Fulfillment of the obligation to pay taxes, fees, insurance premiums (penalties, fines) upon liquidation of an organization is regulated by Art. 49 of the Tax Code of the Russian Federation, and during its reorganization - Art. 50 Tax Code of the Russian Federation.

The Tax Code does not contain special rules establishing deadlines for filing tax returns for the last reporting (tax or accounting) period of activity of a reorganized or liquidated organization, which in practice raises questions on the part of taxpayers.

What are the procedures and deadlines for filing tax returns during the liquidation and reorganization of a taxpayer? We'll tell you in this article.

Who fulfills the obligations to pay taxes during the liquidation (reorganization) of a taxpayer?

The obligation to pay taxes, fees, insurance premiums (penalties, fines) of the liquidated organization is fulfilled by the liquidation commission at the expense of the funds of the said organization, including those received from the sale of its property (Clause 1 of Article 49 of the Tax Code of the Russian Federation).

The obligation to pay taxes of a reorganized legal entity is fulfilled by its legal successor(s) in the manner established by Art. 50 Tax Code of the Russian Federation.

According to this article, the legal successor in terms of fulfilling the obligation to pay taxes is recognized as:

- in the case of a merger of several legal entities - the legal entity resulting from such merger (clause 4);

- when one legal entity is merged with another legal entity - the legal entity that merged it (clause 5);

- in case of division - legal entities arising as a result of such division (clause 6);

- when transforming one legal entity into another - a newly emerged legal entity (clause 9).

According to paragraphs 7 and 8 of Art. 50 of the Tax Code of the Russian Federation, if there are several legal successors, the share of participation of each of them in the performance of the duties of the reorganized legal entity to pay taxes is determined in the manner prescribed by civil law. When one or more legal entities are separated from a legal entity, succession in relation to the reorganized legal entity in terms of the performance of its obligations to pay taxes (penalties, fines) does not arise. In a number of cases provided for by these paragraphs, by a court decision, newly emerged (split-off) legal entities may jointly fulfill the obligation to pay taxes of the reorganized entity.

Use of the Unified Agricultural Tax (USAT) by an entrepreneur

Businessmen - taxpayers of the Unified Agricultural Tax, upon completion of business activities as agricultural producers, submit a declaration by the 25th day of the month, which follows the month of closure of the individual entrepreneur company.

If the day of submission of the declaration to the regulatory authority falls on a Saturday, Sunday or holiday, then the merchant submits it during business hours.

According to Appendix No. 1 to the Procedure for entering data into the declaration document for Unified Agricultural Tax, approved by order of the Federal Tax Service of the Russian Federation dated July 28, 2014, a businessman who is a taxpayer of Unified Agricultural Tax when liquidating an agricultural enterprise indicates the following codes:

- Code value 50 - designation of the last tax period of the individual entrepreneur;

- Code 34 - designation of the calendar year;

- Code name 96 - designation of the last calendar year at the end of the business activities of the individual entrepreneur who applied the Unified Agricultural Tax.

Also, according to Appendix No. 2 to the Procedure for entering data into the declaration under the Unified Agricultural Tax, established by the Federal Tax Service of the Russian Federation, the entrepreneur indicates the following company liquidation codes:

- 1 - when transforming a company;

- 2 - when merging companies;

- 3 - when dividing an organization;

- 5 - when one company merges with another;

- 6 - upon division and simultaneous merger of one company with another;

- 0 - upon liquidation of the company.

Tax period - calendar year

The calendar year is the tax period for the following taxes:

- Personal income tax (Article 216 of the Tax Code of the Russian Federation);

- income tax (Article 285 of the Tax Code of the Russian Federation);

- tax on additional income from the production of hydrocarbons (Article 333.53 of the Tax Code of the Russian Federation);

- Unified Agricultural Tax (Article 346.7 of the Tax Code of the Russian Federation);

- “simplified” tax (Article 346.19 of the Tax Code of the Russian Federation);

- transport tax (Article 360 of the Tax Code of the Russian Federation);

- tax on property of organizations (Article 379 of the Tax Code of the Russian Federation);

- land tax (Article 393 of the Tax Code of the Russian Federation).

