Home • Blog • Online cash registers and 54-FZ • 54 Federal Law on the use of cash registers in 2022

November 16, 2021

907

The use of CCP is mandatory today. The reform started in 2016 and by 2018 it had covered most of the business. By July 2022, almost all entrepreneurs had installed online cash registers, including those who were registered for UTII and PSN.

In 2022, innovations affected an even larger part of individual entrepreneurs; only some categories listed in the law of June 6, 2019 No. 129-FZ received a deferment. Who should take care of using the equipment now, and who can still trade according to the old rules - read about this and much more in our article.

Take the test “Find out what online cash register your business needs”

Special offers on KKT

Large selection of equipment according to 54 Federal Laws. All cash desks are at manufacturer prices with an official guarantee. It has become even more profitable to purchase a cash register in our store - there are special offers.

GET AN OFFER IN THE ONLINE CASH CATALOG

What is cash register technology and how does it work?

A cash register is an analogue of an earlier device that issues a check and records the fact of payment or issuance of money. The difference between the modern device is that now, instead of the ECLZ, all operations are remembered by the fiscal drive. It not only stores, but also transmits data to the tax service so that government authorities always have up-to-date information on money and commodity turnover at their disposal.

Cash register models work in conjunction with the Internet, through which they connect with the fiscal data operator - the link between the retailer and the Federal Tax Service. The Federal Law on the use of cash register systems regulates the activities and use of technology, periodically introducing changes in the form of amendments. Therefore, you need to carefully monitor new editions so as not to violate legal requirements.

What is Federal Law 54 and what general requirements does it regulate?

You can get the most complete information by following the link https://54-fz.ru

- The main amendment to Law 54-FZ “On the use of cash register equipment” of 2022 introduced changes to the work of trade organizations with the tax authorities. The changes affected many people engaged in business activities. The use of cash register systems implies amended regulations that information from each sales receipt must be transmitted via the Internet to the tax office. Sending will be done using the fiscal data operator (FDO). To do this, you need to have an agreement with one of the FD operator companies.

- Now a person carrying out entrepreneurial activities is obliged to operate a cash register only with a fiscal storage device. FN is necessary for recording and storing information about calculations that are carried out on cash registers. The FSN registers indicate approved cash desks for use. At the moment, more than 100 cash register models from different manufacturers have passed tax certification. There are more than ten of them in the register of fiscal drives.

- Having signed an agreement with the OFD, you can register an online cash register with the tax office using the Internet. When using a cash register, a mandatory agreement with the central service center is not required. Now the entrepreneur has the opportunity to do everything himself..

- 54-FZ “On the use of cash register systems” does not contain provisions stating that it is not necessary to provide a printed check in 2022. At the buyer’s request, you must send him a document via SMS or email along with the issued cash register receipt.

What are the advantages of online cash registers?

The introduction of a law obliging the installation of online cash registers was not accepted by everyone unambiguously because This not only requires certain costs, but also takes, although not much, time. Of course, you will have to purchase the cash register itself and a fiscal drive for it. Registration on the tax website, obtaining an electronic signature and searching for OFD will also take time and money. But you should understand that using a new type of cash register is, first of all, a contribution to the automation of your business, as well as many advantages:

- There is no longer any need to go to the tax office and submit paper documents. Cash desks can be registered remotely using an electronic signature on the Federal Tax Service website. If there is no EDS, ask for help from the equipment seller: today many suppliers provide the service of connecting an EDS for a small fee. The registration card will be sent electronically. There is no need to provide the cash register to tax authorities for inspection. In the future, communicate with the inspectorate about the online cash register, view information about transactions, etc. You can go to your personal account on the Federal Tax Service website. It is also no longer necessary to formally draw up an agreement with the central service center. If there are any malfunctions in the operation of the CCP, you can call a technician one-time to troubleshoot the problem or use the customer service department of the CCP manufacturer. The only thing that needs to be done, which was not required before, is to enter into an agreement with the fiscal data operator.

