The cancellation of UTII will not be a surprise for business. Firstly, they have been warning about this for a long time (Federal Law of June 29, 2012 No. 97-FZ). Secondly, the Ministry of Finance considered that there was no reason to extend UTII: the real tax burden on UTII does not even amount to 1% of revenue, and the regime is used mainly for tax optimization.

One way or another, many entrepreneurs and companies will have to stop using UTII and patents in 2022.

Another change is associated with the appearance of bill 720839-7, which has changed in its final version. Thus, it was initially believed that organizations selling labeled goods were deprived of the right to use UTII. However, later the restriction from 2020 was extended only to those who trade in the following goods subject to mandatory labeling:

- medicines;

- items of clothing, clothing accessories and other products made of natural fur;

- shoes.

Therefore, if in 2022 you trade these goods, then you will not be able to apply UTII. And even if you haven’t traded anything from this list, but start doing so in the middle of the year, as soon as you make the first sale, you will automatically lose the right to use UTII and a patent.

Please note: according to the latest changes, those who sell labeled goods will also not be able to combine UTII for other types of activities. Thus, if you trade in medicines or clothing, footwear or fur products, for all other types of activities in 2022 you must apply the simplified tax system or the special tax system.

Maintain accounting and send reports via the Internet

Try it

To decide which is more profitable for you - the simplified tax system or the special tax system, calculate the tax burden for using the “simplified tax system” and the general taxation system. Often accountants who have dealt with UTII and with a large range of items within the framework of trading activities are afraid to switch to the simplified tax system. But in reality, everything is not so difficult. To begin with, you should carefully study Art. 346.17 of the Tax Code of the Russian Federation, which states how goods purchased with further sale are taken into account. If you have a large range of goods, you can set a rule in your accounting policy for writing off these goods. Here it makes sense to use accounting by balances, which should be spelled out in the accounting policy.

For ordinary retailers, the simplified tax system is the best option, and it is advisable to choose the “income minus expenses” object, since those who trade have a large expenditure side. But for pharmacies, “simplified” can be “dangerous”. The fact is that the income limit for the simplified tax system is 150 million rubles. If business fragmentation begins, this may attract the attention of the tax authorities.

Restrictions and conditions for the use of UTII

UTII is introduced by regulatory legal acts of representative bodies of municipal districts, city districts, and cities of federal significance. This is a voluntary taxation regime, which only covers 14 types of activities - all of them are listed in paragraph 2 of Art. 346.26 Tax Code of the Russian Federation.

Types of activities for UTII

- domestic services;

- veterinary services;

- repair, maintenance and washing services for motor vehicles;

- services for the provision of parking spaces and storage of motor vehicles;

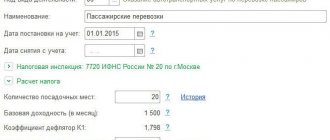

- motor transport services for the transportation of passengers and goods provided by organizations and individual entrepreneurs who own or otherwise have the right to no more than 20 vehicles intended for the provision of such services;

- retail trade through shops and pavilions (hall area - no more than 150 sq.m);

- retail trade through the objects of a stationary trading network that does not have trading floors, as well as objects of a non-stationary trading network;

- public catering services provided through public catering facilities (the area of the visitor service hall is no more than 150 sq.m);

- public catering services through public catering facilities that do not have a customer service area;

- distribution of outdoor advertising using advertising structures;

- advertising using the external and internal surfaces of vehicles;

- temporary accommodation and accommodation services (total area of premises - no more than 500 sq.m);

- services for the transfer for temporary possession and use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as catering facilities without a customer service area;

- services for the transfer of temporary possession and use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities.

For those using UTII, there are restrictions on the number of employees - no more than 100 people, as well as a limit on the share of other organizations - no more than 25%.

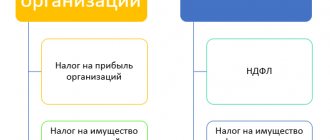

What taxes does “imputation” exempt from?

Legal entities on UTII are exempt from paying:

- income tax;

- VAT;

- tax on property of organizations (except for property, the tax on which is calculated based on the cadastral value).

Individual entrepreneurs do not pay UTII:

- personal income tax;

- VAT;

- property tax for individuals.

