What is the difference between reorganization by division and reorganization by spin-off? What are the tax differences between these methods? We'll talk about this in our new video.

Before moving on to the differences between two of the five existing forms of reorganization, let us briefly recall their essence.

When spinning off a newly created organization, part of the assets and obligations of the reorganized company is transferred without cessation of the latter’s activities (Clause 1, Article 55 of Law No. 14-FZ dated 02/08/1998).

The newly created company as a result of the spin-off is subject to state registration.

When one or more legal entities are separated from a legal entity, partial rights and obligations of the reorganized organization are transferred to each of them in accordance with the transfer act (clause 4 of Article 58 of the Tax Code of the Russian Federation). That is, in this case we are talking about partial succession.

It is best to carry out the reorganization procedure with the help of a qualified lawyer. This will help reduce risks and reorganize the organization as quickly as possible.

If a decision to reorganize a company by spinning off another company from it is made in the absence of a quorum (for example, due to failure to notify the company’s participants about a meeting), then such a decision of the meeting is recognized by the court as void and has no legal force (Resolution of the Arbitration Court of the North-Western District dated June 14 .2016 No. A56-58483/2014).

During division, the reorganized company ceases its activities, and all rights and obligations are transferred to the newly created companies (Clause 1, Article 54 of Law No. 14-FZ dated 02/08/1998). That is, in this case we are talking about the complete transfer of rights and responsibilities to the newly created organization.

When a company is divided, its rights and obligations are transferred to the newly established companies in accordance with the transfer act (clause 3 of Article 58 of the Civil Code of the Russian Federation).

Reorganization by division is considered completed from the moment of state registration of the last of the newly emerged companies, and the reorganized organization is considered to have ceased its activities.

I. Stage one - preparatory

Getting acquainted with the materials of colleagues on this site, I came across the fact that for many, reorganization procedures are interesting from a purely technical point of view. But, since in my reorganization project the goals were absolutely white and involved not only the separation of operating activities and main assets of the business, but also the corresponding tax-free transfer of real estate, I attached special importance to this stage.

- Analysis of information on the financial and economic activities of the Company.

- Development of the concept of the reorganization procedure. Making a business decision by the sole participant on the issue of distribution of assets of the reorganized company.

- Development of the Company's charter, created as a result of reorganization through spin-off.

In the context of massive refusals by registration authorities, I recommend finalizing this stage with some kind of conclusion in writing about the “business purpose” of this procedure. The signatures of a lawyer and an accountant on draft documents on their approval and signatures on a written opinion will greatly help you when communicating with the registration authority in the event of a suspension of the reorganization, due, again, to the directive working methods of our tax authorities and the formal approach to such procedures.

Completion of settlements with debtors and creditors

The responsibilities of the reorganized legal entity include notifying all creditors known to it about the start of the reorganization.

Moreover, clause 2 of Art. 13.1 of Federal Law No. 129-FZ establishes the deadline for such notification - within five working days after the date of sending the notification of the start of the reorganization procedure to the body carrying out state registration of legal entities. The form of notification is arbitrary. The notice must indicate the period during which creditors can file claims for debt reimbursement. If possible, settlements should be closed. Unfinished settlements are transferred to the successor institution, or a separate decision is made on them to write off receivables (payables) in the manner prescribed by law.

Counterparties with whom long-term contracts have been concluded, for example, for the provision of utility services, should be informed of the need to re-conclude them with the successor institution and indicate the information necessary for this - new details, contact persons, terms of application.

II. Stage two - preparation of a corporate decision and notification of the registration authority

- Adoption by the sole participant (general meeting of participants) of the Company of a decision on the reorganization of the Company.

- Preparation and submission to the registration authority of a notification about the start of the Company's reorganization procedure in the form of a spin-off in the form P12003.

- Receiving a record sheet about the beginning of the reorganization procedure.

In my opinion, the most boring and uninteresting stage) But, nevertheless, fundamental.

At this stage, we are guided by clause 1 of Art. 13 of the Law on State Registration of Legal Entities and Individual Entrepreneurs , which states that a legal entity, within three working days after the date of the decision on its reorganization, is obliged to notify the registration authority in writing about the start of the reorganization procedure, including the form of reorganization, with the decision attached about reorganization.

