Supporting NGOs is our profession. Liquidation of an NPO is the final action in the life cycle of a non-profit organization. Having decided to liquidate an NPO, you need to know several important things, which we will consider here. It is important to know all the features of this process in the Ministry of Justice in order to answer the following questions:

- What is the cost of liquidating an NPO, what is the price determined from?

- Should you liquidate the NPO yourself using step-by-step instructions, or entrust the work to specialists?

- What will happen to the property of an NPO upon liquidation?

- Features of the liquidation of the Fund.

- Maybe it’s easier for me to sell my NPO?

Termination of activities of non-profit organizations

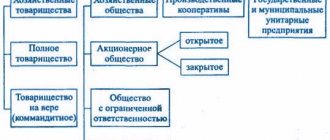

Like commercial organizations, NPOs are organized for specific purposes, function, and can be reorganized and liquidated, ceasing to be subjects of legal and civil relations from the moment of liquidation.

Liquidation of NPOs

Fast and official

from RUB 39,500

Call: +7(968)-878-38-99

Order a consultation

As practice shows, the creation of non-profit organizations and the termination of their work occurs constantly. But at the same time, the legislation providing for their elimination is still imperfect, as is its application in the realities of modern life. In order to understand the problems existing in this area, identify the main trends caused by constant changes in social relations and find their optimal solutions, it is necessary to constantly study and analyze the existing legislation regulating the activities of NPOs.

Currently, in the Russian Federation, legislative norms relating to the liquidation of non-profit associations cannot fully ensure legal regulation in this area, which negatively affects the activities of NPOs as subjects of civil law. This entails the emergence of legal disputes and proceedings. One of the significant shortcomings is that in the field of existing civil legislation there is no clear regulation of the termination of the activities of a non-profit organization. Often during liquidation, disputes also arise when determining guarantees for creditors of an NPO and for the state, which is a creditor, regarding tax obligations.

Step-by-step instruction

Step-by-step instructions for terminating the activities of a non-profit organization is one of the issues related to the liquidation of an association.

It is important that the instructions consist of several stages that must be carried out step by step.

Stages

The procedure for terminating the activities of an NPO includes a number of stages.

These include:

- Holding a general meeting. It makes a decision to liquidate the association. The first stage may consist of a trial, the result of which is the adoption of a resolution to terminate the organization's activities.

- Selection of a liquidator - chairman of the liquidation commission. An individual or a group of individuals may be nominated. Subsequently, all issues based on the termination of functioning are considered by the chairman and the commission. The result of the meeting is recorded in the minutes, after which it is certified by the signatures of each participant.

Within three days after the meeting, an application (form RN0005), the compiled minutes of the meeting at which the decision on liquidation was made, and the minutes of the meeting approving the candidacy of the liquidator are sent to the department of the registration authority.

Additionally, the following documents are attached:

- registration certificate;

- certificate of registration with the tax authorities;

- TIN certificate;

- extract from the register;

- passports of all members of the liquidation commission.

Further actions:

- Publication of the relevant notice in the media. So that interested parties can obtain information about the termination of the activities of a non-profit organization, a message is submitted to the Bulletin. In the advertisement, it is important to indicate: the name of the non-profit organization, the time for submitting claims related to debts (at least 60 days), information for contacting representatives of the non-profit organization. Documents confirming publication must be kept in the archives of the liquidation commission until the completion of the procedure.

- Formation of an interim liquidation balance sheet.

- If there are debts, the next step is settlement with creditors.

- Formation of liquidation balance sheet. If there are no debts, then it will fully correspond to the interim balance.

- Payment of state duty, the amount of which is 800 rubles. It is not paid if the liquidation of a non-profit organization occurs through bankruptcy proceedings.

- Exclusion of an organization from the register. This stage is final.

Solution

The decision to terminate the activities of the enterprise is made at the general meeting of founders. The result is the formation of a protocol.

It will only be valid if there are signatures from each participant.

The decision can be made by the arbitration court if an insolvency procedure is introduced against the organization. At the same time, the observation stage begins.

