What errors occur

Any organization is a payer of taxes, fees, and contributions. At least some tax payment is credited to the state treasury. For the transfer of budget payments, separate rules for filling out payment orders are provided. A mistake will result in penalties and fines. To correct a shortcoming in a payment, send a special application for clarification to the Federal Tax Service with a request to eliminate the inaccuracy.

All payment deficiencies are divided into three categories:

- critical blots in which the defect cannot be corrected;

- non-critical, in which it is enough to contact the Federal Tax Service to clarify the tranche;

- minor defects that do not require correction at all.

IMPORTANT!

Tax authorities have provided separate rules and procedures for clarifying budget transfers. Not all blots can be corrected.

What errors cannot be corrected?

If a critical flaw is found in the payment order, then contacting the Federal Tax Service is pointless. You will have to find the money through the bank, then apply for a refund. There is no guarantee that the funds will be returned to the account. Please note that the return procedure takes a long period of time.

What errors are considered critical:

- The money did not enter the budget system of the Russian Federation. The situation is possible if the taxpayer indicated an incorrect Federal Treasury account in the payment order. If there is no money in the budget, then it is impossible to clarify it. Contact your banking organization to find out the unknown payment.

- The recipient's bank is incorrect. The essence is similar to the first point. If the details and name of the recipient's bank are entered incorrectly, the money will not be credited to the budget. They will remain in unclear tranches or get lost in the bank’s payment system. Contact the bank to find out the erroneous transfer.

IMPORTANT!

In addition to errors in payments, there is another situation when the tranche cannot be clarified. This applies to compulsory pension insurance contributions that are already accounted for in the insured person’s account in the Pension System. Before offset of compulsory pension insurance contributions in personal accounting, clarification of transfers is allowed.

Federal Tax Service requirements: what errors are allowed to be corrected

From 01/01/2019, it is allowed to correct a defect in a payment order only if three conditions are simultaneously met (clauses 7, 9 of Article 45 of the Tax Code of the Russian Federation):

| Condition No. 1 | The limitation period for the transfer has not expired. That is, no more than three years have passed since the completion of the erroneous tranche. |

| Condition No. 2 | The adjustment will not lead to arrears in fiscal payments. This means that if, during the correction, the taxpayer incurs arrears in taxes, fees, and contributions, the adjustment will be refused. |

| Condition No. 3 | The money entered the budget system of the Russian Federation, despite the shortcoming. |

IMPORTANT!

If the money is credited to the budget, then any payment details can be corrected. Including the Federal Treasury number and the name of the recipient bank. To do this, submit an application form for clarification of payment to the tax office. If there is no money in the treasury, then there is nothing to clarify. You will have to look for the tranche through a banking organization.

What cannot be specified

Let's say right away that not all tax payments can be corrected. There are two cases where this will not work:

- The bank number of the recipient of the funds is indicated incorrectly;

- the transferred amount of pension contributions is taken into account in the individual account of the insured person (paragraph 2, clause 9, article 45 of the Tax Code of the Russian Federation).

In the first case, the payer’s bank will not process the payment at all, and the company will have to submit a new payment order with the correct details. In the second case, the fees will have to be paid again.

All other errors in the payment order (for example, indicating an incorrect BCC (Letter of the Ministry of Finance dated January 19, 2017 N 03-02-07/1/2145)) do not lead to the fact that the payer’s obligation to pay the tax/contribution is recognized as unfulfilled, and correct this The error can be made by clarifying the payment.

What errors may not be corrected?

Minor typos, spelling and punctuation errors in the “Purpose of payment” field do not require correction. For example, if the payer missed a comma or abbreviated words incorrectly, this will not affect the flow of funds to the budget. It is not necessary to contact the Federal Tax Service for clarification.

Check whether the error distorts the essence of the payment. For example, if the assignment incorrectly indicates the reporting or tax period, there is a typo in the registration number of the policyholder, etc. Similar shortcomings will have to be corrected by the Federal Tax Service.

IMPORTANT!

The inspectorate has the right to independently correct the deficiency identified in the payment order. For example, if the payer made a mistake in the reporting period and indicated “2119” instead of “2020”. The inspection clarifies similar errors without a statement from the organization. But if the Federal Tax Service does not have enough information to make an adjustment, then the error will remain uncorrected.

Normative base

Letter of the Ministry of Finance of the Russian Federation No. 03-02-07/1/2145 dated 01/19/2017

Letter of the Ministry of Finance of the Russian Federation No. 03-02-08/31 dated 03/29/2012

Letter of the Federal Tax Service of Russia No. SA-4-7/ dated 10.10.2016

It is not regulated by law how to write a letter to the Federal Tax Service to clarify a payment, but the very possibility of contacting the tax office in order to correct errors in payment orders has been established. In Part 7 of Art. 45 of the Tax Code of the Russian Federation states that if a taxpayer discovers inaccuracies in registration that do not result in non-transfer of funds to the budget, the taxpayer has the right to provide explanations with a request to clarify the payment details. This opportunity is successfully used by taxpayers in practice and is confirmed by Letter of the Ministry of Finance of the Russian Federation No. 03-02-08/1/2145 dated January 19, 2017.

How to fix it correctly

To correct the shortcomings, you must contact the Federal Tax Service to clarify the payment. Adjustments are made exclusively on an application basis. This means that the payer will be required to draw up a special application.

Since there are quite a lot of errors, a unified example of a letter to the tax office about payment clarification is not provided. Compose it in any form. The application is certified by the manager. The signature of the chief accountant is not required, but is desirable.

