Power of attorney to receive money is a document giving the right to the authorized person to receive funds from the principal . The principal grants a third party the right to receive funds through a trust of authority. In a specific situation, the principal is the entity who appoints any third-party fiduciary to perform the event of receiving funds in his name. Trustees can be both individuals and institutions of all forms of ownership. A trustee is considered to be an individual who can receive funds in a clearly designated place by the trustor.

Kinds

This document can be drawn up under various circumstances. This has a significant impact on the type of power of attorney. Such a document has three types:

- A one-time power of attorney is issued to perform a specific action . For example, this could be receiving one salary, a scholarship, or a money transfer. The document specifies the event for which it was created.

- Special . The most common type of trust document. The company grants authority to the employee who receives regular transfers.

- Generalka . The document gives the representative all the rights that the principal also has. The holder of such a power of attorney is allowed to receive any amounts at any time. He can also be a representative of the principal in any transactions involving funds, both cash and non-cash.

Nuances of filling

When entering information into a document, you should pay attention to its accuracy. For example, information about the representative must be identical to the passport data. There should be no blots or corrections here. Any unreadable information may cause the document to be invalidated.

Also, do not forget that receiving funds is a rather serious procedure. In this regard, the document almost always must be notarized. It is quite logical that the party issuing the money will require a trust document from the representative. If there is no notary signature here, it is considered void. If for some reason this fact was not established and the money was received, the transaction can be challenged. The party that issued the money has the right to go to court, which will declare the transaction invalid.

( Video : “Executing a power of attorney to receive a pension”)

Although in some situations the services of a notary are not required. For example, under certain circumstances, a document may be certified by other authorities. When notarized, the trust document is recorded in the register of documents. It also contains information about which particular notary certified such a power of attorney.

Document validity period

A power of attorney to receive money for another person can be issued without specifying a validity period. Then it will automatically be valid for 1 year from the date of issue (Article 186 of the Civil Code of the Russian Federation). But if the document will be used for a one-time receipt of money, it must indicate the period during which the trustee will be able to fulfill the powers assigned to him.

A power of attorney is invalid without indicating the date of its execution.

Features for Sberbank and any other financial institution

Quite often, older people do not have the opportunity to personally visit a banking institution, for example, to receive pensions and other social benefits. In such situations, pensioners draw up a power of attorney, which is certified by a notary.

In general, any bank client has the right to agree in writing that another person can receive his deposits. Typically, in this case, the representative is allowed not only to receive money, but also to perform any other actions on behalf of the principal. Here it is more convenient to have the document certified not by a notary, but directly at the bank branch itself. To do this, the client must contact an employee with a correctly completed application. It is advisable to indicate here a list of actions for which the representative has permission. For example, receive statements, or withdraw funds only from a specific account. The bank employee will put a stamp and his signature here. Such assurance will be quite sufficient.

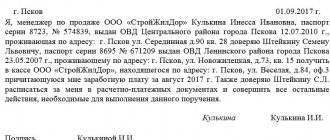

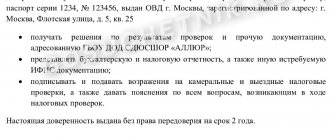

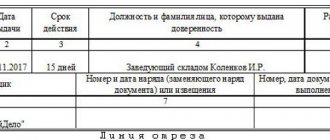

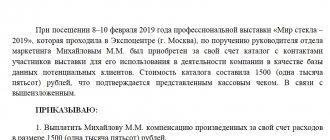

Sample

When, by whom and to whom is a power of attorney issued to receive money?

Any person who has reached the age of eighteen and has not lost legal capacity can act as an attorney. As for the principal, it can also be a minor or even an incapacitated person. In this case, the document will be issued by their legal representatives.

A sample power of attorney to receive money may be useful if transfer of authority is required in the following cases:

- transfer of the right to receive wages to a third party;

- receiving a pension by a trustee;

- receipt of money by an intermediary under a contract for the performance of work or provision of services;

- receiving dividends on the deposit:

- other one-time payments, for example, inheritance.

