Unified simplified declaration for legal entities and individual entrepreneurs

Article 23 and Article 80 of the Tax Code of the Russian Federation lists who submits a single simplified declaration in 2022 and for what period. The report is submitted to the Federal Tax Service by persons who are recognized as taxpayers for one or more taxes, but did not carry out taxable transactions during the reporting period. This applies equally to both legal entities and individual entrepreneurs. The number of transactions in the absence of which it is possible to report using a simplified scheme includes:

- lack of movement of funds in bank accounts or at the cash desk of the organization throughout the entire tax period, but any, even erroneous, crediting or debiting of money will lead to the loss of the right to file such a declaration;

- lack of objects of taxation.

The EUD initially has nothing in common with the tax return under the simplified taxation system (STS), with which it is often confused. In fact, this is simply a zero report for several fiscal payments at once.

Who submits a single (simplified) tax return

The right to report in a simplified manner arises only if the following conditions are simultaneously met (clause 2 of Article 80 of the Tax Code of the Russian Federation):

- there was no turnover in bank accounts and cash registers;

- there is no object of taxation for the corresponding taxes.

Thus, a single declaration is most often submitted by beginning entrepreneurs who do not yet have any transactions. Also, filing a simplified declaration is likely during periods of downtime or suspension of the company’s activities.

It makes sense for companies to submit a single declaration on OSNO. Organizations using the simplified tax system submit a declaration according to the simplified tax system; if necessary, it is zero. For example, in the absence of income, a homeowners association submits a zero declaration under the simplified tax system under the simplified tax system.

single (simplified) tax return free of charge

filling out a single (simplified) tax return

Who submits the EUD

Taxpayers submit a single return for income tax and VAT if there are no movements in the bank or cash account and no objects of taxation. This is not permitted under all taxation regimes and in relation to not all duties. In particular, it is impossible to submit a single report on personal income tax, so entrepreneurs on the general taxation system are deprived of this opportunity. This is explained by the fact that an individual entrepreneur is obliged to provide a personal income tax report, regardless of the availability of an object for it (income in the reporting period).

As for other taxes, the legislation allows reporting in this way only for those whose tax reporting period in the EU is equal to a quarter, half a year, 9 months and a year.

IMPORTANT!

Tax authorities have established a quarterly deadline for the EUD: if the reporting period is a month, the tax cannot be included in a single report. These are all excise taxes, gambling tax and mineral extraction tax.

Detailed instructions from ConsultantPlus experts will help you fill out the report correctly. Use it for free.

To rent or not to rent

| When not to serve | When to serve |

|

|

IMPORTANT!

The EUD does not cancel the taxpayer’s obligation to provide calculations of insurance premiums, accounting financial statements and SZV-M to the Pension Fund to the Federal Tax Service. But it is not necessary to submit a zero 6-NDFL.

Deadline for submitting the declaration

As a general rule, the report must be submitted no later than 20 days after the end of the period for which information is submitted (quarter, half-year, 9 months or year). In some cases, this report is submitted only for the year, in particular, for income and property taxes or the simplified tax system. In these cases, it must be submitted before January 20 of the year following the reporting year. Deadlines for submitting the EUD in 2022:

- for the 4th quarter of 2022 - until 01/20/2022;

- for the 1st quarter of 2022 - until 04/20/2022;

- for the 2nd quarter of 2022 - until July 20, 2022;

- for the 3rd quarter of 2022 - until October 20, 2022;

- for the 4th quarter of 2022 - until 01/20/2023.

Deadlines for filing a single simplified declaration in 2021

When is the unified simplified tax return submitted? The deadline for filing a single simplified tax return is set to the 20th day of the month following the reporting period: quarter, half-year, 9 months, calendar year.

NOTE! Monthly reporting cannot be replaced by a single simplified declaration.

Read more in the material “Tax reporting period in a single simplified declaration.”

Depending on the organizational and legal form of the business entity, it is presented as follows:

- individual entrepreneurs - at the place of registration of the individual entrepreneur;

- organizations - at the location of the head office (legal address).

For submission in 2022, the deadlines for submitting a single simplified tax return will be as follows:

- 01/20/2021 - for 2022;

- 04/20/2021 - for the 1st quarter of 2022;

- 07/20/2021 - for the first half of 2022;

- 10.20.2021 - for 9 months of 2022.

You will need to report for 2022 by January 20, 2022.

Liability for late submission of a single (simplified) declaration is described in the Ready-made solution from ConsultantPlus. This is a trial access to K+, free of charge.

Today, there are 3 options for submitting a single simplified tax return to the tax authority:

- By mail with a description of the attachment. The payment receipt in this case will be a document confirming the submission of the declaration.

- You can personally bring the declaration to the tax authority - in this case it is provided in 2 copies, on which an acceptance stamp is affixed; 1 copy remains with the tax office, and the 2nd copy is returned to the taxpayer and serves as confirmation of delivery.

- The third option is to submit the declaration electronically through specialized operators or through the website of the Federal Tax Service of Russia.

See here for details.

Declaration form and features of its completion

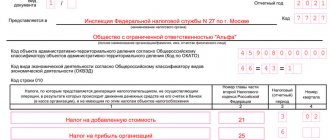

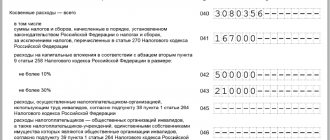

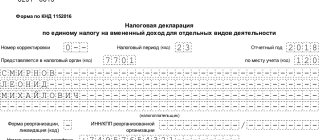

Order of the Ministry of Finance No. 62n dated July 10, 2007 approved the form of a single simplified tax return - KND form 1151085. The same regulatory act also explains the preparation procedure. No calculations are provided, and filling out a simplified tax return consists of correctly indicating the taxpayer’s data on the title page.

