What can you spend retained earnings on and how to reflect this in accounting

At the end of the financial year, many companies need to decide how to spend the net profit received during the reporting period. There are several distribution options, and accordingly, the accounting reflection for each will be different.

Neither the head of the organization, nor especially the accountant, has the right to make a decision on the distribution of net profit. Such a decision can be made exclusively by the general meeting of participants (shareholders). For this reason, it is impossible to automatically summarize the turnover in account 84 “Retained earnings (uncovered loss)” just to reflect the final figure in the balance sheet, since it is necessary to distinguish:

- retained earnings excluding the decision to pay dividends. This value is shown in the “Income Statement” as net profit and in the balance sheet for the reporting year in the “Capital and Reserves” section;

- retained earnings, taking into account the decision of the founders (participants) to pay dividends, are shown in the organization’s balance sheet in the “Capital and Reserves” section after the meeting of the founders, because this profit can be used in subsequent years to pay dividends to the owners of the organization.

At the same time, we would like to draw your attention to the fact that the distribution of profit based on the results of the year falls into the category of events after the reporting date. And also note that in the reporting period for which the organization must distribute profit, in accounting, both synthetic and analytical, it is shown as retained earnings in the corresponding subaccount of account 84. And already upon the occurrence of an event after the reporting date, i.e. i.e. in the period following the reporting period, in the general order, records are given that reflect this event in accordance with paragraphs. 3, 5, 10 PBU 7/98, i.e. the distribution of this profit is reflected.

GOOD TO KNOW

Profit is determined based on accounting data, not tax data. And all “simplified” people can distribute it, regardless of the object of taxation.

In practice, this also happens when the owners at their meeting decide not to distribute the profit received in the reporting year. In this case, in accounting, a change occurs in the corresponding subaccount of account 84, because retained earnings are formed taking into account the decision of the founders.

Thus, data on account 84 regarding the distribution of profit is formed in the year following the reporting one, taking into account the decision made in the same year on the distribution of profit received based on the results of the previous year, since this is already an event after the reporting date. Well, what if the owners of the company, based on the results of the organization’s activities, decided to direct all the net profit received last year to the development of the organization’s production? In this case, the balance in account 84 remains unchanged, which means that the indicator in line 1370 “Capital and reserves” does not change either.

All retained earnings received can be used to purchase new fixed assets, or the designated amount of retained earnings can be used to create an accumulation fund. Yes, that's not bad. An organization's accountant can reflect the creation of such funds in analytical accounting using the corresponding sub-accounts opened for account 84. In this case, the total value reflected in account 84 will remain unchanged. Note that expenses incurred by the organization aimed at developing production are recognized in the reporting period in which they occurred. In addition, the acquisition of fixed assets by an organization leads to a redistribution of amounts within the balance sheet asset, because the organization in this case decreases the amount of cash, which means the balance on line 1250 of the balance sheet will decrease, but then a fixed asset will appear and the balance on line 1210 of the balance sheet will increase by the same amount. As a result, both the balance sheet asset and capital will remain unchanged.

This raises quite reasonable questions: what are expenses at the expense of profit? For what purposes can it be spent?

These questions can be answered this way: profit is expended only when its value on the balance sheet actually decreases. This happens, for example, when dividends are paid to the owners of the organization at the expense of profits, a bonus can be paid at the expense of profits or material assistance can be provided to employees, and a reserve fund can be created at the expense of retained earnings, the size of the authorized capital can be increased, etc. Such situations have an impact and on reporting indicators.

We pay dividends

In practice, one of the most common ways of distributing profits is the payment of dividends, so let's look at this aspect in more detail. Due to the fact that the outflow of assets in connection with the payment of dividends is not recognized as an expense of the organization for tax purposes, dividends are accrued to participants directly from retained earnings, and therefore from the capital of the organization. In accounting, the following accounting entry is given: Debit account 84 “Retained earnings” Credit 75 “Settlements with founders”.

At the same time, dividends accrued to participants can be paid not only in cash, but also in property. In any case, there will also be a decrease in the corresponding asset of the organization.

