Property tax for organizations under the simplified tax system in 2022 - 2022

Property tax is a regional tax.

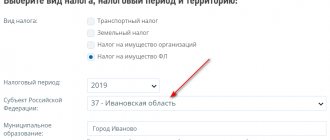

All the nuances concerning it are given in Chapter. 30 Tax Code (TC). Each of the constituent entities of Russia develops its own laws on it in relation to the region, guided by the Tax Code. In them, regional legislators specify the scope of benefits, the tax rate, the procedure and terms of payment. The Tax Code stipulates only maximum tax rates. You can find out the tax rate and benefits in your region using the Federal Tax Service service here.

The property tax of the simplified tax system for 2021–2022 is charged on a number of real estate objects that have a cadastral value (clause 1 of article 378.2 of the Tax Code of the Russian Federation). For “simplified” legal entities, payment of tax on such objects becomes mandatory (Clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

IMPORTANT! Starting with reporting for 2022, all organizations are required to indicate information about movable property accounted for as part of fixed assets in their property tax declaration. To do this, by order of the Federal Tax Service dated December 9, 2020 No. KCh-7-21/ [email protected], a new section 4 was introduced into the form . For details, see here. For 2022, it is necessary to submit a declaration as amended by the order of the Federal Tax Service dated June 18, 2021 No. ED-7-21/ [email protected]

As for individual entrepreneurs using the simplified tax system, this tax is relevant to it if what is listed in paragraph 1 of Art. 378.2 of the Tax Code of the Russian Federation, property is used for business activities. If it is included in the list of objects for taxation at cadastral value, then property tax for individuals will be taken from its value (clause 3 of Article 346.11 of the Tax Code of the Russian Federation). In this case, the Federal Tax Service will independently calculate the amount of tax for the entrepreneur.

If you have access to ConsultantPlus, check whether you paid property tax correctly under the simplified tax system. If you do not have access to the system, get a trial demo access for free.

Deadlines for paying taxes according to the simplified tax system

Based on Article 346.19, as well as paragraph 7 of Article 346.21 of the Tax Code, payment of tax according to the simplified tax system involves the deduction of advance payments within the time limits established by law:

- until April 25 of the current year – for the 1st quarter;

- until July 25 of the current year - for the six months;

- before October 25 of the current year - 9 months.

The final amount of tax under the simplified tax system for 2022 must be transferred to the state budget no later than March 31, 2022. Within the same period, it is necessary to submit a declaration under the simplified tax system for organizations and before April 30, 2022 for individual entrepreneurs. Similar deadlines have been established for paying taxes and submitting reports for 2022 - until March 31, 2023 and until April 30, 2023.

Let us remind you that entrepreneurs and organizations using the simplified tax system do not have the obligation to report to the tax office on the payment of advance payments.

Who must pay tax in 2022 - 2022

Under what conditions must an organization or individual entrepreneur pay property tax using the simplified tax system? They are:

- in a constituent entity of the Russian Federation, the results of the cadastral valuation of real estate listed in paragraph 1 of Art. 378.2 Tax Code of the Russian Federation;

- the subject has adopted a law on property tax, establishing the specifics of determining the tax base for it.

Thus, “simplified” residents are required to pay property tax subject to the following conditions:

- They have buildings in which the premises are used to accommodate offices, trade in various goods and provide services. See also “Simplified residents need to pay property tax on premises in the building, even if the building itself is not mentioned in the cadastral list .

- The regional authorities approved the cadastral valuation of the property listed in paragraph 1 of Art. 378.2 Tax Code of the Russian Federation.

- Legislators in the region where this property is located have adopted a law establishing the rules for calculating and paying taxes on real estate assessed at cadastral value.

- At the beginning of the year, the cadastral value of the objects was determined.

How to find out the cadastral value of a property, read here .

The company's real estate must be reflected in accounts 01 or 03. You can find out whether your property is included in the cadastral list by requesting this list from the tax office. You can also clarify real estate data in the region's Rosreestr by sending there a request for an extract from the cadastre about the value of the building.

