Delivery conditions

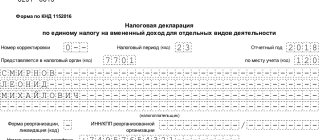

The updated tax return for UTII is submitted to the same place where you submitted the primary report - to the Federal Tax Service at the place of business of the entrepreneur or at his location (if it is impossible to accurately determine the specific place of activity - for example, for taxi services).

The tax declaration of individual entrepreneurs and organizations was filled out based on the results of each quarter - no later than the 20th day of the month following the reporting quarter (clause 3 of Article 346.32 of the Tax Code of the Russian Federation).

If after submission you notice that the submitted declaration contains errors, some data is not reflected, or there is inaccurate information that led to an underestimation of the tax amount, you need to correct the submitted report. This can be done by filing an amended tax return for the same period.

You can also submit an updated return if there is no understatement of the tax amount.

Periods covered by imputed tax reports

The tax period for imputed tax of the Tax Code of the Russian Federation (in Article 346.30) is set equal to a quarter.

What does this mean? The fact that the calculation of the tax (with the submission of reports on it to the tax authority) and its payment must be carried out quarterly (clauses 1, 3 of Article 346.32 of the Tax Code of the Russian Federation). In this case, the data for calculation is taken only for the next completed quarter. Neither the tax base nor the tax itself is calculated on an accrual basis. For this reason, imputed tax reports are tied to periods defined as one of the quarters of a given year (first, second, third or fourth) and cannot cover a period of time equal to a year. This circumstance does not allow using, for example, the wording “tax return for UTII for 2022” in relation to reporting generated when working on imputation.

At the same time, the end of the year coincides with the end of the last tax period included in this year (the fourth quarter). And it is for this period that imputed tax reporting will be compiled, linked to the end of the year. But its correct name would be “UTII declaration for the 4th quarter of 2022.”

IMPORTANT! The UTII declaration for the 4th quarter of 2020 is being submitted for the last time. Since January 2022, the special regime has been canceled throughout Russia.

Find out what taxpayers should do in connection with the abolition of the special regime in the Typical Situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

When to submit an updated declaration

The consequences in the form of sanctions and inspections depend on the moment of submission of the updated declaration.

If you made mistakes that led to an understatement of the tax amount, then after submitting the updated declaration you will have to pay the arrears to the budget and transfer penalties. But liability can be avoided if the following conditions are met:

- submit an amendment before the tax payment deadline if you noticed and corrected an error before the tax authority found it;

- pay the arrears and penalties and submit an update before you find out that the tax office has found errors and ordered inspections;

- submit an updated declaration after an on-site inspection, as a result of which no errors or distortions were found.

If the amount of tax was not underestimated in the primary declaration, then the declaration will be considered submitted without violating the deadline (paragraph 2, paragraph 1, article 81 of the Tax Code of the Russian Federation).

What to do if there was an error in the declaration?

If for some reason a mistake was made in the declaration and it was you who noticed it, then you need to do the following:

- Make a new calculation and pay the difference to the budget

- File a correct corrective tax return. To do this, you need to indicate the correction number on the title page, for example, “1—”

bukhproffi

Important! It is necessary to correct errors in the declaration in this way, and not vice versa. In this case, the tax office does not charge fines and penalties for late payments.

You might be interested in:

Declaration according to the simplified tax system [year] of the year: deadlines, methods of submission, sample filling

Checks of updated declarations

After receiving the updated declaration, the tax office has the right to check the period for which it was submitted. To do this, they begin an on-site inspection. It can even cover a period that extends beyond the three calendar years preceding the year the decision on the inspection was made.

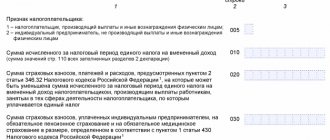

We also note that during a desk audit of the clarification in which the amount of UTII was reduced, the tax office may require clarification. They must be submitted within five days.