Power of attorney to receive funds from a legal entity

The role of the principal in this case will be played by the organization. As a rule, a power of attorney is issued by the director of the company. Such a document is allowed not to be certified by a notary. All you need is the manager's signature. Although everyone understands, it is the notarial document that has greater legal force. The purpose, preparation of the document and the period of its validity are stated here. In the accounting department of the organization, the representative must sign in a special journal. The main difference between a power of attorney and a company is that in most cases the services of a notary are not required. If the order is carried out personally by the director, he does not need any trust documents. After all, this is his duty, which is enshrined in the relevant order.

The manager has no restrictions in choosing a representative. As a rule, these are company employees. Although a power of attorney can be issued to absolutely any person who is not even related to this company. It is also necessary to understand that since we are talking about the issuance of funds, the party to whom the power of attorney is presented will want to make sure that the document is drawn up correctly. There should be no mistakes or false information here.

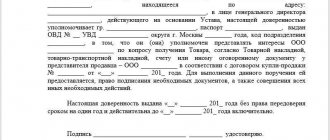

Sample

In what cases should it be used?

[ads-pc-3] [ads-mob-3]

When it is impossible to receive money personally by the person to whom it belongs, you can issue a power of attorney to receive money. According to this document, the trustee can receive any payments - from a large inheritance to a small money transfer.

A power of attorney may be useful in the following situations:

- When receiving interest on a deposit or other types of payments from banking organizations.

- If the principal is unable to independently receive a salary or advance at the place of work.

- In case of payment for any services or work if it is impossible to transfer the money personally to the contractor.

- Receiving a pension.

- In case of illness or long-term departure of the principal.

- In any other cases that are specified in the text of the power of attorney.

A power of attorney is also issued in cases where a representative of a legal entity receives money for services rendered. For example, if an organization is engaged in the sale and installation of furniture, the employees performing such work can take money from clients themselves after completing the order, provided they have the appropriate power of attorney.

From an individual

Unlike a power of attorney, which was issued by an organization, a document from a private individual must be certified by a notary. Such a power of attorney must comply with all rules for drafting. If the money is issued, but the power of attorney is declared invalid, the owner of the funds will have claims against the party that issued them. Accordingly, the real owner of the money has the right to file a claim in court.

Of course, there is the possibility of receiving by power of attorney, which has not been certified by a notary. For example, if we are talking about receiving funds from a bank account or deposit, then their owner must personally appear at the financial institution to confirm the fact that a power of attorney has been issued to a third party.

Sample

Power of attorney to receive funds by mail

Pensioners often receive social benefits at the post office. But due to their advanced age, not everyone can come to the department in person. In such cases, a corresponding power of attorney is used. The document is filled out in a standard format. The main thing you need to pay attention to here is to register the exact post office where the attorney will present the document in order to receive money. It is also recommended to indicate information about the pension document in the power of attorney. If you do not use a notarized power of attorney, the holder of pension payments must personally appear at the post office to show his representative.

Sample

When is a power of attorney needed?

The power of attorney does not have an approved form, so it can be drawn up in free form. But at the same time it is necessary to adhere to a certain structure and take into account the norms set out in Art. 185-189 Civil Code of the Russian Federation. The principal may revoke the power of attorney at any time, of which the authorized person must be notified in a timely manner.

A power of attorney to receive funds is issued if you need to receive for another person:

- wages or other monetary remuneration at the place of work;

- pension (at the post office or at home);

- scholarship (at the place of study);

- state capacity;

- one-time payments of any nature (royalties, winnings, royalties, etc.);

- money transfer at a bank.

At work

Typically, companies use pre-approved templates designed to draw up trust documents. Any employee has the right to fill out the template by hand, or write a power of attorney in free form. It is not at all necessary that the representative also be an employee of this organization. This can be any person whom the applicant trusts to receive wages.

When drawing up the document, it is recommended to indicate the reason why the employee is not able to appear in person at the accounting department. In fact, this is the reason for absence from work. This could be illness, vacation, time off, etc. In this case, you can entrust receiving your salary, for example, to a neighbor.

