Who should buy a work patent?

Citizens of other states arriving to work in the Russian Federation must acquire a special patent .

At the same time, the patent is not available to all foreigners, but only to immigrants from those countries with which Russia has a visa-free regime.

This document replaced the previously mandatory work permit for everyone in our country. During the validity period of the patent, its owners must make strictly fixed advance payments to the Federal Tax Service of the Russian Federation .

Those foreign citizens who came to work in Russia from visa countries are still required to obtain a work permit.

It should be noted that a patent must be acquired regardless of whether the foreigner is an entrepreneur and works for himself personally or is an employee. The organizational and legal status of his employer also does not matter: either an individual entrepreneur or a legal entity can act as such.

Neither commercial nor state enterprises have the right to hire foreign citizens without special permission or a patent.

Otherwise, they face serious administrative punishment in the form of a fairly large fine.

Conditions for reducing personal income tax by the amount of fixed payments under a patent

After employing a foreigner, personal income tax on his income is calculated and withheld by a tax agent - his employer at a rate of 13 percent, regardless of whether the foreigner is a resident or not (paragraph 3, clause 3, article 224 of the Tax Code of the Russian Federation).

The amount of personal income tax is reduced by the amount of fixed advance payments for the period of validity of the patent (clause 6 of Article 227.1 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated June 20, 2019 No. BS-4-11/ [email protected] , Ministry of Finance of the Russian Federation dated March 20, 2019 No. 03-04-07/18414 (brought to the attention of tax inspectorates by letter of the Federal Tax Service of the Russian Federation dated April 11, 2019 No. BS-4-11/6803)).

In order to reduce the amount of personal income tax by fixed payments, the employer must have the following documents on hand:

-notification from the tax office;

-application from a foreigner;

- documents confirming payment of the “patent” personal income tax (clause 6 of Article 227.1 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated March 14, 2016 No. BS-4-11 / [email protected] , dated September 23, 2015 No. BS-4 -11/ [email protected] ).

Important!

Notification by tax authorities must be issued for each tax period (clause 6 of Article 227.1 of the Tax Code of the Russian Federation). If a foreigner has paid for a “rolling” patent, then a notification must be received for each year.

If the decision is positive, the tax authorities will issue a notification within 10 working days. The tax office has the right to refuse to issue a notice if:

- the foreigner was already given a notice in the same tax period;

-in the inspection database there is no information about the conclusion of an employment or civil contract with this foreigner and the issuance of a patent to him.

If a notice is refused, the employer does not have the right to reduce the amount of personal income tax by the listed fixed advance payments (clause 2 of Article 226, Article 227.1 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated September 7, 2018 No. BS-4-11/17454).

Who should apply for the right to reduce personal income tax?

The direct calculation and transfer of personal income tax to the tax service is usually not carried out by the foreigner himself, but by his employer, who is the direct tax agent. He also writes an application to reduce the amount of tax paid due to the advance payments made by the foreigner as payment for the patent. In this case, not all payments are taken into account, but only those that were made in the current calendar year.

It is important to recall here that a patent can be paid either at a time or in installments, since it is issued for a period of 1 to 12 months. All receipts and checks confirming payments made must be kept.

Fixed advance payment for personal income tax

“Visa-free” foreigners, with the exception of certain categories of foreign citizens, in cases provided for by law, can work in Russia only on the basis of a patent (paragraph 1, paragraph 4, article 13, paragraph 1, article 13.3 of the Federal Law of July 25, 2002 No. 115-FZ (hereinafter referred to as Law No. 115-FZ)).

A patent is issued for a period of 1 to 12 months with the right of repeated extension for a period of one month (clause 5 of Article 13.3 of Law No. 115-FZ). The validity period of a patent directly depends on the size of the fixed advance payment for personal income tax. 09.26.2016 Author: Elena Titova, expert of the Legal Consulting Service GARANT, member of the Chamber of Tax Consultants

Payment of a fixed advance payment

When initially obtaining a patent, a fixed advance payment is paid (independently at the place where the foreigner carries out activities on the basis of the issued patent) before the day of its issuance, and subsequent payments to renew the patent must be paid before the expiration date of its validity (Clause 4 of Article 227.1 of the Tax Code of the Russian Federation) . Only under such circumstances the patent is considered extended; otherwise, its validity will be terminated (paragraph 3, 4, paragraph 5, article 13.3 of Law No. 115-FZ).

