The new form of corporate income tax declaration is valid from January 1, 2022. This means that you need to report for 2021 based on it. The new income tax report in 2022 is also used for further periods - the 1st quarter of 2022 and after. In this article about the new income tax return form for 2022 and a sample for filling it out in 2022, we will look at what has changed in the income tax return and how to fill it out now. We will also touch on several other important changes in the calculation of income tax that came into force in 2022.

Who submits income tax returns?

The Russian federal and regional budgets are replenished from income taxes.

Every year, legal entities pay a percentage of their profits to the treasury under the general taxation system. Accountants regularly have to report taking into account all the changes and updates that tax authorities constantly make to the reporting. In accordance with Article 246 of the Tax Code of the Russian Federation, income declarations are submitted monthly on an accrual basis by the following taxpayers:

- Russian legal entities;

- foreign companies operating in the Russian Federation through a permanent representative office;

- foreign companies receiving income from sources in the Russian Federation.

IMPORTANT!

From 01/01/2022, a new tax return form for income tax will be introduced. The changes are related to new benefits and changes in the formula for calculating tax on dividends calculated by tax agents. It must be applied starting with annual reporting for 2022.

Read more: “The income tax return form will change”

Updated income tax reporting form

The declaration form valid for the report for the 4th quarter of 2022 was approved by Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3 / [email protected] as amended on October 5, 2021. This is not the first change in the last year. Taking into account the latest adjustments, what has changed in the new form of profit declaration from 2022:

- sheet 02 “Tax calculation”;

- Appendix No. 4 to l. 02 “Calculation of the amount of loss or part of a loss that reduces the tax base”;

- Appendix No. 5 to l. 02 “Calculation of the distribution of advance payments and corporate income tax to the budget of a constituent entity of the Russian Federation by an organization that has separate divisions”;

- Section A “Calculation of investment tax deductions from advance payments and taxes subject to credit to the budget of a constituent entity of the Russian Federation” of Appendix No. 7 to l. 02 “Calculation of investment tax deduction”;

- Section D “Calculation of the reduction in the amount of advance payments and corporate income tax subject to credit to the federal budget when the taxpayer applies an investment tax deduction” of Appendix No. 7 to l. 02 “Calculation of investment tax deduction”;

- sheet 04 “Calculation of corporate income tax on income calculated at rates different from the rate specified in paragraph 1 of Article 284 of the Tax Code of the Russian Federation”;

- page with barcode “00214339” in sheet 08 “Income and expenses of a taxpayer who has made an independent (symmetrical, reverse) adjustment”;

- Appendix No. 2 to the declaration.

The FTS form also updated the barcodes. In 2022, preferential tax treatment is provided for:

- residents of the Arctic;

- IT companies;

- companies that process hydrocarbons into petrochemical products and produce liquefied natural gas.

Please note that you will not be able to download the income tax return for 2022 in excel, since the Federal Tax Service has released only machine-readable forms in pdf format.

Check for free that you filled out the new form correctly using ConsultantPlus.

Results

Before preparing reports, always make sure that the form you are going to fill out is up to date. Always submit the clarification in the form that was in effect during the period being clarified. You can always find the latest reporting forms and samples for filling them out on our website.

Sources:

- Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Due date: 2022

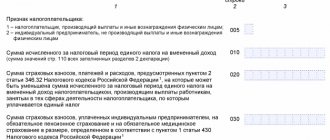

Income tax payers are divided into two categories:

- those who pay advances quarterly;

- those who pay advances monthly.

Companies that pay monthly and quarterly advances have the right to submit declarations quarterly. Once a quarter, advances are paid by companies whose income for the previous 4 quarters did not exceed 15 million rubles (the limit was increased in 2016 from 10 million rubles).

Taxpayers who pay tax from actual profits fill out reports every month.

Let's present the deadline for filing income tax returns in the form of tables.

Quarterly reporting

| Period | Term |

| Year 2021 | Until March 28, 2022 |

| 1st quarter 2022 | Until 04/28/2022 |

| Half year | Until July 28, 2022 |

| 9 months | Until October 28, 2022 |

| Year 2022 | until March 28, 2023 |

Monthly reporting

| 1st month 2022 | Until February 28 |

| 2nd month 2022 | Until March 28 |

| 3rd month 2022 | Until April 28 |

| 4th month 2022 | Until May 30 |

| 5th month 2022 | Until June 28 |

| 6th month 2022 | Until July 28 |

| 7th month 2022 | Until August 29 |

| 8th month 2022 | Until September 28 |

| 9th month 2022 | Until October 28 |

| 10th month 2022 | Until November 28 |

| 11th month 2022 | Until December 28 |

| 2022 | Until 01/30/2023 |

How to correctly fill out the declaration for the 4th quarter of 2021

The current income tax report form consists of:

- title (sheet 01);

- subsection 1.1 of section 1;

- sheet 02;

- appendices No. 1 and No. 2 to l. 02.

