The meaning of the write-off procedure

Any NFA object of an organization may become unusable due to material or physical wear and tear, breakdowns and other factors.

It makes no sense to continue to account for unusable fixed assets on the balance sheet. Objects that cannot be used in the future must be written off. Key accounting tasks in relation to accounting for non-financial assets:

- Control over property assets from the moment they come into the possession of the enterprise, for example, from the moment of purchase until the moment they are completely disposed of (written off) from accounting. The task is accomplished by conducting a systematic inventory.

- Timely calculation of material depreciation in monetary terms. Reliable reflection of transactions in accounting.

- Receive reliable information about the property status of an economic entity for the preparation of reliable financial and tax reporting.

- Calculation and payment of fiscal payments to the state budget in terms of taxation of the organization’s property.

- Control over the effective use of funds aimed at reconstruction, modernization and repair of the company's operating system.

- Supervision of the effective operation of facilities in the production cycle or core activities.

The standard procedure for writing off fixed assets does not allow all non-financial assets of a budget-funded institution to be removed from accounting. For some types of objects you will have to obtain special permission from the owner or founder.

Types of budget property

The owner of non-financial assets of public sector institutions is the state. According to paragraph 9 of Art. 9.2 of Law No. 7-FZ of January 12, 1996, fixed assets of budgetary institutions are assigned to them with the right of operational management. The following types of budget property are distinguished:

| OS type | Right of disposal |

| Real estate | |

| Any buildings, structures, premises, etc. | Operations on this type of OS without the official consent of the owner are unacceptable |

| Movable | |

| Particularly valuable property transferred or assigned by the founder to a budgetary institution, as well as purchased with subsidies | To carry out transactions using OCI data, the consent of the owner is required |

| Particularly valuable property acquired by a budgetary institution at the expense of its own income from business and other activities | The BU has the right to independently dispose of this OCI Exceptions in which the consent of the founder is required:

|

| Other movable | |

IMPORTANT!

An exhaustive list of OCI, as well as the procedure for defining an OS as an OCI, is determined by the owner - founder of the budgetary institution. OCI are objects without which the implementation of the main activities of a state institution becomes impossible or difficult.

Property disposal rules

Legislators have defined key rules for the disposal of property assets of government agencies. The scope of rights depends on the type of organization:

- government institutions are completely deprived of the right to dispose of any property without appropriate permission from the owner (founder, superior manager, body exercising the functions and powers of the founder);

- a budgetary and (or) autonomous institution does not have the right to dispose of real estate, as well as especially valuable property acquired at the expense of budgetary funds or assigned to the organization by order of the owner.

Budgetary organizations have the right to independently dispose only of movable property acquired at their own expense. An autonomous organization, in addition to movable fixed assets purchased through entrepreneurial activity, can also dispose of real estate acquired through its own assets.

State officials do not have such a right, since all funds received from entrepreneurial and other income-generating activities must be directed to the state budget.

Reasons for write-off

The procedure for writing off fixed assets from the balance sheet implies, first of all, identifying the reasons why the property should be removed from the institution’s accounting records. Situations in which write-off from accounting is required:

- complete or partial loss of useful properties of an object, in which the OS cannot function properly;

- physical loss or damage to an object, these include: breakdown, destruction, damage, loss, liquidation;

- moral or technical obsolescence of the OS, in which the modernization of property is economically unjustified;

- loss of property assets due to emergencies or natural disasters.

Write off assets that have become obsolete during the construction, reconstruction, modernization and technical re-equipment of the enterprise as a whole or its individual structural divisions.

Write-offs are also carried out in cases where it is impossible to restore an asset or it requires significant financial costs, which will be regarded as inappropriate, irrational and inappropriate use of budget funds.

What other grounds are there for writing off fixed assets from accounting:

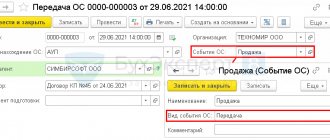

- if an institution decides to sell a non-financial asset to a third-party company or individual, then the object must be written off from the register;

- if the property is transferred into the ownership of third parties under an exchange agreement or free of charge;

- if NFA is transferred to a third party as a contribution to the authorized capital, then the asset is subject to write-off;

- if it is decided to rent or lease the object, provided that the property will be taken into account by the tenant (lessee).

