Specifics of the patent tax system

PSN is a simplified tax regime when a taxpayer purchases the right to engage in a certain type of activity. The permit is certified by a special patent, its form is approved by order of the Federal Tax Service No. KCH-7-3 / [email protected] dated 12/04/2020.

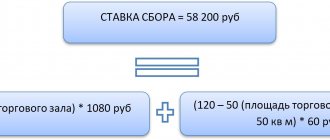

The amount of the patent fee is the tax. It is calculated based on the 6% rate established in Art. 346.50 of the Tax Code of the Russian Federation, and the amount of potential income determined in the laws of the subject of the Russian Federation. To switch to using the patent tax system, you must submit an application to the Federal Tax Service. The form and procedure for filling out a patent application for individual entrepreneurs for 2022 have been updated: form a request on the form from the Federal Tax Service order No. KCH-7-3/ [email protected] dated 12/09/2020.

Features of the patent tax system:

- Only IP applies;

- validity period - from 1 month to 1 year;

- the citizen is exempt from reporting;

- VAT, property tax (except for property at cadastral value) and personal income tax are not collected;

- the number of activities is limited;

- Individual entrepreneurs on PSN are not entitled to have more than 15 employees, and their income is no more than 60 million rubles per year.

Learn more about all the nuances of this tax system: “Patent tax system: key features.”

Advantages and disadvantages of PSN

At the moment, PSN is the most convenient taxation system due to the low administrative and tax burden on entrepreneurs who use it. Its main advantages are as follows:

- minimum amount of reporting. More information about reports on PSN can be found here;

- The cost of a patent cannot be calculated independently. This is done by employees of the Federal Tax Service. However, here we have published a calculation of the cost of a patent, for those entrepreneurs who need to determine whether it will be profitable to work on this system;

- a patent can be taken out for a period of 1 to 12 months, which eliminates the need for overpayment if the activity will be conducted for less than a year;

- an entrepreneur on PSN is exempt from paying personal income tax, VAT and property tax;

- A recent advantage of PSN was also that until July 1, 2019, entrepreneurs using PSN were exempt from the obligation to use cash registers. However, now they are obliged to apply it on a general basis.

- entrepreneurs under the patent taxation system are exempt from the obligation to keep accounting (clause 1 of Article 346.53 of the Tax Code of the Russian Federation);

- An entrepreneur has the right to spend without restrictions all funds received from a bank account, as well as cash proceeds from the sale of goods and services. There is no requirement to prepare an advance report on such spent funds.

Unfortunately, there are some drawbacks:

- Not all entrepreneurs can apply this taxation system. The full list of activities that allow the use of PSN is listed in paragraph 2 of Art. 346.43 of the Tax Code of the Russian Federation and published here;

- An individual entrepreneur on PSN can have no more than 15 employees;

- annual revenue should be no more than 60 million rubles.

Since 2022, in connection with the abolition of UTII, for the application of PSN, the requirements that were previously imposed have been relaxed:

1. The possible area of business premises has been increased for those individual entrepreneurs on PSN who:

- engage in retail sales through a stationary retail chain with a sales floor area of no more than 150 sq. m. (until 2021 – no more than 50 sq.m.);

- provides catering services through facilities with a customer service area of no more than 150 square meters. m. (until 2022 - no more than 50 sq.m.);

2. In 2022 and beyond, PSN taxpayers will be allowed to reduce the cost of a patent:

- for mandatory insurance premiums accrued and paid in the corresponding tax period for yourself and for hired employees.

- sick leave for the first three days of an employee’s illness (except for industrial accidents and occupational diseases).

- contributions for employees for voluntary personal insurance.

Entrepreneurs with hired personnel engaged in “patent” activities have the right to reduce the tax by no more than 50%. Individual entrepreneurs without employees - for any amount up to 100%.

These conditions for the application of PSN are valid throughout 2022.

Statements about the transition to PSN in 2022

An existing individual entrepreneur or someone just starting a business has the right to declare their desire to switch to the patent system. A beginning individual entrepreneur submits an application for PSN upon registration.

Don’t forget: new instructions for filling out a patent application for individual entrepreneurs for 2022 have come into force and its form has changed. It is unacceptable to submit the old form to the Federal Tax Service. The order of the Federal Tax Service No. KCH-7-3/ [email protected] dated December 4, 2020 states:

- patent application form;

- format for submitting an application in electronic form;

- procedure for filling out an application.

