What questions do tax inspectors ask a company director during interrogations? What about the employees? What to do if you don't know the answer? What questions does the inspector not have the right to ask?

In this article we publish two complete lists of questions: for the director and for employees. But even if you learn these questions by heart, it will be of little use. We need to act differently.

The Federal Tax Service and the Investigative Committee of the Russian Federation in a joint letter dated July 13, 2017 No. ED-4-2 / [email protected] approved a list of issues that must be clarified with the manager and employees regarding the selection of counterparties, the procedure for signing contracts, and accounting for inventory items ( hereinafter referred to as goods and materials). Let's imagine that the tax office is interrogating the manager and employees.

List of questions for the manager

- Who and in what position do you work at LLC “1”?

- When did you begin your duties in your position?

- Who appointed you to this position?

- Where and what did you work for before LLC “1”?

- Have you performed similar duties before or is working at LLC “1” a new professional skill?

- Do the founders directly interfere with the financial and economic activities of LLC “1”?

- If the founders interfere in the financial and economic activities of LLC “1”, then how does this happen?

- Do you submit reports on the results of financial and economic activities of LLC “1” to the founders?

- Do you agree on the choice of counterparties or the expenses that need to be incurred with the founders?

- Who in your organization is responsible for preparing contracts for signing by the parties?

- Who is involved in the selection of suppliers and subcontractors for LLC “1”?

- How is the search for counterparties carried out?

- What sources of information do you use when choosing contractors?

- How many people in your department are involved in sourcing?

- How do you usually communicate with the supplier: by mail, in person, through an intermediary?

- Describe the process of preparing a contract within the organization when identifying a supplier.

- Is approval of a particular counterparty a personal or collective decision?

- If the decision is collective, name the decision makers.

- If the decision is made individually, do you initiate the conclusion of an agreement with this particular supplier?

- Are there persons or departments in the organization who are responsible for choosing a particular counterparty? Please indicate them.

- What responsibilities does your organization have when identifying a supplier?

- Who decides which suppliers to choose?

- Who gives instructions for the preparation of draft agreements?

- Who initiates the conclusion of an agreement with suppliers, and who makes the proposal to work with a specific supplier?

To establish the identity of the counterparty manager and the business reputation of the counterparty organization

- Do you personally know the head of the counterparty organization, under what circumstances, when did you meet?

- What relationships (friendships, business) unite you?

- What work (services) did the counterparty organization perform for you, what goods did it supply?

- Has this organization previously provided similar services for you, performed work, or supplied goods?

- What actions did you take to establish the business reputation of the counterparty organization?

Signing a contract and accounting for goods (works, services)

- Does the organization have any regulating documents on document flow?

- Who is responsible for the quantity and quality of supplied goods and materials (fuels and lubricants, spare parts, etc.), services (transport, etc.), works (subcontracting)?

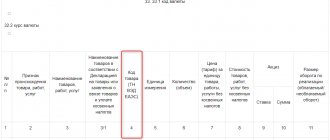

- Who accepts the primary documents from the supplier (TN, TN, TORG-12, acts), who signs the document, where the goods (works, services) are accepted according to the document?

- Who must be present when accepting goods (works, services)?

- Have you come across unscrupulous suppliers of goods (works, services); what actions did you take in such cases?

- Who in LLC “1” is responsible for the safety of inventory items, who keeps records?

- Is there a warehouse and where is it located, who is the storekeeper?

- If representatives of the customer are present when accepting work from a subcontractor, who exactly is present and what documents are signed?

- In the event of a defect or violation of technology for work performed by a subcontractor, who is responsible for the violations to the customer, to LLC “1”?

- Who draws up claims from LLC “1” to the subcontractor in the event of a defect or technology violation, and who signs such documents?

- Does LLC “1” have a security service or employee who deals with the economic security of the organization?

- On which official's computer are the 1C-Accounting, 1C-Trade, 1C-Warehouse databases installed?

- Who has access to the databases 1C-Accounting, 1C-Trade, 1C-Warehouse?

Frequently asked questions of the Federal Tax Service

Frequently asked questions of the Federal Tax Service

Question: What should a taxpayer do if he receives an unfounded (in his opinion) demand for tax payment?

Answer: Subclause 5.1, clause 1, Article 21 of the Tax Code provides for the right of the taxpayer to carry out joint reconciliation of calculations for taxes, fees, penalties and fines with the tax authorities, as well as to receive an act of joint reconciliation of calculations for taxes, fees, penalties and fines. In accordance with paragraph 11, paragraph 1 of Art. 32 of the Tax Code of the Russian Federation, tax authorities are required to carry out such a reconciliation at the request of the taxpayer.