Objects that are temporarily mothballed, for example, those that are not currently used in the production cycle, are not subject to write-off. Also, NFAs that are undergoing reconstruction and modernization, and whose operation is temporarily suspended, are not written off.

If property is transferred from one structural unit to another, the movement is reflected by internal movement. The NFA acceptance and transfer certificate is filled out. If an object is transferred from one separate division to another or to the head office, provided that the divisions are allocated to a separate balance sheet, then the procedure for the gratuitous transfer of fixed assets is observed.

IMPORTANT!

The end of the useful life of an asset is not a basis for writing it off from accounting.

Problems of partial liquidation of a fixed asset

Home articles

05/14/2009 print

When a fixed asset is partially liquidated, it is important for the accountant to correctly determine the value of the retiring and remaining parts, document and correctly reflect the disposal operation in accounting and tax accounting. From the point of view of income tax, the question of whether the useful life of the asset will change after partial write-off is also important.

http-equiv=»content-type»> Complete and partial liquidation of a fixed asset have much in common; only with partial liquidation, not the entire fixed asset is disposed of, but part of it.

This is possible as a result of reconstruction or modernization of the facility, in emergency situations (natural disasters, accidents, etc.) or as a result of its physical and moral deterioration. Most often, partial liquidation concerns buildings and structures, external and internal communications facilities, and other “complex” objects. The accounting unit for fixed assets is an inventory item (clause 6 of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n). This is an object with all the devices and accessories or a separate structurally isolated object designed to perform certain independent functions. It can also be a separate complex of structurally articulated objects that constitute a single whole and are intended to perform a specific job. This, in turn, is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation. Each item included in the complex can perform its functions only as part of the complex, and not independently. If an object consists of several parts, each of which has its own useful life, each such part is accounted for as an independent inventory item. This rule also applies to tax accounting of fixed assets. In any case, you need to start the write-off procedure with documentation, since, according to Article 252 of the Tax Code, for profit tax purposes, justified and documented expenses are recognized as expenses. Draw up documents for liquidation To carry out the disposal of a fixed asset item (which also occurs during partial liquidation) in an organization, the manager must issue an order about this, as well as form a liquidation commission. The commission includes officials, including the chief accountant and those responsible for the safety of fixed assets (clauses 77, 78, 79 of the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). This commission determines the degree of suitability of the object for further use, as well as the possibility of its restoration. The commission: − inspects the object to be written off, studies the technical documentation for it and accounting data; − establishes the reasons for write-off: physical and moral wear and tear; violation of operating conditions; accident or other emergency; non-use in production or management for a long time, etc.); − identifies the guilty persons, due to whose actions or inaction there is a forced disposal of fixed assets, makes proposals to bring these persons to legal responsibility; − establishes the possibility of using individual parts of the disposed object, evaluates them based on the current market value, controls the withdrawal of non-ferrous and precious metals, determines their weight and places them in storage; − makes a decision on the write-off or partial write-off of a fixed asset, draws up, signs and approves an act with the manager. The act indicates: − the date of acceptance of the object for accounting; − year of manufacture or construction; − commissioning time; − useful life; − initial cost and amount of accrued depreciation; − revaluations, repairs; − reasons for disposal and their justification; − condition of structural parts, parts, assemblies. An act of write-off (partial write-off) of an item of fixed assets can be finalized only after completion of the liquidation (partial liquidation) of an item of fixed assets. In the act of partial liquidation, the commission indicates the reason for partial liquidation - modernization, reconstruction or another reason. The document is drawn up in two copies. The first copy is transferred to the accounting department, the second remains with the person responsible for the safety of the property. Based on the document, materials and scrap metal remaining as