If the tax period for the relevant tax is a calendar year, the end date of the tax period is determined taking into account the provisions established by clause 3 of Art. 55 Tax Code of the Russian Federation:

| Period of termination of an organization through liquidation or reorganization | Last tax period |

| Until the end of the calendar year | The period from January 1 of the calendar year in which the organization was terminated until the day of state registration of termination |

| The organization was created and terminated during the calendar year | The period from the date of creation of the organization to the day of state registration of termination as a result of liquidation or reorganization |

| The organization was created in the period from December 1 to December 31 of one calendar year and terminated before the end of the calendar year following the year of creation |

Tax period - quarter

A quarter is a tax period for the following taxes:

- VAT (Article 163 of the Tax Code of the Russian Federation);

- water tax (Article 333.11 of the Tax Code of the Russian Federation);

- UTII (Article 346.30 of the Tax Code of the Russian Federation).

If the tax period for the relevant tax is a quarter, the end date of the tax period is determined taking into account the provisions established by clause 3.2 of Art. 55 Tax Code of the Russian Federation:

| Period of termination of an organization through liquidation or reorganization | Last tax period |

| Until the end of the quarter | The period from the beginning of the quarter in which the organization was terminated until the day of state registration of termination |

| The organization was created and terminated in one quarter | The period from the date of creation of the organization to the day of state registration of termination as a result of liquidation or reorganization |

| The organization was created less than 10 days before the end of the quarter and terminated before the end of the quarter following the quarter in which the organization was created |

Required data

This form is filled out if you have standard data, as with all types of registration:

| Company data | Source |

| Brand name | Extract from the Unified State Register of Legal Entities |

| OGRN | –//– |

| TIN | –//– |

| Date of decision on liquidation | Relevant decision/protocol |

| Date of the decision to appoint a liquidator or liquidation commission | –//– |

And for the applicant, who is the liquidator or the chairman of the liquidation commission (PLC):

| Applicant information | Source |

| Full name | Passport |

| Passport details | –//– |

| Place of residence/stay | –//– |

| TIN | Tax website |

As you can see, the documents are standard.

Tax period - month

The month is the tax period for the following taxes:

- excise taxes (Article 192 of the Tax Code of the Russian Federation);

- mineral extraction tax (Article 341 of the Tax Code of the Russian Federation);

- tax on gambling business (Article 368 of the Tax Code of the Russian Federation).

If the tax period for the relevant tax is a month, the end date of the tax period is determined taking into account the provisions established by clause 3.4 of Art. 55 Tax Code of the Russian Federation:

| Period of termination of an organization through liquidation or reorganization | Last tax period |

| Until the end of the month | The period from the beginning of the calendar month in which the organization was terminated until the day of state registration of termination |

| The organization was created and terminated in one calendar month | The period from the date of creation of the organization to the day of state registration of termination as a result of liquidation or reorganization |

What is the procedure for filling out a declaration by a legal successor during the reorganization of a legal entity?

Taking into account the norms of Art. 50 of the Tax Code of the Russian Federation on the fulfillment of the obligation to pay taxes of a reorganized person by its legal successor, as well as on the unchanged deadlines for the fulfillment of obligations to pay taxes, the legal successor is obliged to submit tax reports and make the appropriate payment of taxes if the reorganized person has not done so.

The preparation of tax returns by the successor organization (including the indication on the title page of the TIN and KPP, the code of the place of submission of the declaration) is regulated by the procedure for filling out the declaration for a particular tax:

| Procedure for filling out the declaration | Filling order item | Details of the order of the Federal Tax Service that approved appropriate filling procedure |

| For income tax | 2.6 | From 10/19/2016 No. ММВ-7-3/ [email protected] |

| For corporate property tax | 2.8 | From 03/31/2017 No. ММВ-7-21/ [email protected] |

| For land tax | 2.8 | From 05/10/2017 No. ММВ-7-21/ [email protected] |

| For transport tax | 2.8 | From 05.12.2016 No. ММВ-7-21/ [email protected] |

| For tax paid in connection with the use of simplified taxation system | 2.6 | From 02/26/2016 No. ММВ-7-3/ [email protected] |

| According to VAT | 16.5 | From 10/29/2014 No. ММВ-7-3/ [email protected] |

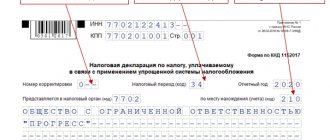

A declaration for a particular tax for a reorganized entity is filled out by the legal successor in the general manner; specifics need to be taken into account only when filling out the title page, which indicates:

- according to the details “TIN” and “KPP” - TIN and KPP of the legal successor who submits the declaration (the same TIN and KPP are reflected on the remaining pages of the declaration);

- according to the details “Tax (reporting) period (code)” - code 50 (the last tax period during reorganization (liquidation) of the organization), when submitting a VAT return - tax period code 51, 54, 55 or 56 (I, II, III, IV quarters, respectively, during the reorganization (liquidation) of the organization);

- according to the details “Submitted to the tax authority (code)” - the code of the tax authority with which the legal successor is registered;

- according to the details “Organization/separate division” - the name of the reorganized entity;

- according to the details “Form of reorganization (liquidation) (code)” - code depending on the form of reorganization, for example 1 - transformation, 2 - merger, 3 - division, 5 - accession, 6 - division with simultaneous accession.