The employer has the right to remove an employee whose patent has expired from work until the patent is renewed, or to completely terminate the employment contract with him (part 1 of article 327.5, clause 5 of part 1 of article 327.6 of the Labor Code of the Russian Federation)

The employer-tax agent has the right to reduce the personal income tax of a foreign employee by the amount of fixed advance payments paid by him independently.

Fixed advance payment amount

The basic amount of a fixed advance payment is 1,200 rubles per month (clause 2 of Article 227.1 of the Tax Code of the Russian Federation). This value is annually indexed by the deflator coefficient and the regional coefficient.

Monthly amount of fixed advance payment for personal income tax = Basic amount of fixed advance payment x Deflator coefficient x Regional coefficient

For 2016, the deflator coefficient is 1.514 (order of the Ministry of Economic Development of Russia dated October 20, 2015 No. 772) (in 2015 - 1.307) (order of the Ministry of Economic Development of Russia dated October 29, 2014 No. 685).

The value of the regional coefficient is established by the law of the constituent entity of the Russian Federation and depends on the regional characteristics of the labor market. If such a coefficient is not established for the next calendar year, then its value is taken equal to 1 (paragraph 2, clause 3, article 227.1 of the Tax Code of the Russian Federation).

EXAMPLE

A citizen of Ukraine received a patent for the right to work in Moscow from 02/04/2016 for a period of one month. The cost of a patent is 4,200 rubles. per month (1200 x 1.514 x 2.3118 (Article 1 of the Moscow Law of November 26, 2014 No. 55)).

To renew the patent for another month, the specified amount must be paid before 02/04/2016 (02/03/2016 is the last day of payment). Further, in order for the patent to remain valid, the monthly fixed advance payment can be made on any day preceding the 4th of each month. The organization may offer the employee (but not oblige) to make a fixed advance payment on a certain day, for example, the 31st, 1st day of each month.

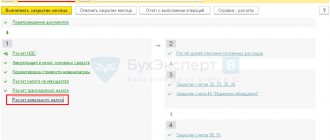

Current accounting

Post:

Comments

How to receive a notification

In order to receive a notification from the tax office about the right to reduce personal income tax through advance payments, the employer of a foreign citizen needs to contact the local tax service with a corresponding request, which is also drawn up in the form of an application in the approved form.

Within 10 days after this application is received by tax specialists, they are required to send the required notification.

Moreover, before sending it, tax officials must make sure that the FMS has proof of the conclusion of an employment contract between a foreigner and a Russian enterprise, and also that a notification has not yet been sent to anyone in relation to this person.

The cost of a work patent for foreign citizens for 2022.

As is known, advance payments of a foreigner (the amount of fixed payments for a work patent) are calculated based on the general deflator coefficient and the regional deflator coefficient. Thus, due to the change in the deflator coefficient for 2022, the amount of the fixed advance personal income tax payment for a work patent in 2022 will also change.

| To easily navigate the page, use the navigation: |

|

In our article, we tried to answer in detail questions related to changes in patent payment in 2022 and the calculation of the monthly payment for a patent, and also provided examples of calculations for calculating the cost of a patent for 2022 in various regions of the Russian Federation.

Below you will find a detailed table indicating the fixed advance payment of a foreign citizen for each region with examples of patent calculation for 2022.

As is known, visa-free foreign citizens working in Russia under a work patent must make monthly fixed advance payments on the patent - personal income tax tax, in order to extend its validity and be able to legally work in Russia further.

In other words, by paying for a patent a month in advance, a foreign citizen pays personal income tax on his work on the patent in the next month.

Thus, payment for a work patent by a foreign citizen must be made every month or several months in advance.

Important!

A fixed advance payment for a patent (personal income tax of a foreign citizen) must be made exactly within the allotted time. And in case of non-payment of personal income tax by a foreigner, as well as in the case of delay in payment of a patent even by 1 day, the work patent will be automatically revoked.

Important!

Be sure to keep all payment receipts for a work patent of a foreign citizen for each personal income tax payment for the entire period of validity of the document.

The monthly fixed advance payment for the 2022 patent must be made in advance, preferably 3-4 days before the date of issue of the patent work.

