015, the preferential water tax rate provided for water withdrawal for the purpose of water supply to the population has been increased. Systematic growth is also planned for it during 2015–2025, but it is expressed not in coefficients, but in specific ruble values. In 2022 - 162 rubles. for 1 thousand cubic meters m of collected water (clause 3 of Article 333.12 of the Tax Code of the Russian Federation) and is applied throughout the entire Russian Federation, regardless of the subject.

For water tax rates, see the material What are the water tax rates for 2022.

From 2026, a calculated increasing coefficient depending on changes in consumer prices will also begin to be applied to this rate in a manner similar to that introduced for water tax rates for main types of water use.