The amendments were required due to the fact that Federal Law No. 373-FZ of November 23, 2022 expanded the list of types of activities for PSN. The order of the Federal Tax Service is valid from 01/11/2021. The previous similar order has become invalid.

In addition, other documents have been approved for the application of the patent tax system. Federal Tax Service Order No. KCH-7-3/ [email protected] dated 12/04/2020 defines the form:

- notices of refusal to issue a patent (KND 1122020);

- messages about non-compliance with the requirements for the use of PSN (KND 1122025);

- applications for termination of business activities under PSN (KND 1150026).

Stages of patent registration

The stages of filing a patent for an invention include:

- submitting an application;

- formal examination of the application;

- publication of information about the application;

- substantive examination of the application;

- issuance of a patent.

Let's take a closer look at each of the stages of filing a patent for an invention.

Filing a patent application

An application for a patent for an invention is submitted to the Federal Service for Intellectual Property (Rospatent) through its structural division - FIPS (Federal Institute of Industrial Property).

The applicant may be:

- the author himself;

- a person who has the right to obtain a patent (employer, legal successor of the employer, heir of the author, state customer).

In addition, the following may apply for a patent for an invention:

- representative of the author or person entitled to receive a patent;

- patent attorney.

Each application must contain an application for a patent for an invention and documents attached to the application.

The application contains:

- application for a patent (indicating the author of the invention and the person in whose name the patent is sought, as well as their place of residence or location);

- description of the invention;

- claims (expresses its essence and is entirely based on the description);

- drawing and other materials (if they are necessary to understand the essence of the invention);

- abstract.

An application for a patent for an invention is drawn up according to the standard form approved by Order of the Ministry of Economic Development of Russia dated May 25, 2016 No. 316 (Appendix No. 1).

The applicant must sign the application. If the application is submitted by a patent attorney, the signature can be placed by the applicant or the patent attorney. When an authorized representative submits an application, he signs the application.

We will provide a sample application and remind you how to fill it out.

Sample application for a patent of the Russian Federation for an invention

The column “Address for correspondence” provides the full postal address of the location in the Russian Federation of the applicant - a legal entity, the place of residence of the applicant - an individual permanently residing in the Russian Federation, or the location of the applicant’s representative, including a patent attorney registered with Rospatent, or another address on the territory of the Russian Federation, surname and initials or name of the addressee, telephone number, fax number and email address of the addressee (if available).

In the application column under code (54) the name of the claimed invention (group of inventions) is given, which must meet the requirements of paragraph 33 of the Requirements for Application Documents and coincide with the name of the invention indicated in the description of the invention.

The application column under code (71) provides information about the applicant.

The application column under code (74) provides information about the person whom the applicant has appointed to conduct business with Rospatent on his behalf or who is such in accordance with the legislation of the Russian Federation. If there are several applicants, a common representative of the applicants may be indicated, in particular, one appointed from among them.

The application column “List of attached documents” is filled out by placing the “×” sign in the appropriate cells and indicating the number of copies and sheets in each copy of the attached documents.

The application must be accompanied by a document confirming payment of the patent fee (receipt, payment order). If there are payment benefits - accordingly, a document confirming these benefits. These documents are attached in original. The fees associated with filing an application and issuing a patent are determined by Decree of the Government of the Russian Federation of December 10, 2008 No. 941.

Read also “How to determine the value of a patent?”

In some cases, additional documents must be attached to the application.

An application for an invention that relates to a microorganism strain, plant or animal cell line, or to a product using an unknown microorganism strain or cell line, containing an indication of their deposit in an authorized collection of microorganisms, shall be accompanied by a deposit document.

The application, which contains a list of nucleotide and/or amino acid sequences, is accompanied by a diskette containing a copy of the same list of sequences, which meets the requirements of standard ST.25 of the World Intellectual Property Organization. In addition, a signed statement by the applicant must be included stating that the information on the floppy disk is identical to the sequence listing provided in printed form.

If the author of the invention (aka the applicant) undertakes, in the event of a patent being issued, to assign it under certain conditions to a Russian citizen or company that is the first to express such a desire and notify the patent holder and Rospatent about this, a corresponding statement is attached to the application.

When the application is ready and all the necessary documents have been collected, they are transferred to FIPS.

