We issue standard deductions

The law allows employees with disabilities, participants in military operations, people affected by radiation, parents, adoptive parents and guardians of children to reduce the tax. The size is given in the table:

| Category | Amount, rub. |

| To myself | |

| Chernobyl victims, other persons exposed to radiation and named in paragraphs. 1 clause 1 art. 218 Tax Code of the Russian Federation | 3000 |

| Disabled since childhood, disabled people of groups I and II | 500 |

| For children | |

| First and second child | 1400 |

| Third and each subsequent child | 3000 |

| For a disabled child of groups I and II | 12,000 (parents and adoptive parents) or 6000 (guardians and trustees) |

To receive a benefit, fill out an application in a form approved by the employer, and if there is none, then apply in free form. Additionally, they prepare documents confirming the right to a tax reduction: birth certificate, disability certificate, etc.

Here's how to write applications when applying for a job to deduct personal income tax or from the new year to reduce the tax base:

Children's deductions and the principle of their application

Deductions for children are as follows:

Features of calculating the deduction amount:

- Deductions for disability and the number of children are summed up. For example, if the second child has a disability, then the amount of the deduction for him will be: 1,400 12,000 = 13,400 rubles.

- Children are counted according to the order of birth, and not according to the deductions provided. Example: deductions are allowed for three children: 1,400 1,400 3,000 = 5,800 rubles. If the first child has reached the age of 18, then no deduction is provided for him, but the third child did not become the second because of this and the deductions are calculated as follows: 1,400 3,000 = 4,400 rubles.

Let us highlight the nuances that should be taken into account when writing an application for a tax deduction.

We reduce taxes in connection with the purchase of property

To reduce the personal income tax base by the cost of purchased housing and mortgage interest, a special application is prepared. It is submitted to the tax office, and if the application is approved, they receive a benefit through the employer. When the tax authorities confirm the possibility of reducing the personal income tax base, the employee asks not to withhold only the amount indicated in the notification from the tax service.

We remind you that from January 1, 2022, a new application form is in effect to confirm the taxpayer’s right to receive property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation. The form was approved by order of the Federal Tax Service No. ED-7-11/ dated 08/17/2021.

IMPORTANT!

An individual has the right to receive a benefit not only through the employer, but also through the Federal Tax Service, including by submitting a declaration, supporting documents and an application through the taxpayer’s personal account. The only difference is that the tax authorities will return the entire amount for the previous year (years) at once, and the employer will return it in parts, without withholding personal income tax from current income.

Tax refund application: how to submit it to the inspectorate

The application can be submitted to the inspection in person or sent by mail. When sending by mail, the day of submission of the application is considered the date of its transfer to the post office employee for dispatch. Please attach all documents confirming overpayment of tax to your application. For example, paid receipts for its transfer.

In the first case (when transferring in person), make an application in two copies. Give the first one to the inspectorate. The second one will remain with you. Request that the tax inspector accepting the tax refund application put a stamp on the second (your) copy indicating acceptance of the application indicating the current date. They MUST do this.

In the second case (when sending by mail), send the application in a certified letter with a list of attachments. Letter rating - 1 rub. Be sure to keep the postal receipt and inventory certified by the postal employee. These documents will confirm the fact that the application was sent to the tax office (receipt of dispatch). The fact that it was received by the inspection can be confirmed by a printout from the Russian Post website. The number indicated on the receipt (mail identifier) will help you track your letter. This is 14 digits. For the Russian Post service for tracking letters, see the link. There you will find out when this letter was delivered to the tax office.

The tax must be returned to you within one month from the date of receipt of your application. If the tax inspectorate misses this deadline, they are required to pay interest (penalties) for each day the return is late. Interest is calculated based on the refinancing rate of the Bank of Russia (key or discount rate) for each calendar day of delay in repayment. For more information about tax refund deadlines, see the link.

Example The amount of tax to be refunded is 150,000 rubles. Delay in return is 48 calendar days. The refinancing rate that was in effect on the days when the tax refund was overdue is 5% per annum.