In a number of regions, lists of cadastral real estate were approved back in 2013. The same lists are valid in 2021–2022 and will be applied in subsequent periods with the necessary additions to them. If a property is on this list, it will remain there forever.

If 20% of the building is used for offices or for commercial purposes, then it is considered an administrative and business center, recognized as an object of taxation (clause 3 of Article 378.2 of the Tax Code of the Russian Federation).

Taxpayers obligated to pay tax on a building included in the cadastral list are allowed to challenge the fact that this object is included in the list in court if they consider that the premises were included there erroneously (Clause 15 of Article 378.2 of the Tax Code of the Russian Federation).

Nuances and conditions

In addition to determining the cadastral (register) value, a legal entity must ensure that the list of conditions is met in relation to the objects:

- Availability of ownership or economic management of the property.

- Accounting for an object on the balance sheet of a legal entity using accounting accounts 01 or 03.

- Permission to place retail outlets or office buildings on the land plot.

- Use of property for the purposes specified in the Charter in an amount of more than 20%. Confirmation of this fact is required.

- The property is included in the relevant list. This is the official list for determining the tax base based on cadastral value.

The list for the last item is determined by the constituent entities of the Russian Federation and is published on the official website page. To find out the cadastral value, you need to obtain an extract from Rosreestr. No tax is paid on book value.

Conditions for paying property tax and a simplified taxation system

So, subject to the above conditions, the payer of the simplified tax system becomes a payer of property tax. Organizations are required not only to pay tax, but also to submit a tax return on it.

Read our article on how to fill out a property tax return for 2021.

For individual entrepreneurs, the tax will be calculated by the Federal Tax Service, sending the results of its calculation in the form of a notification to the individual to pay the tax.

Information on the tax calculated from the cadastral value is entered in section 3. If the company has several taxable objects, a separate page is filled out for each of them. If there are tax benefits, they are reflected here. In addition, the title page and section 1 are filled out in the calculation.

The deadline for tax payment for legal entities is established by the Tax Code of the Russian Federation (clause 1 of Article 383 of the Tax Code of the Russian Federation) - March 1 of the following reporting year. Thus, property taxes for 2022 must be paid by March 1, 2022. Advance payments, if established by the registry, are made before the last day of the month following the reporting quarter.

For individual entrepreneurs paying property taxes according to the rules established for individuals, the deadline is specified in the Tax Code of the Russian Federation. For payments for 2022, this corresponds to 12/01/2022.

For more information about the property tax for individuals, read the article “How is the property tax for individuals calculated?” .

What taxes are required to be paid using the simplified tax system?

Organizations and individual entrepreneurs who own land plots that are recognized as objects of taxation are required to pay land tax. In this case, this also applies to those entrepreneurs who work on the Simplified Taxation System.

In accordance with Article 358 of the Tax Code, individual entrepreneurs and organizations with registered vehicles must pay transport tax. And in this situation, businessmen using the simplified tax system are no exception.

We list the taxes and fees required to be paid under the simplified tax system under certain conditions:

1. State duty (when applying to authorized bodies to perform legally significant actions); 2. Water tax (when using water bodies); 3. Fees for the use of objects of the animal world and aquatic biological resources (upon obtaining permission to extract objects of the animal world, aquatic biological resources); 4. Insurance premiums:

- for compulsory pension insurance;

- for compulsory social insurance in case of temporary disability and in connection with maternity;

- for compulsory health insurance;

- for compulsory social insurance against industrial accidents and occupational diseases (if there are payments to employees).

5. Personal income tax for employees and for yourself; 6. Trade fee.

Property tax rates and calculation

The maximum value of the tax rate (2%) is established by the Tax Code of the Russian Federation (clause 1.1 of Article 380, subclause 2 of clause 2 of Article 406 of the Tax Code of the Russian Federation). Regions can differentiate it by linking it to the category of the payer and the type of property he uses.

Firms using the simplified tax system must pay property tax advances quarterly if this payment procedure is chosen in the regional law. You no longer need to submit quarterly advance payments.