This is a required part.

The remaining applications and pages are completed if the following conditions are met:

- subsection 1.3 of section 1;

- appendices No. 3, No. 4, No. 5 to l. 02;

- sheets 03, 04, 05, 06, 07, 08, 09;

- appendices No. 1 and No. 2 to the declaration.

See the detailed step-by-step filling out the profit declaration for dummies in 2022 in the appendix to Order No. ММВ-7-3/ [email protected]

Report submission deadlines

The reporting period is a month or a quarter, depending on how often the legal entity transfers advances to the budget. The document is submitted on a cumulative basis from the beginning of the year. In addition, a completed tax return form for the organization's profits must be submitted for the year.

The last day of submission is the 28th day of the month following the reporting period. If this day falls on a weekend, the deadline is moved forward.

Composition of an organization's profit tax return

The declaration form was approved by Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] It consists of several sheets, among which are mandatory for everyone:

- title or 01;

- subsection 1.1 of Section 1;

- “Tax calculation” or 02;

- appendices 1 and 2 to the “Tax calculation” sheet.

The remaining sheets are filled out provided that the company has data for them:

- subsections 1.2 and 1.3 of Section 1;

- appendices 3, 4 and 5 to the sheet “Tax calculation”;

- sheets 03, 04, 05, 06, 07, 08, 09;

- appendices 1 and 2 to the declaration.

Note!

Appendix 4, regardless of the availability of data, is added only to the annual report and the report for the 1st quarter.

How to fill out a tax return for an organization's profits?

Title page

. Includes information about the enterprise.

Section 1

. This indicates the amount of tax that the company undertakes to transfer to the budget. Subsection 1.1 records the amount of tax for the reporting period.

Sheet 02

. On this sheet you should indicate expenses and income for the reporting period, the tax base and, ultimately, the amount of tax. Line 110 shows losses from previous periods transferred to the current period.

Appendix 1 to sheet 02

. Filled out to show the company's income. The peculiarity is that it is necessary to display income received in any way, and not just from the sale of goods and services.

Appendix 2 to sheet 02

. Filled out to demonstrate all expenses of a legal entity: direct, indirect and non-operating.

How to send, in what form?

The declaration is submitted electronically or in paper form. The paper format is allowed only for small enterprises, the average number of employees in which does not exceed 100 people (according to Article 80 of the Tax Code of the Russian Federation).

The most convenient way to fill out a report is via the Internet using specialized online services.

Updated declaration

If an error is discovered when calculating income tax after sending the declaration, you need to submit an updated declaration with the correct amount. If the amount of tax paid was less than required, then you must pay additionally, taking into account the penalty.

Responsibility for late submission

The standard fine for late submission of a report is 5% of the tax amount, but not less than 1000 rubles. and no more than 30% of the amount. The fine is charged for each month of delay.

An official of an enterprise who is late may be punished with an administrative fine in the amount of 500 rubles.

QUICKLY AND EFFICIENTLY

Sending invoices to your clients' e-mail. The invoice status will always tell you whether it is paid or overdue. A short introductory text about the invoice for payment. Invoicing with logo, seal and signature. Sending invoices to your clients' emails. The invoice status will always tell you whether it is paid or overdue.

- Convenient online invoicing

- Instantly send invoices by e-mail to your buyer

- Debt control for each customer

Sample of filling out an organization's profit declaration

Download the already completed corporate income tax return for free to have the correct example before your eyes.

Corporate income tax return form

Download a blank income tax return form in your preferred Word or Excel format.

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using the CUBE right now 14 days FREE ACCESS

Important nuances of filling out the declaration

Need to consider:

- The title contains information about the organization. The legal successors of reorganized companies indicate the TIN and KPP assigned before the reorganization. The codes of the reorganization forms and the liquidation code are indicated in Appendix No. 1 to the procedure for filling out the declaration.

- Two additional sheets - 08 and 09. Sheet 08 are filled out by organizations that have adjusted (lowered) income tax due to the use of below-market prices in transactions with dependent counterparties. Previously, this information was placed in Appendix 1 to l. 02.

- It is provided for filling out sheet 05 of the income tax return for 2022 for organizations for operations whose financial results are taken into account in a special manner, with the exception of non-state pension funds.

- Sheet 09 and Appendix 1 to it are intended to be filled out by controlling persons when accounting for the income of controlled foreign companies.

- Sheet 02 contains fields for taxpayer codes, including the new taxpayer code 6, which is indicated by residents of territories of rapid socio-economic development. It also contains lines for the trade fee, which reduces the payment, and fields filled in by participants in regional investment projects.

