Minimum wage: what is it?

The abbreviation MROT stands for minimum wage. This is the lower threshold of the amount that an employer is required to pay an employee for a full month worked. This indicator is approved by law and is mandatory for all employers, regardless of the form of ownership of the organization. Failure to fulfill the employer's obligation to set a salary not lower than the minimum wage entails administrative liability.

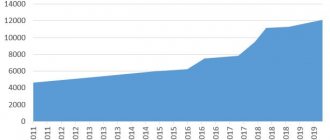

For almost the entire post-Soviet history, Russia was characterized by a significant lag between the minimum wage and the subsistence level, and only since 2016 the situation began to change. From May 1, 2018, the minimum wage is equal to the average subsistence level in the country.

Changes in the federal minimum wage in the Russian Federation over the past 10 years

Data are presented in reverse order.

| Date of establishment of the new minimum wage | Minimum wage amount |

| from January 1, 2022 to the current moment | 12130 rubles |

| from January 1, 2022 to December 31, 2019 | 11280 rubles |

| from May 1, 2022 to December 31, 2018 | 11163 rubles |

| from January 1, 2022 | 9489 rubles |

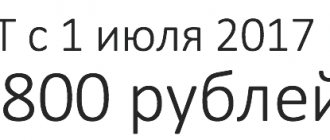

| from July 1, 2022 | 7800 rubles |

| from July 1, 2016 | 7500 rubles |

| from January 1, 2016 | 6204 rubles |

| from January 1, 2015 | 5965 rubles |

| from January 1, 2014 | 5554 rubles |

| from January 1, 2013 | 5205 rubles |

| from June 1, 2011 | 4611 rubles |

| from January 1, 2009 | 4330 rubles |

Watch a foreign video, designed in a cartoon format with Russian subtitles, which clearly reveals the essence of the concept of minimum wage (minimum wage) and how it affects unemployment:

Video: How the minimum wage creates unemployment

Table of minimum wages by year

The minimum wage table is also convenient because you can see not only the value of the indicator, but also track its dynamics.

| Minimum wage 2013 The minimum wage for 2013 is 5,205 rubles. (approved December 2012) |

| Minimum wage 2014 The minimum wage in 2014 is 5,554 rubles. (approved December 2013) |

| Minimum wage 2015 The minimum wage in 2015 is 5,965 rubles. (approved December 2014) |

Minimum wage 2016

|

Minimum wage 2017

|

Minimum wage 2018

|

| Minimum wage 2019 From 01/01/2019 - 11,280 rubles. |

| Minimum wage 2020 From 01.01.2020 - 12,130 rub. |

| Minimum wage 2021 From 01/01/2021 - 12,792 rubles. |

| Minimum wage 2022 From 01/01/2022 - 13,890 rubles. |

Attention! Here you can read about the details of the establishment of a new minimum wage by the legislator.

Why and who needs a minimum wage?

First of all, the minimum wage is used to regulate labor relations. Employers of any form of ownership do not have the right to pay wages below the minimum level established by law. Exceptions are specifically stated in the law; they will be discussed below.

In addition, social benefits (maternity benefits, sick leave), and in some cases unemployment benefits are calculated based on the minimum wage.

The size of the minimum wage in the Russian Federation has not only economic, but also political significance. Some political forces have long called for an increase in the minimum wage to a living wage. Others argued that such actions would fuel inflation by causing wage increases that were not matched by increases in labor productivity and, as a consequence, higher prices. As a result, the principle of political expediency prevailed: against the background of a series of election campaigns over 2 years, the amount of the minimum wage increased by more than 80%. A mitigating circumstance was the record low level of inflation in the country.

In total, according to the Ministry of Finance of the Russian Federation, an increase in the minimum wage directly affects payments to approximately four million working residents of the country. Another 12 million have salaries and benefits tied to the minimum wage.

Who sets the minimum wage

The minimum wage according to Russian legislation is established both at the level of the entire country and for each region. Moreover, the regional minimum wage cannot be less than the federal one.

The all-Russian level is proposed by the government of the Russian Federation, adopted in the form of a law by the State Duma, approved by the Federation Council and signed by the president. The regional size of the minimum wage is established by an agreement concluded for 3 years between the government of the region, territory or republic, the regional association of trade unions and the regional association of industrialists and entrepreneurs.

What laws regulate the minimum wage?

The minimum wage is regulated by several legal acts.