The amount of the advance payment is determined as the product of the cadastral value of the property and the tax rate, divided by 4 (clause 4 of Article 382 of the Tax Code of the Russian Federation). This sets the tax amount for the quarter.

If the organization’s real estate is an integral part of the building, then you first need to clarify what percentage of the area occupied by the company is in relation to the entire taxable area. Then the result obtained should be multiplied by a reducing factor proportional to the occupied area.

For objects owned for less than a full year (quarter), a coefficient is applied in tax calculations that takes into account the number of full months of ownership in the calculation period. Since 2016, a full month is accepted as a month in which the object appeared to the taxpayer no later than the 15th day or disappeared after the 15th day (Clause 5 of Article 382 of the Tax Code of the Russian Federation).

Our article “Step-by-step instructions for calculating property tax from cadastral value” will help you correctly calculate property tax .

Find out how a special regime person can fill out a property tax return in the Ready-made solution from ConsultantPlus. Learn the material by getting trial access to the system for free.

The procedure for calculating tax based on cadastral value

If your company pays tax on the cadastral value, the calculation algorithm is as follows:

1. Request the cadastral value of the building at the beginning of the tax period from the regional office of Rosreestr.

If the cadastral value of the premises is not determined, but the cadastral value of the building in which it is located is known, then the tax base is determined as the share of the cadastral value of the building corresponding to the share of the area of the premises in the building.

2. The amount of tax for the year is equal to the cadastral value of the building, multiplied by the tax rate and the coefficient K.

K = number of months of the reporting period during which the company owned the property (including months of receipt and disposal) / number of months in the reporting period.

If the building has several owners, multiply the cadastral value by your share, and then by the tax rate and coefficient K.

3. If the law of a constituent entity of the Russian Federation provides for quarterly advance payments within the tax period, then the advance payment is equal to ¼ of the tax amount calculated above. All advance payments will then need to be taken into account when calculating your tax for the year.

Results

Every year, before January 1, regional authorities approve the cadastral value of real estate, information about which is included in special lists. If the assets of the “simplified” person are present in this list, then he becomes a payer of property tax. At the same time, companies are required to submit quarterly calculations for advance payments, and at the end of the year, the declaration itself. For individual entrepreneurs using the simplified tax system, the calculation is carried out by the tax office and sends a corresponding notification to the place of residence.

Whether it is possible to write off the tax paid as expenses under the simplified tax system, find out here .

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Legislative acts

The main legal acts in this topic are:

- Tax Code of the Russian Federation. Contains a description of the concept of taxation, structure, rules. complete list of information.

- Civil Code of the Russian Federation. The law clearly defines a legal entity, its rights, duties and responsibilities.

- Law No. 52-FZ of April 2, 2014. The text contains a list of amendments made to the Tax Code of the Russian Federation regarding property tax for simplified people.

- Letter No. BS-4-21/15191 dated 08/06/2022, in which the Federal Tax Service grouped all changes to the Tax Code on property taxes.

List of objects

At the beginning of the year, the government of each region compiles a list of objects, the tax base for which is determined as their cadastral value. This applies to shopping and administrative centers and other premises used for offices and businesses. This list should be sent to the regional Department of the Federal Tax Service, and also posted on the website of the executive body of the subject itself.

Accordingly, whether or not to pay property tax on a simplified basis depends on its type. If the property of a company or individual entrepreneur on the simplified tax system is not included in the mentioned list, then it is not subject to tax.

For example, in 2022 in Moscow, such a list will include non-residential buildings located on land plots for the placement of retail facilities, catering, consumer services or offices. As well as non-residential buildings or premises in them, which are at least 20% used to accommodate the specified objects (there are additional conditions).

Commercial real estate taxes for organizations and entrepreneurs differ in the calculation procedure, payment deadline and reporting. Therefore, we will consider the features of each of them separately.

In what cases do entrepreneurs pay VAT?

According to the general procedure, entrepreneurs who use the simplified tax system do not pay VAT. However, in some cases they will have to remit value added tax and submit a declaration, namely:

- if the entrepreneur (organization) participates in a joint venture agreement;

- in trust transactions;

- if an entrepreneur (organization) fulfills the duty of a tax agent for VAT;

- when issuing invoices on the entrepreneur’s (organization’s) own initiative.

