Russian legislation is very friendly to pensioners, offering them many benefits and allowances, including with regard to paying taxes. The transport tax benefit for pensioners is one of the most popular. They are federal and regional in nature. Federal ones are intended only for certain categories of pensioners (WWII veterans, combatants, disabled people of the first and second groups). As for regional benefit recipients, the transport tax and benefits for it in 2022 have their own characteristics in each region, therefore they are clarified locally.

Previously, the transport tax was called a road tax, but in 2022 the name changed. This tax is collected from all citizens who have personal transport, and the collected funds are transferred to the region to maintain the road infrastructure at the proper level.

For what transport can a pensioner receive a benefit?

Are there any transport tax benefits for pensioners?

In order to understand transport tax benefits for pensioners in 2020-2021, let’s look at the Tax Code. In accordance with paragraph 1 of Art. 358 of the Tax Code of the Russian Federation, all individuals (including pensioners) are required to pay tax on the following types of vehicles:

In what cases can a pensioner receive a benefit for these types of transport? Only in one case - if the regional legal regulation provides for tax bonuses in the form of full or partial exemption from transport tax.

There is also a group of vehicles for which transport tax is not paid at all. Such tax exemption is not considered a benefit (clause 2 of Article 358 of the Tax Code of the Russian Federation).

You can find out more about the list of property not subject to transport tax here .

Questions and answers

Question No. 1. I am a pensioner, live in Moscow and own an expensive car. Are there any transport tax discounts for pensioners?

The legislation of the Russian Federation does not provide for transport tax discounts for owners of expensive cars. Even the fact of the car owner’s retirement age does not affect the amount of tax.

Question No. 2. Yesterday my car was stolen. Are there any transport tax benefits for pensioners whose car has been stolen?

You need to provide the Federal Tax Service with documents about the car theft, which will allow you to avoid paying tax.

What benefits can pensioners count on according to regional legislation?

The establishment of tax benefits for pensioners on transport tax is within the competence of regional authorities. What transport tax benefits for pensioners exist in different regions of our country?

Regions have different approaches to providing transport tax benefits to pensioners. When analyzing regional legal acts, the following approaches can be noted:

- Pensioners pay part of the tax on vehicles of a certain type, limited capacity (Karachay-Cherkess Republic, Republic of Karelia, etc.).

- Pensioners are not provided with benefits (Republic of Adygea, Bashkortostan, Volgograd, Kaluga, Voronezh regions, etc.).

In some regions, benefits are provided only for domestically produced passenger cars, or the condition for receiving benefits is the length of the period during which the vehicle was registered to a pensioner (for example, at least three years).

Most regions provide transport tax benefits to pensioners only for one vehicle.

You can find out what benefits are available in your region using a special service on the Federal Tax Service website.

Benefits for individuals

A number of residents of the region may qualify for transport tax benefits:

- heroes of the USSR, Russian Federation, as well as full holders of the Order of Glory;

- veterans and disabled combat veterans, incl. WWII;

- disabled people (disability group 1, 2);

- citizens who were captured by the Nazis as minors during WWII;

- victims of radiation as a result of the Chernobyl accident;

- guardian of a disabled child, one of the parents in a large family;

- victims of radiation during the accident at Mayak, as well as those exposed to radiation during testing at the Semipalatinsk test site;

- citizens who were at risk during nuclear weapons testing, as well as those who suffered from radiation sickness during such tests;

- guardian of an incapacitated citizen;

- owners of vehicles with engines less than 70 hp.

FILESOpen table of transport tax benefits in the Moscow region

Are there any discounts for pensioners on transport tax on luxury cars?

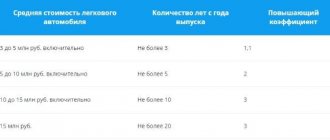

A retired citizen can own a new expensive car. As a rule, the amount of transport tax for such cars is several times higher than the tax liability for ordinary cars. This is due to the use of special coefficients that increase the transport tax depending on how much the car costs and in what year it was manufactured (clause 2 of Article 362 of the Tax Code of the Russian Federation).