1 Federal Law “On the Minimum Wage” (No. 82-FZ of June 19, 2000).

A fairly outdated document, the main value of which is to determine the scope of the minimum wage: to regulate wages and determine the amount of benefits for temporary disability, pregnancy and childbirth, as well as for other purposes of compulsory social insurance. This indicator cannot be used for other purposes.

2 Article 133 of the Labor Code of the Russian Federation.

It states that the minimum wage cannot be lower than the subsistence level. This point has not been implemented for a long time, but since May 2022, reality has been brought into line with the law. Also, Article 133 specifies how the minimum wage should be paid:

- private companies - at their own expense;

- budgetary companies - at the expense of funds from the relevant budgets (federal, regional or local, depending on the organization’s jurisdiction) and extra-budgetary money (for example, from income from paid services, voluntary donations, grants, etc.).

In addition, it is noted that the minimum wage is due to any employee who has fulfilled the monthly work standard established for his position.

3 Article 133.1 of the Labor Code of the Russian Federation

It regulates the setting of minimum wages in the regions. The text almost completely repeats Article 133 with the difference that in regions, territories and republics, workers’ wages cannot be lower than the regional minimum wage. The regional minimum wage does not apply to employees of organizations financed from the federal treasury.

4 Article 129 of the Labor Code of the Russian Federation

Here it is defined that wages are salary, compensation and incentive payments. In relation to the minimum wage, this formulation is important because theoretically, an employee’s salary may be less than the minimum if he does not fulfill the requirements that entail receiving a bonus. This is in conflict with Article 133 of the Labor Code of the Russian Federation (“The monthly wage of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage”). A way out of such a legal conflict was found in increasing the compensation part: even if an employee is not entitled to a bonus in a given month for some reason, he is given an additional payment up to the minimum wage level.

5 Resolution of the Constitutional Court of the Russian Federation dated December 7, 2017 N 38-P

A document with the dry title “On the case of verifying the constitutionality of the provisions of Article 129, parts one and three of Article 133, parts one, two, three, four and eleven of Article 133.1 of the Labor Code of the Russian Federation” is extremely important for millions of Russians. In it, the Constitutional Court of the Russian Federation put an end to discussions of whether regional coefficients (RC) are included in the minimum wage. The fact is that in Article 129 of the Labor Code of the Russian Federation until 2007 there was a clause that the minimum wage is the minimum wage for unskilled labor under normal conditions (accordingly, any allowances for qualifications and special conditions must go above the “minimum wage”). There are still many articles circulating on the Internet that cite this point as valid. However, back in April 2007, State Duma deputies excluded it from the law. They did not fail to take advantage of this in regions where increasing coefficients were established for difficult working conditions - in the Far North, for example.

As a result, it turned out that the region set the minimum wage slightly higher than the federal one, but allowed “northern” allowances to be included in it. The Constitutional Court explained that the minimum wage must be provided to all workers, regardless of working conditions. This means that the “northerns” have nothing to do with it. Accordingly, employers are obliged to pay employees not “minimum wages, including the Republic of Kazakhstan”, but “minimum wages plus the Republic of Kazakhstan”.

6 Federal laws No. 41-FZ of March 7, 2018 and No. 421-FZ of December 28, 2017.

These legal acts establish the amount of the minimum wage as of May 1, 2022 and the rules for changing the minimum wage subsequently (more on this in the FAQ section).

Regional minimum wage

According to Art. 133.1 of the Labor Code of the Russian Federation, in addition to the federal minimum wage, which is valid throughout Russia, regions can set their own minimum wage. It is determined taking into account socio-economic conditions and the cost of living of the working population in the corresponding subject of the Russian Federation.

By law, the minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage established by federal law. At the same time, regional authorities have the right to equate the minimum wage to the federal standard or increase it.

Conducting business according to the law. Services for individual entrepreneurs and LLCs less than 3 months old

Details

Employers have a period of 30 days during which they can send to the labor body a written refusal to join the regional agreement on the minimum minimum wage in a specific subject. Silence automatically means consent, that is, if they do not refuse, they join the agreement.

The minimum wage in the constituent entities of the Russian Federation: table

In connection with the increase in the minimum wage, the question often arises about salary indexation - is it mandatory? We previously wrote about this in the article “Wage Indexation: An Employer’s Right or Obligation?”

What is included in the minimum wage

Based on the above legal acts, the minimum wage includes:

- An official salary or other remuneration for work based on the employee’s skill level.

