When does the taxpayer become aware of errors?

When sending the initial VAT return to the tax office, the taxpayer may not even suspect that inspectors will find errors in it.

Moreover, these errors can arise not only through the fault of the taxpayer himself (due to inaccurate filling, technical errors, etc.), but also in connection with any actions/inactions of his counterparties. Attention! Starting from the report for the 3rd quarter of 2022, the VAT declaration must be completed in an updated form, as amended by the Federal Tax Service order No. ED-7-3 dated March 26, 2021 / [email protected] The changes are related to the introduction of a goods traceability system.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

For example, the partner will not reflect the invoice issued to you in the sales book. As a result, he will not only underestimate the amount of sales and VAT in his declaration, but will also cause a lot of trouble for you, the recipient of the invoice:

- You will be forced to give explanations to the controllers.

- There is an increased risk of denial of VAT deductions on an invoice reflected in your purchase book and not recorded in the sales book of your counterparty.

How will you know that your counterparty did not reflect the invoice in the sales book or the data was distorted? It's simple: you will receive a request from the tax authorities to provide explanations in connection with the discrepancies identified during the audit of the declaration. The annex to the request will list the errors and their codes. We'll talk about this in more detail below.

Additional and universal drivers

If your local network uses computers and laptops with different versions of Windows (XP, 7, 8, 10) and bit depth (32 or 64 bits), then installing the appropriate driver versions is required.

- Find your printer in the list of installed devices in the control panel.

- Go to “Printer Properties”.

- Then go to the “Access” tab.

- At the bottom, find and click the “Advanced” button.

- In the window, mark the required versions and install.

Using a universal driver, which all manufacturers of printing equipment provide with their products, will help get rid of error 0x00000002 if it occurs due to a conflict in the printer software on different versions of the operating system.

To use this option you should:

- Download it from the manufacturer's website.

- Remove named device drivers from all clients.

- Install a universal driver on all PCs that use the printer.

Codes that will tell you about errors in your VAT return

Using the figure below, you can quickly and clearly get acquainted with the coding of errors detected using ASK VAT (automated system for monitoring data from VAT returns):

You can find out what error codes 5 to 9 mean and how to respond to them in ConsultantPlus. You can get trial access to the K+ system for free.

In the following sections we will dwell in more detail on the reasons for the occurrence of errors with individual codes and the subsequent actions of the taxpayer.

Network settings

Working group

We double-check that all computers or laptops used when working with the problematic printer are in the same workgroup. On each of them, go to the PC properties and look at what is indicated in the “Workgroup” field. You need to specify the same one on all PCs.

Firewall and Antivirus

Disable the firewall and antivirus if you have it installed.

In this case, it is recommended to disable it only to identify and resolve an error with the printer. In the future, protection services must be started, but exceptions must be configured for the network device. UDP ports 3702, 5355, 137, 138, 1900 and TCP ports 5357, 5358, 139, 445, 2869 must be open.

- In the search bar of the Start button, enter the word "Firewall". In the list found, click on the corresponding shortcut.

- On the left, select the Enable or Disable link.

- For each network type, select the value next to the red shield.

- Save your changes.

Local port

Essentially, this will be installing a network device.

- Go to the device control panel. Windows+R and the control printers command will help you do this quickly.

- Click on the button on the top panel that says “Install”.

- In the new window, select "Local".

- We will create a new port of the “Local Port” type.

- The port name means indicating the IP address of the device and its network name. Read more about how to find out the IP address in our article.

- Next you have to install the necessary drivers. Follow the installation wizard instructions.

- At the very end, try printing a test sheet.

Code 000000001: there are deductions, but no accrual

Error code 0000000001 in the VAT return indicates the presence of a “tax gap” - when the VAT ASK was unable to match the data in the supplier’s sales book with the data in the buyer’s purchase book. The reason for this gap may be:

- Negligence of the counterparty: he did not submit a VAT return for the same period or reflected in the submitted declaration data that did not allow identifying the invoice and comparing it with the invoices of the counterparty.

- The seller’s dishonesty: instead of actual sales, he reflected zero values in the declaration.

- Buyer's carelessness: mistakes were made when filling out the purchase book.

What are the grounds for refusing a VAT refund, read here.

The figure below shows the possible causes of error code 0000000001 and the procedure for compiling explanations:

In most cases, error code 0000000001 will appear in the tax authorities’ request if you worked with shell companies. They are the ones who most often submit zero VAT returns or do not report to the tax authorities at all.

An example of preparing explanations for a VAT return from ConsultantPlus: Organization "Alpha" received a request from the tax inspectorate to provide explanations for the VAT return for the first quarter of 2022. The request was received electronically via TKS. The appendix to the request contains the error code “1” in section. 8 declaration for the purchase of goods from the Beta organization. This means that the inspection found contradictions between the data in the buyer’s purchase book and information from the seller’s sales book. The accountant of the Alpha organization verified the data... You can view the entire example in K+, having received a free trial access.

Code 000000002: looking for our mistakes

Error code 0000000002 in a VAT return means that there is a discrepancy between the purchase and sales ledger of the reporting company for the same transaction. Here we are not talking about inconsistencies between the declarations of the seller and the buyer, but about discrepancies within the reporting of the company (or individual entrepreneur) itself.

If tax is first assessed and then deducted, the same invoice is recorded in the purchase and sales ledger. How does this happen in practice?