If you submit an updated declaration two years after the deadline established for the initial declaration, then during a desk audit the tax office has the right to request:

- primary and other documents confirming changes in information in the relevant indicators of the declaration;

- analytical tax accounting registers on the basis of which such indicators are formed, before and after their changes.

Fines for late submission of UTII declarations

The standard fine for failure to submit a UTII return on time is 5 percent of the accrued tax. The fine cannot be more than 30 percent of the tax amount and cannot be less than 1,000 rubles (Article 119 of the Tax Code of the Russian Federation).

Where is the declaration submitted?

Providing reporting for LLCs and individual entrepreneurs has certain features. They must be taken into account both when submitting reports and when paying taxes.

If the activity is carried out at the place of registration of an individual entrepreneur or the legal address of an LLC, then reporting is submitted to the tax office, where they are registered.

At the actual place of business, individual entrepreneurs and LLCs must submit reports if the following services are provided:

- In case of transportation of cargo and passengers by road.

- When placing advertising materials on vehicles.

- For peddling or delivery retail trade.

Since in these cases it is impossible to determine the area in which the activity is carried out, individual entrepreneurs provide reporting at the place of their registration, and organizations at their legal address.

The taxpayer carries out several types of activities under a single tax:

- If the activity is carried out at the place of registration of an individual entrepreneur or legal entity. the address of the company who fills out the appropriate number of sheets in Section 2 in the declaration. They must be filled out for each type of activity separately, and Section 1 indicates the total tax amount.

- If activities are carried out in different municipalities, then reports for each point are submitted separately to the tax office corresponding to the OKTMO code.

The taxpayer conducts one type of activity at several retail outlets:

- If the activity is carried out in one municipality, then the indicators are added up in section 2 of the UTII declaration, and one report is submitted.

- When conducting activities in different municipalities, separate reporting is provided to each of them.

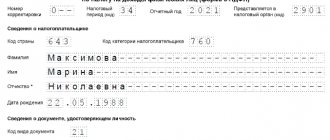

The procedure for filling out the UTII declaration

Submit the updated UTII declaration on the form that was valid in the period for which you are adjusting the report. The rules for document execution are specified in the Order of the Federal Tax Service of Russia dated June 26, 2018 No. ММВ-7-3/ [email protected] Filling out a tax return for UTII occurs after calculating the tax, which is made according to the following formula:

UTII = (Tax base * Tax rate) - Insurance premiums. Let us recall that

Tax base = Imputed income = Basic profitability * Physical indicator

The basic yield is adjusted (multiplied) by coefficients K1 and K2.

Which physical indicator to use depends on the type of activity and is determined by Art. 346.29 Tax Code of the Russian Federation.

In the updated declaration, indicate the correct tax amounts calculated taking into account changes and additions. The difference between taxes does not need to be reflected in the declarations.

Reporting methods

The UTII declaration can be submitted to the Federal Tax Service in several ways:

- Directly to the Federal Tax Service Inspectorate on paper - the entrepreneur or representative of the organization submits it to the Federal Tax Service Inspectorate personally in two copies to the tax inspector. At the same time, if the report is not submitted personally by the entrepreneur, then a notarized power of attorney should be issued to the authorized person.

- By sending a registered letter with a list of attachments. In this case, a receipt from the post office is considered confirmation of submission.

- Electronically by sending a report through a special operator. An electronic digital signature will be required for this.

Attention! For enterprises, when submitting a declaration not by the director, but by another official, a simple power of attorney is issued on company letterhead. In addition, some Federal Tax Service Inspectors may still require that an electronic form be provided along with the report, or that the declaration have a special barcode.

Registration

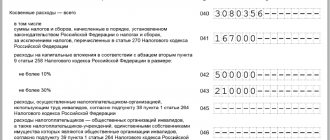

Let's start filling out section 2 of the declaration. There may be several of these sections, for example, depending on the number of retail outlets the company has.