- Compensatory payments (in particular, additional payment to the minimum wage level for employees whose salaries are lower, as well as a regional coefficient in territories where they are in no hurry to implement the decision of the Constitutional Court of the Russian Federation, given above).

- Premium payments.

Minimum wage when working on weekends and holidays

The Labor Code includes special articles devoted to work on holidays, weekends, and at night. This time is calculated and paid in excess of the labor standards established for this position. Accordingly, overtime is not included in the minimum wage. Payments for additional time worked are not included in the minimum wage (if a junior teacher works at one and a half times the rate, the “minimum wage” is calculated based on one rate).

For overtime hours, payment is 1.5-2 times more expensive than usual (Article 152 of the Labor Code of the Russian Federation), and for work on holidays or weekends - double the amount of payment. Night work is paid in accordance with the standards at each enterprise, but always at an increased rate (by at least 20%) compared to daytime work. The difference is also not taken into account in the minimum wage.

When recording working hours in total

Additional payment up to the minimum wage for cumulative accounting of work time begins with the determination of the standard time. It is taken according to the production calendar of a 5-day working week (Order of the Ministry of Health and Social Development No. 588n dated 08/13/09). An accounting period is established, usually a year.

Summarized working time recording is used for employees who may be overworked in one month and underworked in another.

Example: a security guard was hired at a rate of 0.5, his salary was set at 40,000.00 per month at full rate. There are no additional payments. If he worked all days according to schedule, his salary at the end of the month will be 20,000.00 rubles. The standard hours do not play a role here. They clarify what the minimum wage is for the current month in the region. Let it be equal to the federal average and be 11,280 rubles. 1⁄2 of this amount is less than the amount due to the employee - 20,000.00 rubles, therefore, he is not entitled to an additional payment up to the minimum wage.

If the security guard’s salary is set (in violation of labor legislation!) at 1.0 times the rate of 10,000.00 rubles, 1⁄2 times the rate is equivalent to a payment of 5,000.00 rubles, and the “minimum wage” is equal to (11280/2) 5,640, rubles. The additional payment is RUB 640.00.

When paid hourly, the employee is paid for the actual time worked each month. The rate itself must be calculated taking into account the minimum wage and order No. 588n. Recycling must be paid for.

Question: The employer uses a bonus-time wage system; the wages of employees also include payment for work in conditions deviating from normal (night, holidays, combined work). In addition, a monthly bonus is accrued in the amount of 40% of the amount, which consists of the salary and other allowances accrued due to working conditions that deviate from normal ones. The procedure for calculating this bonus is fixed in the regulations on remuneration. How is the size of the bonus calculated taking into account the allowances taken into account when calculating the additional payment up to the minimum wage, if the wage supplements themselves for working conditions that deviate from normal ones are not taken into account when the additional payment up to the minimum wage is made? View answer

Deficiencies are paid based on the provisions of Art. 155 Labor Code of the Russian Federation:

- absenteeism and tardiness are not paid;

- an error on the part of the employer is paid based on average earnings, comparing it with the actual accrued payment for hours worked;

- force majeure, there is no fault of both parties - payment in the amount of 2/3 of the rate.

Let us consider in more detail how to calculate the minimum wage and additional payment for a work schedule that involves shifts, as well as for an incomplete month worked.

The ratio of minimum wage and salary

If the employee’s salary includes only the salary, and the variable part is not provided, then the salary must be no less than the minimum wage. But when the salary includes bonuses, allowances and other incentive components, the salary may be lower than the minimum wage. As mentioned above, Article 133 of the Labor Code of the Russian Federation only requires that the total amount of remuneration for work not be lower than the minimum wage.

An important question: what amount is considered the minimum amount - including personal income tax or “net”, received by the employee in person? The legislation views this issue as follows: the employer is an intermediary between the employee and the tax service. It is not he who collects the tax. This means that the employer’s task is to charge an amount no less than the minimum wage. And paying income tax on this money is the employee’s business; the employer has nothing to do with him (except for technical transfers). Accordingly, from May 1, 2022, the employer is obliged to charge an amount not less than 11,163 rubles. In fact, taking into account the payment of personal income tax, the employee receives 9,711.8 rubles.

Here are two more cases when wages can be legally lower than the minimum wage:

1Part-time job. Article 285 of the Labor Code of the Russian Federation provides for remuneration for part-time work based on the volume of output or in proportion to the time worked.