Prepare a letter to the tax office about clarification of payment in two copies at once if you submit documents in person. One copy of the application will remain with the Federal Tax Service, and the second copy will be marked as accepted by the receiving inspector. It is possible to submit papers by mail, through an authorized representative or electronically (via TKS or through the taxpayer’s personal account).

IMPORTANT!

The period for consideration of an application for clarification by the Federal Tax Service is 10 working days. The inspectorate will notify the applicant separately of the decision. The deadline for sending notification of the decision is 5 working days.

Form

The form of the decision to clarify the payment accepted by the Federal Tax Service is fixed by order of the Tax Service of Russia dated December 29, 2016 No. ММВ-7-1/731. It looks like this:

As you can see, the structure of this document is quite simple. First, the tax authorities provide all the details of the initial payment, and then the amendment payment (only the details being specified).

It makes sense to get the tax authorities to make a decision to clarify the payment when:

- no or a non-existent (incorrect) BCC is given;

- no or a non-existent (incorrect) OKTMO code is provided;

- it is necessary to clarify the part of the payment order amount for the total amount;

- no or incorrect TIN of the payer;

- the declared TIN does not correspond to the name of the payer;

- no or incorrect checkpoint of the payer;

- no or a non-existent (incorrect) TIN of the recipient is provided;

- there is no or a non-existent (incorrect) checkpoint of the recipient is provided;

- the payer is not registered with the tax authorities;

- no or incorrect basis for payment;

- the recipient's name and account number are incorrectly indicated;

- no or incorrect payer status;

- no or incorrect tax (calculation/reporting) period.

It will not be possible to receive a positive decision from the Federal Tax Service to clarify the payment if the Treasury account number and the name of the recipient bank are incorrectly indicated in the payment. The fact is that for this reason money ends up in the treasury in the wrong account.

Also see “Clarification letter to the Federal Tax Service regarding the purpose of payment.”

How to make an application

When drawing up a letter about payment clarification, we take into account the important recommendations of the Federal Tax Service:

| Registration requirements | |

| Prepare a letter of clarification on the organization's letterhead. Or, in the header of the form, indicate all the details of the applicant’s company (name, tax identification number, checkpoint and address). This information is necessary to identify the applicant in the Federal Tax Service database. | |

| Structure requirements | |

| Document header | We indicate the name of the position of the head and the Federal Tax Service itself to which we are submitting the application. Below we write down the address of the inspection location. We disclose information about the applicant. Be sure to indicate the name, tax identification number, checkpoint and address. Enter contact information for communication. We indicate the date of compilation and registration number in the journal of outgoing documentation. |

| Name | Application for clarification of payment |

| Content | We must indicate:

It is not necessary to indicate the reasons for which the deficiency was made. |

| Applications | Make a separate list of attachments to the letter. Be sure to enter the payment details with an error here. It is allowed to attach other documents confirming the circumstances. For example, a bank statement, a copy of a receipt, etc. |

Please attach copies of supporting documents to your application.

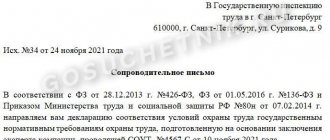

Writing rules and samples

Sample application for clarification of payment order details to the tax office.

Details and main parts of the letter:

- the address part in the upper right corner of the sheet indicating the name, address, INN and OGRN of the sender, taxpayer and addressee, the specific Federal Tax Service of the Russian Federation;

- document title in the middle of the document;

- in the descriptive part, indicate what mistake was made, what details are correct, state a request to attribute the transferred funds to the correct details;

- attachment - a copy of the document confirming the transfer of funds (this is a mandatory requirement of Article 45 of the Tax Code of the Russian Federation);

- signature, date, seal (if available).

Sample

A sample letter to the tax office regarding clarification of payment under the KBK is as follows:

| To the head Interdistrict Inspectorate of the Federal Tax Service of Russia No. 2 for the city of St. Petersburg Address: St. Petersburg, st. Malaya, 16 Limited Liability Company "Clubtk.ru" 123456, St. Petersburg, Pravdy street, building 1 OGRN 1234567891011 INN 1213141516 t. (812)7121212 Ref. No. 13 from 09/17/2020 STATEMENT about clarification of tax payment (error in KBK) LLC "Clubtk.ru" in connection with an error in the payment order dated September 15, 2020 No. 111 for the transfer of insurance contributions for compulsory pension insurance for June 2022 in the amount of 100,000 rubles. asks to clarify the BCC in field 104. KBK was incorrectly specified: 182 1 0210 160. KBK should be considered correct: 182 1 0210 160. Based on clause 7 of Art. 45 of the Tax Code of the Russian Federation, please make the appropriate changes to the payment details. Application: 1. Copy of payment order dated September 15, 2020 No. 111. General Director Andrey Viktorovich Voronov September 17, 2022 M.P. |

What to do if the bank made a mistake

If the fiscal tranche was not received by the Federal Tax Service due to the fault of a bank employee, the payer will only learn about this from the Federal Tax Service. The inspectorate will send a demand to pay the arrears and accrued penalties. The procedure for the payer is as follows:

- Check your payment slip and bank statement. Make sure there are no errors in the papers.

- Contact your bank to clarify the payment. Take copies of your payment and statements with you.

- Having solved the problem with the banking error, contact the Federal Tax Service. Prepare a petition in any form with a request to cancel the accrual of penalties. Indicate that the flaw was made by bank employees. Attach documents confirming the correction of the banking error to the application. For example, this is an explanatory bank and a receipt for transferring money to the budget.

The Federal Tax Service will consider the application. If the payer is not at fault, then the accrual of penalties will be canceled.