Sample

Types of powers of attorney

Depending on the purpose of provision, the nature of the trust document is distinguished:

- one-time;

- special;

- general (general).

One-time

This type is intended to perform a one-time action. For example, it is compiled for one banking transaction (taking a deposit, transfer), one-time receipt of a salary, scholarship, cash benefit. Its peculiarity is that the transfer of rights takes place only once. The specific amount that the trustee receives does not have to be determined, but the type of transaction and the period for receiving funds under the trust document must be indicated.

Special

With this type, you are allowed to perform several similar operations over a specific period of time, for example, carry out several banking operations (withdraw interest on a deposit and withdraw the deposit itself), receive a scholarship over several semesters. The period of use and selection of financial services in the power of attorney are specified separately. The amount received may not be indicated.

General

The purpose of using a power of attorney of this type is to enable the trustee to exercise all the rights of the principal. A specific amount of money is not provided for this type. A citizen can regularly use such a power of attorney to take different amounts at any time. The document can determine the possibility of transferring your rights to another person within the designated period of trust.

Instructions for filling out a power of attorney to receive funds

The law does not oblige principals to use any specific form. Organizations have a special template for this, in which it is enough to fill out the available fields. A private person can draw up a power of attorney on a regular piece of paper. It is advisable to use A4 format. Based on the rules for legal drafting of similar documents, we can highlight important rules for filling out:

- It is worth filling out the “header”, where the name of the document, the date and place of its completion are written;

- If a power of attorney is drawn up from a company, its legal form and other data are specified;

- Below is detailed information about the principal, his passport details, position and other information;

- The same information should be provided about the representative;

- If the document will be presented in any organization, indicate its name, division, department;

- It would be useful to indicate whether the representative has the opportunity to draw up a transfer of power to third parties;

- The validity period of the document is indicated;

- You can specify how much the representative should receive;

- Signatures of the parties are placed at the bottom.

There is no need to have any legal knowledge when filling out the document. You just need to be as careful as possible so that the information you enter is not distorted. You need to understand that if important information is missing, the document may be considered invalid. Accordingly, the representative will not be able to receive funds. The party to whom the power of attorney is presented may request from the attorney a passport and other documents proving his identity and the right to receive money.

How to write correctly?

It is important to know how to write a power of attorney to receive money. You also need to understand when such a document should be notarized. Such paper may be drawn up in any form. A special power of attorney form for receiving funds, approved at the enterprise level, can also be used.

It is necessary to follow the specifics and rules of writing such a document. They depend on who the power of attorney is written for and for what purpose. Any document consists of a header, title, main and final parts.

The text of the trust document must contain the following information:

- Date of preparation;

- place of issue;

- information about the principal and the authorized person;

- description of the delegated authority;

- document's name;

- validity;

- type of payment received (salary, financial assistance, pension, money transfer, etc.);

- signature of the principal;

- list of additional powers;

- possibility of transfer of trust.

When writing a power of attorney, you should use business style and follow these rules:

- avoid syntactic, grammatical and punctuation errors;

- use standard phrases and wording (“I trust to receive funds”, “acting on the basis of the Charter” (for LLC), “the power of attorney is valid until...”, “I certify the power of attorney”, etc.);

- do not correct the test with a proofreader, blade or pen;

- indicate the date of compilation. Without it, the document will be considered invalid;

- if the exact amount of money to be received or transferred is given, then you need to indicate it not only in numbers, but also in words.

For another person

A power of attorney to receive money for another person is usually required in case of illness, business trip, or lack of free time to perform certain actions in person. It is drawn up in any form on a standard office sheet of paper.

In this case, you need to adhere to the structure of the document. Information about the principal and his representative shall include the full name, passport details, and residential addresses of both parties.

A specific action is noted, and within what time it must be performed by another person. The document can be written by hand or typed on a computer and printed. It is advisable to have the power of attorney certified by a notary.

From the organization

A power of attorney to receive money from an organization is needed if the company needs to receive a financial transfer for the provision of certain services, work, or wages for staff. As a rule, it is issued on company letterhead approved at the company level.