The document is allowed to be filled out by hand with a black or blue pen; the Federal Tax Service will accept a machine-readable form filled out using office equipment. Amendments or adjustments to the report are not permitted.

Although there are no special rules on how to fill out a single simplified declaration for the 4th quarter of 2022 or other periods, there are several recommendations that will help you avoid mistakes.

| Field | What to fill out and according to what rules |

| TIN | All taxpayers, both individual entrepreneurs and legal entities, must fill out this form. If an organization's TIN consists of 10 characters, then the first two cells of the TIN field must be filled with zeros. The system will not allow empty cells. |

| checkpoint | Only legal entities can fill it out on the basis of their documents. |

| Document type | If the report is submitted for the first time in this period, then a 1 must be entered in this field. When submitting a clarifying document, the value 3 must be entered in the field and the serial number of the adjustment must be indicated. For example, if clarifications were submitted for the first time, indicate 3/1. |

| Reporting year | The year for which the tax period the report is provided. |

| Federal Tax Service Authority | The name of the Federal Tax Service inspection to which the document is submitted and with which the taxpayer is registered. |

| Name of company | Full name of the organization. It is necessary to decipher abbreviations such as JSC or LLC. An individual entrepreneur indicates his full last name, first name and patronymic. |

| OKATO | Field for the OKTMO code (it must be specified before the new EUD form is approved). If the taxpayer has less than 11 characters in the code, then put zeros in the last empty cells. The letter of the Federal Tax Service No. ED-4-3/18585 dated October 17, 2013 contains a recommendation to enter the OKTMO code in this column. |

| OKVED2 | Code of the main type of economic activity of the taxpayer, indicated in the extract from the Unified State Register of Legal Entities - for a legal entity or Unified State Register of Individual Entrepreneurs - for an individual entrepreneur. |

| Taxes | It is necessary to indicate the taxes for which the report is provided. If there are several of them, then they should be indicated in the order in which they are located in the Tax Code. |

| Chapter number | In this field, indicate the number of the chapter of the Tax Code that governs the tax recorded in the previous field. For example, for VAT this is Chapter 21 of the Tax Code of the Russian Federation. |

| Taxable period | If the period is a quarter, you must enter 3. If the tax period is a year and the reporting period is a quarter, then:

|

| Quarter number | When submitting EUD for the year, this field should be left blank. In the quarterly report, indicate the serial number of the quarter in the form 01, 02, 03 or 04. |

| Phone number | Taxpayer contact telephone number. Filled in only with numbers indicating the country code, without the “+” sign. |

| Number of sheets | In this field, enter 001 if the report is submitted by an individual entrepreneur or a legal entity, since the second sheet of the report is intended only for individuals. |

Look at a sample of filling out a zero single simplified tax return using the KND form 1151085 for the 4th quarter of 2021.

Check for free in ConsultantPlus whether the tax and reporting period codes have been entered correctly in the EUD.

Who takes the EUD

According to the provisions of Art. 80 of the Tax Code of the Russian Federation, if the taxpayer of one or more taxes did not carry out business transactions, did not make calculations and did not have objects of taxation, a simplified declaration is submitted in the absence of activity in 2022 - based on the results of the quarter, half a year, 9 months, year.

The EUND combines several taxes in one form. Typically, taxpayers submit such reports to the OSNO: for the simplified taxation system, a special report is available under the simplified tax system. But taxpayers have the right to submit EUND to both the simplified tax system and the unified agricultural tax.

In Part 2 of Art. 80 of the Tax Code of the Russian Federation indicates who submits a single simplified tax return: organizations and individual entrepreneurs who simultaneously fulfill the following conditions:

- lack of operational activities and, as a result, movements in the cash register and bank accounts;

- absence of a taxable object.

The EUND is submitted if the economic entity did not have any activity in the reporting period. This situation arises at the beginning of the work of a company or individual entrepreneur, when there is not yet a base of counterparties and regular transactions. They report in a uniform form even during the period of suspension of financial and economic activities.

IMPORTANT!

Submitting a EUD does not exempt individual entrepreneurs on OSNO from submitting a zero 3-personal income tax and paying property taxes.

ConsultantPlus experts discussed how to fill out and submit a single simplified declaration. Use these instructions for free.

Responsibility for delay

The issue of liability for late submission of a report remains controversial, since the Ministry of Finance and the Federal Tax Service have different opinions on this matter. If specialists from the Ministry of Finance in letter No. 03-02-07/2-154 dated November 12, 2012 noted that the document was developed to make it easier for taxpayers to submit zero reporting, and therefore fines cannot be imposed for failure to provide it, then tax authorities, in the absence of this report, have the opportunity punish for failure to provide “zero” returns for each tax separately. The second option is more lenient: if the EUD is not submitted on time, the Federal Tax Service will apply liability under Article 126 of the Tax Code of the Russian Federation, since this report is not by its nature a declaration containing information about the objects of taxation and the amount of the calculated payment.

Submitting the EUD late will result in a fine of 1,000 rubles. according to paragraph 1 of Art. 119 of the Tax Code of the Russian Federation (resolution of the Moscow District Court No. F05-16047/2014 dated January 26, 2015).

EUD for the 4th quarter of 2022: new form

The Federal Tax Service has long been planning to bring the unified zero report into compliance with the current tax reporting requirements. In particular, approve the electronic format of the report and replace OKATO with OKTMO in the form. In addition, tax authorities will allow the use of the declaration by payers of the simplified tax system who have no income in the reporting period. Until now, this possibility was questionable and gave rise to different interpretations. On the portal of draft regulatory legal acts, the text of the draft departmental order approving the new form of a single declaration has already been examined, but has not yet moved further.