In the guide for the novice accountant - “Basics of Accounting” we have collected the most interesting and practical articles in the following sections:

| basics of accounting authorized capital and founders cash accounting non-current assets inventories accounting calculations accounting in production wage accounting vacation accounting and vacation pay calculation | maternity benefits accounting and calculation of sick leave dismissal of an employee business trip other personnel items accounting of expenses accounting of financial results other |

| For better navigation through articles, the following designations are used: – the best article according to users. – active discussion of the article in the comments. – an article with many practical examples. |

Authorized capital and founders

The authorized capital determines the size of the organization's property and directly affects the financial assessment by creditors and investors. You will learn below how to account for the authorized capital and pay the founders.

|

|

Terminology

The definition of accounting has been around for centuries and has not changed in that time: it is the process of identifying, measuring and presenting summarized economic information in monetary terms about an organization for the purpose of making informed decisions by its users. That is, accounting is:

- determination of the organization’s own and attracted capital, assets and liabilities, income and expenses, cash flow and other material assets, as well as the company’s liabilities;

- measuring the monetary value of key financial components in a manner that provides a true and fair picture in the financial statements;

- provision of financial reports to the owners of the organization and authorized bodies as users of information.

The contents of accounting include:

- special methods of data processing (balance sheet, chart of accounts, double entry method, etc.);

- reflection of all economic means and processes in monetary (value) terms;

- complete and continuous documentation of all operations;

- systematic recording in accounting registers of all completed business transactions;

- Carrying out regular control activities to verify the accuracy of accounting data (drawing up a balance sheet, conducting inventories, drawing up reconciliation reports with counterparties, etc.);

- Continuity of accounting: not a single business transaction of the company can be missed and must be recorded by an accountant.

As a result, the chief accountant or other authorized person of the company must at any time reliably assess the financial position, solvency and development prospects of his company.

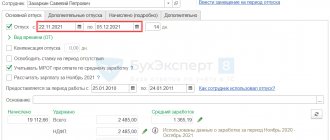

Payroll accounting

Payroll accounting is a key element of an organization's accounting system.

|

Accounting methods

| Name | Description |

| Documentation | Each fact of the company’s activity, any receipt or disposal of property, receipt of income and incurrence of expenses is documented by primary documents. |

| Grade | For data comparability and the possibility of reflecting them in reporting, assets and liabilities are assessed |

| Inventory | The data reflected in the accounting must be periodically compared with actual data. For this purpose, a regular inventory of the property and liabilities of the enterprise is carried out. |

| Calculation | A method for determining the cost of products and services. Provides for the calculation of actual production costs in monetary terms. Used in cost planning and for control in the final analysis of production efficiency. |

| Accounting system | To reflect the state and movement of each accounting object, a separate accounting account is opened. The system of accounts generates an accounting chart of accounts. In the Russian Federation, each company approves it independently, using as a basis the chart of accounts approved by Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000. |

| Double entry | Each accounting account consists of two parts: debit and credit. Reflection of a transaction as a debit to one account is necessarily accompanied by its reflection as a credit to another. Accordingly, at any point in time, a balance equality must be satisfied: the sum of the debit turnover of all accounts must be equal to the sum of the credit turnover. This method allows you to ensure completeness of data reflection and avoid data loss. |

| Drawing up balance sheets and reporting | Ultimately, the accounting system must ensure the preparation of reports that reliably reflect information about the property and liabilities of the organization, sources of financing activities, the results and financial condition of the company. |

Maternity benefits

The employee has the right to receive maternity benefits. The main aspects of calculating payments are considered.

|

Accounting

The organization of accounting in an organization begins with the formation and approval of accounting policies. The objects are the company's property, its obligations and business transactions carried out in the course of its activities. In addition to preventing negative business results and obtaining a complete picture of the state of affairs of the company for every day of work, the accountant receives data for calculating taxes and paying them to the budget.