When specifying information about the principal, the details of the enterprise are written (organizational and legal form, legal registration address, name, INN, KPP, OGRN, full name of the manager).

When describing the transferred authority, it is recommended to mark the document on the basis of which the money should be received. This may be an invoice, a contract for the supply of goods. If the company has a seal, it is better to put its stamp on the power of attorney.

This will eliminate disputes with the counterparty. It is also desirable to have the signature of the chief accountant.

To transfer funds

Transfer of funds today can be carried out in several ways: through the post office, bank, Internet. In the latter case we are talking about electronic wallets. The power of attorney must indicate the method for receiving the money transfer.

Both an individual and a legal entity have the right to draw up such a trust document. It is required if the recipient cannot make or claim the transfer independently for some reason.

A power of attorney is drawn up for a specific person who has reached the age of majority and is legally capable. It can be issued on the company’s letterhead or in free form.

The text should indicate in which organization and when the translation should be made or received.

For cash collection

Cash collection is the collection and transportation of finances between organizations and their divisions. If the responsible person cannot personally receive and deliver money, then a power of attorney is issued to another person. It specifies information about who, from which company and in which organization should receive funds.

The document is certified according to all rules. The power of attorney for the collection of money is limited and gives the right to perform one specific action: to receive finance from a legal entity. It is recommended to draw up a power of attorney on company letterhead and certify it with a seal.

For transfer and receipt of securities

A power of attorney for the transfer and receipt of securities is issued to an individual. Typically, companies give the right to perform such actions to full-time employees. This is a personalized document. A power of attorney can be issued to one or several representatives at once. This point needs to be reflected in the text. A power of attorney to receive securities is issued, usually on company letterhead. It indicates that the person is acting on behalf of the company. It is advisable to have the document notarized.

Transactions with securities involve a large list of actions. Therefore, the text of the document must reflect the full scope of the powers of the trustee. For example, purchasing shares on behalf of companies, signing papers necessary to complete such transactions.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

How long is it valid?

Try to remember to indicate the period during which the representative will be able to receive funds. It should be noted that the absence of a deadline does not cancel the validity of the document. This will only mean that the power of attorney lasts one year from the date of preparation. In general, the principal has no restrictions here. For example, if a representative must receive money once, it is enough to issue a document for several days during which this order is expected to be completed. To regularly receive funds, the validity period of the document may be quite long. Previously, the maximum period was three years. But according to the new rules, the document can be issued for at least several decades.

Do not forget that no matter how long the document is valid, the principal can revoke it at any time. To do this, it is recommended to draw up an appropriate document, notifying not only the attorney, but also the third party to whom this power of attorney was presented, of your intentions.

How much does a power of attorney cost to receive funds in 2022?

For example, if an employee of an organization trusts someone else to receive wages for him, the head assures him. Such a power of attorney does not require notarization; accordingly, its independent execution will be free. This also applies to the preparation of a document in financial institutions, when the principal appears in person at the branch, certifying the fact that powers have been vested in a third party.

But in the case when it is necessary to involve a notary, you will have to pay for his services. The total cost consists of several payments. Thus, it is mandatory to pay a state fee. In addition, a specialist can fill out and print the document. The notary carries out a check to ensure that the information provided is identical to the data specified in passports and other documents. All these legal services cost 700-1000 rubles. This amount may vary slightly in different offices. As a rule, this depends on the price list of a particular specialist and the region of his location. For example, in practice you can notice that notary services in the Moscow region are much higher compared to other regions.

Is notarization required?

The principal's signature alone is not enough for the document to acquire legal force. To certify the document, you can use the services of a notary. In accordance with paragraphs 2-3 of Art. 185.1 of the Civil Code of the Russian Federation, in addition to a notary, a power of attorney can be certified by other persons:

- the head of the organization in which the citizen is employed;

- the head of the educational institution where the principal studies;

- the head physician of the medical institution, sanatorium, hospital, etc., in which the principal is undergoing treatment;

- the head of the military unit in which the principal serves;

- the head of the place of deprivation of liberty where the principal is serving his sentence, etc.

