Upon termination of the employment relationship, in addition to the salary for the work done, the employee may need to be given a number of amounts not related to the direct performance of work duties. To accrue them, you first need to according to certain rules, the average daily earnings upon dismissal in 2022. Moreover, in some non-standard situations, special calculation algorithms are used that allow the employee’s rights to be respected in full.

Also see:

- How the Labor Code of the Russian Federation regulates dismissal while on vacation

- How to correctly calculate the number of vacation days for compensation upon dismissal

In what cases are average earnings calculated upon dismissal?

At the moment of completion of cooperation with the employee, a full payment is made to him. In addition to the salary amount, the resigning employee must be accrued:

- Compensation for the remainder of the vacation (if any) that was not used (part 4 of article 84.1, part 1 of article 127, part 1 of article 140 of the Labor Code of the Russian Federation).

- Dismissal benefits if the employment relationship was terminated for certain reasons (Article 178 of the Labor Code of the Russian Federation).

IMPORTANT!

Severance pay is required to be given to all employees leaving the organization due to optimization of the number of employees or closure of the company. The exception is those who were accepted for a period of up to 2 months. However, this does not deprive the company of the opportunity to include conditions for additional payments to this category of personnel in its internal regulations.

Severance pay is due:

1. Upon dismissal due to the closure of an organization or a reduction in the number of staff :

- in the amount of average earnings for the first month after termination of the employment contract;

- in the amount of average earnings for the second month after dismissal - provided that the dismissed person was unable to find a job and received official unemployed status;

- in special circumstances, by decision of the employment service - for the third month after termination of the employment contract, and for workers in the Far North, it is possible to increase the time of payments to 5 months .

2. In other circumstances of dismissal, benefits may be paid in the amount of two weeks’ average earnings. This:

- conscription into the army;

- rupture of cooperation due to changes in working conditions that make it impossible to continue;

- dismissal due to refusal to move to a workplace in another region;

- worker's medical care indications;

- dismissal due to the return of a previously departed employee on the basis of a judicial act.

Thus, calculating average earnings per day is necessary in all of the above cases.

Severance pay for the first month after layoff

Payment of average earnings for the first month after dismissal due to layoff or liquidation is the responsibility of the employer. It is provided for in Article 178 of the Labor Code of the Russian Federation and is subject to compliance by all employers, with the exception of individual entrepreneurs. Individual entrepreneurs pay severance pay only if such an obligation is specified in the contract with the employee.

The benefit should be paid on the last working day, along with the rest of the money included in the calculation upon dismissal.

You can read about liability for failure to pay amounts due to a dismissed employee on time and in full in this material.

What standards govern the calculation of average daily earnings?

Here are the legal norms on the basis of which the average daily earnings are calculated upon dismissal:

- Art. 139 Labor Code of the Russian Federation;

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages.”

According to them, average daily earnings must be calculated for a period of 12 consecutive calendar months, up to the month in which the basis for the corresponding accrual arose.

In general, the procedure for calculating it includes:

1. Determination of the calculation period and the quantity related to it:

- calendar days - to calculate payments for vacation not taken;

- working days - to calculate severance pay.

2. Summarizing the salary that needs to be taken into account.

3. Dividing the salary amount by the duration of the pay period in days.

Are personal income taxes and insurance contributions collected from severance pay?

Personal income tax and social contributions are not subject to compensation payments to employees during the liquidation of an enterprise in 2022, but only those provided for by the norms of labor legislation (Article 217 of the Tax Code of the Russian Federation, Article 422 of the Tax Code of the Russian Federation, letters of the Ministry of Finance No. 03-04-06/15529 dated 17.03 .2017 and No. 03-04-06/29283 dated May 23, 2016) and which do not exceed three times the average monthly salary, and for employees of organizations located in the Far North and equivalent areas - six times the amount.

If the employer makes all payments within the framework of labor legislation, then insurance premiums are not charged.

Compensation for unused vacation is exempt from insurance premiums, but is not subject to tax exemption (clause 1 as amended by Federal Law No. 147-FZ of June 17, 2019), personal income tax is withheld from this amount.

If, on the basis of internal regulations, severance pay is calculated at an increased rate, then insurance premiums are charged for the excess amount (letter of the Ministry of Finance No. 03-04-06/48330 dated 07/02/2019).

What periods and amounts are included in the calculation of average earnings?

Regardless of the purpose for which the calculation is made, the following days are not taken into account in 12 months:

- when an employee was released from performing official functions while maintaining his salary;

- related to sick leave time;

- periods when the employee did not work and received average earnings.

Bonus payments are included in the calculation of the average salary, regardless of the presence of excluded periods, if they are calculated taking into account the time worked. Otherwise, they must be taken into account as a share of the time actually worked.