a result of write-off of the fixed asset are transferred to the warehouse or sold. As primary accounting documents for the partial disposal of a fixed asset, you can use both unified primary documents for accounting for fixed assets, approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7, and independently developed ones, provided that they contain all the necessary details of the form . This right is given to organizations PBU 1/2008 “Accounting policy of an organization” (approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n) starting from January 1, 2009. An object is accepted for accounting as a fixed asset when certain conditions are met (clause 4 of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) and when the object: − is intended for use in production of products (works, services) or for management needs; − will be used for a long time, that is, over 12 months; − not subject to resale; − capable of bringing economic benefits (income) to the organization. The disposal of an item of fixed assets is recognized on the date of one-time termination of the listed conditions for its acceptance for accounting. How much should I write off? In the event of partial liquidation (as well as reconstruction, modernization, technical re-equipment) of a fixed asset, its initial value changes (clause 14 of PBU 6/01, clause 41 of the Methodological Instructions). The same thing happens in tax accounting (clause 2 of article 257 of the Tax Code of the Russian Federation). Therefore, you first need to determine the residual value of the liquidated part of the object. Note that the procedure for determining it at the legislative level is not established. Part of a building If part of a building (structure) is disposed of due to a change in its area, then in practice, as a rule, the residual value of the part being written off is determined by finding the proportion of the liquidated part of the building in the total area of the building (structure) (letter from the Ministry of Finance of Russia dated August 27, 2008 No. 03-03-06/1/479). Here we need inventory and title documents (for example, BTI acts), which contain information about the area of the building. —————Example 1——————- Suppose, according to BTI documents, the total area of the building is 100,000 sq. m. m. In connection with the reconstruction, part of the building with an area of 25,000 sq. m. is subject to liquidation. m. The initial cost of the building is 30,000,000 rubles, depreciation charges are 26,000,000 rubles. The residual value of the building at the time of liquidation is RUB 4,000,000. We make the calculation: 1) the share of the area of the liquidated part in the total area of the building is 25% (25,000 sq. m: 100,000 sq. m x 100%); 2) the initial cost of the liquidated part of the building is RUB 7,500,000. (RUB 30,000,000 x 25%); 3) the amount of depreciation charges attributable to the liquidated part is 6,500,000 rubles. (RUB 26,000,000 x 25%). ——————END OF EXAMPLE 1—————- To account for the disposal of fixed assets (sale, write-off, partial liquidation, transfer for free, etc.) to account 01 “Fixed Assets”, you need to open a subaccount 01-2 “Disposal fixed assets”, to the debit of which the cost of the disposed object is transferred, and to the credit - the amount of accumulated depreciation. Upon completion of the disposal procedure, the residual value of the object (or its disposed part) is written off from account 01 “Fixed assets” to account 91 “Other income and expenses” (Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). ——————EXAMPLE 2———————— Let’s use the data from example 1. In accounting, when a building is partially written off, the accountant must make the following entries: DEBIT 01-2 “Disposal of fixed assets” CREDIT 01-1 “Fixed assets in organizations" - 7,500,000 rubles. − the disposal of the liquidated part of the building is reflected; DEBIT 02 “Depreciation of fixed assets” CREDIT 01-2 − 6,500,000 rub. − the write-off of depreciation of the liquidated part of the building is reflected; DEBIT 91 “Other income and expenses” CREDIT 01-2 − 1,000,000 rub. (7,500,000 – 6,500,000) – the residual value of the liquidated part of the building is written off as expenses. ———————END OF EXAMPLE 2——————— Sometimes it is impossible to determine the value of the liquidated part of a fixed asset without the involvement of an independent appraiser: for example, when part of a building is liquidated without changing its total area (writing off individual components or failed internal communications) (letter of the Ministry of Finance of Russia dated July 16, 2008 No. 03-03-06/2/79). As was said, not only buildings and structures, but also other “complex” objects can be subject to partial liquidation. The residual value of the liquidated part of such equipment is determined either on the basis of primary documents drawn up when accepting the fixed asset item for accounting, or by an independent assessment of its original cost. Replacing a monitor Let's consider accounting for the partial liquidation of a “complex” object using the example of a