The application in the above form is signed by the executive body of the company in respect of which the decision on reorganization was made.

Concept and methods of reorganization of legal entities

Reorganization is the termination of an organization, in which rights and obligations are transferred to other persons, that is, succession.

Methods for reorganizing legal entities are determined by Art. 57 Civil Code of the Russian Federation.

1. Merger - the union of two or more legal entities into a single new legal entity. In this case, the independent existence of the merging organizations ceases. Reorganization of legal entities in the form of a merger is considered completed from the moment of state registration of the newly emerged legal entity.

2. Affiliation - the “infusion” of one or more affiliated organizations into the organization to which the affiliation occurs. In this case, the merging legal entity ceases its activities, all its rights and obligations are transferred to the legal entity to which the merging takes place. Reorganization in the form of affiliation is considered completed from the moment an entry is made in the state register about the termination of the activities of the last of the merging legal entities.

3. Division – formation on the basis of a defunct legal entity of two or more independent legal entities. During division, a previously existing legal entity ceases its activities, and its rights and obligations are transferred to the newly created legal entities. Reorganization in the form of division is considered completed from the moment of state registration of the last of the newly emerged legal entities.

4. Spin-off – the formation of new independent legal entities, while the reorganized legal entity continues to function, and part of its rights and obligations passes to the newly formed legal entities. Reorganization in the form of separation is considered completed from the moment of state registration of the last of the newly emerged legal entities.

5. Transformation – termination of a legal entity and the emergence of a new legal entity on its basis. Reorganization in the form of transformation is considered completed from the moment of state registration of the newly created legal entity.

In case of reorganization in the form of merger, accession, transformation, succession is formalized by a transfer act, in case of division and separation - by a separation balance sheet. The transfer deed and the separation balance sheet must contain provisions on the succession of all obligations of the reorganized legal entity in relation to all its creditors and debtors, including obligations disputed by the parties. These documents are approved by the founders (participants) of the legal entity or the body that made the decision on the reorganization (Article 59 of the Civil Code of the Russian Federation).

IV. Stage four - reconciliation with the Federal Tax Service and languid waiting

- Conducting reconciliation with the Federal Tax Service.

- Providing reports to the Pension Fund.

- Preparation of the transfer deed.

- Obtaining a certificate from the Pension Fund of Russia (optional).

Although we approved the deed of transfer by decision, at the time the decision was made there was no understanding of the composition of the property being transferred, so instead of the second stage, I attributed it to the fourth stage.

Subject to para. 2 p. 3 art. 11 of the Federal Law of 01.04.1996 N 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, when reorganizing the insured - a legal entity, he submits the information provided for in paragraphs 2 - 2.3 of this article within one month from the date of approval transfer act (separation balance sheet), but no later than the day of submission to the federal executive body that carries out state registration of legal entities and individual entrepreneurs, documents for state registration of the legal entity created through reorganization. The norm is scary, but in reality it’s not all that scary. pp. g) clause 1 of Art. 14 of the Law on State Registration of Legal Entities and Individual Entrepreneurs provides that, in the manner of interdepartmental exchange, the Pension Fund of the Russian Federation independently submits such a certificate to the registration authority. We went the classic route and, to be on the safe side, decided to obtain such a certificate to make sure that there were no possible obstacles to completing the reorganization.

Registration

The transfer deed lists all property owned by the company and all its rights and obligations in relation to all debtors and creditors, including those obligations that are disputed by the parties (Clause 1 of Article 59 of the Civil Code of the Russian Federation). In addition, it also determines the legal successor for each specific obligation (that is, it indicates which company each obligation has been transferred to).