2Part-time work. Article 93 of the Labor Code of the Russian Federation allows the employer to pay below the minimum wage for part-time work. This can be either ordinary work in a reduced volume, or the activities of certain categories of workers who are allowed by the Labor Code to use part-time work (minors; pregnant women; caring for sick family members; parents of a disabled child under the age of 14).

For which relationships is the minimum wage required?

Not every employer who employs other people is subject to minimum wage requirements. This government regulation guarantees a minimum limit for employees only when entering into an employment relationship. In civil cases, in which another form of contract is concluded, in particular, a contract for the provision of paid services, it is not necessary to comply with this requirement. In such relationships, payment is agreed upon by agreement; it may turn out to be lower than the minimum established by the power.

Question: The organization employs employees who receive additional payment for combining professions (positions). The established salaries for such workers are below the minimum wage, but the salary and additional payment for combining professions (positions) for a fully worked month are slightly higher than the minimum wage. Are payments made for combining professions (positions) included in wages in order to compare them with the minimum wage? View answer

What are the consequences of a salary below the minimum wage?

Despite the fact that remuneration for a full month of any work cannot be lower than the minimum wage, there are quite a lot of organizations in Russia where even the minimum wage is not paid. Due to the peculiarities of tax legislation, the main reason for violating the requirements of the Labor Code is an attempt to reduce the fiscal burden on business. The lower the salary, the less accrual on it (amounts going to the Pension Fund and Social Security Fund). Therefore, many entrepreneurs prefer to pay a meager salary officially, and the rest of the salary goes “in an envelope” and is not subject to state accounting and taxation. In many cases, it turns out that formally the monthly payment is below the minimum wage.

For employers paying wages below the minimum established level, a fine of 10 to 20 thousand rubles is provided for officials, and from 30 to 50 thousand rubles for legal entities. Individual entrepreneurs can be punished with a fine of 1,000 to 5,000 rubles.

For a repeated violation, the fine for officials increases to 20-30 thousand rubles, for legal entities - up to 50-100 thousand, for individual entrepreneurs - up to 10-30 thousand rubles. In this case, the guilty official (for example, the director of a company) may be disqualified for up to three years.

What to do if your salary is below the minimum wage?

If you really want to officially receive at least the minimum level of wages (this is not always rational for the employee, since by increasing the official part of the salary, the employer reduces the total amount paid, subtracting taxes and charges from it), the procedure is as follows:

1Make a free-form demand to the employer to review your salary and pay the difference between your official salary and the minimum wage for the entire period of work.

2If the employer refuses to revise the official part of the salary, a copy of the request along with the application can be sent to the labor inspectorate or the prosecutor's office.

What should an employee do if the minimum wage is low?

- First of all, carefully read the employment contract before officially applying for a job. This document must indicate wages and work hours, as well as clarify the nuances regarding additional charges and deductions. If the specified amount is less than the minimum wage, you should not get a job with such an unscrupulous employer.

- If your salary suddenly turns out to be less than usual, ask the payroll department about the reason for the decrease. If the reason is legitimate (see above), the employer is within his rights.

- If the employer has reduced the payment illegally (unilaterally), it is worth applying for protection of your rights to the labor inspectorate in the territorial affiliation of the employer or to the prosecutor's office. To do this, you will need to write a written statement, to which you will need to add written confirmation of the infringement of your rights regarding wages:

- certificates from the accounting department;

- an extract from a salary card account;

- written explanation from the employer (if he provided it), etc.

- Going to court is the last resort for all those unfairly offended. For such claims, you do not need to pay a state fee. If the court decision is in favor of the employee, the employer will be obliged to comply with it. In practice, most often the employee in these cases is forced to resign.

The regulatory authorities will initiate an inspection of the employer and issue an order to eliminate the identified violations.

IMPORTANT! It makes sense to first contact management directly. It is better to do this in writing or in front of witnesses. Most often, employers prefer to resolve the issue amicably with employees who know their rights.

Minimum wage and living wage

Article 133 of the Labor Code of the Russian Federation directly states: the minimum wage should not be lower than the subsistence level. Since the beginning of the 90s, this standard has not been met due to a lack of budgetary funds (most of the positions that are paid below the minimum are in the public sector). Since 2016, the gap between the minimum wage and the living wage has begun to narrow. And on both sides: in many regions, decisions were made to reduce the cost of living.

In order to avoid such manipulations and due to the low level of inflation, as well as for the political reasons that have already been mentioned, a decision was made from May 1, 2022 to set the minimum wage at the level of the average subsistence level in the country. However, in reality, due to the collection of personal income tax, the income of an employee receiving the minimum wage will still be below the subsistence level.