- Sheet 03 shows the current dividend rate of 13%. In section “B”, the following codes are now entered in the field for the type of income:

- 1 - if income is taxed at the rate provided for in paragraphs. 1 clause 4 art. 284 Tax Code of the Russian Federation;

- 2 - if income is taxed at the rate provided for in paragraphs. 2 clause 4 art. 284 Tax Code of the Russian Federation.

- Filling out the income tax return for 2022 on lines 241 and 242 occurs by reflecting in them deductions for the formation of property for statutory activities and the insurance reserve. There are no separate lines for reflecting losses, current or carried forward to future periods.

- To reflect non-operating income after self-adjustment of the tax base for controlled transactions, a separate sheet 08 is provided.

- In Appendix 2 l. 08 there is a field for indicating taxpayer codes.

Filling out a declaration for the organization as a whole

The declaration, which must be submitted at the location of the organization, is filled out in the general manner, taking into account the following features, namely the declaration includes:

- Appendix No. 5 to sheet 02 for each separate division that independently pays tax to the regional budget, including divisions closed during the tax period (clause 10.1 of the Procedure for filling out the income tax return).

- for each group of separate divisions located in the same region (if the tax to the regional budget for this group is paid by the responsible division - clause 2 of Article 288 of the Tax Code of the Russian Federation);

- Appendix No. 5 to sheet 02 on the organization excluding separate divisions

Thus, the declaration for the organization should be filled out in the general manner, additionally including Appendix No. 5 to sheet 02 for each separate division (group of divisions) and for the organization without separate divisions.

Step-by-step instructions for filling out an income tax return

Let's look at an example of filling out an income tax return for the 4th quarter of 2022 line by line, starting with the title.

Here are short instructions for filling out the title page:

- Enter information about the organization: TIN, KPP, name in full, empty cells are always filled in with dashes.

- Enter the correction number. If the declaration is submitted for the first time, enter 0. When making changes to the information, each updated declaration is numbered - 001, 002, 003, etc.

- Enter the reporting period code. It depends on which quarter or month the declaration is submitted for. When submitting an annual report, taxpayers using different advance payment systems also have different codes.

When reporting quarterly:

| 1st quarter | 21 |

| Half year | 31 |

| 9 months | 33 |

| Year | 34 |

For monthly reporting (based on actual financial results):

| 1st month | 35 |

| 2nd month | 36 |

| 3rd month | 37 |

| 4th month | 38 |

| 5th month | 39 |

| 6th month | 40 |

| 7th month | 41 |

| 8th month | 42 |

| 9th month | 43 |

| 10th month | 44 |

| 11th month | 45 |

| Year | 46 |

Tax authority code. Each inspection is assigned a code. Indicate the code of the Federal Tax Service to which you are submitting reports. For example, Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for St. Petersburg.

Code at the place of registration:

| Largest taxpayer | 213 |

| Russian organization | 214 |

| A separate division of a Russian organization with a separate balance sheet | 221 |

| Foreign organization | 245 |

| A real estate property (if a separate procedure for calculating and paying tax is established for it) | 281 |

Enter phone number, full name. payer or representative, number of sheets and date of submission of the declaration.

Section 1, subsection 1.1

The given example of filling out an income tax return in 2021 contains line-by-line formatting of the 1st section:

- 010 is the code of the municipality in which the company is located. Find it out in our reference material;

- 030 and 060 - indicate the KBK for transferring amounts to the federal budget and the regional budget. View all KBK;

- 040 and 070 - amounts to be paid additionally based on the results of the reporting (tax) period, broken down by budget: to the federal budget - line 040;

- to the regional budget - line 070.

Subsection 1.2 section 1

Filled out by income tax payers who pay advances every month. The basic rule for filling out an income tax return with advance payments is to divide the advance amounts between the federal and regional budgets. Information is transferred to it from lines 300 and 310 of sheet 02. The subsection is not included in the report for the 4th quarter.

Subsection 1.3 of Section 1 “Dividends”

Filled out by companies when paying income tax on dividends.

Sheet 02 - tax calculation

The completed sheet 02 of the declaration will show from what amounts of income and expenses the tax base was calculated.

Enter line by line:

- 010 - sum up all sales income;

- 020 - non-operating income (in total);

- 030 - costs associated with sales;

- 040 - non-operating expenses;

- 050 - losses not taken into account for tax purposes (filled in if available);

- 060 - amount of profit (calculate by lines: 010 + 020 - 030 - 040);

- 070 - income that is excluded from profit (if any);

- 080-110 - filled out depending on the specifics of the activity, the presence of tax-free income, benefits or losses;

- 120 - tax base;

- 140-170 - tax rates (should be calculated at rates of 3% and 17%);

- 180 — tax amount (we indicate the amount for the year, not the amount to be paid additionally);

- 190 - amount to the federal budget;

- 200 is the amount of tax to the local budget.