The legislation does not establish a standard form of the transfer deed, therefore its form is developed by each company independently. However, when preparing and drawing up a transfer deed, it is necessary to take into account a number of legal requirements, including:

- requirements for specific obligations (established restrictions, encumbrances, rules or deadlines). For example, Article 50 of the Tax Code determines the procedure by which the legal successor(s) of a legal entity must fulfill the obligation to pay taxes of the reorganized company. The obligation to pay the due amounts of fines imposed on a legal entity for committing tax offenses before the completion of the reorganization is assigned to the legal successor of the reorganized legal entity (resolution of the Federal Antimonopoly Service of the West Siberian District dated September 20, 2005 in case No. F04-6122/2005(14931-A27-23 )). At the same time, the legal successor of the reorganized legal entity cannot be held liable for offenses that were committed by the reorganized company and were discovered after the completion of the reorganization (resolution of the Federal Antimonopoly Service of the East Siberian District dated August 16, 2005 in case No. A3329988/04-S3-F02-3911 /05-S1);

- requirements for conducting an assessment of the company's property (in some cases, legislation requires an independent assessment of property, to determine which an independent appraiser is involved - for example, when determining the repurchase price of shares and the conversion rate of shares of one company into securities of another);

- requirements for the preparation of financial statements (Guidelines for the preparation of financial statements during the reorganization of organizations were approved by Order of the Ministry of Finance of Russia dated May 20, 2003 No. 44n). Thus, paragraphs 6 and 7 of the Methodological Instructions determine that it is recommended to draw up a transfer act at the end of the reporting period (year). The value of the property reflected in the transfer deed must coincide with the data contained in the appendices (inventory, transcripts) to the transfer deed in the corresponding valuation. The founders themselves must choose the method of assessing the transferred property. The property of the reorganized company is assessed as follows: fixed assets and intangible assets at residual value; inventories at actual cost; financial investments at original cost.

After the property has been assessed, it is necessary to distribute assets and liabilities among legal successors. In this case, you need to pay attention to the following points:

- property should be distributed in accordance with the statutory activities of the separated (formed) companies and taking into account the functional purpose of the property that is transferred to them;

- with the equity capital it is necessary to transfer the corresponding amount of additional capital;

- the balance of regulatory accounts is transferred with the property;

- the receivables are transferred to the legal successor along with the corresponding amount of the reserve for doubtful debts;

- reserves to secure financial investments are transferred along with the corresponding financial investments;

- the accounts payable of the reorganized legal entity are distributed among the legal successors in proportion to the amount of assets transferred to them. The distribution of the organization's equity capital also occurs. If receivables and payables relate to the same counterparty, it is recommended to transfer them to one of the legal successors.

The basis for drawing up the transfer act is the financial statements prepared as of the last reporting date before the registration of the transfer of property. It is recommended that this reporting be attached to the transfer deed.

In accordance with paragraph 4 of the Methodological Instructions, the transfer act, in accordance with the decision (agreement) of the founders, may include the following attachments:

- financial statements;

- acts or inventories of the inventory of property and obligations of the reorganized organization, which is carried out before drawing up the transfer act;

- primary accounting documents on material assets and lists (inventory) of other property that is transferred during the reorganization of organizations;

- decoding of accounts payable and receivable with mandatory information about written notification within the established time frame to the creditors and debtors of the reorganized organizations that from the moment of state registration of the organization, the property and obligations under the relevant agreements and contracts are transferred to the legal successor.

Thus, the transfer deed, drawn up taking into account the requirements of the law and the specifics of the company’s obligations, must contain:

- general information about the reorganized companies (organizational and legal form, full name of organizations, legal address, type of reorganization, forms and names of new entities, procedure of succession);

- information about property and all obligations in relation to each debtor and creditor by section of the balance sheet, including the use of profit;

- financial statements as of the last reporting date;

- list and value of assets, liabilities and equity capital of the reorganized legal entity, as well as their distribution among legal successors (not only those rights that can be realized are indicated, but also those for which the term has not yet come; obligations that are disputed by third parties; obligations on arrears and payments to the budget; tax calculations for the reporting period).

The transfer act must be signed by the head of the company and the chief accountant, approved by the authorized body (the general meeting of participants or shareholders of the company - subject to the procedure for holding a meeting or when voting in another way and drawing up a protocol with the decisions taken).

If among the documents submitted for state registration of the reorganization of the company there is no transfer act, or these documents do not contain provisions on succession of obligations of the reorganized legal entity, in this case the state registration of the legal entity created as a result of the reorganization will be refused (clause 2 Article 59 of the Civil Code of the Russian Federation).

