Transport tax rates in the Krasnodar region

For a year

| Name of taxable object | Rate (RUB) for 2022 |

| Passenger cars | |

| up to 100 hp (up to 73.55 kW) inclusive | 12 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 25 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 75 |

| over 250 hp (over 183.9 kW) | 150 |

| Motorcycles and scooters | |

| up to 35 hp (up to 25.74 kW) inclusive | 8 |

| over 35 hp up to 50 hp (over 25.74 kW to 36.77 kW) inclusive | 15 |

| over 50 hp up to 100 hp (over 36.77 kW to 73.55 kW) inclusive | 35 |

| over 100 hp (over 73.55 kW) | 50 |

| Buses | |

| up to 200 hp (up to 147.1 kW) inclusive | 25 |

| over 200 hp (over 147.1 kW) | 50 |

| Trucks | |

| up to 100 hp (up to 73.55 kW) inclusive | 15 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 30 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 60 |

| over 250 hp (over 183.9 kW) | 80 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms | 15 |

| Snowmobiles, motor sleighs | |

| up to 50 hp (up to 36.77 kW) inclusive | 25 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles | |

| up to 100 hp (up to 73.55 kW) inclusive | 30 |

| over 100 hp (over 73.55 kW) | 200 |

| Yachts and other motor-sailing vessels | |

| up to 100 hp (up to 73.55 kW) inclusive | 200 |

| over 100 hp (over 73.55 kW) | 400 |

| Jet skis | |

| up to 100 hp (up to 73.55 kW) inclusive | 50 |

| over 100 hp (over 73.55 kW) | 100 |

| Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage) | 50 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 175 |

| Airplanes with jet engines (per kilogram of thrust) | 200 |

| Other water and air vehicles without engines (per vehicle unit) | 1500 |

FILES

Note to the table: the values are given in the Krasnodar Territory for 2016, 2022, 2022, 2022, 2022, 2022, 2022. To select rates for a specific year, use the selector. These rates are applied in the cities: Krasnodar, Sochi, Novorossiysk, Armavir, Yeysk, Kropotkin, Slavyansk-on-Kuban, Anapa, Tuapse, Labinsk, Gelendzhik, Tikhoretsk, Krymsk, Timashevsk, Belorechensk, Kurganinsk, Ust-Labinsk, Korenovsk, Apsheronsk, Temryuk, Abinsk, Novokubansk, Gulkevichi, Goryachiy Klyuch and other settlements of the Krasnodar Territory.

In the Krasnodar Territory, the number of transport tax payers exceeds 1.5 million individuals (both organizations and citizens). In accordance with the established procedure, more than 2.5 million units of equipment are registered with them. The procedure for paying fees from them to the budget is determined by regional law No. 639-KZ of November 26, 2003.

How is transport tax calculated?

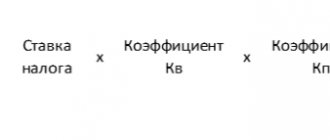

To make correct calculations, you need to know certain data and the formula by which they will be made.

This way, you can independently determine the amount required to pay even before the tax is calculated.

Information for calculations:

- type of technical means;

- transport power;

- regional tax rate of the Krasnodar Territory;

- the period for which the payment will be made.

All this data will be needed for the calculation. Next, you need to follow a certain algorithm that will help you not make mistakes when calculating.

Step-by-step calculation of transport tax:

- look at the tax rate for the required type of technical equipment in the table;

- multiply this coefficient by the transport capacity;

- multiply the result obtained by the period for which it is necessary to calculate the amount to be paid.

Tax calculation and payment deadlines for organizations

Payment rules have been established for legal entities, according to which organizations are required to make advance payments based on quarterly results. The deadline for their transfer is the 5th day of the second month after the end of the quarter (in May, August, November). The legal entity transfers the remaining amount of transport tax until March 1 after the end of the tax year.

Regardless of the type of vehicle, payment is made at the location of the equipment. Russian legislation implies by this wording that the “location” is tied to the legal address of the organization.

Deadline for payment of transport tax for legal entities in 2022:

- for 2022 - no later than March 1, 2022

- for the 1st quarter of 2022 - no later than May 2, 2022

- for the 2nd quarter of 2022 (6 months) - no later than August 1, 2022

- for the 3rd quarter of 2022 (9 months) - no later than October 31, 2022

- for the 4th quarter and the entire year 2022 - no later than March 1, 2023

Benefits for organizations and enterprises

A number of transport tax benefits (this applies to both business entities and individuals) are mandatory for the whole of Russia and operate at the federal level, which is reflected in Art. 358 of the Russian Tax Code.

In addition, in the Krasnodar Territory, local legislative acts stipulate that public fire protection associations are exempt from payment - in relation to special equipment that is used in carrying out emergency rescue operations or extinguishing fires.

Rules and deadlines for paying taxes for individuals

Citizens do not need to calculate taxes on their own or think about the timing and place of payment. All necessary information is recorded in notifications sent out by the tax authority. It is important to remember that such documents are sent to your residential address. And if the payer does not receive it due to absence at the place of registration, this fact will not be considered a valid reason for missing payment. If the tax is not transferred to the budget by December 1 at the end of the reporting year, penalties will be charged on the amount of the debt.

Deadline for payment of transport tax for individuals in 2022:

- for 2022 - no later than December 1, 2022

- for 2022 - no later than December 1, 2023

Please take into account: in accordance with paragraph 7 of Art. 6.1. Tax Code of the Russian Federation, if the last day of the period falls on a weekend, then the day of expiration of the period is considered to be the next working day following it.

