When is an application for deregistration of UTII required?

The application of the taxation regime called UTII is voluntary, however, in order to start working on it, it is necessary to register with the tax authorities. Therefore, when a taxpayer decides to leave UTII, he must also notify the tax authorities about this and go through the procedure of deregistration with the Federal Tax Service.

Voluntary departure from UTII may be due to the following factors:

- termination of activities on the UTII - this happens, for example, if the payer has ceased to provide services transferred to UTII, or territorial authorities have removed its activities from the list of services falling under this regime;

For more details, see: “What is the procedure for deregistering a UTII payer who has ceased activity?”

- switching to another mode.

You can learn more about what else can affect leaving UTII from this material.

Pay attention to one more situation: the taxpayer does not fall under any of the above grounds, but simply moved the place of business. Does this entail the obligation to deregister with the Federal Tax Service?

Look for the answer to this question in the publication “The Ministry of Finance explained how to pay UTII when moving a store to a new location .

See also the article: “Deregistration of UTII in 2018–2019: conditions and terms.”

How to fill out the latest UTII declaration

The liquidation declaration when closing an individual entrepreneur on UTII is submitted on a standard form from the order of the Federal Tax Service dated June 26, 2022 No. ММВ-7-3 / [email protected] It is also filled out in the usual manner, since no specifics in this regard are described in the rules. The only difference is that in section 2 you need to reflect the number of days of activity of the individual entrepreneur for the month that was the last.

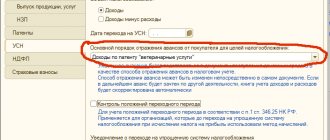

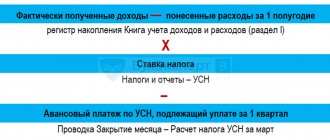

Let's return to our example with the veterinarian entrepreneur Zaitsev. We will calculate the tax that he must pay for the third quarter and provide a sample of filling out the declaration. For this we will use the following data:

- FP is equal to 1 (Article 346.29 of the Tax Code of the Russian Federation). This is the number of employees, including individual entrepreneurs;

- BD is equal to 7500 (Article 346.29 of the Tax Code of the Russian Federation);

- K1 is equal to 2.005 (Order of the Ministry of Economic Development dated December 10, 2019 No. 793);

- K2 is equal to 1 (decision of the Council of Deputies of the city of Yubileiny dated October 30, 2008 No. 59);

- tax rate 15%;

- the number of days in a month is 31, of which 15 are worked.

When closing an individual entrepreneur in 2022, we will fill out the UTII declaration in the following order: title page, section 2, section 3 and section 1. Section 4 is no longer relevant, since it was intended for a cash deduction, which is not provided in 2022.

At the end of the article you will be able to fill out the declaration.

Title page

The line-by-line filling of the first sheet is as follows:

- adjustment number – “0–”, since this reporting is submitted for the first time;

- tax period from Appendix No. 1 to the order that approved the declaration. Our individual entrepreneur indicates the code “23”, which corresponds to the third quarter (codes starting with the number “5” are intended for legal entities);

- reporting year – 2020;

- code of the tax authority that serves Yubileiny is 5018;

- code of the place of registration from Appendix No. 3 to the order - 320 (at the place of business);

- last name, first name and patronymic of the entrepreneur;

- contact number;

- the declaration was submitted on 5 pages, with 0 attachments;

- signatory code is “1”, since the report is signed by the individual entrepreneur himself.

In addition, you must indicate the date of completion and sign. The remaining cells are marked with dashes.

Section 2

The data that is needed to calculate the amount of UTII is reflected here:

- 010 – code of “imputed” activity from Appendix No. 5. Veterinary services correspond to code “02”;

- 020 – address at which the activity is carried out;

- 030 – OKTMO code;

- 040 – basic profitability;

- 050 – K1;

- 060 – K2.

From the block of lines 070-090, only the first line needs to be filled in, since the individual entrepreneur was closed in July and did not work in the remaining two months of the quarter. The following fields are entered in the columns:

- 2 – physical indicator “1”;

- 3 – the number of days that individual entrepreneur Zaitsev worked in July – “15”.

- 4 – monthly base calculation: 7,500×1 x 2,005×1 x 15 / 31 = 7,276

Line 100 reflects the final base - it is equal to the base for July. Line 105 indicates the UTII rate, and line 110 its amount: 7,276×15% = 1,091.

Section 3

The resulting tax amount can be reduced by insurance premiums paid in the same quarter. Individual entrepreneur Zaitsev will pay the balance for himself in July in the amount of 4,000 rubles. Since he no longer had employees in the reporting quarter, he has the right to reduce the tax by the entire amount of contributions.

Section 3 is intended to reflect deductions. In it you need to indicate the following data:

- 005 – code “2”, which means no payments to individuals;

- 010 – the amount of tax, which is calculated in line 110 of section 2;

- 020 – dash, since the individual entrepreneur did not pay contributions for employees;

- 030 – amount of individual entrepreneur’s deductions for himself – 4,000;

- 040 – dash (the line was intended for cash deduction);

- 050 – the total amount of tax that needs to be paid to the budget. It is calculated as follows: UTII - deduction. In our example, this is: 1,091 – 4,000. This results in a negative value, so you need to specify “0”. This means that I.I. Zaitsev must pay tax. you don’t have to - it’s covered by the fees paid.