The details “TIN/KPP of the reorganized organization (separate division)” are filled in.

There will be differences only when filling out the details “At location (accounting) (code)”:

the income tax return and VAT return will indicate code 215 (at the location of the legal successor who is not the largest taxpayer) or 216 (at the place of registration of the legal successor who is the largest taxpayer);

- in the declaration of tax paid in connection with the use of the simplified tax system - code 215;

- in the land tax declaration - code 216 or 270 (at the location of the land plot (share of the land plot);

- in the property tax declaration - code 215, 216 or 281 (at the location of the real estate property (for which a separate procedure for calculating and paying tax is established));

- in the transport tax declaration - code 216 or 260 (at the location of the vehicles).

Note:

In the relevant sections of all of the above declarations, the OKTMO code of the municipality in whose territory the reorganized person was registered as a taxpayer is indicated.

Who pays insurance premiums and submits settlements during the reorganization of a legal entity and in what order?

Individual entrepreneur reporting when winding down a business

Upon completion of business activities, the individual entrepreneur submits the following business papers to the regulatory authority - the inspection of the Federal Tax Service of the Russian Federation:

- application for state registration of an individual’s completion of activities as an individual entrepreneur in form P26001. If a businessman submits an application not himself, but through a proxy, then such an application must first be certified by a notary;

- receipt for payment of state duty (160 rubles).

Individual entrepreneurs must submit certain reports for their subordinates to the Pension Fund of the Russian Federation (PFR) and the Social Insurance Fund (SIF) before closing the company. In addition, the individual entrepreneur himself must deregister from the Social Insurance Fund. Only Pension Fund employees automatically deregister an individual upon receipt of information from the inspectorate about the completion of the merchant’s business activities.

In such a situation, a citizen of the Russian Federation pays fixed insurance premiums to the Pension Fund of the Russian Federation within 15 calendar days from the date of entering specific data into the Unified State Register of Individual Entrepreneurs about the suspension of the business activity of a citizen of the Russian Federation.

An individual entrepreneur can close his business at any time - the businessman submits a declaration document on the liquidation of the company, regardless of the reporting period in which he ceased his activities.

Payment of insurance premiums before completion of the reorganization procedure

According to paragraph 3 of Art. 431 of the Tax Code of the Russian Federation, insurance premiums are paid during the billing period based on the results of each calendar month no later than the 15th day of the next calendar month. Article 45 of the Tax Code of the Russian Federation establishes that the payer has the right to fulfill the obligation to pay insurance premiums ahead of schedule.

In this regard, the reorganized person may pay insurance premiums earlier than the established period, until the state registration of termination of activities through reorganization.

In accordance with paragraph 3 of Art. 55 of the Tax Code of the Russian Federation, when a legal entity is terminated through reorganization, the last tax period for it is the period from January 1 of the calendar year in which it was terminated until the day of state registration of termination.

The Tax Code does not contain rules establishing other deadlines for paying insurance premiums and submitting calculations of insurance premiums for the last billing period to the tax authorities when reorganizing the payer of insurance premiums.

Filling out sections

Sections 1.1 (object according to the simplified tax system “Income”) and 1.2 (“Income minus expenses”) of the declaration do not have any fundamental features in filling out when closing an individual entrepreneur. Here's what they usually say:

- OKTMO;

- tax (advance payments thereon);

- by what amount you reduce the tax or have to pay extra to the budget.

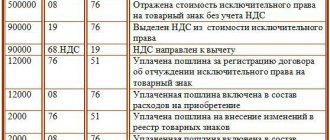

But Sections 2.1.1 (object “Revenue”) and 2.2 (“Revenue minus expenses”) - where the tax is calculated - have a common filling feature. When closing an individual entrepreneur, the value of each declaration indicator (income, expenses, amounts of insurance premiums, trade fees, tax amount according to the simplified tax system) for the last reporting period (quarter/half-year/9 months) is repeated in the line for the tax period of the corresponding indicator.

For example, this is how it looks for the “Revenue” object (let’s agree that the income was only in the first quarter of 2022):