computer. Let’s assume that an organization has capitalized the system unit and the monitor as one inventory item and is replacing the old monitor, that is, first carrying out a partial liquidation, and then upgrading, since it is installing a more advanced new monitor, for example, a liquid crystal one. This approach is based on the explanations of financiers contained in the above-mentioned letter of the Ministry of Finance of Russia No. 03-03-06/1/479. Modernization costs increase the initial cost of a fixed asset (clause 27 of PBU 6/01). Let's consider the scheme of accounting entries, provided that the old monitor is disposed of (accounting will reflect only expenses - the residual value of the monitor and the costs of its disposal). To simplify the operation of accounting and deducting “input” VAT from the cost of a new monitor, we do not include it. DEBIT 08 “Investments in non-current assets” CREDIT 60 “Settlements with suppliers and contractors” - a new monitor was purchased; DEBIT 01-2 “Disposal of fixed assets” CREDIT 01-1 “Fixed assets in the organization” - reflects the disposal of the old monitor; DEBIT 02 “Depreciation of fixed assets” CREDIT 01-2 − reflects the write-off of the corresponding part of the accumulated depreciation; DEBIT 91 “Other income and expenses” CREDIT 01-2 - the residual value of the monitor is written off as expenses; DEBIT 91 “Other income and expenses” CREDIT 60 – the cost of services for disposing of the monitor was written off as expenses; DEBIT 01-1 CREDIT 08 style=»font-weight: bold;»> − the initial cost of the computer has been increased by the cost of a new monitor. Note that such accounting for partial liquidation also complies with IFRS standards (IAS 16 “Fixed Assets”). Capitalize spare parts If, as a result of partial liquidation, materials, spare parts, and scrap remain that can be used in the future, then they need to be capitalized. They are assessed at market value and reflected on the date of acceptance for accounting as a debit to the materials account and a credit to the profit and loss account (as other income) (clause 16 of the Guidelines for accounting of inventories, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, clause 79 of the Methodological guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). The same is true for the monitor. If the reason for its replacement is not related to fatal faults, it can be used in the future. An old monitor or its parts suitable for further use can be capitalized as part of other income at market price, and under-accrued depreciation (residual value of the monitor) can be included as part of expenses. Delivery of materials to the warehouse is completed by an invoice for the internal movement of materials (clause 57 of Order No. 119n of the Ministry of Finance of Russia dated December 28, 2001; standard intersectoral form No. M-11, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a). Dismantled equipment arrives at the warehouse according to a receipt order (clause 49 of order No. 119n; standard intersectoral form No. M-4, approved by Resolution of the State Statistics Committee of Russia No. 71a). Tax accounting during liquidation According to the general rule in tax accounting, expenses for the liquidation of fixed assets decommissioned, including the amount of depreciation under-accrued over their useful life, are accepted when calculating income tax (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation). There is no direct instruction on accounting for expenses for partial liquidation of fixed assets in the Tax Code. But there are clarifications from the Russian Ministry of Finance on this matter, which states that such expenses can be accepted when calculating income tax if the requirements of Article 252 of the Code on economic justification and documentary evidence of expenses are met (letter dated July 16, 2008 No. 03-03-06 /2/79). After all, partial liquidation of a fixed asset is a special case of complete liquidation, and it can be considered economically justified if the property being destroyed is unsuitable for further use, its restoration is impossible or impractical from an economic point of view. A similar opinion is expressed in the letter of the Ministry of Finance of Russia dated August 27, 2008 No. 03-03-06/1/479. If, as a result of the liquidation or partial liquidation of a fixed asset, materials suitable for further use (surplus inventories) are received, then when they are disposed of, the amount of tax calculated on the income received can be included in expenses (letter of the Ministry of Finance of Russia dated June 15, 2007 No. 03-03-06/1/380). ——————EXAMPLE 3——————— As a result of dismantling the internal communications of the building, the organization received and accepted the details. Their market value was 20,000 rubles. These parts were later used for repair work. Tax expenses include the amount of income tax calculated at the current rate - 4,000 rubles. (RUB 20,000 x 20%). ———————END OF EXAMPLE 3———————- Tax accounting during modernization Let's return to the case of replacing the