So, when dividends are paid in cash, the following entry will be given in accounting:

| Debit | Credit | Operation |

| 75 | 51 | |

| And when paying with property, say, goods, the sale will be shown in accounting, and the following accounting entries will be made: | ||

| 76 | 90.1 "Revenue" | Recognized revenue from the sale of goods transferred to settle the payment of dividends |

| 90.2 “Cost of sales” | 41 | The cost of the goods is written off |

| 75 | 76 | Debt on payment of dividends to participants has been repaid |

We create funds

Let us focus on one more method of distributing profits according to the decision of the founders. This is the creation by an organization of certain funds. Let's name the main ones. Let us say right away that the creation of a reserve fund is the prerogative of joint stock companies. The mandatory creation of this fund is indicated in paragraph 1 of Art. 35 of the Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”. The law also provides for the size of this fund, which, naturally, must be determined by the company itself, but it must be no less than 5% of the authorized capital, and the amount of annual contributions to this fund should not be less than 5% of the net profit.

As for limited liability companies, in accordance with paragraph 1 of Art. 30 of the Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” can create a reserve fund in the manner established by the company’s charter and in the amount determined by the organization’s accounting policies.

The reserve fund is created in accounting by posting: Debit to account 84 “Retained earnings” Credit to account 82 “Reserve capital” and is reflected in the balance sheet on line 1370 “Capital and reserves”.

Moreover, all organizations, regardless of their form of ownership, can create other funds designated by the charter of the company. For example, you can create both a dividend fund and a consumption fund to pay bonuses to employees and provide them with financial assistance from retained earnings. It would be a good idea to create a fund to pay off losses from previous years and other funds, although these and other similar funds are not mentioned either in the Law on JSC, or in the Law on LLC, or in the current accounting regulations.

GOOD TO KNOW

The creation of various funds from retained earnings is not mandatory. However, a company can create such if they are established by the charter of the LLC and their size is determined by the accounting policy of the organization. At the same time, we believe that the creation of funds helps maintain order in the distribution and use of the organization’s profits.

Example 1.

Vympel LLC uses the simplified tax system. Based on the results of the organization’s activities in 2013, a loss was received in the amount of 120,000 rubles. In 2014, the company made a profit of 150,000 rubles.

In May 2015, a general meeting of participants was held, at which it was decided to distribute profits in the following order: 120,000 rubles. It was decided to use it to create a reserve fund, which will be used to repay losses from previous years. At the same time, the accounting policy of the organization also determines the size of the reserve fund at 120,000 rubles. Therefore, at the meeting of the founders, it was decided not to accrue or pay dividends to the owners for 2014, but to pay the remaining profit in the amount of 30,000 rubles. do not distribute.

The decision of the founders, i.e., an event after the reporting date, was reflected by the company’s accountant in the following accounting entries for 2015:

| Debit | Credit | Amount (rub.) | Operation |

| 81.1 “Retained earnings” | 82 “Reserve Fund” | 120 000 | A reserve fund of the enterprise was created at the expense of profits |

| 82 “Reserve Fund” | 84.3 “Uncovered loss” | 120 000 | Repayment of losses from previous years using the reserve fund |

| 84.1 "Retained earnings" | 84.2 “Retained earnings” | ||

| The organization's chart of accounts defines: Balance sheet account 84.1 “Retained earnings” without taking into account the decision to pay dividends Balance sheet account 84.2 “Retained earnings” taking into account the decision to pay dividends Balance sheet account 84.3 “Uncovered loss” | |||

As we can see, from the point of view of financial reporting, the creation of a reserve fund leads to a redistribution of amounts within the “Capital and Reserves” section. As a result of such a redistribution of amounts, the structure of the organization’s balance sheet improves, because only retained earnings can be distributed for dividends, including next year, and the reserve fund is inviolable. Moreover, covering losses from the reserve fund makes it possible to show a “break-even” balance, which looks more attractive to investors.

