I think it’s no secret to anyone that about 10–15% of enterprises fully comply with labor protection in Russia, the rest do it partially, or I don’t even know what it is and why it is necessary.

This attitude always leads to accidents at work, there are many reasons, and this could be faulty equipment or tools, ignorance of labor safety rules, non-use of personal protective equipment, and so on.

Why is this happening? Most often due to lack of funds or insufficient funding.

But the state has provided preventive measures to reduce injuries and encourage employers to comply with safety requirements at work - this is reimbursement of costs for labor protection measures from the Social Insurance Fund.

This is what we will talk about in this article, read, comment and share your examples from practice, this will be useful for all readers. Let's share our experience!

Reimbursement of labor protection costs

Not everyone knows that you can use this type of government support, such as reimbursement of costs for labor protection measures from the Social Insurance Fund, but any employer would like to get back the money spent and put it into business.

And if you decide to take advantage of such a program this year, I do not recommend delaying it and putting it on the back burner, because the allocated funds from the Social Insurance Fund for financing are not unlimited and the requirements for the execution and content of documents are high.

I’ll say right away that the deadline for submitting an application is until August 1 (clause 4 of the Appendix to Order of the Ministry of Labor No. 467n).

But you need to prepare in advance, because the preparation procedure is labor-intensive, and in order not to be rejected due to incorrectly prepared documents, you can use a step-by-step algorithm without unnecessary “water”.

Determining the amount of insurance premiums

First, you need to understand how much money should return to the enterprise’s treasury, because many “don’t bother” with the amount of 10,000 rubles.

But there are enterprises whose budget can be replenished by 200,000 - 500,000 rubles; it’s worth spending working time here.

You can independently calculate how much will be reimbursed for the costs of occupational safety measures from the Social Insurance Fund using the formula:

Formula for calculating the amount for reimbursement of costs of labor protection measures from the Social Insurance Fund

According to Order of the Ministry of Labor of the Russian Federation No. 467n, compensation for labor protection costs can be up to 20% from insurance premiums; for the previous calendar year, if you had accidents or occupational diseases, you must deduct the costs of sick leave for these workers and for paying for sanatorium vacations of the insured persons (treatment and travel).

Reimbursement of labor safety costs can be increased to 30% (clause 2 of the Order of the Ministry of Labor and Social Protection of the Russian Federation dated July 14, 2021 No. 467n), if pre-retirement employees were sent to sanatorium treatment, these are those who have 5 years left before old age insurance pension.

Here, for example, is one case from practice: at a small enterprise, pre-retirement employees were sent for sanatorium-resort treatment at a sanatorium. Not only did the occupational safety specialist make a request to the Social Insurance Fund to clarify how much money can be returned for occupational safety measures, she found a sanatorium, prepared all the necessary documents for concluding an agreement, sent pre-retirement workers on vacation and submitted documents to the Social Insurance Fund for a refund amounts. The only advantages from this event:

- free vacation for pre-retirement employees in a sanatorium;

- compensation for labor protection costs 30% from insurance contributions, and now receiving this amount to the employer’s account;

- a nice bonus for an occupational safety specialist from an employer is an additional cash bonus.

If an organization with a staff of up to 100 people has not previously received financial support for preventive measures for labor protection, or has not used them for 2 years in a row, then it can count on the amount for the three previous years, but not more than the amount of insurance premiums that are subject to transfer to the Social Insurance Fund for the current year.

But not everything is as wonderful and simple as it would seem at first glance; there are reasons when organizations may refuse to reimburse the costs of labor protection measures.

Why is this happening? Simply without understanding all the details, we collected documents and submitted an application to the Social Insurance Fund, spent a lot of time, but the results are only experience, and there is no chance of compensation for labor protection costs through insurance premiums.

Operating principles of the Social Insurance Fund

The main activity of the Fund is the provision of financial support for expenses for compulsory social insurance in case of temporary disability and in connection with maternity, for compulsory social insurance against industrial accidents and occupational diseases.

If we consider its activities within the framework of the relationship between employer and employee, then in simple terms this fund pays all expenses associated with injuries and occupational diseases received by employees in the workplace.

Where does he get the funds for this?

These funds come from the employer and amount to 2.9% of the employee’s salary. These deductions are required to be paid for each employee officially registered with you under an employment contract.

In addition, a so-called “injury contribution” is paid for each employee. That is, the rate is directly on insuring employees against accidents and occupational illnesses related to production activities. Its size is set in the range from 0.2% to 8.5%. It increases in proportion to the increase in the degree of risk to which the main activity of the enterprise is assigned.

All these parameters are established by law. At the moment, there are 32 tariffs, formed taking into account different areas of activity. They characterize different degrees of risk and the corresponding percentage of contributions.