The reconciliation period should not exceed 15 working days. If discrepancies are identified, their cause is clarified and corrections are made within 5 working days.

Question: How can an individual who is not an individual entrepreneur, lawyer, or notary engaged in private practice obtain a Certificate of Registration with the tax authority?

Answer: To obtain a Certificate of Registration with a tax authority, you must submit an Application to any tax authority serving individuals. Registration with the tax authority of an individual who is not an individual entrepreneur is carried out by the tax authority at his place of residence. You must have an identification document with you confirming your registration at your place of residence. If there is information in the Unified State Register of Taxpayers about registration with the tax authority of an individual at the place of residence who has applied with an Application for registration, registration with the specified tax authority is not carried out, and the Application for registration serves as the basis for issuing to this individual a Certificate in the form established by the Federal Tax Service of Russia, within five working days from the date of receipt of such an Application. You can submit an Application for Registration to the tax authorities in person, send it by mail, or fill out an Application on the official website of the Federal Tax Service www.nalog.ru using the service “Submitting an Application for Registration by an Individual.” When sending the Application by mail with acknowledgment of delivery, a duly certified copy of a document identifying the individual and confirming registration at the place of residence may be attached to the Application for Registration.

Question: What time period is provided for the tax authority to respond to a written request from a taxpayer?

Answer: Individual informing of the taxpayer based on his written request is carried out within 30 calendar days from the date of his registration with the Federal Tax Service of Russia. If necessary, the period for consideration of a written request may be extended by the head of the inspection of the Federal Tax Service of Russia, but no more than 30 calendar days with the obligatory notification of the taxpayer about the extension of the period for consideration of such a request, indicating the reasons for the extension of the period no later than 3 working days before the expiration of the period its execution.

Question: In what ways and in what form can citizens contact the tax authorities?

Answer: Citizens have the right to contact the tax authorities:

- in writing (by post, fax) to the address of the tax authorities;

- in the form of an electronic document without an electronic signature from the official website of the Federal Tax Service on the Internet www.nalog.ru through the online services “Contact the Federal Tax Service of Russia” and “Personal Account of an Individual Taxpayer”;

- in the form of an electronic document through the federal state information system from the official website of the Unified Portal of State and Municipal Services on the Internet www.gosuslugi.ru;

— orally directly to the tax authority or by calling the tax authorities helpline;

- in the manner established for personal reception of citizens.

Question: Where can I find out information about property tax debts of individuals?

Answer: You can obtain information about debt in one of the following ways:

-using the service of the official website of the Federal Tax Service of Russia “Taxpayer’s Personal Account for Individuals” www.nalog.ru;

— on the Unified portal of state and municipal services www.gosuslugi.ru;

— check the availability of information about yourself in the Data Bank of Enforcement Proceedings of the Federal Bailiff Service www.fssprus.ru;

- when contacting the tax authority in person;

- by personal contact to the Multifunctional Center for the Provision of State and Municipal Services in the Republic of Tatarstan (MFC).

Question: How to correctly draw up a payment document when paying taxes for another person?

Answer: In order for a payment made for other persons to be reflected in a timely manner for its intended purpose, it is necessary to comply with the Rules for filling out payment documents, which are determined by Order of the Ministry of Finance of the Russian Federation No. 107n.

Thus, if the payment is made for another person, the payment documents indicate in the appropriate fields the details of the payer whose obligation to pay taxes is being fulfilled. This applies to such details as TIN and checkpoint.

In this case, the name of the payer making the payment is indicated in the “Payer” field.

Also, the status of the payer must correspond to the status of the person whose obligation to make payments is fulfilled.

In the “Purpose of payment” field, the first information about the TIN and KPP of the person making the payment is indicated, then the name of the taxpayer whose duty is being fulfilled.

Question: What actions must a property owner take if he has not received a tax notice letter?

Answer: Tax notices are not sent by mail to taxpayers in the following cases:

1) the presence of a tax benefit, tax deduction, other grounds established by law that completely exempt the owner of the taxable object from paying tax;

2) if the total amount of tax liabilities reflected in the tax notice is less than 100 rubles;

3) the taxpayer is a user of the Internet service of the Federal Tax Service of Russia - the taxpayer’s personal account and has not sent a notification about the need to receive tax documents on paper.