- The cash register must be connected to the Internet. If the connection is lost, you have 30 calendar days to fix the problem. Otherwise, inspectors will block the cash register. Communication interruptions will not affect the operation of the cash register. It saves the data and, as soon as the connection is restored, will send it to the operator.

- no books and no reports - all this was abolished. All data immediately goes to the OFD, and then to the tax office and is automatically generated in a report. The FDO has data on each client, which means that regulatory authorities do not need to carry out inspections with the frequency with which they occurred before. Now checks will be initiated only in case of any inconsistencies, for example, if the seller’s reporting contradicts the movement of money in the account.

- there is no need to do anything manually. You can contact the OFD with a request to receive a data exchange protocol (API), which will allow you to connect to their server and “pull up” your own data from there for analysis and balance formation. In addition to significant time savings, this reduces the number of miscalculations and errors. If the new cash register has built-in software, then integration is also not needed. Using cash desks with advanced functionality, an accountant can quickly view revenue for any period of time, and the owner of the company can easily go on business, monitoring sales through his personal account on his mobile phone. Many modern cash registers even allow you to set up a CRM and create your own systems of bonuses, discounts and special offers, and even set up a website and start online sales.

Changes coming in 2018

From 2022, the law on cash registers requires an increase in the volume of initial data in strict reporting forms and checks.

The changes also affected entrepreneurs with UTII and patents. Previously, they were exempt from using cash registers, but from 2022 the Federal Law obliges them. The use of CCP will become mandatory for everyone from July 1, 2019. Entrepreneurs working in public catering and retail will switch from July 1, 2022.

It will be possible to deduct from the tax the costs of purchasing a cash register in the amount of up to 18 thousand rubles for each device.

54 Federal Law from 2022 does not apply to everyone. There are organizations that are exempt from using cash registers. It is not necessary to use a cash register for persons carrying out entrepreneurial activities and organizations with an arbitrary taxation system for sales:

- vegetables, fruits, live fish and melons;

- frozen products and soft drinks in trays and kiosks;

- retail markets without premises, fairs and peddling;

- milk, butter;

- newspapers and magazines.

Transition schedule to cash register

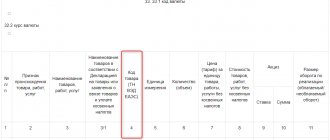

| date | Who should move |

| From July 1, 2022 | Sellers on the simplified tax system, OSNO, unified agricultural tax |

| From July 1, 2022 | Entrepreneurs on UTII and PSN, if they have employees in the field of trade and catering |

| From July 1, 2022 | Entrepreneurs without employees on UTII and PSN, working in the field of trade and catering, as well as all individual entrepreneurs in any mode, providing services to the population. |

* Please note: since March 31, 2017, sellers of beer and other alcohol are required to use cash registers on a general basis, regardless of the taxation regime, including in the catering industry.

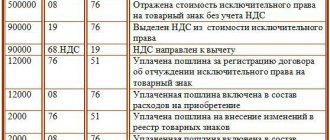

Penalties for evading the use of cash registers

Impressive monetary penalties await individuals engaged in business activities that fail to comply with the law on online cash registers. For example, when using a cash register that does not meet the established requirements, an individual entrepreneur will pay a fine of 3 thousand rubles, and an LLC will pay a fine of 10 thousand rubles. Trading without a cash register is much more expensive. The individual entrepreneur will pay 25-50 percent of sales, not less than ten thousand rubles. The LLC owner will pay 30 thousand rubles, or up to 100% of sales. For a check not sent to the buyer, a fine of 10 thousand rubles or even more.

Severe sanctions apply for repeat violations. In case of repeated failure to comply with the law, the activity of this person is suspended by the Tax Service for up to 3 months, and a fine of 10 thousand rubles is imposed.

Law on the application of CCP

According to Federal Law No. 54 on the application of cash register systems, any type of business activity, including the provision of services, must record financial transactions exclusively through a new-style cash register. This applies to those who have been using such technology for a long time, and to groups that previously did not have to use devices when serving customers.

