What are intangible assets? These are objects that do not have a material, physical form, intended for use in the production process, provision of services, or performance of work. Intangible assets (IMA) are the result of intellectual activity, and IMA is not the result of the activity itself, but the exclusive right to use this result.

In the article we will analyze the accounting of intangible assets when they enter the organization. What are intangible assets? What are the methods for entering intangible assets into an organization? What entries reflect the receipt of intangible assets?

The concept of intangible assets

For intangible assets the following basic rules are followed:

- they are intended for long-term use over 1 year;

- not intended for sale;

- must bring economic benefit;

- the value of objects can be reliably determined.

Accounting for intangible assets is regulated by PBU 14/2007.

Intangible assets include the exclusive right to:

- Computer programs, databases;

- inventions, utility models, industrial designs;

- topology of integrated circuits;

- breeding achievements;

- know-how, so-called production secrets;

- trademarks;

- brand names;

- commercial designations;

- business reputation of the organization.

The organization's right to own an intangible asset and its use must be properly documented.

The following may serve as supporting documents:

- evidence;

- patents;

- agreement on alienation of exclusive rights;

- license agreement.

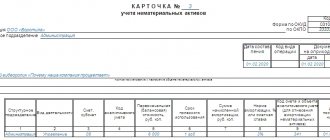

An intangible asset is accepted for accounting on the basis of an acceptance certificate. For each object of intangible assets accepted for accounting, an accounting card, Form IA-1, is filled out.

In which accounts should intangible assets be recorded?

The accounting account for an intangible asset depends on the right under which it was obtained.

| Right | Account | Example |

| Exclusive right | 0 102 XN 000 “Scientific research (research development)” 0 102 XR 000 “Experimental design and technological development” 0 102 XI 000 “Software and databases” 0 102 XD 000 “Other intellectual property” | Exclusive right to software - account 0 102 ХI 000; Exclusive right to a selection achievement - account 0 102 ХN 000; Exclusive right to a trademark - account 0 102 ХD 000; Exclusive right to an invention - account 0 102 ХN 000 |

| Non-exclusive right | 0 111 6N 000 “Rights to use scientific research (research developments)” 0 111 6R 000 “Rights to use experimental design and technological developments” 0 111 6I 000 “Rights to use software and databases” 0 111 6D 000 “Rights to use other objects of intellectual property" | Non-exclusive right to antivirus - account 0 111 6I 000; Non-exclusive right to a utility model - account 0 111 6N 000; Non-exclusive right to an electronic archive - account 0 111 6I 000; Non-exclusive right to a literary work - account 0 111 6D 000. |

Objects of intangible assets are grouped according to clause 37 of Instruction No. 157n. That is, objects received under exclusive right are accounted for in the corresponding account 102 00, where X can take the value 2 “Especially valuable movable property of the institution”, 3 “Other movable property of the institution” or 9 “Property in concession”.

More on the topic: Real estate accounting before state registration

For example, on account 102 91 “Software and databases in concession” information about programs for electronic computers, databases, information systems and (or) sites on the Internet or other information and telecommunication networks that are the objects of concession agreements is subject to reflection. which includes such computer programs and (or) databases, or about the totality of these objects, as well as about operations that change them.

The grouping by type of property, designated by the letters N, R, I or D, corresponds to the subsections of the classification established by OKOF *(3) (clause 67 of Instruction No. 157n, letter of the Ministry of Finance of Russia dated September 17, 2020 No. 02-07-10/81813). Namely, OKOF provides for the following groups of intellectual property objects (OKOF code 700):

- scientific research and development (OKOF code 710);

- software and databases (OKOF code 730);

- other objects of intellectual property (OKOF code 790).

For example, multimedia applications are named in the “Software and Databases” group - OKOF code 732.00.10.08. Consequently, the exclusive right to this object, related to other movable property, is taken into account in account 102 3I. And if an institution has a non-exclusive right to multimedia applications, then it will be reflected in account 111 6I.

Purchase of intangible assets

Upon receipt by an organization, intangible assets are taken into account at their original cost, also called actual cost. Fixed assets are also taken into account in the same way. This cost consists of the cost of the exclusive right to intangible assets and its use in accordance with the contract, patent and other documents, as well as all associated costs (payment of various types of duties, customs duties, related taxes, services of third-party organizations, information and consulting services, etc. ) minus VAT. VAT is allocated from the sum of all costs and sent for reimbursement from the budget.

VAT is not subject to the sale and transfer of the exclusive right to computer programs, databases, inventions, utility models, industrial designs, topologies of integrated circuits, know-how, as well as the rights to use them.

For accounting of intangible assets, account 04 “Intangible assets” is intended; the debit of this account reflects the receipt of the object, and the credit its disposal and write-off.

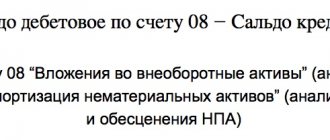

Just as in the case of fixed assets, before getting to account 04, all costs for the acquisition of intangible assets are collected in the debit of account 08 “Investment in non-current assets”, after which, from the credit of account 08, they are recorded in the debit of account 04 .