In other cases, if a tax notice is not received, the taxpayer must contact the tax office in person or electronically using the Internet service of the Federal Tax Service of Russia “Taxpayer Personal Account for Individuals.”

Owners of real estate or vehicles who have never received tax notices and have not claimed tax benefits are required to report the presence of these objects to any tax authority using the approved Report form.

Question: If an individual owns two apartments, for which of them is a tax deduction applied when calculating property tax for individuals?

Answer: The application of the tax deduction for taxable objects provided for in Article 403 of the Tax Code of the Russian Federation when calculating property tax for individuals does not depend on the number of residential premises owned by the taxpayer and provides for a reduction in the tax base for each apartment by the cadastral value of its 20 square meters.

Question: Can the owner of a car that is on the wanted list not present a certificate from the internal affairs bodies about the theft of the car in order to be exempt from transport tax?

Answer: The provisions of the Tax Code of the Russian Federation do not impose on the owner of wanted vehicles the obligation to submit to the tax office a document confirming the theft of the relevant vehicle.

If an application is received from the owner of a vehicle for tax exemption without submitting documents confirming the fact that his car was stolen, the tax inspectorate will send an additional request to the authorized body to confirm this fact, indicating the period from the beginning of which the taxable object is on the wanted list.

Question: Is an entrepreneur who was previously exempt from paying property tax in relation to his store required to pay property tax based on the tax notice received?

Answer: Since 2015, Federal Law No. 382-FZ of November 29, 2014 has come into force, abolishing property tax benefits in relation to certain real estate properties of individual entrepreneurs.

This Law regulates the relations provided for in Article 378.2 of the Tax Code of the Russian Federation.

Objects must have an approved cadastral value and are subject to inclusion in the List, which is approved for each tax period by the authorized executive body of the constituent entity of the Russian Federation.

If the entrepreneur’s store is located in a building included in the above List, then the entrepreneur must pay property tax for individuals on the basis of a tax notice.

Question: Can the calculation of property tax in a tax notice differ from the tax amount indicated in the Internet service of the Federal Tax Service of Russia “Tax Calculator”?

Answer: When entering the cadastral number of an object in the Internet service of the Federal Tax Service of Russia “Tax calculator - calculation of land tax and property tax for individuals calculated on the basis of the cadastral value”, the tax calculation is carried out based on the value of the cadastral value contained in the Rosreestr databases for the current date .

If in a constituent entity of the Russian Federation new results of the state cadastral valuation of real estate were approved this year, then the value of the cadastral value used to calculate the tax for previous years will be different.

Taking this feature into account, to calculate the tax, the Calculator provides an additional mode of “manual” input of the cadastral value for the date selected by the applicant.

In addition, when using the “Calculator” to calculate property tax based on cadastral value, it is necessary to take into account the amount of tax calculated based on the inventory value of the property. More details on the official website of the Federal Tax Service www.nalog.ru.

Question: How can a user of a taxpayer’s personal account receive a tax notice by mail to their place of residence?

Answer: Based on Article 11.2 of the Tax Code of the Russian Federation, if it is necessary to receive a tax notice by mail, users of the taxpayer’s personal account must notify the tax authority about this through this Internet service. The notice must be signed electronically. You can receive an enhanced non-qualified electronic signature directly in the taxpayer’s Personal Account online. More details on the official website of the Federal Tax Service www.nalog.ru.

Question: Will the tax authority recalculate the tax with the formation of a new tax notice if the local government decided to reduce the property tax rate for individuals?

Answer: The specified circumstances that improve the taxpayer’s position are the basis for recalculating the tax, including for previous tax periods.

For users of the taxpayer's personal account, the updated tax calculation will be posted in the new tax notice in their personal account.

To receive a new tax notice, you can contact the tax office directly at your place of residence or at the location of the taxable objects.

The results of recalculation of tax liabilities in other cases will be included in tax notifications sent by tax authorities during the campaign for mass distribution of tax documents in the next tax period.

Question: What deadline for tax payment is indicated in the tax notice prepared after the recalculation of land tax in connection with the decision taken by the local government to reduce the tax rate?

Answer: The current legislation for individuals establishes a single deadline for paying property taxes no later than December 1 of the year following the expired tax period.

If the tax authority recalculates previously calculated tax, payment of the tax is carried out according to the tax notice within the period specified in the tax notice. In this case, the tax notice must be sent no later than 30 days before the deadline specified in the tax notice.