The class to which an organization’s activities belong can be determined using two regulatory documents:

1) OKVED;

2) Classification of types of activities by risk, in accordance with Order N 851 of December 30, 2016 “On approval of the Classification of types of economic activities by occupational risk classes”

It is worth noting that accidents at work, as well as facts of identified occupational diseases, give the Social Insurance Fund the right to increase the “injury” coefficient for the organization.

Thus, each organization makes monthly contributions to the Social Insurance Fund for each employee in order to reimburse all necessary expenses from the fund in the event of an insured event.

I will conduct a professional risk assessment for you

Enter your phone number and I will calculate an estimate for your tasks. Enter without the eight. “Ekaterina Vorontsova’s Bureau” is a professional solution to your occupational safety problems. High quality and on time!

Reasons for refusal to reimburse labor protection costs

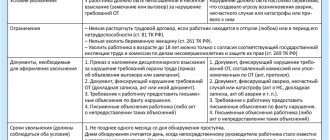

There are a number of reasons why an organization may be refused reimbursement of costs for labor protection measures from the Social Insurance Fund:

Reasons for refusal to reimburse costs for labor protection measures from the Social Insurance Fund

As you can see, the reason for refusal may be an incompletely prepared package of documents, and this is another reason to start preparatory work in advance, so that in case of refusal, there is time to make corrections and re-state your desire to reimburse the costs of labor protection measures from the Social Insurance Fund.

Special assessment in the 4-FSS report

Until 2022, many organizations and individual entrepreneurs delayed carrying out SOUT. However, the law on special assessment dated December 28, 2013 No. 426-FZ established strict deadlines that forced most employers to enter into agreements with specialized companies and carry out the required activities. The employer must retain a report on the SOUT.

Conducted a special assessment - reflect it in 4-FSS. If not, the report contains columns that need to be filled out in this case as well. If you have previously carried out assessment procedures, and in the 4th quarter of 2022 you were forced to carry out an unscheduled inspection, then the report will reflect the information from the unscheduled inspection report.

To reflect the special assessment in 4-FSS, Table 5 is filled out, where all the results are entered.

Documents for reimbursement of costs for labor protection measures from the Social Insurance Fund

In order to start collecting documents, you need to check with the accounting department whether there were any reasons for a future refusal, and the amount that can be reimbursed from the Social Insurance Fund.

From personal experience I can say that finding out the amount that can be reimbursed from the Social Insurance Fund and spending it is better to write a letter addressed to the head of the Social Insurance Fund. You can see a sample letter here.

The organization will only be able to spend money on labor protection measures. And what is the meaning of the word “spend” in this case?

Previously, the organization did not receive real money. The Social Insurance Fund counted the costs of labor protection at the expense of insurance premiums.

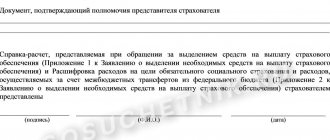

From 2022, according to the Resolution of the Russian Federation No. 2375, the organization, no later than December 15 of the current year, submits an application to the Social Insurance Fund for reimbursement of expenses for payment of preventive measures with documents confirming these expenses.

After which, the FSS, within 5 working days from the date of receipt of the documents, makes a decision on the reimbursement of funds from the FSS fund and transfers the funds to the organization’s current account specified in the application.

In order for expenses to be counted, you need to plan activities at the expense of which reimbursement of labor protection costs will be made.

What makes it possible to reimburse labor protection costs?

This program is aimed at reducing injuries in organizations and improving working conditions for workers, which is why the list of activities is extensive.

It includes almost all sections of labor protection (clause 3 of the rules to Order No. 467n):

List of activities subject to reimbursement at the expense of the Social Insurance Fund

List of activities subject to reimbursement at the expense of the Social Insurance Fund

Also in 2022, it was possible to use a new clause in the approved rules to Order No. 467n - clause 3.1 “Costs for the implementation of measures to prevent the spread of COVID-19.”

According to this paragraph you can:

- purchase disposable protective equipment (masks, respirators, gowns, etc.);

- purchase disinfectants (wipes, antiseptics, etc.) and dosing devices;

- purchase equipment (air recirculators and virucidal disinfectants for complex treatment);

- purchase a device for contactless monitoring of workers’ body temperature (electronic thermometers);

- conduct laboratory tests of workers for COVID-19 (PCR method and/or test for antibodies to COVID-19).

We'll see whether it will be possible to compensate costs in 2022 for measures to prevent Covid-19.

The ideal option that our organization resorted to when receiving compensation was to call a FSS specialist and inform them that we were planning to write an application and send it with a package of documents to compensate for labor protection costs.

If you establish contact, FSS specialists will meet halfway and advise on all issues, provide the necessary sample documents and, by agreement, check for errors.