Section 1

This section is intended to reflect the results. It is filled out like this:

- line 010 indicates the OKTMO code;

- line 020 reflects the amount of tax that needs to be paid to the budget for the quarter. Individual entrepreneur Zaitsev has “0” in this line.

.

So, we looked at filling out the UTII declaration when closing an individual entrepreneur. When the report is ready, it must be signed in two places - on the title page and in section 1. Then the document must be sent to the tax authority in which the former individual entrepreneur was registered as a UTII payer. The tax must be paid to the budget by the 25th day of the same month in which the last declaration is due. However, in the example considered, you will not have to pay anything.

What deadlines must be met to submit an application for withdrawal from UTII?

When leaving the UTII, the payer must submit an application for deregistration within 5 days from the moment he stopped working for UTII. At the same time, the procedure for calculating the period for deregistration of UTII is different:

- if the activity is terminated by the taxpayer himself, then the countdown begins from the moment of its actual completion;

- if deregistration is due to reasons beyond the payer’s control, then the 5 days are counted differently.

How - you will learn from this material .

Having received such an application, the tax authorities, in turn, are obliged to remove the payer from the register within 5 days from the date of its submission. After deregistration, the Federal Tax Service sends a corresponding notification.

You can find out more about it here .

It also happens that the “imputed” person does not meet the deadline specified for filing the application. Then the tax office will not comply with it within the 5-day period allotted by law.

When the Federal Tax Service will deregister such a payer, this material .

Having withdrawn from tax registration, it is important not to forget to submit a UTII return.

Which inspectorate should you submit your latest report to, is described in the material “Deregistered under UTII? . ”

How to fill out an application for deregistration of UTII for an LLC

In the UTII-3 form, companies must indicate the following data:

- information about the reason for refusal of UTII; at the same time, it is important to reflect the correct details that characterize it, depending on the termination of one of several types of activity;

- Name;

- Kind of activity;

- place of business;

- other data.

“UTII Form 3: application for deregistration of an organization” will help you fill out UTII-3 accurately .

Registration as UTII payers

No later than five days from the moment you began to conduct activities subject to UTII, you must submit an application to the tax office for registration as payers of “imputed” tax.

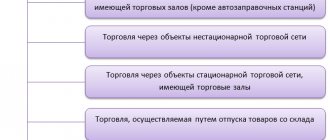

As a general rule, you need to register with the tax office at the place of business (paragraph 2, paragraph 2, article 346.28 of the Tax Code of the Russian Federation). However, there are exceptions to this rule. For certain types of activities, registration is carried out at the location of the organization (place of residence of the individual entrepreneur). This applies (paragraph 3, paragraph 2, article 346.28 of the Tax Code of the Russian Federation):

- delivery or peddling retail trade;

- activities related to advertising on vehicles;

- activities for the provision of motor transport services for the transportation of passengers and goods.

Application forms for firms and entrepreneurs were approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/ [email protected] To register, organizations fill out an application in the UTII-1 form, individual entrepreneurs - in the UTII-2 form.

Sample applications in the form of UTII-1 and UTII-2 are given below:

If an organization (entrepreneur) violates the deadline for submitting an application for registration as a UTII payer, tax authorities will have the right to hold it accountable under paragraph 1 of Article 116 of the Tax Code. That is, the “imputed” person faces a fine of 10 thousand rubles (letter of the Federal Tax Service of Russia dated March 29, 2016 No. SA-4-7/5366).

This conclusion is supported by arbitration practice. Thus, in the resolution of the Federal Antimonopoly Service of the North-Western District dated April 10, 2013 in case No. A56-32161/2012, the judges indicated that a fine for late filing of an application is legal even if the UTII payer is already registered with this tax office in another way. basis. In the resolution of the Federal Antimonopoly Service of the Volga Region dated September 27, 2011, the arbitrators also noted that the taxpayer’s obligation to register as an “imputed person” does not depend on whether he is registered with the same Federal Tax Service on another basis.

The date of registration (deregistration) for a company that is going to switch to paying UTII (or leave this special regime) will be the date specified in the application for registration (deregistration).

note

The Tax Code does not oblige organizations and individual entrepreneurs to confirm their right to use UTII with regulatory or legal documents. Consequently, tax inspectorates should not require those wishing to use imputation to submit these documents when registering.

How an individual entrepreneur should fill out an application for deregistration of UTII

In the application, the individual entrepreneur indicates the following information:

- about yourself - last name, first name, patronymic;

- the reason for termination of activity on the imputation, indicated by codes from 1 to 4.

What else needs to be reflected in this form is discussed in the article “UTII Form 4: application for deregistration of individual entrepreneurs.”

So, deregistration must be accompanied by mandatory notification of this fact to the tax authorities. “Withdrawal from UTII” will help you understand how to do this correctly .