Why was the procedure for using CCP introduced? There are several reasons for this:

| Revenue tracking. Service through cash registers will allow you to bring unscrupulous business owners out of the shadows, creating healthy competition for all other entrepreneurs. In this way, not only do legal contributions to the budget increase, but pricing is also regulated. |

| Reduced inspections. Despite some negativity at the start of the project, the majority of trade participants noted the positive dynamics associated with the use of cash register systems. The number of inspection raids has decreased, since the tax office always has the necessary data at hand. |

| Process automation. With the help of modern cash register equipment and appropriate software, it was possible to establish automatic generation of reports, preparation of documents and a lot of other paper work that was previously performed manually. |

| Buyer protection. Now, having received an electronic copy of the receipt, you can find out details about the purchase, its origin and other information. Such a service was previously unavailable to the average consumer, so it was received very positively. |

Application of CCP in 2022: who should install the device

Cash equipment is required to be used by everyone who carries out business activities related to the receipt and issuance of funds. Moreover, this applies not only to cash, but also to non-cash payments via bank cards or electronic wallets. However, there are some nuances here: for example, if funds are transferred from account to account by enterprises, then a cash desk is not needed. At the same time, the interaction of an individual with a company is no longer included in this exception; such transactions are subject to a general requirement.

There are some exceptions - for example, until July 2022, individual entrepreneurs who do not have employees may not use CCT, but only if they provide services or sell products of their own making. As soon as at least one employment contract is concluded or a third-party item is sold, cash register equipment must be installed within 30 calendar days.

Special cases of using CCP (UTII, patent, simplified tax system)

Material on the topic Online cash registers under the simplified tax system: application features

The Law on Cash Registers 2022 for individual entrepreneurs and organizations working on UTII or a patent obliges the use of cash registers from July 1, 2022 (Clause 1 of Article 2 of Law 54-FZ). These taxpayers were granted a 12-month deferment.

Organizations and individual entrepreneurs on the simplified market are required to use cash register systems from July 1, 2020. In the case of providing services to individuals, you do not have to punch a check, but issue a strict reporting form (SRF). The relaxation is valid until July 1, 2022.

Electronic check: details

The documents regulating the use of cash registers also determine the contents of the cash receipt issued to the buyer. Moreover, regardless of its form - paper or electronic, it should display the following basic details:

- title and serial number of the document;

- date, time and place where the calculation was made;

- name, TIN and taxation system of the individual entrepreneur/organization;

- form and amount of payment - income-expense, cash-non-cash;

- the name and position of the employee who issued the check;

- link to the website where you can view all the information (for the paper version);

- detailed information about the product or type of service, the amount of VAT.

It also includes the number, series of the fiscal drive and cash register and a QR code. A recent innovation was an addition to the details - a mandatory “product code” item was added. The use of cash register systems for services does not require a product code, which is formed in accordance with the activities of the enterprise. For marked goods there is also a special mark on the receipt in the form of [M].

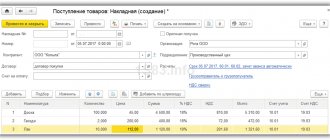

Nomenclature in online cash registers from 2022

Another change in online cash registers, which has already come into force on February 1, 2022, concerns the display of items in cash register receipts. Previously, it was indicated only by organizations and everyone whose activities are related to labeled goods and alcohol. From 2021, nomenclature in online cash registers is mandatory even for individual entrepreneurs in special modes.

The concept of “nomenclature” includes the name of the product (work, service), price per unit and quantity. The details are displayed in such a way as to be clear to the buyer. A specific classifier of goods for providing nomenclature has not been established, so businessmen can enter names on their own.

Working with online cash registers from 2022 involves updating the firmware, which supports the generation of receipts in a new format. It may be necessary to update the inventory software or completely replace the cash register if the model does not allow it to work according to the requirements.

Using CCP in 2022: what it looks like in practice

54-FZ on the use of cash registers requires the mandatory sending of fiscal data to the tax office about each financial transaction. To do this, you need to connect the device to the Internet. The exception is for regions remote from communications; they are listed in special lists formed by regional authorities.