Let us note that the owners’ decision to repay losses from the reserve fund must be disclosed in the notes to the statements in accordance with clause 10 of PBU 7/98.

IMPORTANT IN WORK

It is unlawful to write off in the debit of account 84 such current expenses of the organization as expenses for charity, the purchase of gifts and other events of a cultural, educational and sports nature.

Example 2.

Signal LLC applies the simplified tax system. Based on the results of work for 2014, a net profit of 800,000 rubles was received. In addition, the organization, as of January 1, 2014, had retained earnings from previous years, taking into account the decision to pay dividends in the amount of RUB 1,200,000. In March 2015, a meeting of shareholders was held, at which it was decided to distribute the total amount of retained earnings in the amount of RUB 2,000,000. (RUB 1,200,000 + RUB 800,000) in the following order: to the enterprise development fund - 20%, for payment of dividends - 50%. The remaining profit will be used to create a consumption fund, 20% of which will be used to pay bonuses to employees based on the results of work in 2014, and 10% to pay financial assistance to employees as needed.

At the same time, the amount of the organization’s authorized capital is 200,000 rubles, and the amount of net assets is 1,600,000 rubles.

The credit balance at the beginning of 2014 on account 84.2 amounted to RUB 1,200,000.

In 2014, during the balance sheet reformation, the following entry was made in accounting:

| Debit | Credit | Amount (rub.) | Operation |

| 99 | 84.1 | 800 000 | “Retained earnings” without the founders’ decision to pay dividends |

| In March 2015, in accordance with the decision of the founders following the results of the meeting, the following accounting entries were given: | |||

| 84.2 | 81.1 | 1 200 000 | Profit from previous years accepted for distribution |

| 84.1 | 84.4 | 400,000 rub. = (RUB 2,000,000 x 20%) | Sent to the enterprise development fund |

| 84.1 | 75, 70, 69 | 1,000,000 rub. = (RUB 2,000,000 x 50%) | Dividends accrued to founders* |

| 84.1 | 84.5 | 600,000 rub. = (RUB 2,000,000 x 30%) | Sent to the consumption fund |

| 84.5 | 70, 69 | 120,000 rub. = (RUB 600,000 x 20%) | Bonus payments to the organization's employees were accrued from the consumption fund* |

| * For simplicity of the example, the accrual is shown in total, without individual distribution and without separate accrual of insurance premiums. Personal income tax deductions from accrued amounts of dividends and bonuses are also not shown. When calculating bonuses to employees of an organization at the expense of profits, it is necessary to draw up the following documents: - minutes of the general meeting of founders (participants); — decision of the general meeting of founders (participants) on the expenditure of the consumption fund; — payment of the bonus is made in accordance with the order of the head of the organization. | |||

As a result, after distributing the entire amount of retained earnings in 2015, we have:

- credit balance on account 84.3 – 400,000 rubles. (enterprise development fund);

- credit balance on the account 84.5 – 480,000 rubles. (consumption fund).

As we can see, in the presented example, based on the results of 2013, the available retained earnings were not distributed, because in 2014 the founders held a meeting at which it was decided not to distribute the profits received in 2013. In 2015, a meeting of the founders also took place, and all retained profits available in the organization for this period were distributed. At the same time, the organization had such an opportunity, since the amount of net assets significantly exceeded the amount of the authorized capital, which is important for this.

And one more important nuance. For many years, the issue of the possibility of using retained earnings from previous years to pay dividends has remained controversial, since neither tax nor civil legislation contains restrictions on the payment of dividends from retained earnings of previous years.

Currently, it is possible to enlist tax legislation on this issue. So, in accordance with Art. 43 of the Tax Code of the Russian Federation, retained earnings from previous years can be spent on paying dividends, because “a dividend is any income received by a shareholder (participant) from an organization when distributing profits remaining after taxation.” This position is also consistent with letters from the Ministry of Finance of the Russian Federation dated October 5, 2011 No. ED-4-3/16389, dated April 6, 2010 No. 03-03-06/1/235. In addition, such payments must also be provided for in the company’s charter.