You can check whether your car is included in this list on the website of the Ministry of Industry and Trade.

Are there any relaxations in the payment of transport tax for pensioners - owners of “sophisticated” SUVs and other luxury vehicles? Do pensioners have transport tax benefits for cars worth 3 million rubles? and more? What if, after retirement, a citizen is unable to transfer significant tax amounts to the budget for his transport?

In this case, pensioners cannot hope for tax breaks. No matter how much their car costs, their obligations to the budget to pay transport tax must be fulfilled in full, and if there are regional benefits, they must be taken into account. The state does not undertake the obligation to forgive a citizen part of his tax payments just because he retired. Therefore, you will not find benefits for pensioners on expensive vehicles in any regional legal regulation.

We will tell you in this publication how to pay transport tax on an expensive car if it is not on the list of the Ministry of Industry and Trade.

Exemption from transport tax for pensioners in Moscow in 2022

In accordance with Art. 4 of the Moscow Law of July 9, 2008 No. 33 “On Transport Tax” (as amended and supplemented) defines the segment of transport tax beneficiaries:

| Category of citizens | Transport tax benefit |

| · Heroes of the Soviet Union · Heroes of the Russian Federation and full holders of the Order of Glory · Veterans of the Great Patriotic War · disabled people of groups I and II, disabled since childhood · citizens exposed to radiation during the accident at the Chernobyl nuclear power plant | Exempt from payment of transport tax, but no more than one vehicle per tax period |

Important! If persons have the right to receive benefits on several grounds, the benefit is provided on one basis in accordance with the taxpayer’s application.

Moscow pensioners do not belong to the categories of citizens who are subject to transport tax, and therefore there are no transport tax benefits for pensioners.

A pensioner's car was stolen: how to get benefits?

Are there any benefits for pensioners on payment of transport tax if the car is not used due to its theft?

This is not a benefit, but there really is an opportunity not to pay tax if it is stolen. And not only among pensioners.

According to sub. 7 paragraph 2 art. 358 of the Tax Code of the Russian Federation, vehicles that are on the wanted list, as well as vehicles for which the search has been stopped, are not taxed. Facts of theft (theft), return of the vehicle must be confirmed:

- a document issued by an authorized body;

- or information received by tax authorities from the traffic police through the system of interdepartmental electronic interaction.

Thus, if a pensioner wants to save on his tax payment, he has two options:

- Report the theft to the tax office. It is advisable to attach a supporting document to the application (for example, a theft certificate obtained from the police). But even if you do not have such a document, the Federal Tax Service must accept the application and contact the traffic police itself for confirmation. The tax will not be charged from the month the search for the car began until the month it was returned to the owner.

- Remove the car from registration with the traffic police - from that moment on, no tax will be charged.

What tax benefits do pensioners have when selling a car?

When selling a car, no special bonuses or transport tax benefits are provided for pensioners. In addition, in some cases, a pensioner needs to pay income tax (NDFL) to the budget and submit a 3-NDFL declaration.

The obligation to pay personal income tax on the proceeds from the sale arises for a pensioner if he has owned the vehicle for less than three years (subclause 5, clause 1, article 208, clause 17.1, article 271 of the Tax Code of the Russian Federation).

How you can reduce the amount of personal income tax in this case, find out from this material.

Despite the fact that there are no transport tax benefits for pensioners when selling a car, there is a way to reduce the tax by using a special coefficient. With its help, the period of ownership of the vehicle in the year of sale is taken into account. The closer the sale date is to the beginning of the year, the lower the amount of transport tax on the sold vehicle.

When calculating the months of ownership of a vehicle, the date of deregistration is important (clause 3 of Article 362 of the Tax Code of the Russian Federation): if this event occurred before the 15th day, then this month is not included in the tax calculation, if after the 15th day - the month accepted as complete.

Example

The Patrikeev family has two absolutely identical cars, registered separately in the name of husband and wife. Every year, each spouse pays a transport tax in the amount of 3,630 rubles for their car.