Question: What increasing coefficients are applied to the transport tax for owners of powerful expensive cars?

Answer: For passenger cars with an average cost of 3 million rubles or more, the amount of transport tax is calculated taking into account the increasing coefficients established by paragraph 2 of Article 362 of the Tax Code.

The list of such cars is published annually no later than March 1 on the official website of the Russian Ministry of Industry and Trade.

Since the transport tax is calculated not on the cost of the car, but on the power of its engine, the average cost of expensive cars is the value necessary to determine the coefficient. The cost of purchasing a car, as well as its physical or technical condition, are not taken into account when determining the coefficient.

Question: What are the features when calculating land tax on plots where housing construction is taking place?

Answer: In 2022, for the first time, land tax will be calculated at double the rate on land plots allocated for individual housing construction, but on which there are still no built and registered houses.

According to paragraph 16 of Article 396 of the Tax Code of the Russian Federation, in relation to land plots acquired by individuals for individual housing construction, the tax amount is calculated taking into account the coefficient 2 during the design and construction period exceeding a ten-year period. Coefficient “2” is applied until the state registration of rights to the constructed property.

For land plots acquired during 2006 by individuals for individual housing construction and in the absence of a registered object on it, the ten-year period for calculating land tax in a single amount expired in 2016. For 2016, the tax on such plots will be calculated with an increasing factor of “two”, i.e. in double size.

At the same time, when determining the ten-year period, the date of issue of the permit for the construction of a residential building is taken into account. Ten years will be calculated from the date of issuance of the permit, and not the registration of rights to the land plot.

Question: I am a pensioner. In 2016, she received paid dental services (dental prosthetics). Can I get a social tax deduction?

Answer: The procedure for providing social tax deductions, including the amount allocated for medical services, is established by Article 219 of the Tax Code of the Russian Federation.

Based on Article 219 of the Tax Code of the Russian Federation, the taxpayer has the right to receive a social tax deduction in the amount paid by the taxpayer in the tax period for medical services. However, the deduction is provided only if during the specified period the citizen had income from which personal income tax was withheld.

If a pensioner does not have income on which tax is withheld at a rate of 13%, a social deduction for the tax period is not provided.

Question: What is the procedure for providing a social tax deduction for education in the case where an agreement with an educational institution is concluded by a student, and an additional agreement to the agreement involves payment by both the student and one of his parents?

Answer: In this case, both the student himself and his parents can apply for a social tax deduction in the prescribed manner, provided they have documents confirming payment for education, issued respectively to the student himself and to one of his parents.

Question: An apartment acquired during marriage (at the expense of the spouses’ common property) is registered as the common shared property of one of the spouses and their minor child. Does the other spouse, who is not named in the title documents for this apartment, have the right to receive a property tax deduction? If yes, in what size?

Answer: Property acquired by spouses during marriage is their joint property, unless an agreement between them establishes a different regime for this property. The common property of spouses includes, in particular, real estate acquired at the expense of the spouses’ common income (including apartments and shares in them), regardless of which spouse’s name they were acquired in, or in the name of which or which of the spouses contributed funds.

Consequently, despite the fact that the share of the apartment is registered as the property of only one of the spouses, the second spouse has the right to receive a property tax deduction, the amount of which is determined in the prescribed manner

taking into account the specified share and the written statement of the spouses on the procedure agreed between them for the distribution of property tax deductions.

Also, this spouse has the right to receive a property tax deduction in the amount of expenses incurred by the spouses to purchase an apartment as the property of a minor child - based on the share of ownership registered in his name.

Question: In what case is income received in cash and in kind from individuals as a gift not subject to exemption from personal income tax?

Answer: In accordance with paragraph 18.1 of Article 217 of the Tax Code, income of individuals (citizens of the Russian Federation, foreign citizens, stateless persons) in cash and in kind received from individuals as a gift is not subject to exemption from personal income tax in the case when the following conditions are simultaneously met:

- firstly, the donee and the donor are not family members and (or) close relatives - spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half (having a common father or mother) brothers and sisters ;

- secondly, the object of the gift agreement is real estate (apartments, rooms, residential buildings, land plots, etc.), vehicles, shares, shares, shares.

At the same time, individuals who are tax residents of the Russian Federation are subject to personal income tax on the above income received both from sources in the Russian Federation and from sources outside the Russian Federation. Individuals who are not tax residents of the Russian Federation pay personal income tax on such income received from sources in the Russian Federation.