Example 1

Almira LLC (supplier) received an advance payment from Sigma Lux LLC (buyer) and charged VAT on the amount. When shipping products, the supplier declared a deduction of accrued advance VAT (clause 6 of Article 172 of the Tax Code of the Russian Federation). These two operations will compare the VAT ASK.

If there is a deduction in the declaration, but the tax is not charged, the system will generate a request with error code 0000000002. Having received an inspection request with this error code, Almira LLC:

- checks whether the advance invoice is registered in the sales ledger;

- Having identified an advance invoice not reflected in the sales book, he draws up an additional list for the sales book (for the period of receiving the advance payment), pays additional tax and penalties, and also submits an updated declaration.

Almira LLC will receive the same error code if it calculates advance VAT and accepts it for deduction, but at the same time makes errors when registering the invoice in the book of purchases and sales.

Example 2

PJSC KeramzitStroy leases municipal property and acts as a tax agent for VAT. The company issues a monthly invoice and registers it in the sales book, and also pays VAT to the budget. Then PJSC KeramzitStroy declares a deduction for the same amount in the purchase book.

If KeramzitStroy PJSC makes a mistake when reflecting an invoice in the book of purchases and sales, when checking the declaration, the system will indicate an error with code 0000000002. After receiving a request for clarification, the company must follow the algorithm described in example 1.

What to do after receiving a request containing error codes

The actions of the taxpayer in such a situation are presented in the figure:

It is important to remember that at each stage there are deadlines, failure to comply with which threatens the taxpayer (VAT tax agent) with fines and, in some cases, blocking of accounts.

The main deadlines are shown in the figure:

Inspectors have a very effective and unfavorable tool for the taxpayer to force him to send a receipt for receipt of the claim on time - blocking the account (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

When an updated declaration is required when errors with the specified codes are identified

After receiving from the inspectorate a request to provide explanations in connection with errors identified in the declaration, the question arises: can the taxpayer limit himself to submitting only explanations or is an updated declaration also required?

To answer it you need:

- take from the primary declaration submitted to the inspection the indicators of lines 040 and 050 of section 1 (information about the calculated amount of tax to be paid or reimbursed);

- analyze how the correction of errors affected the amount of tax indicated in these lines;

- If, after correcting errors, the tax payable to the budget turns out to be underestimated (the amount of compensation turned out to be overstated), it is mandatory to submit an updated declaration.

See also “Correcting errors - reducing VAT in the declaration.”

An updated declaration will not be required if there is no understatement of tax. But explanations must be provided:

- in the case when you did not find any errors in your declaration;

- when adjustments (caused by the identification of errors) did not affect the change in the tax base and the final amount of tax.

We talk about the rules for writing and submitting explanations when errors are identified in a VAT return, as well as the amount of fines for failure to submit them (or being late with explanations) here .

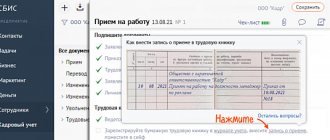

How to fix “0300300028-The template with the document code is not identified”

This is another common mistake when sending calculations and declarations. Everything here is a little confusing, and the error itself occurs if you filed a return for 2022 using an “outdated” form from 2016. According to the order of the Federal Tax Service, declarations completed in the form for 2016 must be accepted until February 18, 2018, and in some branches of the Federal Tax Service they have already stopped accepting it. How to proceed? We recommend waiting until February nineteenth of the current year (02/19/2018) and submitting the adjustment in the updated 3-NDFL.

On the Federal Tax Service website there is a specialized program “Declaration 2017” from JSC GNIVC (Main Scientific Research Computing Center of the Federal Tax Service of the Russian Federation). Great for automated completion of personal income tax returns. The program itself and installation instructions can be found on the official website of the Federal Tax Service.

Results

During a desk audit of VAT returns, four types of errors may be identified in the submitted data. Error code 0000000001 indicates a tax gap between the data for the same transaction in counterparties’ declarations, and error code 0000000002 indicates possible errors in the reflection of transactions in the purchase book or sales book of one taxpayer. Code 0000000003 indicates discrepancies in data about one transaction in parts 1 and 2 of the invoice journal, and code 0000000004 may indicate errors when registering an invoice. After receiving a request from the tax authorities to provide explanations, it is necessary to understand the reasons for the errors, then pay additional tax and penalties, submit an updated declaration (if, as a result of an error, the tax payable was underestimated) or limit yourself to explanations (if the tax is not underestimated and the deductions of counterparties will not be affected) .

Sources:

- Tax Code of the Russian Federation

- Letter of the Federal Tax Service of Russia dated November 6, 2015 No. ED-4-15/19395

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why are control ratios needed?

Control ratios for any reporting form are a method of mathematical data verification that reflects the correctness of the information entered into the report by comparing certain indicators.

Data is compared both within the form itself and with other reports. Tax officials create and supplement a table comparing the indicators of the insurance premium calculation form and send it to the territorial offices so that the territorial Federal Tax Service Inspectors check the correctness of the data specified in the payers’ documents. The information is not kept secret: the policyholders themselves have the right to use the developed indicators for self-checking before submitting the calculation. The Federal Tax Service of Russia has already published a memo for insurance premium payers on how the 6-NDFL and DAM reconciliation is carried out in 2022: policyholders use it for self-checking before sending data. Often, special programs are used for verification, since reports are filled out and submitted electronically.