If the documents for the last reporting period are late, it is allowed to include the report for June in the income tax return for the 4th quarter of 2021, this was indicated by the Ministry of Finance in letter No. 03-03-06/1/17177 dated 03/24/2017. Officials noted that, according to the provisions of Article 54 of the Tax Code of the Russian Federation, if errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods, in the current tax (reporting) period, the tax base and tax amount are recalculated for the period in which the specified errors (distortions) were made. And is reflected in the reporting for the corresponding period.

In the continuation of sheet 02 we enter the advance payment of the previous period. During this period additional payment is required:

Appendix 1 to sheet 02

In Appendix 1 to Sheet 02 we detail the income by line:

- 010 - all revenue for the reporting period.

Then in detail:

- 011 - revenue from the sale of goods of your own production;

- 012 - revenue from the sale of purchased goods.

The remaining lines are filled in if conditions are met. Then the totals:

- 040 - the sum of all sales income;

- 100 - all non-operating income.

Appendix 2 to l. 02

Appendix 2 details the costs.

Lines 010-030 are filled out only by companies that use the accrual method to recognize income and expenses. With the cash method, the lines are left blank:

- 010 - expenses for the sale of goods of own production;

- 020 - direct costs associated with the sale of goods wholesale and retail;

- 030 - the cost of goods that were purchased for resale as part of expenses;

- 040 - indirect costs (amount). They are listed in detail in the following lines.

Let's assume that the organization's indirect expenses consisted of taxes and the acquisition of depreciable property as a capital investment:

- 041 - amounts of taxes and fees;

- 043 - expense in the form of a capital investment of 30% of the amount.

The remaining fields in our case remain empty. Depreciation expenses are indicated separately:

- 130, 131 - depreciation amounts taken into account in the reporting period.

The remaining fields in Appendix 2 of the declaration remain empty if there are no conditions for filling out.

Appendices 3 and 4 to sheet 02

Appendix 3 is drawn up only if the organization during the reporting period:

- sells depreciable property;

- sells outstanding receivables;

- bears the costs of maintaining production;

- had income or expenses under property trust management agreements;

- sells land purchased during the period from 01/01/2007 to 12/31/2011.

In the form of a declaration to l. 02 also has Appendix 4. When should you fill out Appendix 4 to sheet 02? When there is a loss that reduces the tax base. Filled out only in the declaration for the year and for the 1st quarter. It is allowed to reflect only those losses that arose no earlier than 2007.

Filling out a declaration for a separate division

At the location of the separate division, it is necessary to submit an income tax return for the separate division (group of separate divisions) in the following composition:

- Title page (Sheet 01);

- subsection 1.1 of Section 1;

- subsection 1.2 of Section 1 (if monthly advance payments are made during the year);

- Appendix No. 5 to Sheet 02.

Here are some features of filling out a profit declaration in the OP.

On the Title Page, in the “Checkpoint” field, the checkpoint of the separate unit at the location of which the declaration is being submitted is indicated.

Accordingly, in the field “Submitted to the tax authority (code)” the code of the Federal Tax Service where the declaration is submitted is indicated.

In the field “At location (accounting) (code)” code 220 is indicated. This means that the declaration is submitted at the location of a separate division of the Russian organization.

In the “Organization/separate division” field, the full name of the separate division is indicated.

In subsection 1.1 of Section 1, lines 040 and 050 are not filled in (dashes are placed), because the tax to the federal budget is paid at the location of the parent organization.

If income tax to the budget of a constituent entity of the Russian Federation is due for additional payment, line 070 is filled in. The amount reflected in it corresponds to the value shown on line 100 of Appendix No. 5 to Sheet 02.

If the tax is to be reduced, line 080 is filled in (from line 110 of Appendix No. 5 to Sheet 02).

If the organization pays monthly advance payments, then in subsection 1.2 of Section 1 you need to fill out lines 220-240.

In these lines you need to show 1/3 of the amount reflected in line 120 of Appendix No. 5 to Sheet 02.

Please note that subsection 1.2 is not included in the tax return for the year.

In Appendix No. 5 to sheet 02, data on this division should be transferred from the corresponding Appendix No. 5 to sheet 02 of the main declaration (in particular, the share of profit of a separate division).

Features of filling out an updated declaration

An updated declaration will be needed if an error is discovered in the calculations and the income tax could not be calculated correctly the first time. The instructions for the income tax return will help you avoid mistakes - similar rules apply for clarification. The amended declaration indicates the amount taking into account the detected error. If the tax amount is underestimated during the first calculation, then along with submitting an adjustment, you must pay the difference to the budget and transfer penalties.

You can fill out the declaration in online services and view the step-by-step completion of the report for the 4th quarter of 2022 online on the websites of accounting software developers - “My Business”, “Kontur”, “Sky” and others. Some sites allow you to do this freely, but usually the services require a small fee (up to 1000 rubles).