On line 010, indicate the code of the type of business activity. It is taken from Appendix No. 5 to the Procedure for filling out the declaration.

On line 020 - the full address of the place of implementation of the type of business activity indicated on line 010 (take the code of the subject of the Russian Federation from Appendix No. 6 to the Procedure for filling out the declaration).

On line 030, enter the OKTMO code corresponding to your address.

In line 040, indicate the basic profitability per unit of physical indicator per month for the corresponding type of business activity. You can find it in paragraph 3 of Article 346.29 of the Tax Code. For example, in retail trade without a sales area, the basic profitability is 1,800 rubles.

In line 050, enter the deflator coefficient. In 2022, it is 2.005 (Order of the Ministry of Economic Development of Russia dated December 10, 2019 No. 793).

Show the value of the K2 coefficient on line 060. It takes into account the totality of the features of the company’s business activities. This coefficient is set by regional authorities. You can find it in the regulatory act that introduced the UTII tax in the territory of a particular city or district. Its value must be between 0.005 and 1.

The value of the K2 coefficient is rounded to 3 decimal places. If the K2 coefficient is not set, it is equal to one.

In lines 070-090, calculate the tax base for each month of the quarter. In column 2, write down the value of the physical indicator in whole units. If the value of a physical indicator has changed in one of the months, then for the calculation take the new value of the indicator, and not the one that was previously.

In column 3, indicate the number of calendar days of activity in the month in which you registered (or deregistered) as a UTII payer. This column is filled in only by those “imputed” persons who were registered or deregistered in the reporting quarter. In the example given, the retail outlet opened on October 12, and at the same time the individual entrepreneur was registered as a UTII payer. Therefore, the first month contains 20 calendar days.

In column 4, indicate the tax base for each calendar month of the quarter (the product of the indicator values by codes 040, 050, 060 and 070 (080, 090)). In the example given, the amount in line 040 is determined depending on the number of days. That is:

(RUB 1,800 x 2,005 × 20 m) : 31 days. × 20 days = 46,567.74 rub.

In line 100, indicate the amount of lines 070-090 in column 4, and in line 110 the calculated tax (line 100 x 105/100).

Declaration form

In 2022, the form introduced by the Federal Tax Service order No. ММВ-7-3/ dated 06.26.2018 is used. We will demonstrate how to fill out the UTII declaration online for free, based on the recommendations on the procedure for working with the form from Appendix No. 3 to this order.

The UTII report form consists of a title page and four sections. Totals must be filled out in whole rubles. Text fields are formatted in capital block letters. Corrections are not permitted. Fill out the reporting form by hand (in black ink) or using a computer.

Fill out the form using instructions from ConsultantPlus experts.

Section 4 of the UTII declaration for the 3rd quarter of 2018

This section is completely new and was introduced in order to calculate the amount of the “cash” deduction. It consists of several blocks of lines 010-050, each of which corresponds to one purchased cash register.

- Line 010 indicates the cash register model.

- Line 020 contains the serial number of the device.

- Lines 030 and 040 indicate the registration number and date of registration of the cash register with the Federal Tax Service.

- Line 050 contains the amount of acquisition costs. The value in it should not exceed 18,000 rubles. (Clause 2.2 of Article 346.32 of the Tax Code of the Russian Federation).

Zero reporting on UTII

Sometimes it happens that the imputator temporarily ceases activities. Is he obliged to submit zero reports in this case? The opinions of regulatory authorities on this issue differ.

If a company has ceased operations, but still has physical indicators for calculating tax (retail space, vehicles, etc.), the regulatory authorities are categorical: the taxpayer, despite the lack of real income, is not exempt from paying tax.

If both activity and physical indicators are absent, then there is nothing to calculate the tax from. But the Federal Tax Service sometimes makes claims in this case too.

To avoid disputes with the Federal Tax Service upon termination or suspension of work at the “imputation”, submit an application for deregistration.