V. Stage five - “finish line”

- Submission to the registration authority of an application for state registration of a newly emerging legal entity created through reorganization, in form P12001.

- Obtaining a record on the creation of a legal entity through reorganization in the form of separation.

And finally, a month has passed since the second publication in the journal “Bulletin of State Registration”, and we successfully submitted an application in form P12001 with the attachment of the charter of the legal entity being created, the transfer deed, a receipt for payment of the state duty and a certificate from the Pension Fund of the Russian Federation to the registration authority. After five working days, we received the registration sheet.

What are the tax differences between a reorganization by demerger and a spin-off?

Reorganization, both in the form of division and in the form of spin-off, is most often used to optimize taxation (for the application of a special regime, etc.).

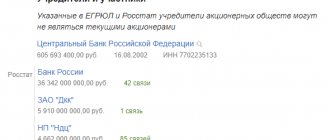

According to the general rule established by Art. 50 of the Tax Code of the Russian Federation, if the reorganized company did not pay or was unable to pay taxes (fees) before its reorganization, then this obligation is fulfilled by its legal successor (legal successors).

If the reorganization is carried out in the form of division, then the legal successor (the person obligated to pay tax (fee) after the reorganization of the company) are the companies that arose as a result of the division (the share of each company is determined on the basis of a transfer deed or on the basis of a court decision).

In the event that the reorganization is carried out in the form of separation, then there is no legal successor. However, spin-off companies may be required to pay taxes based on a court decision (if the reorganized company is unable to fulfill the obligation to pay taxes, penalties and fines in full).

The tax inspectorate must present evidence in court of the reorganized company’s inability to pay off its tax debts. As arbitration practice shows, this is quite difficult to do (Resolution of the Volga-Vyatka District Arbitration Court dated March 12, 2015 No. A28-3813/2014).

VI. Stage six - technical

- Preparation and submission of a package of documents when registering the transfer of ownership of the transferred real estate

- Obtaining an extract from the Unified State Register of Real Estate on registration of the transfer of ownership of real estate

- Organization of document flow in the established Company.

- Organization of accounting and tax accounting in the established Company.

Society has been created.

Assets transferred. By the way, in a tax-free way. That's all. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

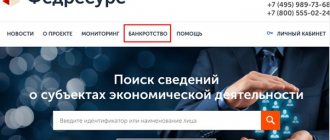

Transfer of rights to real estate in connection with reorganization

This article discusses the legal provisions and features of registration in the Rosreestr of the transfer of rights in relation to real estate, in connection with the reorganization of a Closed Joint Stock Company (hereinafter CJSC) through a merger with a Limited Liability Company (hereinafter LLC).

Thus, the reorganization of a legal entity (merger, accession, division, separation, transformation) can be carried out by decision of its founders (participants) or a body of the legal entity authorized by the constituent document (clause 1 of Article 57 of the Civil Code of the Russian Federation).

In accordance with paragraph 4 of Art. 57 of the Civil Code of the Russian Federation, a legal entity is considered reorganized, with the exception of cases of reorganization in the form of merger, from the moment of state registration of legal entities created as a result of the reorganization. Similar provisions are contained in paragraph 2 of Art. 16 of the Federal Law of 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” (hereinafter referred to as the Law on Registration of Legal Entities and Individual Entrepreneurs).

According to paragraph 1 of Art. 58 of the Civil Code of the Russian Federation, upon the merger of legal entities, the rights and obligations of each of them are transferred to the newly emerged legal entity.

In cases provided for by law, rights establishing the ownership of an object of civil rights to a specific person, restrictions on such rights and encumbrances on property (rights to property) are subject to state registration. State registration of rights to property is carried out by an authorized body in accordance with the law based on the principles of verifying the legality of the grounds for registration, publicity and reliability of the state register. The state register must contain data that allows one to definitely establish the object to which the right is established, the authorized person, the content of the right, the basis for its emergence (clause 1 of Article 8.1 of the Civil Code of the Russian Federation).