monitor. Installing a new monitor is also an upgrade for tax accounting. Modernization costs increase the initial cost of a fixed asset based on paragraph 2 of Article 257 of the Tax Code. They should be written off as expenses gradually, by calculating depreciation (subclause 3, clause 2, article 253, clause 4, article 259, clause 3, article 272 of the Tax Code of the Russian Federation). Restoration of VAT on the under-depreciated part Tax officials insist that, on the basis of paragraph 3 of Article 170 and sub-clause 1 of paragraph 2 of Article 171 of the Tax Code, the previously deducted amount of VAT on the under-depreciated part of the retiring fixed asset must be restored for payment to the budget. At the same time, financiers recommend determining the restored tax amounts based on the residual (book) value without taking into account revaluation. These amounts can be taken into account as part of other expenses when calculating income tax on the basis of Article 264 of the Code (letter of the Ministry of Finance of Russia dated December 7, 2007 No. 03-07-11/617, dated November 22, 2007 No. 03-07-11/ 579). However, in paragraph 3 of Article 170 of the Code, among the cases when VAT must be restored, there is no case of restoring the amount of VAT from the under-depreciated part of a liquidated fixed asset. Arbitration practice shows that arbitrators, as a rule, take the side of taxpayers in such disputes (resolutions of the FAS Moscow District dated July 27, 2007 in case No. KA-A40/6508-07, Volga District dated March 4, 2008 in case No. A57 -3429/06-25). In our opinion, the decisive arguments for an organization in this situation should be the price of the issue and the desire to sue the inspectorate. If the organization has decided to restore the amount of “input” VAT from the residual value, previously accepted for deduction, then the accounting entries need to be made: DEBIT 19 “VAT on acquired values” CREDIT 68 subaccount “Calculations for VAT” - the amount of “input” VAT has been restored ; DEBIT 91 “Other income and expenses” CREDIT 19 – the amount of restored VAT is written off as other expenses. Deduction of VAT on dismantling services If the dismantling of the liquidated fixed asset is carried out by a third-party organization, then the contractor, if he is a VAT payer, will present VAT to the buyer as part of the amount for payment for his services. Can this tax be deducted? In this matter, you can adhere to this logic. If the liquidated object is subject to destruction, then this operation can be recognized as not subject to VAT, and the amount of “input” tax cannot be deducted (letter of the Ministry of Finance of Russia dated March 24, 2008 No. 03-07-11/106). In such a situation, the court, most likely, will not support the taxpayer, as, for example, the FAS of the Volga-Vyatka District in the resolution of December 26, 2007 in case No. A31-2632/2007-23. If, as a result of dismantling, an organization receives surplus material assets that can be used in the future in any of the transactions subject to VAT (sale or use for production or management needs), then it is likely that the court in this situation will support the taxpayer’s right to accept deductible VAT paid for dismantling services (resolution of the Federal Antimonopoly Service of the North Caucasus District dated April 17, 2006 in case No. F08-1410/2006-589A). As in the previous situation with the restoration of VAT, everything should depend, in particular, on the price of the issue. Please note that the process of liquidating a fixed asset can be lengthy. There may be a situation when the fixed asset is disabled in one tax period, and its liquidation is completed in another. Then the costs of eliminating the fixed asset can be recognized in expenses in the period to which they relate, namely, on the date of signing the act of work performed (letter of the Ministry of Finance of Russia dated October 21, 2008 No. 03-03-06/1/592). Does the useful life change? After the partial liquidation of the fixed asset, its initial cost changes (Clause 2, Article 257 of the Tax Code of the Russian Federation). Taking into account the “liquidated” share, the “new” value of the fixed asset is formed in the accounting. Depreciation on it continues to be accrued in the same order as before the partial liquidation process, based on the residual value of the fixed asset and the remaining useful life. If, after a partial liquidation of the fixed asset, its initial cost is less than 20,000 rubles, it is necessary to accrue shock absorption on it until the cost of tax accounting for profit (letter of the Ministry of Finance of Russia dated March 14, 2006 No. 03-03-04/1 /229). As for the useful life, this is possible only in the direction of its increase in reconstruction, modernization or technical re -equipment. It is impossible to change the useful life of the remaining part of the fixed asset during partial liquidation (letter of the Ministry of Finance of Russia dated August 27, 2008 No. 03-03-06/1/479). Style = "font-weight: bold; font-style: italic; "> e. Tsivilev, expert

