Deadline for filing 3-NDFL declaration

Tax return 3-NDFL is submitted to the tax authority at the place of residence or place of stay.

For 2022, the declaration must be submitted no later than April 30

2022.

Individuals who want to receive tax deductions can submit a 3-NDFL declaration throughout 2022

.

Fines

for late submission of the declaration:

- If the tax has been paid - 1,000 rubles

. - If the tax has not been paid - 5%

of the amount of tax payable on the basis of this declaration, for each full or partial month from the day established for its submission, but

not more than 30%

of the specified amount and

not less than 1,000 rubles

.

Additional supporting documents

| Any user will be able to fill out a 3-personal income tax form online on our website in literally 15 – 20 minutes and order a free check by our specialists. It is very important to us that you ultimately receive a tax return without errors and with the maximum possible deductions according to your situation. Below are instructions for submitting a tax return to the inspectorate, as well as a list of additional documents that may also be needed. Fill out the 3-personal income tax declaration online |

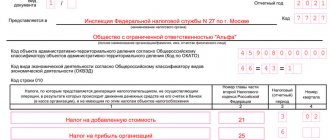

Print out the completed 3-NDFL tax return in 2 copies (only one-sided printing is allowed) and pay attention to the following:

- on the title page of the declaration, almost at the very bottom, on the right, above the block “To be filled out by a tax authority employee,” you need to indicate the number of sheets of supporting documents that you will submit along with the declaration;

- on the Title Page of the declaration, at the very bottom, on the left, in the block “I confirm the accuracy and completeness of the information specified in this declaration” - you must put a Signature and Date;

- on each printed sheet of the declaration, at the very bottom, starting with Section 1, you must put a Signature and Date.

You can find out what documents need to be attached to the declaration in the Tax Deductions section of our website.

In most cases, if the purpose of preparing a declaration is a tax refund, you need to attach a Tax Refund Application (form and completed sample below, in paragraph 1), as well as a certificate in Form 2-NDFL and documents confirming expenses.

You can submit a declaration to the tax office in person, through a representative by proxy, or by Russian post with a list of the contents.

Please also pay attention to our article: In what cases does the inspector have the right to refuse to accept a 3-personal income tax declaration

Additional documents that may also be needed along with the declaration:

1. Tax refund application

ATTENTION!!!

Starting with the declaration for 2022, the tax refund application is integrated into the 3-personal income tax form itself, it is its integral part. For declarations for other years, it is still necessary and must be filled out on a separate form.

In the case of preparing a tax return 3-NDFL for the purpose of obtaining tax deductions (tax refund), an Application for Tax Refund is also submitted along with the declaration.

If you filled out the declaration on our website, then after paying for it, the Application can also be filled out online in your Personal Account!

Please note the following:

1) on the first sheet of the Application, line-by-line data - amount to be returned, OKTMO Code and Budget Classification Code - you will find in Section 1 of the declaration you prepared;

2) after filling out the Application, click “Save as...”, otherwise the entered data may not be saved.

2. Register of supporting documents when submitting a 3-NDFL declaration

In case of filing a tax return 3-NDFL, the taxpayer has the right to fill out and attach the Register of supporting documents (2 copies). If he does not do this, then the tax inspector himself will form one. Also, the inspector can prepare a new Register if there are any inconsistencies or errors in the Register provided by the taxpayer.

The Register provides additional fields where you can add other documents that are not directly named in it.

3. Inventory of attachments

If a 3-NDFL tax return is submitted by mail, the taxpayer is required to draw up an Inventory of Attachments in 2 copies indicating all the documents being sent.

4. Application for distribution of property deduction

In the case of preparing a tax return 3-NDFL for the purpose of obtaining a property deduction in connection with the purchase of housing in common joint ownership or in the sole ownership of one of the spouses and deciding to establish the proportion of which of the spouses will receive the deduction and in what amount, it is also necessary to attach a corresponding application on the distribution of deductions between spouses.

5. Agreement on the distribution of actual expenses

In the case of preparing a tax return 3-NDFL in order to obtain a property deduction in connection with the purchase of housing in common shared ownership and a decision to establish the actual costs of the purchase of each of the owners, that is, which of the spouses will receive a deduction and in what amount, it is also necessary to attach relevant Cost Sharing Agreement.

6. Application for distribution of property deduction regarding mortgage interest

From 01/01/2014, taxpayers - spouses have the right every year anew, according to the Application, to distribute the actual mortgage interest paid, that is, to determine who will receive a deduction and in what amount. To do this, you must attach the appropriate Application for the distribution of interest paid.

