When and what errors occur

Errors in payments between counterparties are made by the compilers of payment orders, i.e. employees of accounting departments. In this case, incorrect data can be in a variety of points in the document: for example, the number of the agreement under which funds are transferred is incorrectly indicated, the purpose of the payment is incorrectly written, or, sometimes, VAT is allocated where it is not necessary, etc.

This can be corrected unilaterally by sending a letter to the partner to clarify the purpose of the payment.

In this case, the other party is not obliged to send a notification of receipt of this message, but it will not be superfluous to make sure that the letter has been received.

What can and cannot be adjusted

There are a number of errors that are considered non-critical in payment orders, i.e. subject to editing (for example, an incorrectly entered BCC - budget classification code, TIN, KPP, name of the organization, etc.) and they are the ones that are corrected by submitting the appropriate application to the tax office.

At the same time, there are inaccuracies that cannot be corrected in the manner described above:

- incorrectly specified name of the receiving bank;

- Invalid federal treasury account number.

In cases where the sender of the payment made errors in such details, the function of paying the contribution or tax will not be considered completed, which means the money will have to be transferred again (including late fees, if any).

Is it possible to challenge a new payment assignment?

Typically, changing the “Purpose of payment” parameter occurs by mutual agreement and without any special consequences. But in some cases complications are possible. For example, if the tax inspectorate during an audit discovers such a correction and considers it a way to evade taxes, sanctions from the regulatory authority can be considered inevitable. It happens that friction regarding the purpose of payment arises between counterparties, especially in terms of payments on debts and interest. In most cases, in order to challenge the correction, the party protesting it will have to go to court, and no one will give guarantees of winning the case, since such stories always have many nuances.

An important condition necessary in order to avoid possible problems is that information about changes in the purpose of the payment must be transmitted to the banks through which the payment was made. To do this, you just need to write similar letters in a simple notification form.

What can you do wrong when filling out the payment details?

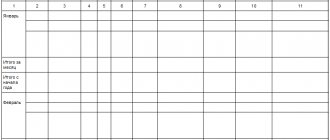

The composition of the information reflected in the “Purpose of payment” field is shown in the diagram:

An error in any of these points can lead to negative consequences for both the recipient of the money and the payer (legal proceedings and material costs).

Company 1 transferred payment to company 2 in the amount of RUB 661,474. 22 kopecks, designating the purpose of the payment as “Payment of invoice for materials,” although no agreements were concluded between the counterparties for the supply of materials or other goods.

Company 2 considered that the money transferred was rent, since the rental relationship with company 1 actually existed at that moment.

Company 1, through the court, managed to recover from company 2 as unjust enrichment the specified amount plus interest for the use of other people's funds (decision of the Court of Justice of the Tula Region dated 06/09/2016 in case No. A68-10135/2015).

The above example shows how you can suffer serious material losses because of one phrase in the payment instructions.

Find out who and what needs to be done if there is an error in the purpose of the payment.

How to write a letter correctly

A letter to clarify the purpose of payment does not have a unified template that is mandatory for use; accordingly, it can be written in any form or according to a template approved in the company’s accounting policy. At the same time, there is a number of information that must be indicated in it. This:

- name of the sending company,

- his legal address,

- information about the addressee: company name and position, full name of the manager.

- a link to the payment order in which the error was made (its number and date of preparation),

- the essence of the admitted inaccuracy

- corrected version.

If there is several incorrectly entered information, then they must be entered in separate paragraphs.

All amounts must be entered on the form in both numbers and words.

When writing a letter, it is important to adhere to a business style. This means that the wording of the message should be extremely clear and correct, and the content should be quite brief - strictly to the point.

How to make an application

When drawing up a letter about payment clarification, we take into account the important recommendations of the Federal Tax Service:

| Registration requirements | |

| Prepare a letter of clarification on the organization's letterhead. Or, in the header of the form, indicate all the details of the applicant’s company (name, tax identification number, checkpoint and address). This information is necessary to identify the applicant in the Federal Tax Service database. | |

| Structure requirements | |

| Document header | We indicate the name of the position of the head and the Federal Tax Service itself to which we are submitting the application. Below we write down the address of the inspection location. We disclose information about the applicant. Be sure to indicate the name, tax identification number, checkpoint and address. Enter contact information for communication. We indicate the date of compilation and registration number in the journal of outgoing documentation. |

| Name | Application for clarification of payment |

| Content | We must indicate:

It is not necessary to indicate the reasons for which the deficiency was made. |

| Applications | Make a separate list of attachments to the letter. Be sure to enter the payment details with an error here. It is allowed to attach other documents confirming the circumstances. For example, a bank statement, a copy of a receipt, etc. |

Please attach copies of supporting documents to your application.