Special commission on write-offs

The organization must create a permanent commission that is authorized to make decisions on similar issues. The composition of the special commission should be fixed by a separate order of the head of the government agency or defined in the accounting policy.

Who to include on the commission:

- chief accountant or his deputy;

- accountant responsible for maintaining NFA records;

- persons responsible for the safety of the operating system at the enterprise;

- heads of structural units, workshops, departments;

- deputy head or the head himself (usually the chairman of the commission);

- other employees of the enterprise, at the discretion of management.

Include in the special commission workers whose activities are directly related to accounting, control and examination of OS. When considering an applicant for write-off, it is necessary to evaluate not only the appearance and technical characteristics of the OS, but also documentation, such as a technical passport, floor plan, diagrams, etc. This is necessary to compare actual performance with the stated technical characteristics.

The commission must indicate the following:

- Determine for what reason a specific piece of property may be removed from the institution’s accounting records.

- Decide whether individual parts of the decommissioned OS can be used in activities as materials or spare parts.

- Indicate the presence of precious metals or other expensive components and parts that can be sold by the enterprise.

- Control the removal of parts, parts and assemblies that can be used or sold.

- Drawing up an effective protocol that reflects the identified positions.

The minutes of the meeting can be drawn up in any form. There is no special form for documentation. The institution has the right to develop and approve an independent form for use in its work.

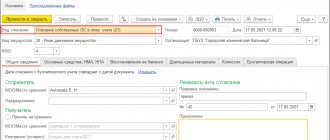

How to correctly draw up a write-off act in form OS-4

The current document flow procedure allows filling out the form both manually and electronically, so here the decision is made directly by the responsible employee. The main condition is the presence of original personal signatures of the head of the organization, as well as each member of the evaluation commission. But certification using a seal is not a mandatory requirement, since since 2016 the legislation has left the use of stamps and cliches as an optional right of legal entities.

The document is drawn up in two copies: the first of them is transferred for further work to the accounting department of the enterprise, serving as the basis for reflecting entries in the accounting program, the second is retained by the employee financially responsible for the property being written off, until the moment of transfer to the warehouse and subsequent disposal or sale. If necessary, it is also possible to increase the number of copies, each of which must be properly executed and certified.

How is the procedure completed?

The documentation for writing off fixed assets looks like this:

- The minutes of the meeting of the standing committee are approved, which determines the key points of the disposal of fixed assets from the register.

- Based on the protocol, the manager creates a separate order - an order for operations with fixed assets.

- An effective act on writing off fixed assets from accounting is drawn up.

The form of the act is determined individually, depending on the category of the asset being written off.

Service memo

A memo is an internal document with the help of which subordinates convey the necessary information to management.

The note is formatted differently in different companies. A special form (template) may be provided for it, or employees may design it at their own discretion.

Principles for drawing up a memo:

- you need to write a note addressed to the manager (or according to the hierarchy accepted in the company);

- information should be presented without excessive detail, but reflecting the necessary facts;

- The note must be completed by indicating your position, full name, personal signature and date of preparation.

The note is presented in the manner that is accepted in the company for such papers (given personally to the manager, sent by e-mail, transmitted through the secretary with recording of received correspondence in the journal, etc.).

Following these principles will give the note the status of an official document and will relieve its compiler from the need to provide additional explanations on the information contained in the note.

Sample memo:

The main purpose of the memo is to promptly inform management about the existing problem and thereby start the process of writing off fixed assets from the balance sheet.