That is, for example, if your patent was issued on December 10 (issue date), then you need to make the next payment to the patent no later than January 10. At the same time, it is better to pay for the patent a little earlier, on January 8 or 9, so that by January 10, the entire amount of the fixed advance personal income tax payment for the work patent has already been “credited to your account.”

Today, the system for accounting for payment of income tax (fixed advance payments for a patent by foreign citizens) is fully automated, so the absence of an advance payment on a specific date leads to the automatic cancellation of a patent for work in the database of the Main Directorate for Migration of the Ministry of Internal Affairs.

Thus, if a fixed advance payment for a work patent in 2022 is made later than the date of receipt of the patent, even by one day, the document will be automatically canceled for late payment of the patent.

Today, a foreign citizen must renew registration on the basis of a patent whenever he pays advance personal income tax on a work patent.

That is, every time after the next payment for a patent in 2022, a foreign citizen will have to renew his registration. And since this is a rather troublesome procedure, a reasonable question arises: is it possible to pay for a work patent several months in advance so that you do not have to renew the registration every month?

Thus, if you are interested in the payment period for a work patent, that is, how many months in advance a foreign citizen can pay for a patent, we answer: At one time, a foreign citizen can make a fixed advance payment of personal income tax on a patent for a period of 1 to 12 months.

That is, if a foreign citizen pays for a patent one month in advance, then he will need to extend the registration of the patent for 1 month. And a month later, everything starts again: first, pay a fixed advance payment of personal income tax on the patent for the next period, then immediately after paying for the patent, renewal of registration.

If a foreigner pays for a patent 3 months in advance, then he needs to renew the registration 3 months in advance. And you will have to return to this issue only after 3 months, immediately after making the next advance payment for a patent to work as a foreign citizen.

Important! However, it will not be possible to pay for a work patent for more than 12 months, since the document will be valid for a maximum of one year from the date of issue.

That is, for example, if a foreign citizen makes a fixed advance payment of personal income tax immediately 15 months in advance, then the patent will still be valid for only 12 months from the date of issue. The rest of the fixed advance payment for the patent for 3 months will go to the state account and will simply burn out.

Accordingly, the maximum period for payment of a fixed advance payment for a work patent is 12 months from the date of issue.

Thus, a foreign citizen can pay for a work patent immediately a year in advance by making fixed advance payments of personal income tax on the patent for the next 12 months, or make a monthly advance payment on the patent throughout the year.

Many foreign citizens have already heard about changes in the cost of a patent for 2022, and therefore they are very interested in the question of whether it will change much and how much they need to pay for a patent in 2022.

We answer: the amount of payment for a patent in 2022 will change compared to 2022, since the deflator coefficient for 2022 for a patent has been changed, on the basis of which the monthly patent tax for a foreign citizen is calculated.

Thus, by order of the Ministry of Economic Development, the personal income tax deflator coefficient for 2022 was approved, which amounted to 1.980. Let us recall that last year, 2022, the personal income tax deflator coefficient was 1.864.

Accordingly, in 2022 the patent amount for foreign citizens has changed, and now the monthly payment for a patent in 2022 will be paid taking into account these changes.

The table below shows the monthly fixed cost of a patent for foreign citizens in 2022 for each region of the Russian Federation. How much NFDL should pay for a work patent to a foreign citizen in 2022 is displayed in the last column of this table.

In other words, in the last column of the table you can see the size of the fixed advance payment for a work patent for foreigners in 2022 by region of the Russian Federation.

The following presents the cost of a patent for foreign citizens in 2022, taking into account the new regional deflator coefficient for 2022, presented for each region of the Russian Federation.

Important! The yet unapproved regional coefficient for 2022, and, accordingly, the unapproved patent cost for 2022, are highlighted in red.

*The established regional deflator coefficient for 2022 is indicated in parentheses (). **The amount of monthly income tax for individuals under a patent in 2022 is highlighted in bold

How to fill out an application and submit it to the tax office

The application is written strictly according to the model developed and approved by the Federal Tax Service.

The form includes information about the employer and foreign worker, as well as the tax office to which the application is submitted, but the amount of personal income tax is not indicated in it.

Once the application has been properly completed, it must be submitted to the tax office. You can do this in any convenient way:

- coming to the tax office in person,

- coming with a representative holding a power of attorney,

- through electronic means (provided that the employer has a digital signature registered in accordance with all the rules),

- by sending via Russian Post by registered mail with acknowledgment of receipt.