IMPORTANT!

Monthly bonuses are taken into account in the actual amount, but no more than one monthly payment for each individual indicator.

Bonuses for quarters that are fully taken into account in the period of calculating average earnings are accepted in full . Otherwise, they are included in proportion to the number of months in the quarter included in the 12 months before the month in which average earnings are calculated.

Annual bonuses for the previous year are taken into account in full , regardless of the time of their payment.

IMPORTANT!

An exception to the general rule is financial assistance for vacation, which is taken into account when calculating average monthly earnings upon dismissal (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 30, 2010 No. 4350/10).

Who is paid severance pay?

- Employees dismissed due to the closure of the organization;

- Employees who have been reduced in staff or size of the organization;

- An employee who has been called up for military or alternative service;

- The employee who takes the place of a previously dismissed employee has been reinstated by the court or labor inspectorate;

- An employee who refused to be transferred to another location due to the relocation of the employer;

- An employee who cannot perform his functions according to a medical report, in case of refusal to move to another job or the absence of suitable work for him;

- An employee who has completely lost his ability to work due to health reasons;

- An employee if he refuses significant changes to his working conditions;

- An employer dismissed from office by decision of the founders (clause 2 of Article 278 of the Labor Code), in the absence of guilty actions on his part;

- The employer, his deputies and the chief accountant removed from their positions by the new owners of the organization;

- An employee dismissed due to the cancellation of an employment contract, if such a contract was concluded in violation of the law due to the fault of the employer. We are talking about significant violations that prevent the performance of official duties:

- A court decision according to which a person does not have the right to hold certain positions;

- Lack of special education;

- There are diseases;

It should be noted that if the manager, at the time of concluding the employment contract, did not require from the applicant a document confirming the absence of restrictions on work established by law, then regardless of whether the employee knew about these restrictions or did not know, he is entitled to payment in the event of dismissal due to such circumstances severance pay.

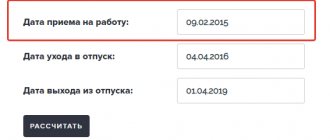

How to calculate average daily earnings for vacation compensation

To calculate the average daily amount of earnings for vacation compensation, take the average monthly number of days per month equal to 29.3 (Part 4 of Article 139 of the Labor Code of the Russian Federation). If within 12 months before the month of dismissal there are no periods excluded from the calculation, then the formula is used:

EXAMPLE

The amount of the salary of an employee dismissed in June 2022 from June 2020 to May 2022 amounted to 564,000 rubles. The specified time has been fully worked out. Let's calculate the average daily earnings.

Solution:

564 000 / 12 / 29,3 = 1604.09 rub.

If in the period taken into account there was time excluded from it, the formula changes:

The number of days in months not fully worked is determined by the formula:

| (29.3 / NUMBER OF CALENDAR DAYS IN AN INCOMPLETE MONTH) × NUMBER OF CALENDAR DAYS FOR TIME WORKED |

EXAMPLE

The employee will retire in June 2022. From June 2022 to May 2021, he worked for 10 full months. In February 2022, he was on vacation from 02/01/2021 to 02/20/2021, and in April 2022 he was on sick leave from 04/01/2021 to 04/25/2021. Earnings amounted to 879,000 rubles excluding vacation pay and sick leave. Let's calculate the average daily earnings upon dismissal.

Solution:

- In February 2022, we take into account 9 calendar days out of 28.

- In April, we take into account 5 days out of 30.

- The duration of partial periods in days will be: 29.3 / 29 × 9 + 29.3 / 30 × 5 = 9.09 + 4.88 = 13.97 days.

- The amount of average charges per day will be: 879,000 / (29.3 × 10 + 13.97) = 879,000 / 306.97 = 2863.47 rubles.

How to calculate three times your average monthly earnings

Article 178 of the Labor Code of the Russian Federation provides for two amounts of severance pay:

- Average monthly earnings - paid in the event of liquidation of an organization and reduction in the number or staff of employees.

- Two-week average earnings - paid in other cases, including upon termination of an employment contract:

- with a person employed in seasonal work in connection with the liquidation of an organization, reduction in the number or staff of the organization’s employees (Article 296 of the Labor Code of the Russian Federation);

- with a foreign worker or stateless person in connection with the suspension or cancellation of the permit to attract and use foreign workers, on the basis of which such a worker was issued a work permit (Article 327.7 of the Labor Code of the Russian Federation).

We also note a benefit in the amount of three months' average earnings paid to the head of the organization, his deputy or chief accountant in connection with a change in the owner of the property, to a manager dismissed by decision of the owner of the organization.