To ensure the tasks assigned to the accountant, he must adhere to certain principles that are common to all:

- ensure data autonomy, i.e., take them into account only in relation to one organization;

- apply the double entry method (use a chart of accounts and postings);

- ensure objectivity and impartiality of data;

- exercise caution and caution, avoid dubious transactions;

- ensure regular recording of data on all operations and summing up;

- maintain confidentiality;

- depending on the accounting policy, use the accrual method (accounting for transactions as they occur) or the cash method (accounting for transactions as they are paid for);

- use the national currency of the Russian Federation (ruble) for calculations.

Accounting features may differ depending on the status of the company, its legal form and the chosen tax regime. For example, a small business has the opportunity to take into account data and submit reports in a simplified manner.

Accounting and calculation of sick leave

An employee has the right to receive sick pay due to health reasons. Let's consider the key stages of calculating an employee's sick leave.

|

Reporting

It is better to appear incompetent in front of senior colleagues first than to appear incompetent in front of tax authorities and superiors later.

The younger generation of accountants sometimes somewhat overestimate the capabilities of modern technology and their own strengths. As a result, both the job and the reputation of the young specialist may suffer. Among those who have recently joined the accounting profession, there are many of the so-called “Generation 1:C”. These people submit to the tax and statistical authorities what the program gives them. They are not at all worried that the balance on the current account may be in credit, or that the depreciation on the fixed asset has already exceeded its original cost three times. Software tools are not yet endowed with intelligence and do not represent the real state of affairs in the organization. The only thing they can provide is the mandatory presence of a double entry algorithm in computer wiring. You can be 100 percent sure that the balance will definitely come together! So they bring reporting forms to the inspectors, filled out according to the “bear stepped on your ear” principle. An experienced inspector will find errors even when checking simple compliance when filling out lines in different reporting forms. The inspector will certainly want an explanation. How will the communication end? Here's a practical example. An audit of a waste removal company's records has resulted in multimillion-dollar fines. It started when the accountant, having submitted the annual reports, was unable to link the indicators of 1–5 forms of financial statements. Therefore, it is important to be careful when sending reporting forms signed personally and by the CEO. The latter, unfortunately, does not always understand what absurd figures he puts his signature under.

Among those who have recently joined the accounting profession, there are many of the so-called “Generation 1:C”. These people submit to the tax and statistical authorities what the program gives them.

Expense accounting

|

|

"Primary"

If a young accountant plans to send an income tax return on the 28th from the Central Telegraph at 23.59, then he should keep in mind that this tax had to be transferred to the budget by 15.00. Otherwise - delay, fine, penalties.

Don’t doubt it – it will take years to master the primary documents. It is only at first glance that the “receipts” and “consumables” can be filled out with ease. You also don’t have to rely on the fact that it is enough to repeat the work algorithm after your predecessor or “one familiar accountant.” It is necessary to read the primary sources! For example, cash transactions are regulated by a special procedure for their conduct and corrections in them are unacceptable. It is also important to ensure that all documents are promptly marked with the visas required by law. People tend to quit on the same day or go on sick leave. Later, the manager or tax inspector will ask the accountant for these shortcomings.

An important point related to the “primary” relates to invoices and acts of work performed, write-off acts or documents providing accounting of fixed assets. Sometimes the flow of primary documentation is so large that it seems that some transactions can be reflected a little later. Tomorrow or the day after tomorrow... after all, nothing bad will happen if some of the documents just lie under the keyboard for a day or two. But imagine that another colleague did not have time to finish the cash book and fell ill. In this case, it will take a week or a week and a half to replace it. Responsibilities will unexpectedly expand to the “restoration” of the cash register for cash register checks that do not exist. The predecessor simply kept it all in his head, and hid the Z-reports, for example, under the system unit. The consequences are not difficult to imagine - violation of the cash limit, uncertainty with the cash balance... That is why the accountant must end each working day as if it were his last, no matter how fatal it may sound. Be careful – there are no trifles in accounting work.”

Dmitry Vasiliev, financial director of the company