For these purposes, a separate subaccount 5 “Acquisition of intangible assets” is opened on account 08, the debit of which reflects all costs.

Example:

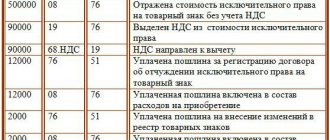

An organization acquires the exclusive right to a trademark under an alienation agreement. The costs are as follows:

- The cost, according to the agreement, amounted to 590,000 rubles, including VAT of 90,000 rubles. (the right to a trademark is subject to VAT).

- A fee of 12,000 rubles was paid for registration of the agreement.

- For making changes to the register of trademarks, a fee of 2000 rubles was paid.

How to accept an intangible asset for accounting, how should the entries be made?

Postings when purchasing an intangible asset for a fee:

Creation of an intangible asset

In addition to the fact that an intangible asset can be acquired for a fee, that is, purchased, it can also be created on behalf of an organization on its own or with the involvement of third-party services.

In this case, the intangible asset is taken into account in a similar way at its historical cost, consisting of the cost of all expenses associated with the creation of the intangible asset.

Expenses in addition to paying duties and fees can also include remuneration of their employees involved in the creation of an intangible asset, as well as insurance premiums accrued to them, the cost of services of third-party organizations, expenses for research and other equipment used in the process of creating intangible assets, as well as depreciation accrued on them.

In a similar way, all expenses are collected on the debit of account 08, after which one transaction for the total amount is sent to account 04 (posting D04 K08).

Features of calculating amortization of intangible assets

In the process of using an intangible asset, its original cost is gradually written off using depreciation charges. From the 1st day of the month following the month of receipt, it is necessary to calculate depreciation and write off its amount as expenses. The cost of intangible assets is written off using depreciation charges throughout the entire useful life of the asset.

Useful life of an intangible asset

Establishes at the time of its acceptance for accounting.

This period for an intangible asset can be either the period specified in the document for the exclusive right to an intangible asset, or the period during which it is planned to use this asset in order to obtain economic benefits.

In the first case, the useful life is the period for which the enterprise is given the right to use this asset; this period is prescribed in the documents on the basis of which the exclusive right was obtained (patent, certificate, etc.). For example, if an exclusive right to use a computer program has been obtained for 3 years, then this period is taken as the useful life of the intangible asset (36 months).

In the second case, the organization itself determines the period based on the planned period of obtaining economic benefits from this intangible asset. The only point is that this period cannot be less than 1 year.

The selected useful life must be reflected in the accounting policies of the organization.

Postings for depreciation

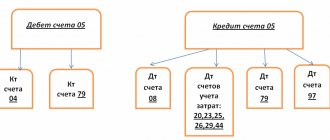

The Chart of Accounts contains account 05 “Depreciation of intangible assets”, which can be used to calculate depreciation. The calculated amount of depreciation is written off monthly by posting D20 (44) K05.

It must be said that it is not at all necessary to use accounting account 05 for the purpose of writing off depreciation. You can do without it by writing off monthly depreciation directly from the credit of account 04 on which the asset is listed. In this case, the depreciation entry has the form D20 (44) K04.

Methods for calculating amortization of intangible assets

To calculate depreciation charges, you can use one of three available methods:

- Linear

- Reducing balance method

- Method of writing off cost in proportion to production volume

By the way, to calculate the depreciation of fixed assets, 4 methods are used; to the above, the write-off method is added by the sum of the numbers of years of the useful life.

As for the three methods for calculating depreciation for intangible assets, these methods were discussed in detail when studying fixed assets. The calculation principle for intangible assets does not change. Below we will briefly discuss each of them.

Linear method

It is characterized by uniform write-off of the value of intangible assets, which is very convenient for the organization. This method is the most popular and most often used by organizations.

With the straight-line method, the same amount of depreciation is written off every month, which is calculated using the formula:

Am. = initial cost of intangible assets * depreciation rate / 100%,

Where the initial cost of intangible assets is the cost at which the asset is accepted for accounting in the debit of account 04, and the depreciation rate is calculated as 100% divided by the useful life.

Example of calculation using the linear method:

NMA has the first article. 100 thousand rubles, useful life 4 years. Straight-line depreciation is calculated as follows:

Norm = 100% / 4 = 25%

Am. per year = 100,000 * 25% / 100% = 25,000.

Am. per month = 25,000 / 12 = 2083.33.

Reducing balance method

This method is also called accelerated. It is characterized by a decrease in the amount of depreciation charges with each year of operation. This is ensured by using an acceleration coefficient that the organization sets independently.

With this method of calculating the depreciation of intangible assets, in the first years the largest value of the asset is written off, which allows for a faster return of funds invested in the intangible asset.

If the organization’s non-current funds are quickly updated, then this method is convenient for the organization. But, accordingly, depreciation costs in the first years are maximum, which increases the cost of products and goods. That is, the method has its pros and cons.

Depreciation is calculated using the reducing balance method using the following formula:

Am. = residual value * depreciation rate / 100%.

Norm = 100% * acceleration factor / useful life.

How to calculate depreciation using the reducing balance method, where an example of calculation is given for a fixed asset; for intangible assets, the calculation principle is similar.