Filing a 3-NDFL declaration

You can submit a declaration in the following ways:

- In paper form (in 2 copies). One copy will remain with the tax office, and the second (with the necessary marking) will be returned. It will serve as confirmation that the declaration was submitted on time.

- By mail with a description of the attachment. In this case, there should be a list of the attachment (indicating the declaration to be sent) and a receipt, the number in which will be considered the date of submission of the declaration.

- In electronic form via the Internet through an EDI operator, ensuring the exchange of information between tax authorities and taxpayers.

Inventory of documents for transfer to the archive

When transferring documents to the archive for each case, an internal inventory of the documents included in it is compiled. The form of such an inventory is given in Appendix No. 27 to the rules, which were approved by order of the Ministry of Culture of Russia dated 03/31/15 No. 526. And the procedure for its preparation is described in sufficient detail in clause 3.6.17 of the Rules for the work of archives of organizations (approved by the decision of the Board of the Russian Archive dated 02/06/02 ).

In particular, it is indicated that the inventory must be drawn up on a separate sheet and signed by the compiler. The internal inventory contains information about the serial numbers of the case documents, their indexes, dates, headings and sheet numbers of the case. And at the end of the inventory there should be a final record, which indicates in numbers and in words the number of documents included in it and the number of sheets of the internal inventory. In this case, the specific content of documents in the “archival” inventory is not required to be disclosed. Since documents of the same type are placed in the case, a heading (name of the counterparty, full name of the employee, etc.) is sufficient.

How to fill out the 3-NDFL declaration

The easiest and most convenient way to fill out the 3-NFDL tax return - and use the free “Declaration”

.

Below is a visual step-by-step video instruction on how to correctly fill out the 3-NDFL tax return using this program:

Note

: To fill out the declaration, you may also need a 2-NDFL certificate (issued by the employer).

In addition, the 3-NDFL tax return can be filled out manually ().

note

, in many branches of the tax service, computers and printers are installed, on which you can also fill out and print the 3-NDFL declaration.

Entrust reporting to specialists

How to apply for an income tax refund

The declaration along with the documents is submitted to the Federal Tax Service at the place of permanent registration of the individual. This can be done by coming to the inspection office and submitting the documents in person; in this case, you need to print out a second copy of the declaration for yourself, on which they will put a mark of acceptance.

You can send the entire set by valuable letter with an inventory. Please note that the register of attached documents to 3-NDFL, the form of which we discussed above, cannot be considered such an inventory - it is filled out on a special postal form, where a stamp with the date of dispatch and the signature of a postal employee are affixed.

It is possible to prepare documents for income tax refund and send a declaration electronically, which requires the taxpayer to have an electronic digital signature. The attached documents, pre-scanned, are uploaded as files and sent to the Federal Tax Service through the “Taxpayer Personal Account” on the Federal Tax Service website.

The deadline for filing a personal income tax deduction return is not limited - it can be submitted throughout the year for the previous 3 tax periods. If, in addition to the deduction, an individual declares his income, he needs to meet the deadline of April 30 (in 2022, the declaration for 2022 must be submitted no later than May 3).

Register of documents for 3-NDFL form (sample)

Sample application for personal income tax deduction

Register of documents for 3-NDFL (2022 form) download

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Basic rules for filling out the 3-NDFL declaration

When filling out the declaration, the following rules must be taken into account:

- the declaration is filled out by hand in capital printed characters, or printed on a printer using blue or black ink;

- at the top of each page the taxpayer’s TIN, as well as his surname and initials are indicated;

- all tax amounts are indicated in whole rubles according to rounding rules;

- Double-sided printing and corrections are not allowed;

- It is not necessary to print blank pages of the declaration;

- at the bottom of each page (except for the title page), you must put a signature and the date of signing the declaration;

- There is no need to staple or staple the declaration.

If errors are found in the submitted declaration, it is necessary to correct them and submit an updated tax declaration to the tax authority.

Papers for auxiliary writing

To ensure that no precedents or disputes arise in a tax organization, the paperwork for the declarant to generate 3-NDFL must be described in the letter (register) attached to it. This process can be carried out in free form, but it is necessary to indicate at what position the form is submitted, and the period for which the profit report is provided, the name of the tax organization and information about the applicant-applicant himself.

The main thing when drawing up an inventory of documents is to adhere to the purpose for which the application is being submitted. When checking all the papers, the tax office may require additional information certificates and documents.

Note! If the payment is made in cash, there must be supporting documentation: a receipt, a cash register receipt or a strict reporting form. Certificates that indicate timely payment or other types of confirmation are not acceptable .

We have sorted out the issue of the inventory for the declaration. Now filling out the register of supporting documents will not be so difficult.