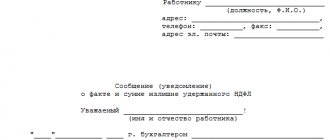

Sample of filling out an application to confirm the right to offset advance payments for personal income tax

The structure of the form is quite simple and understandable, but still some points may cause slight difficulties.

- At the beginning of the document, the TIN and KPP of the enterprise that is the foreigner’s employer are written, and the number of pages in the application is indicated next to it.

- Below, you should enter the serial number of the application for the current year (remember, it can be written at least every month - there are no explanations or restrictions on this issue in the legislation).

- Then the code of the tax service to which the completed form will be sent is entered in numbers.

- After this, the application indicates the full name of the employing organization or the personal data of the individual entrepreneur.

- Next, in the appropriate cells, you should note the year for which you want to reduce the amount of personal income tax and the number of pages on which the application is written.

- Next to it you need to indicate how many documents confirming the payment of advance payments are attached.

Filling out information about the taxpayer

Filling out information about the taxpayer is in the lower left corner of the first sheet of the document. Here you enter data about the person who, with his signature, confirms the authenticity of the information included in the application: the head of the company, his representative, or an individual entrepreneur.

You must provide information about the individual:

- surname-first name-patronymic,

- TIN,

- contact phone number (in case the tax authorities have any questions),

- date of filling out the application.

There is a space on the right for a tax specialist to fill out; here the taxpayer does not need to write anything.

Sample of filling out the second page of the application

The next part concerns directly the foreign citizen who claims to reduce personal income tax through advance payments under a patent. Here you need to enter his personal information:

- FULL NAME,

- date of birth,

- TIN,

- information from the identity document: series, number, date of preparation and place of issue.

Then all information entered in the application is confirmed by the signature of the applicant.

Fixed advance payments in certificate 2-NDFL for the Federal Tax Service

Since 2022, 2-NDFL certificates have two forms - for submission to the tax office and for issuance to hired personnel (Order dated 10/02/2018 No. ММВ-7-11 / [email protected] ). When filling out both forms on the income of foreign citizens working for Russian business entities, differences will appear from certificates on the income of citizens of the Russian Federation:

- taxpayer status - for foreigners who are employed under a patent, code “6” applies;

- country of citizenship code;

- an individual may not have a Russian-style patronymic and TIN, but it is permissible to indicate his full name in Latin letters;

- the employee’s identity document may be a passport of a foreign citizen (code “10”);

- the amount of tax withheld and paid to the budget will differ from the calculated amount due to its adjustment to advance payments made by the foreigner independently when paying for the patent.

Fixed advance payments in the 2-NDFL certificate submitted to the tax authority will be highlighted in section 2. Payments for a patent are entered in one amount, taken into account by the employer in total for the period shown.

For example, a Chinese citizen works at an enterprise in the Republic of Crimea. He paid the cost of the patent for the work in 12 months. His monthly earnings are 35,800 rubles; in July, his income consisted of vacation pay accrued in the amount of 33,650 rubles. Personal income tax on the income of a foreign worker is withheld at a rate of 13% (clause 3 of Article 224 of the Tax Code of the Russian Federation), taking into account the standard deduction for two children provided to him as a tax resident (the right to this benefit was retained in January-September, after which the income limit was exceeded ). When issuing a 2-NDFL certificate, the amount of fixed advance payments and the amount of final tax liabilities to the budget are reflected as follows:

- total income is recorded according to the information reflected in the Appendix to the certificate and amounts to 427,450 rubles;

- The tax base is reflected minus “children’s” deductions – RUB 402,250. (427,450 – 1400 x 9 months x 2);

- the calculated annual tax is 52,293 rubles. (402,250 x 13%);

- payments for a patent are shown in the documented amount of 38,700 rubles. (amount of monthly payment in Crimea is 3225 x 12 months);

- withheld and transferred tax is reflected taking into account adjustments for fixed advance payments - RUB 13,593. (52,293 – 38,700).

The notification received by the employer from the tax authorities, who have been given permission to offset the patent payments of a foreign citizen when taxing wages, is reflected in the last lines of Section 3 (notification code - “3”, date and document number, code of the tax authority that issued the notification)

Read also: Income codes in the 2-NDFL certificate in 2019