In general, the deadlines for paying VAT and submitting reports on this tax are different and depend on the situation.

Property recognized and not recognized as an object of taxation (table)

Property tax is charged on non-movable property listed on the balance sheet of an enterprise and used in production processes for the purpose of making a profit:

- fixed assets involved in the production process;

- material values;

- property given for a time to another enterprise;

- cash deposit.

The following are not subject to property tax:

- fixed assets not involved in production;

- plots of land;

- natural objects;

- maritime transport listed in the State Register;

- cultural heritage;

- historical and architectural monuments;

- nuclear installations;

- nuclear waste storage facilities;

- space objects;

- objects placed temporarily at the disposal of federal authorities for the purpose of conducting military operations, protecting the country's territory and ensuring law and order.

What taxes should entrepreneurs not pay using the simplified tax system?

Article 346.11 (paragraphs 2-3) contains a list of taxes from which individual entrepreneurs and organizations using the Simplified Taxation System are exempt.

So, individual entrepreneurs and organizations do not have to pay the following taxes in 2022:

| Tax that does not need to be paid to the simplified tax system | Exception and comment |

| Property tax | It is necessary to pay property tax according to the cadastral valuation |

| Corporate income tax | Payable on dividends that entrepreneurs rely on the simplified tax system from other businesses |

| Value added tax (VAT) on the sale of valuables (in the vast majority of cases) | There is no need to keep a book of purchases and sales, submit reports and issue an invoice |

| Personal income tax (NDFL) in relation to income from the activities of individual entrepreneurs | Personal income tax is being replaced by a simplified single tax |

To know what taxes individual entrepreneurs must pay and when, we recommend studying this tax calendar.

That is, individual entrepreneurs and organizations are not required to pay all the taxes that were listed in the table. All fees are replaced by tax according to the simplified tax system.

Let us add that the tax according to the simplified tax system may have one of the following objects of taxation:

- income;

- income minus expenses.

Let us note that the application of the simplified tax regime does not exempt either organizations or entrepreneurs from performing the function of a tax agent for personal income tax.

Taxation of individual entrepreneurs using the simplified tax system and LLCs using the simplified tax system (table)

Let's take a closer look at the taxation of individual entrepreneurs:

| IP on the simplified tax system | LLC on the simplified tax system |

| Tax rates | |

| – 6%, the object of taxation is the total income of the enterprise for the year. Costs are not included in the calculation. The regime is beneficial to those who receive stable incomes and do not incur large expenses. – 15%, the tax base is made up of the difference between the income and expenses of the enterprise. The system is beneficial to those who have relatively large expenses in the course of their activities and hire employees. | |

| Frequency of tax payment | |

| Once a year | Every quarter (advance payments, 25% of the total tax) |

| Submitting reports | |

| The declaration only needs to be submitted once at the end of the year. | |

| Accounting and document flow | |

| If a 6% rate applies, no accounting is required at all. If you choose a system with a rate of 15%, you need to keep a Book of Income and Costs. In both cases, keeping accounts and organizing document flow does not seem to be a difficult task. | |

| Minimum opportunities to receive claims from the tax service | |

| The list of costs that can be taken into account when calculating tax and thereby reducing the tax base is closed, which means that other costs cannot be included in the list of costs in principle. Therefore, it is almost impossible to cause dissatisfaction with the tax authorities regarding the illegality of reducing the tax base. | |

| No need to pay VAT | |

| One less reason for a tax audit. | |

| No income tax | |

| And along with it - the need for the Federal Tax Service to control the accounting of losses of the enterprise | |

| Restrictions on the use of the simplified tax system | |

| – No more than one hundred employees, including part-time workers and contractors; – There is an income limit: from January 1, 2022 it is 150 million rubles. | |

| Limitation of transition to simplified tax system – The amount of income for 9 months cannot exceed 112 million rubles; – The company’s equity capital must be at least 75% of the total; – The cost of fixed assets should not exceed 150 million rubles. | |