A sample decision to liquidate an organization is here.

Notification

Notification of the termination of the activities of a non-profit organization is sent to all interested parties, as well as creditors who may make demands for repayment of debts.

In accordance with the received requirements, a register of requirements is formed.

Interim balance

An interim liquidation balance sheet is required to match the assets and liabilities of the organization.

Once drawn up, it must be approved by the body that made the decision to terminate the activities of the non-profit organization.

Using the balance sheet, it will be possible to systematize profits and expenses and facilitate an audit by the tax authorities, if the relevant authority decides to carry it out.

A sample of filling out the interim liquidation balance sheet is here.

Calculation

The calculation will be carried out after compiling a register of creditors' claims within the specified time frame.

Initially, funds are paid to NPO staff, after which debts are repaid to non-governmental organizations, and then to other citizens and companies.

If there is disagreement with the creditor’s requirement, then the issue that has arisen can be resolved through the courts.

In a situation where capital funds are insufficient to repay debts, the liquidator’s property is sold.

Dismissal of employees

Employees must be notified of the upcoming layoff two months prior to liquidation.

For these purposes, notices are sent to them against signature, and at the same time the dismissal is reported to the social security authorities.

A sample notice of dismissal to employees due to liquidation of the organization is here.

Exclusion from the Unified State Register of Legal Entities

The completion of the procedure for terminating activities in 2022 is the exclusion of the non-profit organization from the register of legal entities.

The result is the issuance of the appropriate Certificate.

The cost of liquidating a non-profit organization.

The cost of liquidating an NPO depends on its organizational and legal form. For example, liquidating an Autonomous Non-Profit Organization, a Private Institution, an Association, or a Public Organization will not be difficult if you seek our qualified help (subject to all norms of current legislation) and the cost of this procedure is fixed - 39,500 rubles.

The service for liquidating a non-profit organization in 39500 consists of five stages:

1. Notification of the beginning of the liquidation procedure of a non-profit organization

2. Appointment of a liquidator or liquidation commission of a non-profit organization

3. Publication in the press about the liquidation of a non-profit organization, the procedure and deadline for filing claims by its creditors

4. Registration actions related to the preparation of an interim liquidation balance sheet containing information about the composition of the property of the liquidated non-profit organization, the list of claims presented by creditors, as well as the results of their consideration

5. Presentation of the compiled liquidation balance sheet, exclusion of the non-profit organization from the Unified State Register of Legal Entities.

It is important to remember that in addition to liquidation services, the costs of a notary, publication in the press and state fees are paid separately. This cost is difficult to predict, since everything depends on the publication in the press, since their cost is calculated per square centimeter of text published in print, but the approximate amount of all expenses is from 8,000 rubles.

Please note that before it is excluded from the unified state register of legal entities, a non-profit organization is obliged to submit all reports required by the legislation of the Russian Federation - to the Federal Tax Service, the Social Insurance Fund, the Pension Fund of the Russian Federation, and in addition to the costs of liquidation, it is necessary to remember about payment for the accountant’s work, since if it is not submitted although If there is only one report or there is an outstanding fine (penalty), the organization will not be able to be liquidated.

If the liquidated organization is not registered at a home address, then you should not forget about the costs of maintaining an office, the address of which will be indicated in the press to notify creditors’ claims.

Provided that you refused the premises long before liquidation and in fact the organization is not located anywhere, then problems may arise at the last stage of liquidation indicating the reason for the refusal - providing false information about the location of the organization, and not properly notifying creditors.

How does the liquidation of an NPO differ from the liquidation of an LLC?

Despite the fact that both procedures are carried out on the basis of the law “On State Registration of Legal Entities. persons and individual entrepreneurs" dated 08.08.2001 N 129-FZ, there are many differences between them.