According to clause 2 of article 8.1 and clause 1 of article 131 of the Civil Code of the Russian Federation, articles part 3, 6 of art. 1 of the Law on Real Estate, ownership and other real rights to real estate, restrictions on these rights, their emergence, transition and termination, as well as transactions with it, subject to state registration, arise, change and terminate from the moment of state registration by the authorities carrying out state registration rights to real estate and transactions with it and making a corresponding entry in the Unified State Register, unless otherwise provided by law.

Legal capacity, namely the ability to have civil rights corresponding to the goals of the activity provided for in the constituent document, and to bear the responsibilities associated with this activity, of a legal entity arises from the moment information about its creation is entered into the Unified State Register of Legal Entities and terminates when information about its termination is entered into the specified register (Clause 1, 3, Article 49 of the Civil Code of the Russian Federation).

Clause 2 of Article 218 of the Civil Code of the Russian Federation states that in the event of reorganization of a legal entity, ownership of the property belonging to it passes to legal entities - legal successors of the reorganized legal entity

That is, during the reorganization of a legal entity in the form of annexation, the rights and obligations cease, including in relation to real estate, the acquired legal entity, and in the order of universal legal succession, the rights and obligations of the newly reorganized legal entity to which the annexation took place arise.

Since legal succession during reorganization in the form of annexation is universal, the rights to real estate are transferred to the reorganized legal entity, along with other rights. Moreover, in these cases, the moment of transfer of the right to property is associated not with the moment of state registration of rights to real estate, but with the moment of completion of the corresponding registration actions in the Unified State Register of Legal Entities by the body that registers legal entities and the moment of completion of the reorganization.

At the same time, the norms of Art. 84 of the Law on Real Estate imposes the obligation to provide the Department with documents that are the basis for state registration of the declared right on the applicant, except in cases provided for by law (the documents necessary for its implementation must be attached to the application).

Clause 8 of Art. 14 of the Real Estate Law establishes that the grounds for state registration of the presence, origin, termination, transfer, limitation (encumbrance) of rights to real estate and transactions with it are, among other things, other documents provided for by federal law, as well as other documents that confirm the existence, emergence, transition, termination of rights or restrictions on rights and encumbrances of real estate in accordance with the legislation in force at the place and at the time of the emergence, termination, transfer of rights, restrictions on rights and encumbrances on real estate.

It should be noted that in the case under consideration, the moment of emergence of the ownership right to real estate objects in the LLC is associated with the moment of completion of the reorganization and making the corresponding entries in the Unified State Register of Legal Entities, then the grounds for registering such a right in the Unified State Register of Legal Entities are the documents submitted during the implementation of registration actions by the tax authority when making registration entries in the Unified State Register of Legal Entities.

The procedure and features of state registration of legal entities, state registration of changes made to the constituent documents of a legal entity and the introduction of changes to information about a legal entity contained in the Unified State Register of Legal Entities carried out in the event of reorganization, as well as the entry into the Unified State Register of Legal Entities of other entries in connection with the reorganization of legal entities, are regulated provisions, among other things, of Chapters V and VI of the Law on Registration of Legal Entities and Individual Entrepreneurs.

In addition, from the contents of paragraph 3 of Art. 17 of the Law on Registration of Legal Entities and Individual Entrepreneurs it follows that when a legal entity is reorganized in the form of a merger into a registration authority at the location of the legal entity to which the merger is being carried out, an agreement on merger must be attached to the application for making a record of the termination of the activities of the merged legal entity and deed of transfer.

By virtue of paragraph 1 of Art. 21 of the Law on Real Estate necessary for state registration of rights Documents establishing the existence, emergence, transition, termination, limitation of rights and encumbrance of real estate and submitted for the implementation of state cadastral registration and (or) state registration of rights must comply with the requirements established by the legislation of the Russian Federation, and reflect the information necessary for state cadastral registration and (or) state registration of rights to real estate in the Unified State Register of Real Estate. These documents must contain a description of the real estate and, unless otherwise established by this Federal Law, the type of registered right; in cases established by the legislation of the Russian Federation, they must be notarized, certified by seals, and must have the appropriate signatures of the parties or officials determined by the legislation of the Russian Federation.

At the same time, it should be noted that the deed of transfer must be certified by a seal, and also contain the real estate objects declared for state registration.