In this case, an employment or collective agreement may provide for increased amounts of severance pay, with the exception of the cases specified in Art. 349.3 Labor Code of the Russian Federation. In particular, this article applies to the following categories of workers:

- managers, their deputies, chief accountants and members of collegial executive bodies of state corporations, state-owned companies, as well as business companies, who have concluded employment contracts, as well as business entities, more than 50% of the shares (shares) in the authorized capital of which are in state or municipal ownership;

- managers, their deputies, chief accountants of state extra-budgetary funds of the Russian Federation, territorial compulsory medical insurance funds, state or municipal institutions, state or municipal unitary enterprises.

The amount of compensation for these employees is three times their average monthly earnings. Payment to them of other benefits or compensation upon dismissal by agreement of the parties (Article 78 of the Labor Code of the Russian Federation) cannot be provided for by such an agreement.

The three-month average earnings do not include:

- wages due to the employee;

- average earnings retained in cases where an employee is sent on a business trip, for vocational training or additional vocational education outside of work, in other cases in which, in accordance with labor legislation and other acts containing labor law norms, the employee retains average earnings;

- reimbursement of expenses associated with business trips, moving to work in another area;

- monetary compensation for all unused vacations;

- average monthly earnings retained for the period of employment in the event of liquidation of an organization or reduction in the number or staff of employees.

Severance pay is paid to the employee, along with other compensation and amounts due, on the last day of work. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed request for payment is presented (Article 140 of the Labor Code of the Russian Federation).

The benefit is accrued based on the order of dismissal of the employee. There is no need to draw up a separate order for payment of benefits. The amount of the benefit is indicated in the calculation note issued upon dismissal.

Severance pay, which generally does not exceed three times the average monthly salary, is not subject to personal income tax and insurance contributions (Letter of the Ministry of Finance of the Russian Federation dated July 2, 2019 No. 03-04-06/48330).

Calculating average monthly earnings can be useful when calculating vacation pay, laying off an employee, or in situations where his rights are infringed.

Different life situations lead to a change in activity type. If this happens through the fault of the employer, then the person can count on temporary financial support. The terms of such payments will be limited to a minimum of 2 months.

To determine material payments, you must know the possible average income for 1 month. Take into account the number of days already worked and the number of working days that will be paid in the future.

The need to determine the amount of average monthly earnings may arise in several cases:

- If an employee is going to be laid off due to a reduction in staff.

- Determination of vacation pay for the employee’s rest period.

- Situations when there is a deterioration in working conditions for an employee or other infringements that are prescribed in the collective agreement of the enterprise.

If an employee has been laid off, the company undertakes to pay an amount equal to the average monthly salary for the period of time determined by the Labor Code of the Russian Federation.

If, after being laid off, it is not possible to get a job immediately, the company will provide financial assistance, which is determined by the size of the average monthly income.

Calculation of average daily earnings is needed to determine the payments that a person should receive.

Situations when it is necessary to calculate the average amount of income per working day can be completely different. The calculation is carried out to determine the payments that a person should receive.

All cases are regulated by the legislative framework and present the following options:

- If a person has temporarily lost his ability to work for some reason.

- Payments provided to women on maternity leave when caring for a child up to 1.5 years old.

- In cases of unused vacation, a person may receive monetary compensation.

- If a person became a donor and did not go to work on a certain day due to donating blood.

- The employee was seconded on official business during the work week.

- Days when a person was absent from work while caring for a child or disabled relative.

There are other situations where payment is provided in the amount of average daily income. In the process of signing a rental agreement, clauses regarding payments are negotiated by the two parties.

To determine a specific amount, you should use a special formula that accountants use in their work. This scheme is approved by the TR of the Russian Federation and is relevant for modern legislation:

- First, you should add up your wages for all 12 months. To get the most accurate number possible, it is best to use checks or bank statements.

- The resulting number must be divided by 12 working months. Since wage amounts may vary due to periodic accrual of bonuses, remunerations and additional payments, dividing by 12 will help determine the arithmetic average.

- The arithmetic mean is divided by the index 29.3. The presented index represents the optimal number of working days in a month.

If a workweek has more or fewer working days, then the index 29.3 is not used. It is enough to calculate the total number of working days per month.

Calculation example

The employee received the following amounts during the year: 10000, 10050, 12500, 20000, 7700, 8900, 12000, 10880, 12222, 10500, 9500, 10400. The working week is represented by 6 working days.

We calculate:

- 10000 10050 12500 20000 7700 8900 12000 10880 12222 10500 9500 10400 = 134652. Addition of all amounts that the employee received each month during the year.

- 134652/12=11221. The arithmetic mean of income is determined.

- 11221/29.3=382.97. Calculation for the subsequent months after termination of cooperation with this company.

The cost of one working day is determined.

Average monthly earnings should be skillfully calculated using the appropriate instructions and provisions of the labor code.