- First of all, the registration authority for most NPOs is the Ministry of Justice , which means that the set of documents will differ from the documents that need to be submitted to the tax office (for example, the number of copies of protocols). The time frame for reviewing documents by the Ministry of Justice also differs significantly from the time frame for reviewing documents by the tax inspectorate. The following are registered with the Ministry of Justice: autonomous non-profit organizations (ANO), foundations, non-profit partnerships (NP), associations of legal entities (associations, unions), public organizations and associations, as well as other NPOs. Not registered with the Ministry of Justice, for example: HOAs, garden partnerships, garage cooperatives.

- Pay attention to the type of NPO and who is authorized to make the decision to liquidate the NPO. An excellent example, in this case, would be the liquidation procedure for a non-profit foundation: the decision to liquidate the fund is made only by the court (Clause 2 of Article 18 of the Federal Law “On Non-Profit Organizations”). You can read more about the fund liquidation procedure in this article.

- There are some nuances in filling out documents related to the liquidation of non-profit organizations, some of which we will try to reflect in this instruction.

How is the liquidation of non-profit associations carried out?

Translated from Latin, liquidation or liguidatio means the end of affairs; in relation to NPOs, it is defined as the termination or completion of activities. Even at the stage of creating a non-profit organization, you need to know what the basic requirements are by law for its liquidation, and familiarize yourself with the step-by-step instructions for completing its activities, which will help you avoid mistakes and problems with the law. It should be taken into account that for different organizational forms of NPOs, the stages of liquidation may differ slightly.

Liquidation of a public organization without registration of a legal entity

It should also be taken into account that a public organization is not always registered as a legal entity, and this is completely legal. In this case, there is no need to make changes to the state register. For all other organizations, this is a mandatory final stage of work, from the moment of which the society ceases to exist.

NOTE : It is also worth noting another stage of liquidation, which is used in relation to commercial organizations. Thus, recently the liquidation of tax LLCs has been occurring quite often, and this is the difference between a commercial organization and a non-profit organization: the Federal Tax Service cannot liquidate a non-profit organization.

Phased liquidation of a non-profit organization

The highest management body of the NPO makes a decision to terminate its activities, after which a liquidation commission is elected, in some cases a liquidator. Then a representative of the NPO is determined who will submit documentation regarding the liquidation of the non-profit association to the appropriate government body, usually the Ministry of Justice. No more than 3 days should pass from the moment the decision on liquidation is made until the documents are submitted.

The following documents must be submitted:

- the decision by which the liquidation commission or liquidator was appointed;

- notarized notice of termination of the activities of the NPO, drawn up in form P15001.

The next stage involves notifying the public about the upcoming liquidation of the NPO. For this purpose, the liquidation commission or liquidator publishes a corresponding statement in the State Registration Bulletin. From the moment of notification, the period of claims for creditors begins, which should not be less than 2 months.

To place a publication in a state publication, you must provide the editor with:

- decision to terminate the activities of the NPO;

- accompanying letter and application for publication;

- a receipt confirming payment for posting information.

After notification of the upcoming termination of activities, the liquidation commission or liquidator examines the affairs of the non-profit association and identifies existing obligations. Then a repayment schedule is drawn up and a reconciliation is carried out with all government funds, tax and other authorities. After this, all established debts must be eliminated.

After eliminating debts and settling obligations, the accounting documentation of the non-profit organization is brought into the required state and an interim balance sheet is determined, which is submitted to the relevant government agency along with form P15003.

If the NPO has registered full-time employees, they must be dismissed after the established obligations are paid off.

At the last stage, the final liquidation balance sheet of the NPO is compiled, which is then approved by the highest management body and submitted along with Form P16001 to the appropriate government agency.

Once an NPO has been excluded from the state register, its activities cease. But it is imperative to take several more important actions - close current accounts, prepare and transfer documentation for storage in the state archive.

As experts advise, after the liquidation of an NPO, it is necessary to retain documentation confirming its exclusion from the state register for 3 years

Features and types of liquidation

You can liquidate an NPO:

- voluntarily (by decision of the highest authority);

- forcibly (by court decision).

The exception is funds: they are always liquidated by court decision. If the liquidation is voluntary, an application to the court can be filed either by a government body - a prosecutor or an authorized body, or by the fund itself - its founders or trustees.