How to format a letter

The law makes absolutely no requirements for both the informational part of the letter and its design, so you can write it on a simple blank sheet or on the organization’s letterhead, and both printed and handwritten versions are acceptable.

The only rule that must be strictly followed: the letter must be signed by the director of the company or a person authorized to endorse such documentation.

It is not necessary to stamp the message, since since 2016 legal entities have been exempted by law from the need to do this (provided that this requirement is not specified in the company’s internal regulations).

The letter must be written in at least four copies :

- you should keep one for yourself,

- transfer the second to the counterparty,

- the third to the payer's bank,

- the fourth to the recipient's bank.

All copies must be identical and properly certified.

Letter to counterparty about VAT

The recipient of the payment does not have the right to adjust its purpose in the payment order; he can only clarify the wording with the partner. Only the owner of the transferred funds - the payer - can change or supplement this information. The change must be formalized by a letter certified by the persons who signed the payment order (Article 209 of the Civil Code of the Russian Federation, paragraph 7 of Article 9 of the Law “On Accounting” No. 402-FZ of December 6, 2011).

The procedure for making amendments to the purpose of payment and the special requirements that must be observed in this case have not been established by the legislator, and a standard form for such a document is not provided. Therefore, when faced with the need to correct or supplement VAT information in a payment invoice, companies independently decide how to draw up the document, how to certify it and deliver it to the counterparty (by courier, by registered mail or electronically via TKS).

If such clarifications in the purpose of payments occur systematically, for example, due to logistics or technological features, it is worth developing a special document template and drawing up a letter to the counterparty about VAT clarifying the payment using this sample.

Following the requirements of business correspondence, when writing a letter, they usually adhere to the structure of an official document and use a business style, formatting the text on letterhead or regular office paper. The essence of the changes is presented briefly and clearly. The letter is certified by the manager, or a person authorized for such actions, and the chief accountant.

How and for how long to store a letter

After sending, all letters about clarification of the purpose of payment must be registered in the journal of outgoing documentation, and one copy must be placed in the folder of the current “primary” company. Here it must remain for the period established for such documents by law or internal regulations of the company, but not less than three years . After losing its relevance and expiration of the storage period, the letter can be transferred to the archive of the enterprise or disposed of in the manner prescribed by law.

Main features of letter formation

If you need to notify your counterparty of confirmation of any fact on your part, we recommend that you carefully read the tips below and look at a sample document.

First of all, let's say that the confirmation letter does not have a unified form, so you can compose it in any form or, if your company uses some kind of its own template for this document, based on its sample.

The letter can be written by hand (but in the modern world this option is not widespread) or printed on a computer. For a letter, an ordinary sheet of paper of any convenient format (preferably A4) and company letterhead are suitable (the second option will give the document greater respectability).

When writing a letter, there are several important points to consider:

- all monetary amounts must be entered in it in numbers and in words;

- write dates in the format “day-month-year”;

- indicate documents with the date of their preparation and number.

If any additional papers (photos, video materials) are attached to the letter, their presence must also be noted in the text of the letter as a separate paragraph.

The letter must be signed by the sender (the person on whose behalf it is written) and the head of the company, and if the organization uses stamps in its activities to endorse papers (i.e. seals or stamps), then the letter can be certified with their help.

There is usually only one copy of the confirmation letter - the original, which is recorded in the journal of outgoing documentation.

Samples of confirmation letters

Universal confirmation letter template

A convenient template for all occasions - from confirmation of payment to a thank-you letter notifying that the transaction has been completed. Excess parts can be removed.

_______ (date of)

_______ (address) Dear _________,

With this letter I want to confirm that our agreements in correspondence are fully valid, and also ______________________.

As a reminder, you must _______________ by (date) to begin the process.

If you have any questions, please contact the following phone numbers: (telephone) Please confirm once again that you agree to all the terms and conditions.

Sincerely, full name, position, name of organization, Contact information.

Confirmation of booking of travel services

You should pay attention to a detail that is extremely important for the entire route: the manager once again asked for the tourist’s arrival time and flight number. A good marketing ploy is to ask for a phone number “just in case.” Now the tourist will feel a little more confident in an unfamiliar place.

Dear ___,

I confirm with this message that your tourist route is fully booked according to our correspondence. The route will begin with your meeting at the airport in ___. Flight number: ___, arrival at xx:xx (date). The driver will take you to the hotel, then everything will be according to the program.

In case of any problems, please call me at: _____. I recommend keeping my phone number. Although your airport pick-up and other services are fully confirmed, you can contact me if you have any questions.

I wish you a successful trip and our staff will do their best to make it enjoyable.

Please confirm your flight number and arrival time again.

Best wishes, Name, position, company name. Contact details.