Before installing the cash register you will need:

- Select and purchase cash register and fiscal storage

- Create an electronic signature

- Connect the Internet and OFD

- Register with the Federal Tax Service

After installing the cash register at the workplace and concluding all the necessary contracts, it is necessary to instruct employees, with a signature on their financial responsibility.

Having prepared the consumables and connected the device to the network, you need to open a shift:

- press the corresponding button on the device;

- punch several blank checks to check the operation of the equipment;

- print the interim X-report.

The use of cash register systems for payments is mandatory; a check is issued to the buyer and an electronic version is sent if the client so desires.

To close a shift, the following actions are carried out:

- collection and delivery of proceeds to the responsible person;

- Z-report printout.

An online cash register can be push-button, for example, a compact device Atol 91F, with autonomous operation and a wireless connection for working on the road. More respectable multifunctional models, such as Vicky Micro, operate on touch controls - such a cash register is equipped with a large display and a clear interface.

Need help selecting a CCP?

Don’t waste time, we will provide a free consultation and select the cash register that suits you online.

What are the risks of incorrect use of cash register equipment in 2022?

For failure to use a new cash register, an entrepreneur may be fined 25–50% of the amount passed through the cash register, but not less than 10,000 rubles. Organizations - 75–100%, but not less than 30,000 rubles. For using a cash register that does not comply with the requirements of the law, an individual entrepreneur faces a fine of up to 3,000 rubles, and a company - up to 10,000 rubles. In the event of a repeated violation, if the settlement amount is more than 1 million rubles, the activities of the entrepreneur or organization may be suspended for up to 90 days.

Amendments have been made to the Code of Administrative Violations - now they will also punish for fictitious cash register checks. They will be able to recover up to 40,000 rubles from companies, and up to 10,000 rubles from individual entrepreneurs. The Federal Tax Service will also be able to fine organizations up to 100,000 rubles, and entrepreneurs up to 50,000 rubles for incorrectly indicated goods on a receipt or untimely transmission of fiscal data. If an individual entrepreneur or company is caught violating it again, and the settlement amount is more than 1 million rubles, the fine will range from 800,000 to 1 million rubles.

In addition, tax officials will have the right to block the operation of cash registers that were used during the violation. This will be possible in the presence of two witnesses or using video recording.

What to do?

For some beneficiaries, the transition to the new work order ended on July 1, 2022, but for most entrepreneurs it has already begun on July 1, 2022. Therefore, you need to buy equipment now. There is no longer any place to put it off: keep in mind that the process may take a long time - the required cash register may not be available, you will have to wait for delivery, registering the cash register will also take some time. And then you will also need to set up a cash register, select and install a cash register program, check all this for compatibility and learn how to work.

The transition will be much easier and faster with a ready-made solution. We offer a turnkey online cash register: in one set - a cash register with a fiscal drive, a subscription to the OFD and a convenient cash register program. There is no need to wait for delivery - all equipment is in stock. We will help you set up everything and teach you how to use the program. The solution is proven and reliable: last year it was already tested by our users, who were part of the first wave of implementation of online cash registers.

Experts predict a shortage of fiscal drives on the market, which will lead to inflated prices for them. According to the Chamber of Commerce and Industry of the Russian Federation, today FNs are produced much less than cash registers, and delays in deliveries reach three months.

So start the transition now—without waiting until the deadline. And MySklad will help you save time, nerves and money. The cost of our Economy set is covered by tax deduction. And our cash register program is compatible with new cash register models, does not require installation or expensive implementation, and is suitable for automating any number of retail outlets.

Reliable with us! MySklad is an official participant in the first experiment with online cash registers: a pilot project that was carried out back in 2015. Then, for the first time, the first few thousand cash registers were equipped with a module that transmits data to the Federal Tax Service. The project was considered successful and was implemented throughout Russia.

Try MyWarehouse for free: after registering with the service, we will open a trial period for you for 14 days, and a personal manager will answer all your questions.