Its management must inform employees and employment authorities about the liquidation of an NPO no later than two months before the start of the process.

Liquidation of non-profit organizations in 2022 – features and nuances.

No non-profit organization is immune from liquidation. Therefore, it should be possible for the governing body to make a decision to terminate the activities of a non-profit association.

There are a number of reasons that lead to the liquidation of an NPO. The main ones are:

- funding stopped;

- the goals set when creating the NPO have been achieved and its continued existence is inappropriate;

- disagreements have arisen between the persons who created the NPO regarding the direction of the organization’s functioning, which makes its further existence impossible;

- obstacles to the activities of a non-profit association from government bodies;

- NPO organizers have lost interest in their activities and do not see the point in their continued existence.

The problem with all non-profit organizations is that the legislation regulating their activities is structured in such a way that it is much easier to create an NPO than to liquidate it later. On the part of the state, this is quite logical and understandable, since the non-profit association carried out certain activities and had obligations to the state, to other organizations and individuals. Therefore, during liquidation, regulatory authorities must ensure that the NPO has met all the requirements provided for by law, namely:

- The organization paid salaries in full to all its employees;

- All obligations and debts to creditors are covered;

- All taxes have been paid;

- All necessary reports for the entire period of existence of the NPO have been submitted;

- Creditors are notified of the upcoming termination of the activities of the non-profit association;

- The property remaining after the liquidation of the NPO is distributed in accordance with the organization’s charter.

List of documents

At the final stage you need:

- an application for state registration of an NPO in connection with liquidation in form No. P15016, which must be notarized (as well as a copy certified by the liquidator);

- receipt of payment of state duty (800 rubles);

- decision or minutes of the meeting of the highest body on approval of the liquidation balance sheet and completion of the liquidation procedure, in two copies, with original signatures;

- certificates from the Federal Tax Service, Pension Fund, Social Insurance Fund about the absence of debt.

After submitting all these documents, an entry is made in the Unified State Register of Legal Entities (USRLE). And the liquidation of the NPO is considered complete.

Legal basis

Who is involved in the liquidation of NPOs?

The decision to terminate the activities of a non-profit organization is made by the highest management body of the non-profit organization. This body also appoints a liquidation commission or liquidator, and approves the interim and final balance sheet.

Depending on the organizational form of the NPO, the supreme body may be:

- General meeting in public non-profit organizations;

- Council or Presidium, according to the charter, in autonomous non-profit associations;

- If the NPO is a foundation, then the decision to terminate its activities is made by the court according to the application of the interested person.

According to the decision of the governing body, the termination of the activities of the NPO is entrusted to the liquidation commission or the liquidator - a person who assumes all responsibilities for completing the affairs.

The liquidation commission or liquidator deals with

preparing and submitting the necessary documentation to the relevant authority;

notification of creditors about the termination of the activities of a non-profit organization;

publication of information about the upcoming liquidation in the state printed publication;

interacts with government funds and authorities when receiving and submitting certificates, notifications and other papers.

An accountant also takes part in the liquidation of an NPO, whose responsibilities include:

- maintaining and preparing financial statements;

- preparation of interim and final balance sheets;

- conducting reconciliations with government funds and creditors;

- solving other problems related to accounting.

At first glance, it may seem that there is nothing complicated in liquidating an NPO.

after the supreme body of the NPO makes a decision to terminate its activities, a liquidator or liquidation commission is appointed. From this moment, within 3 days, the state body is notified that the liquidation procedure has begun;

after the liquidator receives the relevant documents, a notice of the upcoming termination of the NPO’s activities is published for creditors;

after two months from the date of publication, the accountant draws up, and the supreme body approves, an interim and then a final balance sheet. All necessary documents are submitted by the liquidator to the Ministry of Justice;

if the documentation is provided in full, the obligations and debts are closed and there are no claims against the NPO, then the organization is excluded from the state register and its activities are terminated.

If you strictly comply with all the requirements of the legislation of the Russian Federation, then the termination of the activities of an NPO will take place without problems or difficulties. You should know that this is not a very quick process - at least 6 months will pass from the moment the decision on liquidation is made until the cases are completely completed.