Amount of interest that the inspection is obliged to pay: RUB 150,000. x 5%: 365 days. x 48 days = 986 rub. 30 kopecks

Professional benefits

On this basis, personal income tax is reduced when performing work or providing services under a civil contract or receiving royalties for the creation of literary, musical, artistic, and other works, the invention of models and industrial designs. The amount is determined either in the amount of costs incurred, or according to those established in clause 3 of Art. 221 Tax Code of the Russian Federation standards.

Read more about the professional basis for reducing personal income tax

If for some reason the employer calculated personal income tax on the full amount of income, then at the end of the year they submit a 3-personal income tax return to the Federal Tax Service and return the overpaid tax.

ConsultantPlus experts looked at what personal income tax deductions there are and how to use them. Use these instructions for free.

Social benefits for treatment and training

To reduce tax on this basis, you must contact the Federal Tax Service. Let us remind you that in accordance with Article 219 of the Tax Code of the Russian Federation, personal income tax benefits are issued for:

- education;

- treatment;

- payment of additional contributions to a funded pension;

- expenses for voluntary insurance: pension and life.

If the inspectorate allows you to return personal income tax, you will be notified of this. With the document, contact the accounting department and ask how to fill out an individual’s application for tax deductions for treatment or education, ask to see a template. If the organization does not have this, then use our sample application for a social deduction for personal income tax from an employer in 2022:

IMPORTANT!

If you spent money on charity or an independent assessment of an employee’s qualifications, then a refund of the tax paid will be provided only after filing a 3-NDFL declaration at the end of the reporting year.

How to return tax through the Federal Tax Service

Citizens have the opportunity to choose how to receive fiscal benefits; this is provided for in the Tax Code of the Russian Federation. Taxpayers have the right to write and send an application for any tax deduction directly to the territorial office of the Tax Service.

To return personal income tax through the inspection, you will have to collect a package of documents confirming your rights to benefits. Note that the registration of benefits through the Federal Tax Service begins only in the year following the year in which the grounds for applying the fiscal deduction arose. For example, if you have rights to benefits in 2022, then you will be able to contact the Federal Tax Service only in 2023.

In addition to the documents, you will need to prepare a 3-NDFL tax return and fill out a special tax refund form. Such a written application for a tax refund is completed using a unified form, which is part of the 3-NDFL. The form and instructions for filling out the 2022 declaration (which is submitted based on the results of 2022) were approved by Order of the Federal Tax Service No. ED-7-11/ dated 10/15/2021.

IMPORTANT!

Deductions for which citizens have rights since January 1, 2020 are allowed to be processed by the Federal Tax Service in a simplified manner. Citizens are invited to fill out and submit applications listing the necessary data through the taxpayer’s personal account, and tax officials will request all the necessary supporting documents themselves. If you indicate that you want to receive a deduction through your employer, then the corresponding notification will be sent to him from the Federal Tax Service independently.

Application for property deduction: registration procedure

An application for a tax refund must be drawn up in the form approved by Order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] (as amended on August 17, 2021). It is mandatory for all tax inspectorates in Russia. On our website there is:

- Detailed procedure for registration and a sample of a completed tax refund application form. Those lines that need to be completed are filled in in red font.

- A blank tax refund application form in Excel format (see files at the bottom of the page). You can download it, fill it out based on our sample and indicate your own data. Here you will also find a sample of the completed form.

For information about the time frame within which the inspectorate is obliged to return the tax upon application, see the link.

To receive a tax refund, you need an account in any bank. If it is not there, then an account should be opened (for this you only need a passport). You should also know the details of this account. They are included in the application. You can find out the necessary information in person at the bank or in your personal account online, if you use it. You will learn more about how to do this below.

General rules

The application consists of three sheets. You definitely need to fill out the first two - the title and your bank details. The third one (it contains your passport details) is needed if you have not indicated your TIN. If it is included in the first and second sheets, then the third sheet can be left blank.

The title page contains your details and other information about the tax being refunded (in your case, this is personal income tax). On the second sheet enter your bank details to which the money will be returned. The third sheet is devoted to individual information about you: passport details and place of registration (registration).

If you do not have the data to fill out certain lines of the application (for example, you have not been assigned a TIN or you do not know OKTMO), do not fill them out. The most important information in a return application is the following:

- about you (full name). Without them, it is unclear from whom the application was received;

- about your bank details. Without them, it is unclear where to pay the tax;

- about the amount of tax. Without them, it is unclear how much you are asking for a refund.