The UTII rate is 15%. The deflator coefficient for 2022 is 1.915. And for 2022 - 2.009.

Local authorities can change the deflator coefficient, and this should be monitored. Therefore, by the beginning of the year, look for a local document that approves UTII in your municipality. It will indicate the value of the correction factor K2. K2 values can be set in the range from 0.005 to 1 inclusive (Clause 7, Article 346.29 of the Tax Code of the Russian Federation).

For those who have chosen UTII, it does not matter how much they actually earn. The imputed base (the amount of imputed income) plays a role.

Online accounting for self-employed entrepreneurs who do not understand accounting. Beginning entrepreneurs get a year as a gift!

To learn more

Formula for calculating UTII

When calculating tax, a formula is used that contains the following values:

- physical indicator (depends on the activity: the number of workers together with individual entrepreneurs, the parking area of the trading floor, etc.);

- basic profitability (indicated for each type of activity in Article 346.29 of the Tax Code of the Russian Federation);

- coefficients K1 (regulated by the Ministry of Economic Development and set for each year) and K2 (regulated by the municipality);

- tax rate (15% of the amount of imputed income).

How is UTII tax calculated?

UTII for the quarter = (tax base (imputed income for the quarter) × tax rate) – insurance premiums

The tax base is determined as follows:

Tax base (imputed income for the quarter) = basic profitability for the month × (the value of the physical indicator for the 1st month of the quarter + the value of the physical indicator for the 2nd month of the quarter + the value of the physical indicator for the 3rd month of the quarter) × K1 × K2

UTII: code of type of entrepreneurial activity

The business activity code for UTII-2, UTII-4 (for entrepreneurs) and UTII-1, UTII-3 (for organizations) should be indicated in accordance with the appendix to the procedure for filling out a tax return for the single tax on imputed income for certain types of activities (Order Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/). Appendix 5 to this order contains UTII codes for each type of activity defined in clause 3 of Art. 346.29 Tax Code of the Russian Federation.

Deduction on cash register when using UTII

Individual entrepreneurs using UTII have the right to claim a deduction for the purchase of cash registers. Its size is 18,000 rubles. for each cash register. Thus, if you purchased two devices, you can count on a maximum deduction of 36,000 rubles.

Only individual entrepreneurs have the right to deduction. But there are also restrictions for them - the period when the cash register is registered matters.

Individual entrepreneurs on UTII in the field of retail trade or catering with employees could qualify for a deduction if they registered a cash register from February 1, 2022 to July 1, 2022. Thus, they were entitled to a deduction when purchasing a cash register only in 2022.

If an individual entrepreneur is not engaged in retail business and catering with hired employees, then he can claim a deduction if he registered a cash register before July 1, 2022.

To take advantage of the cash register deduction, fill out section 4 of the UTII declaration.

We recommend that you separately read the article “How to get a deduction for the purchase of an online cash register.”

Where to find the activity code for imputation

For the purpose of drawing up documents intended for tax authorities, the types of activities carried out on UTII have codes. They are given in Appendix 5 to the Procedure for filling out a tax return for UTII (hereinafter referred to as the Procedure). Since 2015, the procedure approved by the order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/ [email protected] Appendix 5 to this procedure is a table consisting of columns with codes and types of business activities.

UTII and separate accounting

Since UTII applies to certain types of activities, if you are engaged in something that does not fall under these types, you will have to keep separate records and use several taxation systems.

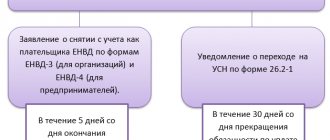

Simultaneously with UTII, it is reasonable to have another taxation system. Therefore, do not be lazy to notify about the application of the simplified tax system. Most likely, the “simplified” approach with the “income” object will be more profitable for you. Keep in mind that you can only declare your desire to use the simplified tax system from the beginning of the year. To do this, you need to send a tax notice before December 31, 2022.

Let's consider an example: a trade organization has a retail store and uses UTII as part of this activity. But the store has a device for paying for cellular communications, and this activity does not fall under UTII. If there is a simplification, the organization pays a tax rate of 6% (object “income”). If there is no simplified tax system, then under the OSN he pays income tax and VAT.

The mechanism for maintaining separate accounting is prescribed in Art. 346.26 and art. 346.27 Tax Code of the Russian Federation.

Features of the use of UTII within certain types of activities

Let's consider several types of activities to take into account important details

Domestic services

UTII includes the types of activities included in OKUN. In addition, they must be named in the local list of household services, that is, UTII can be applied to these types of activities in a particular municipality.

The Tax Code provides a more precise definition of household services: these are paid services that are provided to individuals. But here there are subtleties.

So, for example, an atelier that sews curtains falls under UTII. If curtains are purchased by an individual, the organization pays UTII from this income. If the order is made on behalf of an organization, that is, from a legal entity, UTII is not applied to this income - this amount must be paid either within the framework of the simplified tax system or within the framework of the OSN.

Another example: a beauty salon provides haircutting, hair coloring, etc. services. In addition, the salon has a solarium, which is not subject to UTII. Tax authorities often pay attention to such cases.

Various situations of using UTII in household services are given in Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 157.

Retail

As you know, trade can be carried out in halls, without trading floors, it can be delivery and delivery. But only retail trade falls under UTII when goods are purchased for personal, family or other use not related to business activities. And a retail purchase and sale agreement is considered concluded if the buyer is given a cash receipt, sales receipt or other document confirming payment.

Previously, tax authorities were interested in who the trade was carried out - a legal entity or an individual. But documents such as Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 157 and Letter of the Federal Tax Service of the Russian Federation dated March 1, 2010 N ShS-22-3 / [email protected] appeared, which say that now the tax authorities do not care who buys, but now they check for the existence of a purchase and sale agreement.

This is important because the use of UTII is permissible if a number of conditions are simultaneously met:

- retail trade refers to entrepreneurial activity aimed at systematically generating profit;

- in the municipality where the seller works, the corresponding form of trade has been transferred to UTII;

- A retail purchase and sale agreement has been concluded between the seller and the buyer.

The area of the sales area should not exceed 150 square meters. m. If it changes, then you need to call the BTI, get a new explanation or renew the lease agreement. Then the new area will be taken into account.

Do not forget that UTII does not cover trade in online stores.

Public catering

Here it is important to take into account the area of the service hall - it should not exceed 150 sq.m. This is especially true when some establishments add terraces in the summer.

The area of the hall does not include the kitchen, but dance floors and billiard rooms are included, if they are not allocated separately.

How will the conditions for using UTII change in 2022?

The main thing you need to know about UTII 2022 is that the list of those who will be entitled to use this system will be reduced. That is, in fact, for some, the abolition of UTII will come a year earlier.

Who will be able to apply UTII in 2022:

- Those who operate in regions where UTII is permitted, whose type of activity does not contradict the use of UTII, and at the same time they are not among the largest taxpayers of the Unified Agricultural Tax.

- The number of employees of your company should not exceed 100 employees over the past calendar year.

- Legal entities cannot be on UTII if the share of their authorized capital is more than 25% owned by other companies.

- The retail area cannot be more than 150 square meters.

- If an entrepreneur is engaged in transportation, then his vehicle fleet should not exceed 20 cars.

- UTII is prohibited for those who carry out business activities on the basis of trust management, or if we are talking about a partnership.

If all conditions are met, then the entrepreneur is given the right to pay taxes according to the UTII system. However, you need to remember that it is paid regardless of whether there is revenue.

Now comes the fun part. In 2022, the road to UTII will be closed to those entrepreneurs who trade in labeled goods.

- On March 1, 2022, labeling of tobacco products began.

- On July 1, 2022, footwear labeling began.

- From December 1, 2022, the government is significantly expanding the list of labeled goods.

This will include:

- Perfume and eau de toilette

- Leather clothing

- Tires with pneumatic rubber tires

- Knitted knitted clothing

- Outerwear

- Bed, kitchen, table, toilet linen

- Cameras, as well as flash lamps and photo flashes.

Do you feel how the circle of prohibition is systematically narrowing?

And from 2022 it is planned to introduce the need to label medicines, shoes and fur clothing. These restrictions will be introduced in accordance with Russian Government Decree No. 792-r dated April 28, 2018. The bill has not yet been adopted, but the trend speaks for itself.