But, as practice shows, at present there are a number of nuances that cause difficulties in carrying out liquidation measures. You need to know about them before making a decision on liquidation in order to avoid complications and problems with the law.

IMPORTANT! The most common problems encountered when liquidating an NPO are:

- The termination of activities was not agreed upon by all participants of the NPO - in this case, the conclusion on liquidation may be canceled by the court;

- Not all reports for the full period of activity of the non-profit association have been submitted, which does not allow the NPO to be closed;

- The liquidator was previously disqualified from the state register. Therefore, it is necessary to check for disqualification before appointment, otherwise changing the liquidator may take a long time;

- The address at which the non-profit association was registered was previously recorded in the register as unconfirmed. Before starting the liquidation process, you need to make sure that there is no such record. If it exists, then before notification of termination of activity it is necessary to change the address data in the state register.

If, during the liquidation of an NPO, problems arise that cannot be solved for some reason, then it will have to be canceled and the non-profit association will have to be closed in another way, for example, by reorganizing it.

In practice, there are two more opportunities to complete the activities of an NPO with virtually no effort.

First, transfer it to an NPO. Change the director, founders and management bodies. The NPO is transferred to new owners who pursue similar goals and are full of strength and determination. The fact is that non-profit organizations less than 1 year old have a number of restrictions in carrying out their activities. But having accepted the existing NPO, most of them will be absent.

The second method is the most dubious. To do this, you need to close your bank account, not submit reports to the relevant government agencies, not confirm the continuation of work, that is, not perform any actions, as if forgetting about the existence of the non-profit association.

In this case, the NPO is recognized as inactive and on this basis is excluded from the state register. But, having decided to take such a step, you need to know that because the founders of the organization did not act in accordance with the legislation of the Russian Federation, did not carry out liquidation in accordance with the rules, and the state did this for them, excluding the NPO from the register, all persons participating in this organization are disqualified for 3 years. A record of their disqualification is made in the state register of legal entities. In fact, they are blacklisted, must withdraw from participation in other organizations and will not be able to create a new one for 3 years.

Property of an NPO after liquidation.

The procedure for distribution of property during the liquidation of a non-profit organization must be specified in the organization's charter. As a rule, after settlement with creditors, property is directed to the purposes of a non-profit organization, and if this is not possible, then this property is turned into state income. It is very important to remember that property during liquidation is not distributed among its founders (participants, members).

Distribution of NPO property after liquidation

The general rule that applies to the distribution of the remaining property of an NPO after completion of settlements is established by clause 8 of Art. 63 of the Civil Code of the Russian Federation: they must be directed to statutory or charitable purposes. The rule provided for in Art. 20 of Law No. 7 states that if it is impossible to allocate funds for statutory purposes, they must be turned into state income.

For some NPOs there are exceptions from the general procedure:

- Public organization. The funds remaining after repayment of claims are directed to statutory purposes, and in their absence, to purposes that will be determined by the general meeting or conference of participants of the public organization. In controversial cases, the goals are determined by a court decision. The decision made is subject to publication by the liquidation commission. In case of liquidation on the grounds provided for by the Law “On Counteracting...” dated July 25, 2002 No. 114-FZ, it becomes the property of the Russian Federation (Article 26 of the Law “On Public Associations” dated May 19, 1995 No. 82-FZ).

- Non-commercial partnership. The remaining funds are distributed among members in the amount of property contributions. The remainder is allocated for statutory purposes (clause 2 of Article 20 of Law No. 7-FZ, this rule does not apply to other associations and unions, which include (as a separate type) a non-profit partnership in accordance with subclause 3 of clause 3 of Article 50 of the Civil Code RF).

- Institution. The remaining property is transferred to the owner (clauses 3, 4, Article 20 of Law No. 7-FZ).

Full distribution of assets must be made before completion of the procedure by registering liquidation. If there are disputes between the participants about the thing, it is sold by the liquidator at auction (clause 8 of Article 63 of the Civil Code of the Russian Federation).