Question: What is the deadline for the refund of overpaid personal income tax when the taxpayer exercises the right to tax deductions if an application for a tax refund is submitted simultaneously with a tax return in Form 3-NDFL?

Answer: A desk tax audit of a tax return in Form 3-NDFL is carried out by the tax authority within three months from the date of submission of such a declaration and the necessary documents. If the taxpayer’s right to apply a tax deduction is confirmed, he has the right to a tax refund. The amount of overpaid tax is subject to refund upon a written application from the taxpayer within one month from the date the tax authority receives such an application. The decision to refund the amount of overpaid tax is made by the tax authority within 10 days from the date of receipt of the taxpayer’s application. Thus, if a taxpayer submits an application for a tax refund simultaneously with a tax return, the maximum period for receipt of funds to the applicant’s current account is 4 months.

List of questions for employees

- When did you begin your duties in your position?

- What is your education, specialty?

- What are your job responsibilities?

- Have you performed similar duties before?

- Where and what did you work for before LLC “1”?

- Who is involved in the selection of suppliers and subcontractors for LLC “1”?

- How do you search for counterparties, what sources of information do you use when choosing counterparties?

- Who initiates the conclusion of an agreement with suppliers, and who makes the proposal to work with a specific supplier?

- Is the approval of this or that counterparty your sole decision or a collective one?

- Are there persons or departments in the organization who are responsible for choosing a particular counterparty? Please indicate them.

- What responsibilities does your organization have when identifying a supplier?

To establish the identity of the counterparty manager and the business reputation of the counterparty organization

- Do you personally know the head of the counterparty organization, under what circumstances, when did you meet?

- What relationships (friendships, business) unite you?

- What work (services) did the counterparty organization perform for you, what goods did it supply?

- Has this organization previously provided similar services for you, performed work, or supplied goods?

- What actions did you take to establish the business reputation of the counterparty organization?

Signing the contract

- Who gives instructions for the preparation of draft agreements?

- Who in your organization is responsible for preparing the draft agreement or do you use standard agreements?

- Do you personally communicate with prospective partners, on whose territory?

- What questions do you ask during a meeting, what documents do you review?

- If the counterparty is not located in Moscow or the Moscow region, how do you interact?

- If necessary, who do you ask for your partner’s contact information?

- Who approves draft agreements for subsequent signing by you?

- Does the organization have any regulating documents on document flow?

- Who is responsible for the quality of supplied goods and materials (fuels and lubricants, spare parts, etc.), services (transport, etc.), works (subcontracting)?

- Name the program that is used to account for inventory items.

- How is document flow organized in your company from the moment the document is received from the supplier until the goods (work, services) are accepted for accounting and reflected in the accounting program?

- Who has access to the databases 1C-Accounting, 1C-Trade, 1C-Warehouse?

- Have you come across unscrupulous suppliers of goods (works, services); what actions did you take in such cases?

- Who in LLC “1” is responsible for the safety of inventory items, who keeps records, and what internal documents are used to write off inventory items for their departments for work?

- Is there a warehouse and where is it located?

- Who controls the quality and quantity of goods (works, services) supplied?

- If work is performed by subcontractors, who deals with the everyday issues of workers and engineering personnel at the work site?

- Are you personally present when accepting work from a subcontractor? What documents do you sign?

- In the event of a defect or violation of construction technology for work performed by a subcontractor, who is responsible for the violations to the customer, to LLC “1”?

- Does LLC “1” have a security service or employee who deals with the economic security of the organization? Indicate your full name, duties and responsibilities.

- Specify the official who endorses the documents you are drawing up.

- List the names of the documents you are preparing.

Why doesn't even memorizing these questions guarantee that you will pass the interrogation?

The tax office has one goal - to prove the unreality of a business transaction and, as a result, to charge additional taxes.

The interrogation protocol is drawn up by the inspector. The purpose of the interrogation is to prove that the director and his employees cannot really explain anything about the counterparty, or about the transaction, or how it was executed (after all, in this case, the transaction is fictitious, and the counterparty is nominal). Therefore, the inspector will try to interpret the questions in such a way that your answers are reduced to phrases like: “I don’t know,” “I don’t remember,” “I need to clarify,” etc., which will be regarded by the inspectors as a fictitious relationship.