When receiving money from a bank, a power of attorney can be certified in advance directly at this institution. The principal must contact the bank management with a ready-made power of attorney or use the proposed power of attorney form to receive funds. You need to have your passport with you.

If a power of attorney to receive money is issued on behalf of an organization (for example, for an employee to receive cash from a bank), the signature of its head and seal (if any) will be sufficient.

If a power of attorney is issued with the right of substitution, notarization is mandatory.

Receiving money for another person

A power of attorney provides a citizen with the authority to receive money for another person through a state or commercial enterprise or from another person. Despite the fact that the form of this document is free, it must be filled out in writing on a specific form.

general characteristics

Power of attorney comes from the word “to trust,” so a person who issues a document to another citizen must be sure that he will not use it for his own selfish purposes. The role of trustee can be any individual, relatives or complete strangers. A document must have certain content, without which its validity is subject to doubt:

- Title of the document.

- Date of preparation and place of signing.

- Individuals indicate their full name and passport details.

- The amount of authority is determined. The principal has the right to indicate a specific account or amount of funds that the trustee can receive. Rights can be one-time or systematic.

- The signature of the principal is required.

- The authorized person is given the right to sign payment documents.

- The deadline for the issued document is specified.

If the documentation is one-time, then a short period is indicated during which the authorized person can perform actions on this document. If the power of attorney does not specify a period, by law it is valid for one year from the date of issue. If the document itself does not indicate the date, then it is considered invalid. If money will be received as part of a transaction that requires notarization, then the power of attorney itself must be certified by a notary. If the filling takes place at home, for example, due to a person’s illness, then a notary is called to the house. A standard power of attorney form for receiving money can be downloaded from this link.

The power of attorney can indicate or prohibit the right of subrogation. If nothing is indicated about this, then powers can be delegated only if circumstances arise that force this to be done to protect the interests of the principal. The prescribed prohibition prohibits any transfer of trust, regardless of the circumstances. In any case, the power of attorney must be certified by a notary, and the principal must be notified of this fact.

Important! In the case of a power of attorney to receive wages and other remuneration for work activities, copyrights and patents, scholarships, pensions and benefits, sub-power of attorney is not permitted.

To receive a salary

You can draw up a document at home, but after that you need to visit a notary for certification. As an alternative, you can certify the document at the place of work or study (if you receive a scholarship). That is, if you trust someone to receive your wages, you can certify the document for free at the place of work. It is also possible to obtain certification from the administration of medical institutions if the principal is undergoing treatment. In addition, there are a number of cases when a certificate is equivalent to a notary; they are described in Article 185.1, paragraph 2 of the Civil Code of the Russian Federation.

Important! The authorized representative is required to provide an identification document, otherwise funds will not be issued even if there is authorization documentation.

The text indicates not only the full name and passport details of the employee, but also his position, company name and signature. The authorized person has the right to sign the statement for the principal, but the cashier will also then make a note that the money was issued by proxy. A sample form can be downloaded here. If the power of attorney is drawn up according to the rules and properly certified, then the company’s accounting department does not have the right to refuse to issue money.

To receive a pension and money in the bank

Pensioners often, due to their health, are unable to visit a bank or post office every month to receive funds. In this case, they provide a letter of trust to a relative, social worker, neighbor or representative they know. A pensioner can issue a power of attorney independently through a notary office and set the term of this document. You can also certify the document directly at the post office or at a bank. Elderly people often issue a general power of attorney so that a person can perform other actions on their behalf. to represent the interests of a pensioner, including receiving cash payments, can be found here.

An incapacitated citizen cannot issue any powers of attorney. His legal representatives should do this for him. At the same time, incapacity can only be recognized by a court, therefore, if there is no such conclusion, the pensioner can draw up the documents himself, and the bank does not have the right to refuse to issue funds. Similarly, a power of attorney is issued to receive money from the bank account of any person, not necessarily a pensioner. It can be certified directly at a banking institution. You can download the standard form from this link.