Features of the liquidation of a non-profit foundation.

In the case when you plan to liquidate the Fund, it is worth considering that this is a more complicated procedure, since the Fund can only be liquidated based on a court decision and this is a rather lengthy and labor-intensive process, which can sometimes last up to 2 years. With such inputs, the cost of liquidating the Fund starts from 90,000 rubles.

The peculiarity of the liquidation of the Fund, as noted above, is that the Fund is liquidated only through the court. Below we briefly describe the stages of liquidation of the Fund:

1) The interested person draws up an application to the court for the liquidation of the Fund and asks the court to appoint a liquidator

2) The court makes a decision to begin the liquidation procedure of the Fund

3) The court appoints the liquidator of the Fund

4) The liquidator carries out registration actions with the Ministry of Justice about the beginning of the liquidation procedure of the Fund

5) The liquidator publishes messages in the State Registration Bulletin stating that the Fund is in the process of liquidation

6) The liquidator takes measures to identify creditors and collect receivables

7) The liquidator identifies the property of the liquidated Fund

The liquidator carries out all necessary actions for settlements with creditors.

9) The liquidator carries out a reconciliation of the Pension Fund, Social Insurance Fund, Inspectorate of the Federal Tax Service

10) The liquidator draws up an interim liquidation balance sheet

11) The liquidator draws up a liquidation balance sheet

12) The interested party applies to the court to complete the liquidation process of the Fund and approve the interim liquidation balance sheet and liquidation balance sheet

13) The liquidator carries out registration actions with the Ministry of Justice upon completion of the liquidation procedure of the Fund

14) The Ministry of Justice excludes the Foundation from the Unified State Register and the Foundation ceases its activities.

All stages of liquidation of a non-profit organization are carried out strictly in accordance with the current legislation of the Russian Federation and its charter, for example, payment of sums of money to creditors of the liquidated organization is made by the liquidator in the order of priority established by the Civil Code of the Russian Federation, in accordance with the interim liquidation balance sheet starting from the day of its approval, for with the exception of creditors of the third and fourth priority, payments to whom are made after a month from the date of approval of the interim liquidation balance sheet.

The settlement of creditors is carried out on the basis of the financial statements and identified property of the organization, and the remaining property after settlement with creditors is distributed in accordance with the charter of the organization.

Solutions in case of insufficient funds of a liquidated NPO

The order of repayment of debts is determined by Art. 64 Civil Code of the Russian Federation. Also in the Civil Code of the Russian Federation there is an indication that if the NPO does not have funds, the costs of the procedure are borne jointly by the participants or founders (clause 2 of Article 62 of the Civil Code of the Russian Federation).

If a shortage of funds is determined, the liquidation commission is authorized to sell the property of the NPO, guided by the procedure established for the execution of court decisions (clause 4 of Article 19 of Law No. 7-FZ). However, the proceeds may also not be enough.

The question arises: what to do in this case?

There is a general rule that provides for separate property liability of a legal entity and its founders without the possibility of assigning it to each other (Clause 2 of Article 56 of the Civil Code of the Russian Federation). However, for some NPOs, exceptions have been made and additional responsibility for the founders has been established:

- for a consumer cooperative - in the amount of the unpaid part of the contribution (clause 2 of Article 123.3 of the Civil Code of the Russian Federation);

- association or union - in accordance with the charter (clause 4 of article 11 of law No. 7-FZ, clause 3 of article 123.8 of the Civil Code of the Russian Federation);

- a private, government institution - always (clause 4 of article 123.22, clause 2 of article 123.23 of the Civil Code of the Russian Federation), budgetary, autonomous - according to the demands of individuals arising from a tort (clauses 5, 6 of article 123.22 of the Civil Code of the Russian Federation).

Submitting claims in the procedure for applying subsidiary liability falls within the powers of creditors, but not the liquidator (see paragraph 7 of Article 63 of the Civil Code of the Russian Federation, article “What is subsidiary liability under the Civil Code of the Russian Federation?”). The liquidator has the right only to initiate bankruptcy.