A patent application can be submitted in person or through a representative, by mail or by fax. If the application was submitted by fax, then within a month it is necessary to submit the originals of the submitted documents. They should be accompanied by a letter that will help identify the application previously received by fax.

If the documents are not submitted by the applicant, it is necessary to attach a power of attorney, which indicates the authority of the person to submit the application and the documents attached to it.

FIPS will notify you in writing about the receipt and registration of application documents, indicating the registration number of the application and the date of receipt of the documents.

note

When submitting an application and accompanying documents, it is important to correctly indicate the address for correspondence. For example, if FIPS asks you to clarify the information contained in the application or submit missing documents.

This may be the home address of the applicant-citizen, the legal address of the company, the home address of the head of the company, or a patent attorney.

When sending the requested information to FIPS, be sure to put the application number in the upper left corner. Otherwise, such a document will remain without attention, and the application may be withdrawn even if there is a response to the request.

And one last thing. On the envelope or in the cover letter, indicate the FIPS department from which the request came. In this case, the answer will not be lost in other departments of the institute.

Formal examination

After the application is registered, a formal examination is carried out.

Its goal is to establish the presence of all necessary documents and the absence of violations of the law.

If, as a result of the formal examination, it is established that the application was filed in violation of the requirement of unity of invention, the applicant, within two months from the date of the start of the formal examination, is sent a notice of violation of the requirement of unity of invention.

Within three months from the date of sending the said notification, it is necessary to inform which of the claimed inventions (which group of inventions that meet the unity requirement) should be considered and, if necessary, make changes to the application documents.

If the application contains all the necessary documents and the requirements for them are met, established by the Civil Code and Order of the Ministry of Economic Development of Russia dated May 25, 2016 No. 316, FIPS will notify about the positive result of the formal examination and the assigned filing date of the application (the priority date of the invention).

In this case, 18 months from the date of filing the application, information about it will be published in the official bulletin of Rospatent.

According to the Regulations on official publications of Rospatent (approved by order of Rospatent dated August 4, 2015 No. 105), the following are recognized as such publications:

- official bulletins “Inventions. Utility Models" (published at least three times a month), "Industrial Designs" (published at least once a month), "Trademarks, service marks and appellations of origin of goods" (published at least twice a month), " Computer programs. Database. Topologies of integrated circuits" (published at least once a month);

- official text of the International Patent Classification (IPC);

- official text of the International Classification of Industrial Designs (ICDD);

- official text of the International Classification of Goods and Services (ICGS);

- annual report on the activities of the Federal Service for Intellectual Property. Published annually.

Read also “How to apply for a patent for a utility model”

From the date of receipt of the results of the formal examination until the publication of information about the grant of a patent, the claimed invention is granted temporary legal protection.

The essence of such protection is the prohibition of unauthorized use of the invention. A person who illegally uses the invention during this period is required to pay compensation to the patent owner after he receives the patent.

Substantive examination

The substantive examination of the application is carried out subject to the completion of the formal examination with a positive result.

Rospatent makes the final decision to issue a patent (or to refuse to issue) only after a substantive examination has been carried out.

A substantive examination is carried out at the request of the applicant. The application must be filed within three years, and if an application for extension of time is submitted, within three years and two months from the date on which the result of the formal examination was received. If the application is not received within the specified period, the application will be considered withdrawn.

A request for a substantive examination of an application is drawn up in the form presented in Appendix No. 3 to Order No. 316 of the Ministry of Economic Development of Russia dated May 25, 2016.

The examination essentially consists of the following stages:

- determining the compliance of the claimed invention with the requirements of the Civil Code;

- information search for compliance of the invention with the conditions of patentability established by part four of the Civil Code of Russia.

During the substantive examination, FIPS may request additional materials, without which the examination is impossible. If the materials are not submitted within the appointed time, the application will be considered withdrawn.

Based on the results of the substantive examination, one of the following decisions can be made:

- on the grant of a patent;

- refusal to issue a patent;

- on recognition of the application as withdrawn.

Keep in mind: applicants have the right to appeal actions (inactions) and decisions of Rospatent and (or) its officials, federal civil servants. Registration of a complaint is the basis for starting the pre-trial (out-of-court) appeal procedure.

A complaint received by Rospatent is considered within 15 working days from the date of its registration.