An example of how the director and other witnesses can correctly answer inspection questions

Employees of Tax Lawyers accompany company directors for questioning several times a week. This practice allowed us to create our own selection of questions that inspectors ask. We are ready to share some of these questions and their answers:

Question : How do you prepare accounting and tax reporting, did you personally sign the accounting and tax reporting, did you instruct someone to do this on your behalf and submit it to the tax authorities, what is the full name of this person?

Answer : My friend helps with accounting and tax reporting. She does this for free. We send reports via TCS (telecommunication channels), i.e. electronically. My friend sends the reports in my presence. Telecom operator - Taxcom (or specify another organization).

Question: Have you met with the director of Contractor LLC?

Answer: The director called me on the phone, and we discussed some issues with him. However, a company representative came to our company office. He discussed with me (or the manager) all commercial issues (product range, cost, delivery logistics, etc.). As far as I remember, he had a power of attorney and, according to his words, it was he who was responsible at Kontragent LLC for negotiating contracts and agreeing on commercial terms of delivery. His name was _____. More precise contact information for this person should be found in the office. The director did not come to our office.

Question : How is the product delivered?

Approximate answer : our organization conducts intermediary activities, there are familiar suppliers and buyers, based on their demand/supply we are looking for buyers-sellers (customers-performers), we receive income due to the difference in price. We try to carry out sales on a same-day basis, i.e. the buyer picks up the goods from the supplier’s warehouse or the supplier delivers the goods directly to the buyer’s warehouse. If necessary, we use the services of transport companies, pick up the goods from the seller’s warehouse and transport them to the buyer’s warehouse.

Question : What due diligence measures did you take when choosing Counterparty LLC as your supplier?

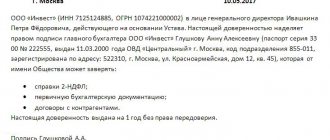

Answer : From all our suppliers, including Counterparty LLC, we request certified copies of constituent documents (certificates of registration of a legal entity and tax registration), a decision on the creation of a company and an order on the appointment of a general director and chief accountant, a copy charter, an extract on the types of activities of OKVED, etc. We also check counterparties from open sources of information (in court cases, debts in the bailiff service, we check the accuracy of information about the counterparty on the tax inspectorate website. We also sometimes request information on the counterparty from Kontur- Focus" and at the servicing bank. Documents regarding this counterparty are available in the office (employee).

Of course, the examples above should not be taken as an axiom. Depending on what kind of activity your company conducts, the answers will be different. But we think the general direction of the answers is clear.

How does the tax office cheat by asking questions to the director and employees?

Let us repeat, the purpose of the tax office is to assess and collect additional taxes. Therefore, inspectors sometimes allow themselves some liberties.

For example, they ask the driver about the work of the accounting department, and the accountant about the makes and models of cars. But this is a primitive technique.

Another version of the “timeless classic” is to ask the question incorrectly. So that the director or employee does not understand what exactly is being asked of him. And then interpret the answer received in your own way. For example, use both affirmation and negation in a question. In this case, if the answer is monosyllabic (yes or no), it can still be interpreted by the inspector in two ways, that is, in favor of the inspector.

Sometimes inspectors show imagination and ask questions about facts that actually did not exist. Naturally, the witness replies that he cannot remember these circumstances. The inspector is satisfied: there is something to cling to in order to draw generalized conclusions and make additional charges.

How to ask for clarification or make a complaint

Citizens, including taxpayers, have the right to contact the tax authorities:

- in writing (by post, fax) to the address of the tax authorities;

- in the form of an electronic document (without an electronic signature) from the official website of the Federal Tax Service on the Internet (via the online service “Apply to the Federal Tax Service of Russia” or territorial tax authorities “Apply to the Federal Tax Service (IFTS) of Russia”);

- in the form of an electronic document (without an electronic signature) from the official website of the Federal Tax Service on the Internet (via the online service “Personal Account of an Individual Taxpayer”;

- in the form of an electronic document (with an enhanced qualified electronic signature) according to the TKS;

- in the form of an electronic document through the federal state information system “Unified portal of state and municipal services (functions)” on the Internet www.gosuslugi.ru;

- orally directly to the tax authority or by calling the tax authorities helpline;

- in the manner established for personal reception of citizens.

As a general rule, a written appeal is subject to mandatory registration within three days from the date of receipt by a state body, local government body or official. However, if, for example, it is not within their competence to resolve the issues raised in the appeal, such an appeal within seven days from the date of registration is sent to the competent body or official with notification of the applicant about the forwarding of the appeal (Parts 2, 3, Article 8 of Law No. 59-FZ).