Property tax benefits for individuals

Benefits for paying property tax for individuals are determined by Article 407 of the Tax Code of the Russian Federation and the Decision of the Krasnodar City Duma dated November 17, 2016 No. 26, clause 13:

| · Heroes of the Soviet Union · Heroes of the Russian Federation and full holders of the Order of Glory · Veterans of the Great Patriotic War · Disabled people of groups I and II, disabled since childhood · Citizens exposed to radiation during the Chernobyl accident · Military personnel and citizens discharged from military service due to length of service, health conditions, staff optimization, having military service experience of 20 years or more · Persons who took part in special risk units in testing nuclear and thermonuclear weapons · Family members of a military personnel who have lost their breadwinner · Pensioners · Citizens who performed international duty in Afghanistan and other countries · Persons who received radiation sickness as a result of testing nuclear installations · Parents and spouses of military personnel and government employees who died in the line of duty |

An application from the taxpayer confirming the status of the preferential category is required. A tax benefit is provided in respect of one taxable object of each type at the taxpayer’s choice, regardless of the number of grounds for applying the benefits |

| Large families | The benefit is provided in relation to one taxable object at the taxpayer's choice. Base:

|

| Individuals engaged in professional creative activities | The benefit applies to specially equipped premises and throughout the entire period of use:

|

| Land owners | The benefit applies to economic buildings or structures, the area of each of which does not exceed 50 sq.m., located on land plots provided for personal subsidiary plots, dacha farming, vegetable gardening, horticulture or private housing construction. |

Property tax benefits for legal entities

Property benefits for legal entities are determined by the Law of the Krasnodar Territory of November 26, 2003 No. 620-KZ “On the property tax of organizations”:

| Legal entities | Explanation |

| State authorities of the Krasnodar Territory, local government bodies in the Krasnodar Territory, as well as institutions under the jurisdiction of these authorities, in terms of the following property: · historical and cultural monuments; · public roads, bridges and other transport and pedestrian engineering structures; · perennial decorative and landscaping plantings; · shelterbelts and other forest belts; · artificial plantings of botanical gardens, other research institutions and educational institutions for research purposes; · waste disposal facilities. | |

| Credit organizations providing loans for a period of more than one year for the implementation of investment and leasing projects | The volume of loans for these purposes is at least 20 percent of the total volume of loans provided by the credit institution, and the interest rate on lending does not exceed the current refinancing rate of the Central Bank of the Russian Federation on the date of conclusion of the loan agreement |

| Religious organizations regarding property intended for the production and processing of agricultural products | |

| Religious organizations in terms of property transferred under a free use agreement to state and municipal educational organizations for orphans and children left without parental care (legal representatives), as well as state and municipal special (correctional) educational organizations for students (pupils) with disabilities in development in order to carry out the main statutory activities of these organizations | |

| Military-type automobile columns, motor transport enterprises and organizations supplying vehicles for the formation of military-type automobile columns and specialized formations, in terms of the roster of vehicles supplied to the Armed Forces of the Russian Federation | |

| Housing cooperatives, housing construction cooperatives, homeowners' associations |

Calculation of cadastral value of real estate objects

Resolution of the Head of Administration (Governor) of the Krasnodar Territory dated January 16, 2012 No. 12 “On approval of the results of the state cadastral valuation of real estate located on the territory of the Krasnodar Territory” allows persons who have ownership rights to real estate in Krasnodar to familiarize themselves with the cadastral value of what is due to them object.

Also, to obtain the cadastral value, you can go to the website of the Federal Service for State Registration, Cadastre and Cartography https://rosreestr.ru.

Transport tax for legal entities in Krasnodar

Legal entities registered in Krasnodar and operating any taxable transport in their activities, unlike individuals, are required to make advance deductions towards payment of transport tax by the 5th day of the month following the reporting period. Reporting periods mean the 1st, 2nd and 3rd quarters of the calendar year.

Organizations must pay the amount of transport tax by March 1 of the next year (that is, on March 1, 2022, the company pays tax for 2016).

Table of property tax rates for individuals

By decision of the Krasnodar City Duma dated November 17, 2016 No. 26, clause 13, tax rates for the property of individuals were determined based on the cadastral value:

| Object of taxation | Tax rate |

| · residential building, residential premises; · an object of unfinished construction if the designed purpose of such objects is a residential building; · a single real estate complex, which includes at least one residential premises (residential building); · garages and parking spaces; · economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for the conduct of personal subsidiary plots, dacha farming, vegetable gardening, horticulture or individual housing construction | 0,2% |

| · administrative, trade and business centers and premises in them; · non-residential premises providing for the placement of offices, retail facilities, public catering facilities and consumer services; · real estate of foreign companies that do not operate in the Russian Federation through permanent representative offices; · real estate of foreign companies not related to the activities of these companies in the Russian Federation through permanent representative offices; · residential assets not accounted for as fixed assets. | 0,5% |

| Real estate objects built in accordance with the Program for the construction of Olympic venues and the development of the city of Sochi as a mountain climatic resort (in whole or in part using funds raised in accordance with loan agreements concluded with state corporations) | 2017 – 0% 2022 – 0.7% 2022 – 1.5% 2022 – 2% |

| Taxable objects whose cadastral value exceeds 300 million rubles | 0,5% |

| Other objects of taxation | 0,5% |