GOOD TO KNOW

Funds can be formed from retained earnings only in accounting. The creation and use of funds under the simplified tax system does not in any way affect tax accounting.

Example 3.

Orion LLC uses the simplified tax system. The general meeting of owners, which took place in April 2015, decided to use part of the profit of the reporting year (RUB 150,000) to increase the authorized capital of the organization.

Based on the decision made, changes must be made to the constituent documents. After registering these changes in the prescribed manner, the corresponding entry is given in the accounting records: Debit 84.1 Credit 80 - 150,000 rubles.

Why are loss standards needed?

Account 94 “Shortages and losses from damage to valuables” influences the formation of expenses. It displays:

- Deficiencies identified during the inventory.

- Damage resulting from damage to company property.

This account is active-passive, so it can have debit and credit balances. The debit collects lost property in total terms. Depending on the amount of losses, there are certain indicators, based on which the company writes off its damage:

- within the limits of natural loss;

- above the norms of natural loss with the appointment of a responsible person;

- above the norms of natural loss without a specific culprit.

Natural loss is the property’s ability to shrink, shrink, rot, break dishes and other factors beyond the control of the carrier, supplier or storekeeper.

For each such product in trade there are standards within which shortages and losses are acceptable. For example, when transporting peaches, a certain amount may be crushed in the container, since this is a very delicate product, and there are potholes and potholes on the roads.

To prevent this factor from being used for theft purposes, a specific standard has been established for the product. Loss in excess of the required standard is regarded as theft or intentional damage. Natural loss is calculated using the formula:

cost (weight) of goods * loss standard / 100.

FROM THE EDITOR

Retained earnings is an amount indicating the amount of capital accumulated by an organization for the reporting year.

It represents the final financial result of its activities minus income tax. In addition, this value is a factor in the growth of the enterprise, which is achieved not only by increasing the organization’s income, but also by saving money spent on generating income. Currently, along with the concept of “retained earnings”, both in accounting and reporting, the concept of “net profit” is also used. Let us note that these concepts are often identified. However, they are still different categories. Let's try to figure this out.

Thus, retained earnings are a category inextricably interconnected with the organization’s own sources of funds – the capital of the organization. It represents funds invested in the activities of the organization, i.e., the profit remaining at the disposal of the organization from the beginning of its activities minus payments to owners, expenses for the formation of a reserve fund (if one is formed) and other payments made from net profit in accordance with with the legislation of the Russian Federation.

In turn, net profit is a category inherent only to a given reporting period; it represents the excess of an organization’s income in the current reporting period over its expenses.

- Back

- Forward

Reflection of the transfer of property from account 21 to 1C: BGU 8

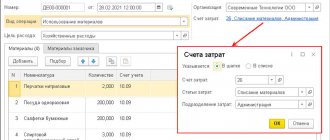

To restore the balance of fixed assets accounted for in off-balance sheet account 21, use the document Write-off of fixed assets, intangible assets, legal assets with the type of write-off Write-off of own fixed assets in oper. accounting (21) and the flag enabled: Restore to balance . the Restore on balance flag, the Restore on balance tab appears .

On the Fixed Assets, Intangible Assets, Regulatory Assets , fixed assets are selected that are written off from off-balance sheet account 21. On the Balance Restoration , data on fixed assets that are written off from off-balance sheet account 21 are indicated.

On the Accounting transaction , select the standard transaction Write-off of fixed assets with restoration on the balance sheet and in the additional details indicate the full working account 401.10.172. The gratuitous transfer of a fixed asset is formalized by the document Transfer of fixed assets, intangible assets, legal acts with the type of transfer - Transfer of own fixed assets, intangible assets, legal acts on the balance sheet (101, 102, 103) and the standard transaction Gratuitous transfer to organizations of fixed assets, intangible assets, legal acts (401.20.280) .

More on the topic: Information on accounts receivable and payable (f. 0503169, 0503769): how to check control ratios with other forms (Video materials for the 2019 annual reporting - topic 10)

Published 05/19/2021