The head of the family decided to upgrade his car and sold his old car at the beginning of January 2022 (immediately after the New Year holidays). In the same month, his wife damaged her car as a result of unsuccessful parking. After the repairs, she decided to sell it, but only deregistered it with the traffic police on December 16, 2020.

As a result for 2022:

- the husband does not pay transport tax - including for January (the month of sale and deregistration), since the date of deregistration of the car falls before January 15;

- the wife is obliged to pay the transport tax in full for the year - the date of deregistration of the car falls in the period after December 15 and this month is fully taken into account when calculating the transport tax.

As a result, in 2022, both spouses did not use their cars, and the amount of transport tax turned out to be completely different for them.

It turns out that when selling a car there are no transport tax benefits for pensioners. But from the moment the sold car is deregistered, the pensioner ceases to be a payer of transport tax on it.

A pensioner has a heavy-duty vehicle: what tax benefits can he count on?

For the purposes of applying transport tax benefits, a heavy-duty vehicle is understood to be a vehicle with a permissible maximum weight of over 12 tons.

What formula is used to calculate the permissible maximum (permitted) weight of a car, see here .

From 2022 there are no benefits for heavy trucks. And not only for pensioners, but also for all other tax payers.

Until December 31, 2018, a pensioner who owned such a car could count on benefits in the form of:

- full exemption from transport tax or

- reducing the tax amount.

Thus, an individual (including a pensioner) who owned a heavy truck was completely exempt from transport tax if:

- his heavy truck is registered in the register of vehicles of the Platon system;

- the payment to Platon for the year in respect of this heavy load was equal to or exceeded the amount of transport tax.

If the amount of transport tax on heavy cargo exceeded the payments made to Platon, the benefit was provided in the amount of the payment made (by reducing the tax by this amount).

From 01/01/2019, both taxes and fees are paid to Platon for heavy loads.

Transport tax: definition and general rules of calculation

Transport tax is a government fee collected from each owner of a registered vehicle. Its size depends on a number of factors, ranging from the region of residence to the power of the car engine. The main purpose of introducing a transport tax is to accumulate funds for further use for road repair and construction. It is worth saying that analogues of transport tax exist in all countries of the world. Vehicle tax is mandatory. Contributions to the treasury are made once a year.

The owner of the car is obliged to pay the tax before December 1 of the year following the reporting year. That is, car owners will receive tax receipts for 2022 in 2022.

Transport tax is subject to:

- Motor scooters.

- Motorcycles.

- Cars.

- Water vehicles.

- Trucks.

- Self-propelled vehicles.

As mentioned above, the calculation of the amount of transport tax depends on a number of individual factors. One of them is a rate set at the regional level. The regions also provide benefits for certain categories of citizens.

What is required from a pensioner to receive benefits?

If a pensioner is entitled to a transport tax benefit, he must inform the tax office about this. This message is issued in the form of a statement in the established form (order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/ [email protected] ).

You can apply for free by clicking on the picture below:

A sample from ConsultantPlus will help you fill out the application. Get trial access to the system for free and proceed to the sample.

Using this document, you can declare your right to benefits for three property taxes at once:

- transport;

- land;

- on property.

If the pensioner does not send this application to the tax authorities, he will not receive benefits.

You can attach documents confirming your right to benefits to your application, although this is not necessary (clause 3 of Article 361.1 of the Tax Code of the Russian Federation). If documents are missing, the tax authorities themselves will request them from the relevant authorities that have the necessary information. And only if the controllers do not receive this information will they inform the pensioner about the need to submit documents.

Results

Pensioners can count on certain transport tax benefits if regional authorities have provided for such a possibility in regulations. This may be a full or partial tax exemption. Regions solve the issue differently: they allow pensioners to reduce the tax burden by 20%, 40%, 50% of the tax base for specific types of transport or set reduced rates per unit of capacity.

If a pensioner does not use his car due to theft, he does not have to pay transport tax. To do this, you need to bring a police certificate to the tax authorities or deregister the car with the traffic police.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.