Low value assets

Not all fixed assets should be reflected on the balance sheet accounts of the institution. The accounting regulations of public sector institutions provide special rules for maintaining records of low-value assets. These include fixed assets worth up to 100,000 rubles.

The category of low-value assets is divided into two groups:

- fixed assets, the cost of which is no more than 10,000 rubles per unit;

- fixed assets, the price of which ranges from 10,000 to 100,000 rubles per unit.

Depending on the value of the asset, the standard for reflection in accounting is determined. If the price of a low-value basic non-fiscal asset is below 10,000 rubles inclusive, then it cannot be taken into account on the balance sheet account 0 101 00 000 of accounting and budget accounting. Such fixed assets are subject to simultaneous write-off to the off-balance sheet, where they must be accounted for in a special off-balance sheet account 21 “Fixed assets in operation.”

Reflect the disposal of low-value fixed assets worth up to 10,000 rubles inclusive by the appropriate decision of the special commission. Write off assets based on the primary document (write-off act) at the cost at which they were accepted for off-balance sheet accounting.

Fixed assets worth up to 100,000 rubles, but more than 10,000, are accounted for on the balance sheet account 0 101 00 000. But their initial cost is immediately written off to depreciation charges. In simple words, the initial price of fixed assets in the amount of 100% is written off for depreciation - accounting account 0 104 00 000.

IMPORTANT!

Even 100% depreciation for a specific fixed asset does not provide grounds for its removal from accounting. Therefore, it is impossible to write off fixed assets worth from 10,000 to 100,000 rubles from the balance sheet.

Such an asset can be removed from the balance sheet only for certain reasons: moral and (or) physical wear and tear, liquidation, loss or damage, impossibility of restoration, irrationality and inexpediency of modernization. Or if the property is decided to be leased or rented (reflected on the recipient’s balance sheet), sold, donated or transferred free of charge.

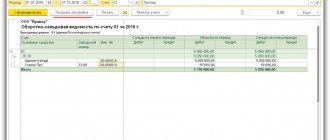

Accounting for write-off of fixed assets

Accounting entries for the disposal of fixed assets are given in paragraph 10 of the section “Non-financial assets” of the Instructions for the use of the budget chart of accounts, approved. by order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n. Here are the main entries:

| Description | Dt | CT |

| Write-off of assets due to loss, shortage, destruction for reasons not related to natural disasters | 010400000 “Depreciation” (010411410–010413410, 010415410, 010418410, 010421410–010428410, 010431410–010438410, 010441410–010448410), 0 40110172 “Income from operations with assets” | 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010121410–010128410, 010131410–010138410, 010141410–010148410) |

| Write-off of fixed assets in connection with emergencies and natural disasters | 010400000 “Depreciation” (010411410–010413410, 010415410, 010421410–010428410, 010431410–010438410, 010441410–010448410), 040120273 “Through extraordinary expenses on transactions with assets" | 010100000 “Fixed assets” (010111410–010113410, 010115410, 010121410–010128410, 010131410–010138410, 010141410–010148410) |

| Write-off of the OS for other reasons, including in connection with the decision of the commission to end the use of the OS due to loss of technical properties | 010400000 “Depreciation”, 040110172 “Income from operations with assets” | 010100000 “Fixed assets” |

| Assets for which a decision has been made to write off, but dismantling measures have not yet been carried out, are reflected on the balance sheet | 02 “Material assets accepted for storage” | |

| Materials remaining after write-off of fixed assets have been accepted for accounting | 010500000 “Inventories” (010521340–010526340, 010531340–010536340) | 040110172 “Income from operations with assets” |

| The costs of carrying out work to write off the operating system are reflected | 040120200 “Expenses of an economic entity” | 030211730 “Increase in payables for wages”, 030306730–030311730 “Increase in payables for insurance premiums”, etc. |

A sample act on the liquidation of an asset was provided by ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

For general information about fixed assets in budget accounting, read the article “Budget accounting of fixed assets in 2020-2021 (nuances)” .

Read about innovations in budget accounting in the article “Working chart of accounts for budget accounting for 2020 - 2022” .