The rest of the data is not really needed. Therefore, their absence is not critical. Let's move on to the procedure for filling out the document.

The application can be filled out by hand in block letters, or on a computer. But the signature on the application must be “live” (that is, written by hand). It is placed only on the title page.

You can apply several years in advance. For example, for 2017, 2022 and 2022. In this case, you need to make not one, but three statements. One for each year.

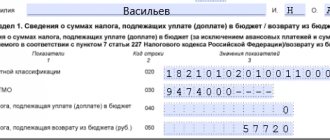

When purchasing real estate, you can claim a tax refund both on the cost of the apartment (room, house) itself, and on the cost of paying interest on a mortgage loan. The application must indicate the total amount to be refunded without breaking it down into taxes on the cost of the apartment and on mortgage expenses. That is, there is no need to separate them in the application. The application must indicate the amount of tax to be refunded. It will be entered in your income tax return (form 3-NDFL) on line 050 of Section 1 and line 160 of Section 2.

Title page of the application (sheet 001)

1. Enter your Taxpayer Identification Number . If you don’t know it, then you can find it out through our “Find out your TIN” service. There is no need to fill out the checkpoint line. It is intended exclusively for organizations.

2. Write the page number in the format “001”.

3. Enter the application number in the format “1 — — — — “. If you submit a second application in the same year, its number will be “2 — — — —”, etc.

4. Write the code of the tax office to which you are submitting the application. If you return income tax when receiving a property deduction, this is the inspection at your place of residence.

You can find out the code of the required tax office on the tax service website using the link.

5. Enter your last name, first name and patronymic (if any) in capital letters on each line of the application.

The completed lines will look like this:

6. Next, indicate the payer status . When receiving a deduction for an apartment or other real estate, enter the number “1”.

7. Provide an article of the Tax Code , on the basis of which you are required to return the money. This is always Article 78 of the Tax Code. The reasons for the return (error, overpayment, deduction) do not matter.

8. Then enter the overpayment reason code . If you paid (or were deducted from you) an excess - 1, if the amount was forcibly collected from you (for example, bailiffs) - 2, indicator - 3 applies only to organizations. In your case, this number is “1”.

9. Next, indicate the payment code you are returning. If the tax is 1, if the fee is 2, if the insurance premium is 3, if the penalty is 4, if the fine is 5. Enter “1” in this column.

10. In the next line, enter the amount that you are required to return . The number should be pressed to the right side of the line (see example below). If you are returning income tax, the figure in this line will coincide with the same figure in line 050 of Section 1 of the income tax return (form 3-NDFL). If your declaration contains several lines of Section 1 050, then you need to fill out several applications.

Let us emphasize once again that this applies to taxes overpaid before 2020. If the overpayment was in 2022 and later, then you do not need to fill out an application.

11. Indicate the OKTMO code (all-Russian classifier of municipal territories). OKTMO is the code of the region where income tax was paid. It is included in the income certificate (2-NDFL), which must be obtained at the place of work.

You can find out OKTMO at this link.

Attention! If you are returning tax that was paid under different OKTMO (for example, at different places of work), then you need to fill out two different applications. Each code has its own.

12. Next, enter the details of the payment document . You do not need to fill out these fields. These fields are filled out only under one condition - you return the state fee.

13. The next line of the KBK is the code for the budget classification of budget income, which consists of 20 digits. Look for it on the Internet. Example request: “KBK for personal income tax.” For example, KBK for income tax refund is 182 1 0100 110. We do not write these codes because they change regularly.

14. Next, indicate the number of pages in the application. It is always “003”. Whether you need to fill out sheet 003 or not doesn’t matter. Let us remind you that this sheet does not require completion if you indicated your TIN on the title page.

15. Enter the number of sheets of documents that you are attaching to the application. If one sheet is “001”, if two - “002”, if three - “003”, etc. When receiving deductions and returning income tax, all documents that confirm the right to deduction are attached to the declaration, and not to statement. You do not need to re-attach them to the application. Therefore, you will have dashes in this field.