In case of incomplete working month

IMPORTANT! A sample order for additional payment to the salary up to the minimum wage from ConsultantPlus is available at the link

So, we found out that the application (or non-application) of an additional payment to the minimum wage takes into account many factors in practice:

- the regional minimum wage itself;

- actual payments to the employee, including wages and additional payments in accordance with the Labor Code of the Russian Federation;

- his rate, full or partial;

- the established standard of time for the employee.

How do these provisions apply if the month is not fully worked? Let's look at a situation in which an employee worked for less than a full month, for example, due to his dismissal. Let the security guard mentioned earlier in the example have a salary of 20,000.00 rubles, there are no other payments. He works full-time and has a 40-hour work week. The security guard worked only 35 hours on schedule this month and then quit. Let's find out whether in this situation he is entitled to an additional payment up to the minimum wage.

This month he has 143 normal working hours. The salary will be: 20000.00: 143*35 = 4895.10 rubles. Despite the fact that the amount is less than the minimum wage (11,280 rubles), the employee is not entitled to additional payment, since the salary for the full number of hours worked at the rate (143) is greater than the minimum wage (20,000 rubles).

Conclusion

- An additional payment up to the minimum wage is made if the employee’s wage income for the month is lower than the current minimum wage in the region.

- At the same time, payment according to the tariff rate, and payment according to the salary, and the work schedule, including shift work, cannot affect the specified norm. Whatever the calculation procedure for the employee is enshrined in the employment contract, LNA, income at a monthly rate below the minimum wage are subject to additional payment. It is produced at the expense of the company and is included in costs for NU purposes.

- Additional payments for processing, if they are allowed according to the schedule or for other reasons, do not count towards additional payments to the minimum wage.

- Whether to include additional payments for overtime, holidays, “seasonal” and other payments in the calculation of wages in relation to the additional payment of its amount up to the minimum wage is a question that has not been clearly resolved today. Judicial practice on it is contradictory, which means that the final decision is made by the employer.

Minimum wage and sick leave

Temporary disability benefits are calculated based on the minimum wage in several cases:

- If the employee's work experience is less than 6 months.

- When the average employee's earnings are below the minimum wage.

- If the sick person has had no income in the last 2 years.

- If an employee, being admitted to a hospital, violated the hospital regime (for example, went home without permission, interrupting the course of treatment).

- If an employee missed a regular medical examination (at jobs where it is mandatory) and then went on sick leave.

The amount of sick pay depends on length of service. The calculation algorithm is as follows:

1Calculation of the minimum average daily earnings (MSW):

MSZ = minimum wage * 24 months / 730 days

2If sick leave has been issued over the past two years, then the number of days of temporary disability is subtracted from 730 days.

Minimum wage and benefits

“Maternity” benefits are calculated based on the minimum wage in several cases:

- If the employee has not worked within the last 2 years

- If the employee’s average salary was lower than the current minimum wage

- If the employee's length of service is less than six months

Child care benefits up to 1.5 years old cannot be lower than the minimum wage.

Unemployment benefits depend on the minimum wage when the unemployed person has minor children or other persons with limited legal capacity as dependents. In this case, the benefit amount increases by ½ minimum wage for each dependent.

The maximum unemployment benefit cannot exceed the “minimum wage” by more than 1.5 times.

Payments that no longer depend on the minimum wage

Until recently, entrepreneurs made insurance contributions based on the minimum wage, but from January 1, 2022, they were replaced by fixed amounts.

Until mid-2007 (before amendments were made to the Code of Administrative Offenses by Federal Law No. 116-FZ dated June 22, 2007), fines depended on the minimum wage. The minimum wage for calculating fines was considered equal to 100 rubles.

Until July 2009, the minimum wage was used to calculate the size of the authorized capital of joint-stock and unitary enterprises.

Minimum wages in the regions

In accordance with Article 133 of the Labor Code of the Russian Federation, any region of Russia has the right to establish its own minimum wage. The only condition is that it should not be lower than the federal one. In the northern regions, in addition to the national minimum wage level, bonuses and coefficients are awarded. In Moscow and St. Petersburg, the minimum wage has historically been higher than the national average. The minimum level of wages varied significantly in cities with special working conditions (Norilsk and other industrial areas). Before May 1, 2018, almost three dozen regions of the country had a minimum wage that differed from the national minimum wage. After raising the minimum level to 11,163 rubles, the number of such federal subjects decreased.