Issuance of a patent

If the results of the examination are essentially positive, Rospatent makes a decision to issue a patent. All issued patents for inventions are subject to registration in the State Register of Inventions.

Information about the grant of a patent is published in the official bulletin of Rospatent. Once this information is published, anyone has the right to review the application documents and the search report.

The period for issuing (directing) a patent is five working days from the date of publication of information about the issuance of a patent in the official bulletin of Rospatent.

List of required documents

To apply for a patent, an entrepreneur will need the following documents:

- passport to correctly indicate registration;

- OGRNIP for correct indication of its number (for an already registered individual entrepreneur);

- lease agreement, extract from the Unified State Register of Real Estate, previously valid certificates of ownership to correctly indicate the address of business;

- documents for machines and buildings used in business.

To fill out the application, we use the updated form 26.5-1.

Where and how to apply?

To register for PSN or switch to this system, you must submit an application in form 26.5-1 to the Federal Tax Service. The form was approved by order of the Federal Tax Service of the Russian Federation dated December 9, 2022 No. KCH-7-3/891. You can do this in one of the following ways:

- Personally.

- Through a representative.

- By registered mail with a list of attachments.

- If you have an electronic signature key, you can submit an application for a patent in 2022 through your Taxpayer Personal Account Nalog.ru.

If the application is submitted simultaneously with the documents for registration of the individual entrepreneur, then the PSN will be applied from the moment the certificate of registration of the individual entrepreneur is issued.

If an individual entrepreneur plans to conduct business at his place of residence, an application for PSN must be submitted to the Federal Tax Service at his place of residence. If the activity will be carried out in a region different from the region of residence, then the application must be submitted to the Federal Tax Service of the region where the activity will be carried out.

If an individual entrepreneur plans to engage in several types of activities at the same time, he must obtain a patent for each of them. To do this, you need to submit several applications at once (letter of the Ministry of Finance No. 03-11-11/33119 dated 05/07/2019).

In a situation where an individual entrepreneur has issued a patent for a period of less than a year and wants to apply this taxation system further, he must submit a new application in Form 26.5-1 and obtain a new patent (clause 2 of Article 346.45 of the Tax Code of the Russian Federation), since the Tax Code does not provide extension of the patent term. To work on the PSN without interruption, you must submit an application no later than 10 working days before the expiration of the previous patent.

The minimum validity period of a patent is 30 calendar days, and days are not necessarily calculated from the 1st day of the month.

Algorithm for filling out form 26.5-1

The form consists of 5 sheets, but entrepreneurs do not always have to fill out all of them. Let's give an example - instructions on how to correctly fill out a patent application for an individual entrepreneur for 2022 for retail trade through stationary retail chain facilities.

Step 1

Fill out the title page and indicate:

- TIN of an individual entrepreneur;

- his full name;

- OGRNIP;

- patent validity period;

- telephone for communication.

Indicate the number of completed sheets and attachments to them, indicate the date of completion and sign the document.

Step 2

First, the types of activities are indicated. Their official names and codes must be found in the laws of the constituent entities of the Russian Federation. In the corresponding fields, codes indicating the presence of employees are indicated: 1 - if there are employees, 2 - if the individual entrepreneur works without them. The average number field must also be filled in. If you specified code 2, enter 0. The tax rate is entered only when a reduced rate is applied.

Step 3

We fill out sheet A and enter information about the place of business activity. We indicate:

- code of the subject of the Russian Federation (Appendix No. 2 to Order No. KCh-7-3/ [email protected] );

- tax authority code (only if it differs from the place of registration and the individual entrepreneur conducts business outside the constituent entity of the Russian Federation);

- address (according to the FIAS state register).

IMPORTANT!

To obtain a patent for retail trade, sheet A is not filled out.

Step 4

On page B, data is filled in for vehicles used for business, the types of which are indicated separately in paragraphs. 10, 11, 32 and 33 p. 2 art. 346.43 Tax Code of the Russian Federation (cargo transportation, etc.).

Step 5

Sheet B is intended to indicate information about objects that are used for business activities from paragraphs. 19, 45–48, 65 p. 2 art. 346.43 Tax Code of the Russian Federation. We indicate:

- code of the subject of the Russian Federation;

- Federal Tax Service code, if the inspection differs from the place of registration;

- type of object;

- attribute of the object, if regional authorities determine the profitability by the area of the object;

- area and address of the object.

For carry-out and distribution trade, the address is not filled in.

How to fill out an application using Elba if you have already registered an individual entrepreneur

To do this, go to the “Details” section → “For reporting” → “Submit a patent application” or click on the “Create a patent application” link in the “Current tasks” section.

A step-by-step task will open. Fill out the form, Elba will take the rest of the data from the details.

Step 1. Fill in the details

The patent can begin on any date, but we recommend specifying the first of the month. Many tax authorities do not accept applications with a different date.

The tax rate is almost always 6%. This does not mean that you will pay 6% on proceeds. For each type of activity on a patent, the regions determine the amount of expected income. It is from this fixed amount that you will pay the rate.

If you fall under a tax holiday, choose a 0% rate. Indicate the clause and article of the regional law that introduced holidays for your business. A 0% rate means that you do not need to pay for a patent.

In Crimea and Sevastopol the rate is 4%. Elba will substitute it automatically when you select a region.

Step 2: Specify objects

What this step will be depends on your type of activity.

If your business is retail or public catering , select an object, fill in its address, indicate the object's characteristics and area.

It is sometimes difficult for retailers to determine the difference between a store and a pavilion. Clause 3 of Article 346.43 of the Tax Code of the Russian Federation provides the following definitions:

- Store - a specially equipped building (part of it) intended for the sale of goods and provision of services to customers and provided with retail, utility, administrative and amenity premises, as well as premises for receiving, storing goods and preparing them for sale;

- Pavilion is a building that has a sales area and is designed for one or more workplaces.

To fill in the sign and area, the regional patent law will be useful. In some regions, the cost of a patent depends only on the area of the sales floor or service area, and in others - on the total area of the store or cafe.

There are eight attributes of an object, but retail and catering need to choose one of three. The first sign is intended for rental, 2-4 - for retail, 5-7 - for catering, and the last one - for parking lots.

| Code | Sign | When to indicate |

| 1 | The area of the rental property. | You rent out residential or non-residential premises, a garden house or a plot of land. |

| 2 | The area of a stationary retail chain facility with a sales floor. | There is a trading floor. In your region, potential income depends on the total area of the store or pavilion. |

| 3 | The area of the trading floor for the object of trade organization. | There is a trading floor. In your region, potential income depends on the size of the sales floor. |

| 4 | The area of a retail space in a stationary retail chain facility that does not have a sales floor. | There is no trading floor. Trade at a retail market, fair or kiosk. |

| 5 | The area of a catering facility that has a customer service hall. | There is a service hall. In your area, the potential income depends on the total square footage of the restaurant, bar, cafe or eatery. |

| 6 | The area of the customer service hall at the catering facility. | There is a service hall. In your region, potential income depends on the size of the service area. |

| 7 | Area of a catering facility that does not have a customer service hall | There is no service hall. You sell through a kiosk, tent or culinary department at a restaurant, bar, cafe or other catering outlets. |

| 8 | Vehicle parking area | Activities of parking lots for vehicles |

If you are renting out real estate , click on the “Add property” button and select what you are renting out: land, residential or non-residential premises. Fill in the address and select the attribute “1 - area of the property being rented out.”

If you transport cargo or passengers , you will see the “Add vehicle” button. Select the type of vehicle and indicate the characteristics from the documents for it.

For other types of activities, simply indicate the address where you plan to work. If there is no specific address, do not fill in anything, but proceed directly to the next step to submit the application.

Step 3. Submit the application to the tax office

Sign and submit the application. If you do not have an electronic signature, print it out and submit it on paper. In 2022, the tax office accepts applications until December 16.

Once submitted, you will receive an acceptance receipt or rejection notice. The inspection does not send the patent electronically, so after 5 days it is better to pick it up on paper - the cost and payment details will be indicated there. In addition, the counterparty may ask for a scan of the patent to make sure that you are working in a special mode without VAT.

In fact, it is not necessary to go to the tax office. You can calculate the cost of a patent using a calculator, and create a payment using the tax service. If you are worried that you might make a mistake with the payment, pick up the patent on paper.

Information about the patent will appear in the taxpayer’s personal account: number, validity period and payment calendar.

As of 2022, patent laws have changed. On Elba's blog we talked about the changes and answered frequently asked questions.