The completed application lines will look like this:

16. If you are submitting the application in person, in the last block of the title page “Accuracy and completeness of the information specified ...”, indicate the number “1”. If a representative does this for you using a notarized power of attorney, the number “2”. In this situation, in the subsequent lines you need to enter the full name of the representative in capital letters.

17. In the “Contact phone number” , enter your telephone number at which you can be reached without gaps, brackets or spaces.

18 and 19. In the next line “Signature” put a “living” signature, and in the line “Date” indicate the date of the application in the format DD.MM.YYYY.

If the application is submitted by a representative, indicate the number and date of his power of attorney. It must be notarized.

There is no need to write anything in the “To be completed by a tax authority employee” block. The tax authorities will fill it out.

If you are submitting an application on your own (without a representative), this block of the application will be filled out like this:

Bank details in the application (sheet 002)

On the second sheet of the document you need to indicate the bank details of the account to which the tax office is obliged to return the money to you. There aren't many of them. You need:

- full name of the bank;

- Bank BIC;

- your bank account number.

You can find out all the necessary information in the bank itself or in your personal bank account online. Below we will show where you can view them using the example of Sberbank online.

Sheet 002 is filled out like this.

1. Re-enter your TIN

2. Enter the page number - “002”.

3. Re-write your last name and initials .

4. Enter the name of the bank in which you have an account and through which the money will be returned to you.

5. Write down the account type code to which the money will be returned to you:

- “02” - if the money is credited to a bank card or account “on demand”;

- “07” - if the money will be credited to a bank deposit (deposit).

These application fields will be formatted like this:

6. Next, enter your bank identification code (BIC). These are the 9 digits that are in the bank details. Each bank has its own BIC.

7. In the “Account number” , enter the number “1”.

8. Indicate the number of your bank account to which the money should be credited. These are 20 digits that are in bank details. The number must be entered very carefully. An error in even one figure and the tax authorities will not be able to return your money. Therefore, the application will have to be submitted again. Keep in mind that the card number (located on its front side) and the account number are completely different numbers. You need an account number. You do NOT need to enter your card number on your application.

9. In the “Recipient” , write down the number “2”.

10. For the third time, indicate your last name, first name and patronymic (if any).

Application details such as “Budget classification code of the recipient” and “Personal account number of the recipient” do not need to be filled out.

If you enter the bank details of another person (for example, a wife or husband) into the application, then the money will not be transferred to you under such an application. Also, you will not be able to receive money if you make a mistake in the details (it is enough to miss or write one number incorrectly). Of course, in all these situations there is nothing terrible. The money will be returned to you in any case. But this will require a new application with the correct data. As a result, the return process will take at least 1 month.

Bank details in the application can be filled out as follows:

Now we’ll tell you how to view bank details in your bank account. For example, let's take Sberbank online.

Go to your personal account, click on the card you want to receive money on (1) and click on the “About the card” tab (2).

The “About the Card” tab will contain all the details needed for the application:

- 3 - full name of the bank (column 4 in the application);

- 4 - BIC of the bank (column 6 in the application);

- 5 - bank account number (column 8 in the application).

This information must be carefully and carefully transferred to the return application.

Personal data in the application (sheet 003)

You do NOT need to fill out the third sheet of the application if you indicated your TIN on the first one. If you do not have this number, then enter your passport details on the third sheet. Everything is quite simple here.

1. Enter the page number - “003”.

2. For the fourth time, write your last name and initials .

3. Provide the code of the document that proves your identity. Each such document has its own code. In particular:

- 21 — passport;

- 03 - birth certificate;

- 07 - military ID;

- 10 - passport of a foreign citizen.

The full list of documents with codes is in Appendix 2 to the Order of the Federal Tax Service of Russia dated October 15, 2021 No. ED-7-11/ [email protected]

4. Indicate the series and number of this document.

5. Enter the name of the department that issued the document to you. If its name does not fit into 2 lines, shorten it. There are no rules for such reduction. So make the cut at your own discretion. For example, instead of the Ministry of Internal Affairs, indicate - Ministry of Internal Affairs; instead of the district, indicate - r. and so on.

6. Indicate the date the document was issued.

The third sheet of the application can be filled out as follows: