Procedure for making advance payments

Deadline for payment of land tax for the 3rd quarter (clause 1 of Article 397 of the Tax Code of the Russian Federation):

- no later than November 8, 2021 (postponement from October 31 + postponement due to non-working days).

Accountant's calendar for the fourth quarter of 2022 for the payment of taxes and fees

Who is required to pay:

- Organizations: which have property recognized as an object of taxation;

- in the region (municipal entity) in which the payment of advance payments is established.

What are advance payments for land tax, and to which entities do they apply?

In Chapter 31 of the Tax Code of the Russian Federation there is a rule according to which municipal authorities not only establish the land tax itself, but can also formulate regulations according to which it will need to be calculated and paid for certain categories of taxpayers.

Advance payments are periodic payments in parts that make up the total amount, in this case, land tax.

This payment procedure may be applied subject to several conditions:

- The payer of the type of payment in question is a legal entity;

- If such a payment procedure is provided for by the corresponding approved regulations of the municipality, which establishes reporting periods for land tax.

Thus, if the local authorities have not established reporting periods, then there is no need to make advance payments, and the land tax is paid in a lump sum.

In order for a specific organization to find out whether there is a need to make advance payments, the accountant must:

- contact the relevant Federal Tax Service at the place where the company is registered for advice;

- look at the official website of the Federal Tax Service of Russia, where in the section “Reference information on rates and benefits for property taxes” you can find the municipality’s decision on establishing reporting periods and advance payments.

Setting up land tax advances in 1C

Setting up advance payments in 1C Accounting 8 is done in the Main section - Taxes and reports - Land tax.

Set

the Advances are paid flag the Payment of advance payments , then the land tax will be calculated quarterly.

Further sequentially:

- Registration of land plots — check the relevance of data on registered areas. If necessary, update the data by creating a new record Registration of land plots the start date of the new indicators.

- Ways to reflect expenses — make sure that the method for reflecting accrued tax in accounting and accounting expenses has been established.

Calculation and payment of advance payment for land in 1C 2021

Do legal entities need to pay advance payments for land tax?

All land plots (exceptions are described in Article 389 of the Tax Code of the Russian Federation) that are used by legal entities and individuals to carry out commercial activities are subject to taxation. Individual entrepreneurs and commercial organizations need to remember the following:

- the base that is used when calculating land tax is the cadastral value of the plot (it is revised by the relevant authority once every 5 years);

- tax period – calendar year;

- Legal entities and individuals independently calculate the tax, after which the accrued tax liabilities are transferred to the budget, and reports are submitted to the local tax service.

Legal entities, in accordance with the Tax Code of Russia (Article 393), must pay advance contributions.

Monitoring the procedure for paying the land deposit and advance payments is the responsibility of municipal authorities. It is they who must, at their level, adopt the appropriate law, in which business entities can be exempted (Tax Code of the Russian Federation, Article 393, paragraph 3) from the obligation to pay an advance to the budget.

If legal entities fail to pay advance land tax payments on time, no penalties will be applied to them. In this case, only a penalty will be charged for each day of delay.

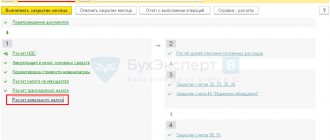

Calculation of advances on land tax in 1C

The calculation of the advance payment for land tax for the 3rd quarter is carried out as a routine operation when performing the Month Closing for September from the Operations .

After completing the operation, data on the calculation of the advance payment for the reporting period is recorded Land Tax Calculation

A posting is generated in accordance with the Method of reflection in expenses (Main - Taxes and reports - Land tax - link Methods of reflecting expenses).

Postings

After carrying out the regulatory operation Calculation of land tax, generate a calculation certificate of the same name. PDF

Calculation of advance payments for land tax in an incomplete year

Advance payments for plots purchased or sold during the year are calculated taking into account the number of full months of ownership of the resource. In this case, a month is considered complete if the right of ownership is registered before the 15th day inclusive; registration of the object after the 15th day excludes this month from the calculation of the advance payment. So, if the registration of the right to own a plot occurred on October 20, then in the 4th quarter the number of full months for calculating the tax will be 2.

The same rules apply when terminating land ownership rights: a full month will be the registration of this action before the 15th. For example, when selling a plot on October 15, the number of full months of ownership will be 10, and on October 16 – 9.

The advance amount for an incomplete year is calculated using the formula:

- Ang = (Sk X Sn / 4) X (Kpm / 3), where Ang is an advance payment for less than a full year.

Payment of land tax

It is convenient to pay tax from the Main - Organizational Tasks section.

Click the Pay to generate a payment order to pay the tax.

Directory of Payment Orders 2021

We looked at how in 1C 8.3 Accounting to set up and calculate advance payments for land tax for the 3rd quarter of 2022, the timing of payment of advance payments for the 3rd quarter of 2022, the tax register for land tax.

Payment of land tax for 2022

Both organizations and individuals and individual entrepreneurs must pay land tax for the year. How to determine the amount of tax, in what time frame must payment be made, and who has the right to count on benefits?

Who pays land tax

Land tax is paid by owners of land plots and persons with lifelong inheritance to land. Tax is not paid in the following cases:

- if the use of the land plot is free of charge or temporary;

- if the site is rented;

- if the site has no taxation.

Taxpayers can count on the following benefits:

- local, established by local governments;

- federal: the tax is not provided for indigenous peoples, and citizens listed in Art. 391 of the Tax Code of the Russian Federation can count on reduced taxes.

In some regions, the tax does not apply to disabled people of groups 1 and 2, WWII veterans and citizens affected by the accident at the Chernobyl nuclear power plant.

In other areas, the tax may not apply to both legal entities and individuals. The law also provides for tax reduction. Thus, the capital's sanatorium-resort organizations and medical institutions enjoy land tax benefits of up to 30%. And in Yekaterinburg, Heroes of the Soviet Union enjoy benefits of up to 100,000 rubles.

Due date

From 2022, submitting a land tax return is no longer required. Payment is made on March 1 for the reporting year. That is, payment of tax for 2022 must be made no later than the specified deadline - March 1.

Payment of tax for 2022 by individuals and individual entrepreneurs must be made no later than December 1, 2022. Payments can also be made quarterly. Advance payments may be provided for by legislative acts of local authorities.

Land tax rates

Land tax rates in 2022 have not undergone any changes:

- 0.3% for agricultural land plots, summer cottages and for plots used by the army for the defensive purposes of the state;

- 1.5% for other categories of land.

Subjects can set their own rates, which should not exceed the rates adopted at the federal level.

How is land tax calculated?

Land tax is calculated using the formula: Land tax = Tax base x Tax rate.

Tax base – cadastral value of a plot of land as of 01/01/2020. This information can be obtained by making a request to Rosreestr or visiting the official website of the department. You can familiarize yourself with the tax base in more detail by studying Art. 391 Tax Code of the Russian Federation.

If the owners of a land plot are several persons and land was bought or sold in the reporting year, land tax will be calculated using a different formula: Land tax = KSTx STx D x Kv , where:

Kst – cadastral value;

St – tax rate;

D – share of ownership of the land plot;

Kv – coefficient of land ownership per month.

When calculating the last position, the following features must be taken into account:

- if the purchase of the plot was completed before the 15th day of the current month, then the month is included in the calculation. If after the 15th, then the month is not taken into account;

- if the sale of land to owners occurred after the 15th, then this period of time is not taken into account for calculating tax.

What is the procedure for paying land tax?

Tax calculation and payment in advance is carried out by organizations independently, if this is stipulated in local laws. We would like to remind you that from 2022, land tax declarations should not be provided by organizations.

For individual entrepreneurs and individuals, tax inspectors carry out calculations and send payment notices to the taxpayer’s postal address. The notification indicates the amount of tax, data on the object of taxation, tax base, rate and payment deadline.

The notice must be sent to the taxpayer no later than November 1, 2021. If it has not arrived within the specified period, you must independently find out the amount of tax and pay it by contacting the tax authority. Late payment of tax or transfer of not the entire amount, as a rule, becomes the reason for the application of sanctions:

- a fine of 20% of the tax amount for an unintentional offense;

- a fine of 40% of the tax amount if the offense is intentional.

To avoid making a mistake in payment, you must carefully check the KBK.

Land tax for the year must be paid in accordance with the cadastral value of the land plot until 03/01/2021 for legal entities and until 12/01/2021 for individuals and individual entrepreneurs. Rates and benefits are regulated by local legislation. all articles

The most frequently asked questions regarding the calculation of land tax

Question No. 1. How to calculate the amount of land tax?

To do this, it is enough to multiply the cost of the land plot (cadastral) tax rate and the area of the land plot.

Question No. 2. Where and when is a cadastral passport for land issued?

After land surveying has been carried out, the owner of the plot must be issued with the appropriate document in the cadastre, which is necessary to register it as private property.

Question No. 3. What should we do if, after paying the land tax, we found out that the cost of the plot was indicated incorrectly?

In the event that Rosreestr made an error that affected the amount of land tax, it must be recalculated for all periods in which these values were applied.

Question No. 4. If we believe that regulatory authorities use the inflated value of a land plot when calculating taxes, what should we do?

If such a situation arises, you need to go to court with a statement of claim. If during the proceedings you are able to justify your position, the court will rule in your favor. Based on this, the land tax will be recalculated.

Question No. 5. I am the owner of a small company, I work for the simplified tax system. Do I need to submit a land tax return?

Those who use the simplified taxation system do not need to submit reports. You only need to make advance payments.

Advances on land tax in 2022

Whether or not it is necessary to pay quarterly advances during the year for land tax (hereinafter we will use the abbreviation ZN) depends on local legislation in the region in which the land is located.

You can find out how ZN is paid for a specific area by referring to special reference books on the Federal Tax Service website.

In 2022, regions can introduce or eliminate the advance tax payment procedure, but cannot set their own payment deadlines. If there are advances, they must be paid according to uniform deadlines, before the last day of the month following the 1st, 2nd and 3rd quarter.

The amount of the advance is determined as a quarter of the amount paid for the full year.

Advance = Tax base X Tax rate X 1/4

In the vast majority of cases, the cadastral value of the land serves as the base. As an exception, in regions where cadastral valuation has not yet been completed, the base can be determined by the standard price of land (for example, in Crimea). But this is a temporary phenomenon.

The ZN rate is also set by the region. Information on the applicable rate can also be found in the reference section of the Federal Tax Service website.

Land tax benefits

Some payers may be able to take advantage of federal and local incentives. If the tax authority has information about the payer's right to a benefit, it will be taken into account when calculating the tax. But if the taxpayer noticed upon receiving the notification that the benefit was not taken into account, he needs to submit an application to the Federal Tax Service using the form from the order dated November 14, 2017 No. ММВ-7-21 / [email protected] The application is provided only once - then the benefit applies automatically.

Federal benefits

The indigenous peoples of the North, Siberia and the Far East, as well as their communities, do not pay land tax on plots that are used to preserve their traditional way of life.

When calculating the tax for certain categories of payers, the base is reduced by the cost of 6 acres of land area. The benefit is valid for disabled people of groups 1 and 2, Heroes of the USSR and the Russian Federation, WWII veterans, pensioners, parents of large families, and Chernobyl survivors. The full list of preferential categories is in paragraph 5 of Art. 391 Tax Code of the Russian Federation.

If there are several plots, the tax exemption benefit for 6 acres is valid only for one of them. The payer himself can choose which one. To do this, he needs to submit to any Federal Tax Service a notification about the elective land plot in the form approved by Order of the Federal Tax Service dated March 26, 2018 N MMV-7-21/ [email protected]

Local benefits

Representative bodies of municipalities may, by their acts, introduce additional benefits for certain categories of citizens. They allow you not only to reduce the amount of land tax required to pay, but also not to pay it at all.

To obtain information about established land tax benefits, you can use a special service on the tax service website.

Free accounting services from 1C

Calculation of ZN

The amount of tax payers for individual payers is determined by the tax authorities, and organizations evaluate the tax payer independently. To check the correctness of the ZN, you can calculate it yourself using the formula:

N=K*S*M/12, where:

- N – land tax, rub.;

- K is the cadastral value of the land plot as of January 1, rubles;

- C — tax rate, %;

- M - time of land ownership (month).

In addition, when calculating the salary, the share of the right to the land and the available benefits must be taken into account.

When calculating ZN, the value of KS can be found on the Internet on the Rosreestr website in the “Public cadastral map” section. To do this, you must indicate the site number or its address.

A table will be issued showing the area of the land plot and its cadastral value.

In accordance with the Tax Code (Article 394), the tax rate should be no more than 0.3% for plots used:

- for agricultural production;

- for dwellings;

- for subsidiary farming, gardening, dacha farming;

- for the defense or security of the country.

The tax rate for memory for other purposes should not exceed 1.5%.

Calculation examples

Example 1

Calculate land tax for the full year 2016 for ZU No. 103 SNT “Inventor” in the Zaraisky district of the Moscow Region. Cadastral number ZU 50:38:0050302:210. The plot belongs to a pensioner.

To calculate, you need to do the following:

- Go to the Rosreestr website (https://pkk5.rosreestr.ru)/

- In the “Plots” section, dial the cadastral number of the land plot.

- A table will appear. Storage area = 600 sq.m. Cadastral value = 203640 rub.

- To determine the tax rate, go to the Federal Tax Service website (https://nalog.ru/m50/service/tax/) to the “Certificates and benefits” section

- Select the territory (Zaraisky district), type of tax (land) and tax period (2016).

- Find the section “Zaraisk urban settlement”.

- You are viewing the "Bets" section. For gardeners the rate is 0.3%.

Checking the availability of local benefits according to the Decision of the Zaraisk Council of Deputies “On Land Tax” shows that there are no benefits for this category of owners.

Then the ZN for this section will be equal to: N=K*C=203640*(0.3/100)=610.92 rubles.

Example 2

The charger is used for gardening and has KS = 800,000 rubles. It is jointly owned by two brothers, one of whom is disabled of the 2nd group. The ZN tax rate in this area is 0.3%.

Determine the ZN that will be paid by each of the ZU owners.

The first owner - a disabled person of the 2nd group must pay ZN:

H1=(K-10000)*C*Kd=(800000-10000)*(0.3/100)*0.5=1185 rub.

In the formula, Kd = 0.5 is a coefficient that takes into account shared ownership of property.

The second owner must pay:

H2=K*S*Kd=800000*(0.3/100)*0.5=1200 rub.

As can be seen from the calculation results, the benefit for a disabled person is only 15 rubles.

The establishment of an easement can occur both with the consent of the owner (private) and without his consent (public). How to properly buy a plot of land from the owner and what nuances should be taken into account? Find out about it here.

Why is land surveying tedious and in what cases is it mandatory? You can read more about this in our article.