This approach will help you correctly assemble a complete package of documents the first time, save time and avoid unnecessary trips to the Social Insurance Fund.

Occupational safety action plan

An important document provided for reimbursement of costs for labor protection measures from the Social Insurance Fund, an action plan to improve working conditions and labor protection, which is drawn up not only to streamline work, but also for participation in this program.

You can find out how to prepare it, format it and what to include in a detailed article on this topic.

Select activities that will help you receive the maximum amount of compensation and will actually be implemented, because then you will have to report to the Social Insurance Fund about their implementation.

Drawing up a financial plan

The next important document that will have to be prepared is a financial support plan (Appendix to Order No. 467n).

The plan includes all planned labor safety costs, for example, the costs of conducting a special assessment of working conditions, with a breakdown of the amounts for its implementation, deadline, number of jobs and justification (regulatory document).

These costs, of course, are not taken from the head, but from a pre-concluded contract for carrying out SOUT, or according to the planned implementation (clause 6 a of the rules to Order No. 467n).

In any case, before including any of the labor protection measures in the financial support plan, it is necessary to familiarize yourself in detail with the list of necessary documents provided to the Social Insurance Fund.

To better understand the scale, I’ll explain what these documents are. For example, based on the results of a periodic medical examination, you must provide:

- a copy of the list of employees subject to mandatory periodic medical examinations this year;

- a copy of the contract with the medical organization for medical examinations;

- calculation of the cost of services for medical examinations;

- a copy of the license of the medical organization, constituent documents (Charter, powers of attorney, etc.).

Here is another example - to purchase medical first aid kits, you must provide a list of purchased medical products (order No. 1331n dated December 15, 2020), indicating their quantity and cost, as well as indicating the sanitary posts to be equipped with first aid kits.

When providing copies of documents, do not forget to certify them (clause 6 of the rules to Order No. 467n), and sign the financial support plan with the head of the organization and the chief accountant.

Application for reimbursement of expenses

To receive compensation for occupational safety measures, you need to submit an application to the Social Insurance Fund either on paper or electronically by October 1 of the current year with a full package of documents.

The regulated application form is available in the appendix of Order No. 237 dated 05/07/2019 or you can follow the link.

Fill it out and send it in two copies along with the rest of the documents to the FSS.

FSS decision

After submitting a package of documents for reimbursement of labor protection costs, approval takes place within 10 - 15 working days (depending on the planned amount).

That is, now it becomes clear why you need to prepare documents in advance; three weeks is a long time.

Next, the adopted decision is formalized by the FSS within 3 working days as an order and can be delivered in person, sent by mail or electronically through the State Services portal. It all depends on which method you indicate in the application.

You can additionally submit an application and the necessary copies of documents no later than October 1 of the current year if an application was initially submitted for an amount less than the estimated amount of funds and an order for financial support was received (clause 13 of the rules to Order No. 467n).

By including future expenses in the plan, you may not be able to fully take advantage of them; in this case, the Social Insurance Fund must be informed before November 20 of the current year (clause 14 of the rules to Order No. 467n).

If the FSS approves financial support from insurance premiums, then you will then need to report for these funds quarterly (clause 16 of the rules to Order No. 467n).

To submit a report, use the recommended form at the link.

Along with the report, documents confirming the implementation of the declared activities are submitted. For example, if these are periodic inspections, then the final act, invoice for payment, payment order, act of completed work.

The declared amount and the actual expenses must match penny to penny.

If the amount is a difference of 1 ruble, then your efforts may be in vain and you need to clearly control this important nuance.

Main conclusions

Reimbursing the costs of labor safety measures from the Social Insurance Fund, although a very labor-intensive process that requires special control from a labor protection specialist and the collection of a huge package of documents, is also very useful for saving the company’s budget.

You will need to collect a fairly voluminous package of documents and submit to the FSS:

- Application for financial support.

- Plan to improve working conditions.

- Financial support plan.

It might not seem like much, but in fact the picture is completely different. And if you want to raise your own authority in the eyes of management and know that the financial security will be decent, it’s worth devoting time to this. This procedure will add a plus to your karma and show that you can not only spend on labor protection, but also save.

Well, if you liked the article, I would be grateful if you share it on social networks, this will motivate me to prepare even more new useful and interesting notes.

I wish you safe and efficient work!

If you have something to add or have examples from practice, write comments, it will be discussed, this is important for other readers.

Results

Table 5 of the 4-FSS report is filled out to provide the FSS with information on the results of a special assessment of working conditions and medical examinations. The order in which information is reflected in the table depends on 4 key factors: the presence of employees; places of performance of duties by employees - on the territory of the company or outside it; results of special assessment of workplaces; there is an obligation to conduct a medical examination of employees.

Sources: FSS order dated September 26, 2016 No. 381

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.