Regions in which the minimum wage differs from the national average

| Region | Regional minimum wage (rub.) |

| Moscow | 18742 |

| Saint Petersburg | 17,000 (11,163 for public sector employees) |

| Magadan Region | 19500 – 21060 (depending on territory) |

| Kamchatka Krai | 18360 – 21180 (depending on territory) |

| Irkutsk region | 11163 – 27908 (depending on territory) |

| Krasnoyarsk region | 11163 – 26376 (depending on territory) |

| The Republic of Sakha (Yakutia) | 17388 (11163 – for public sector employees) |

| Yamalo-Nenets Autonomous Okrug | 16299 (including allowances and bonuses) |

| Murmansk region | 15185 (11163 – for public sector employees) |

| Moscow region | 13750 (11163 – for public sector employees) |

| Tula region | 13,000 (11,163 for public sector employees) |

| Nenets Autonomous Okrug | 18567 (11163 – for public sector employees) |

| Tomsk region | 11163 – 16500 (depending on territory) |

| Khabarovsk region | 11163 – 15510 (depending on territory) |

| Republic of Karelia | 11163 – 12100 (depending on territory) |

| Kemerovo region | Cost of living in the region for the previous quarter * 1.5 |

| Volgograd region | Cost of living in the region for the previous quarter * 1.2 |

| Bashkortostan | Federal minimum wage + bonuses, allowances and coefficients (the minimum wage includes only salary) |

| KHMAO-Yugra | Federal minimum wage + regional coefficient |

As mentioned above, the regional minimum wage is irrelevant for employees of budgetary institutions receiving salaries from the federal budget. In addition, in order to avoid a sharp increase in regional budget expenditures, many federal subjects establish an all-Russian minimum wage for all budgetary organizations - both federal, regional and local.

FAQ

The minimum wage has been legally increased to the subsistence level. But the latter is set every quarter and often downwards. Does this mean that the minimum wage may be higher than the subsistence level?

On May 1, the legislator introduced a flexible system for determining the minimum wage. Federal Law No. 41-FZ of March 7, 2018 established the minimum wage at 11,163 rubles. This minimum wage will be valid until January 1, 2022, after which Article 3 of Federal Law No. 421-FZ of December 28, 2017 will come into force. It states: the minimum wage is set once a year from January 1 at the level of the subsistence level for the second quarter of the previous year. Moreover, the current level of the minimum wage cannot be reduced: if it turns out that the cost of living has fallen, the minimum wage will still be 11,163 rubles. So, in theory, the minimum wage may be higher than the subsistence level.

I am an employer, I opened a branch in a region where the local minimum wage is higher than the federal one. Established by tripartite agreement. If I refuse to join this agreement, can I calculate the salaries of branch employees based on the federal minimum wage?

Formally, the employer has the right to refuse to join the agreement on the regional minimum wage. To do this, he must, within a month from the date of publication of the agreement or opening of the enterprise, send an official refusal to the commission that concluded the agreement. The document must be motivated. In your case, this may be the start of a business; difficult economic circumstances are also taken into account: a fall in the stock market, the bankruptcy of the bank in which your funds were located, a refusal of a loan, emergencies, etc. Each argument must be supported by documentation: an extract from the balance sheet, a report from the insurance company, and so on. But even in this case, the chances of a positive solution to your question are almost zero. At least in the Russian Federation, there are no precedents when companies were allowed to apply the federal minimum wage in regions where a higher regional one applies.

Over the past 2 years, the minimum wage has been increased 4 times. From what minimum wage are sick pay calculated (when calculating them, a period of 2 years is taken) - from the current one, or are all 4 amounts taken into account, broken down by the periods in which they were valid?

All benefits (for temporary disability, for pregnancy and childbirth, for child care up to 1.5 years) are calculated only on the basis of the minimum wage in force at the time of calculation.

Less than the minimum wage on hand

Sometimes it turns out that an employee receives less than the minimum wage, and this is legal. In this case, the salary includes the figure established by federal law. This may happen when:

- the amount issued is reduced due to accrued personal income tax (the “dirty” salary corresponds to the minimum level, and a smaller amount is obtained by deducting 13%);

- other mandatory deductions are deducted from the salary - the amount of the minimum wage issued can be reduced by insurance, membership dues to a trade union, etc.;

- the employee has arrears in alimony payments (up to 70% of wages can be written off under a writ of execution).