To accurately determine the average monthly income, you can contact the company’s accounting department.

You can independently determine the amount of the benefit, which is determined precisely by calculating the average monthly earnings.

Average monthly earnings = amount of full salary/actually worked days * number of calendar days.

The formula for determining the amount of average monthly earnings is very easy to use. Anyone can use this algorithm for calculations. First, you should carry out mathematical calculations that will determine each component of the formula, and then substitute it into the general scheme for data processing.

Calculation formula:

- First, you should take a statement from the accounting department, which clearly indicates the salary that the employee receives monthly.

- It is worth getting a certificate from HR or accounting that indicates how many days were worked out of the full pay period.

- Using the calendar, calculate the number of working days in accordance with the working week that remain after dismissal.

Having collected all the data, you can begin to process it: divide the amount of the full salary by the days actually worked. Multiply the resulting result by the number of calendar days.

This formula is relevant when determining the benefit that an employee who has been laid off will receive.

Calculation example

Sometimes it is very difficult to figure out the definition of many nuances, even if the calculation formula is elementary.

The employee was dismissed due to staff reduction on April 15, 2018. The billing period is determined from March 1 to March 31. The monthly salary during the employment period was 1000 rubles.

We calculate how much you can get for a year of work: 12,000 rubles: you need to multiply the monthly wage by the number of months in the year. The work period was 250 days. This means that the average daily earnings are determined in accordance with the following rules: 12000/250. We get 4.8 for each day.

This example is relevant if the severance pay was received on the same day on which the calculation was made.

No enterprise or production can give its employees guarantees that it will not go bankrupt or disband. If the financial situation of the production is deplorable and liquidation is planned, then employees must be warned at least 2 months in advance.

In addition, employees are entitled to a number of material benefits. What can workers count on during the liquidation of production?

When contracting

If an employee is laid off, he has the right to compensation, which is the amount of average monthly earnings. Payments are made within 2 months after dismissal. Sometimes payments are made for 3 months.

Upon dismissal

- Additional remuneration for the work of class teachers and teaching staff.

- Bonuses and other remunerations to personnel for the performance of labor duties approved by the LNA of the enterprise.

- Other types of payments in accordance with the payment procedure adopted by the employer.

How to calculate average earnings for severance pay

In general, the average daily earnings for severance pay are calculated using the formula:

| AVERAGE DAILY EARNINGS = AMOUNT OF EARNINGS FOR THE BILLING PERIOD / NUMBER DAYS WORKED IN THE BILLING PERIOD) |

IMPORTANT!

If in the 12 months before the month of calculation there were non-working holidays (as in connection with the situation with coronavirus 2022 according to the decrees of the President of the Russian Federation), neither these days nor the amounts of payment for them are included in the calculations (letter of the Ministry of Labor of Russia dated May 18, 2020 No. 14- 1/B-585).

EXAMPLE

The employee will be laid off in June 2022. During the period from June 2022 to May 2022, he worked 254 days and earned 645,000 rubles. What will be his average daily earnings and the amount of severance pay?

Solution:

645,000 / 254 = 2539.37 rubles.

In order to calculate the average monthly earnings upon dismissal, you need to multiply the amount of average accruals per day by the number of working days for the monthly period according to its planned schedule - starting from the day following the date of dismissal.

Let's supplement the example by indicating that during this monthly period he had to work 20 days. Then the severance pay will be:

2539.37 rub. × 20 = 50,787.4 rub.

Payments to internal part-time workers

Calculate severance pay and average earnings for the period of employment in the general manner.

The main job and part-time work are documented in two different employment contracts. Therefore, calculate severance pay and average earnings for the period of employment separately for each employment contract. That is, if an employee is laid off from both places of work, severance pay and average earnings for the period of employment must be calculated separately for both contracts: based on payments for the main job and based on payments for part-time work.

If an employee is laid off in one of his positions (either his main position or a part-time position), then he is not entitled to average earnings for the period of employment. He only needs to pay severance pay. To calculate severance pay, take into account payments only for the position being eliminated. That is, if a part-time worker is laid off, to calculate benefits you need to take payments received from part-time work. If your main position is laid off, calculate the benefit based on payments at your main place of work.

This follows from Part 1 of Article 178, Article 287 of the Labor Code of the Russian Federation.

Calculation of average earnings if there was no income in the billing period

There are often circumstances as a result of which the employee had no income in the 12 months before dismissal. Then the following rules are used for calculations:

- If in earlier periods the employee worked and had accruals, take the previous billing period, which is equal in duration.

- When the worker did not have any accruals before the month of separation, the calculation is based on the actual amounts of salary and days worked in the month of calculating the average daily earnings upon dismissal.

- If the employee has not previously been employed by employers for pay, the established salary or tariff rate is used for calculation.