Form TS-2 is used by those who pay the trade tax (TC) if they cease to be its payers. What to do if there is a need to deregister not all retail outlets, but only some? Is the TS-2 form relevant when liquidating an organization or closing an individual entrepreneur? We will answer these questions and explain how to correctly enter data into the TS-2 withdrawal notification form in our publication.

Also see:

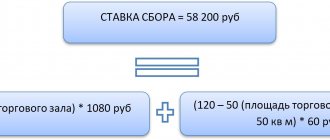

- Trade tax in Moscow in 2022: rates, payment deadlines and BCC (tables)

- What changes in the trading tax in 2022

Who is on the list of vehicle payers?

Chapter 33 of the Tax Code of the Russian Federation is devoted to the trade tax. It was introduced by Federal Law No. 382-FZ of November 29, 2014.

For 2022, the fee was and continues to be valid only in Moscow .

Payers of the fee include entities that carry out activities that fall under the Customs Union. That is, if an organization or individual entrepreneur is registered in Moscow, and the store is located in another region, they are not payers of the vehicle. And vice versa: if an entity is registered in another region, but trades in Moscow, it is obliged .

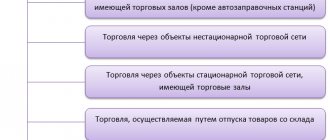

TS is established in relation to types of trading activities at certain facilities.

TS payers are organizations and individual entrepreneurs that conduct trading activities at trading facilities . We will reveal further what is meant by these concepts.

The legislation made it possible not to pay TC to some categories of business entities. These include individual entrepreneurs on a patent and payers of the unified agricultural tax (Article 411 of the Tax Code of the Russian Federation).

What is trading activity and what is classified as an object of trade?

Let us decipher these concepts in order to correctly apply Chapter 33 of the Tax Code of the Russian Federation.

Here is a list of types of trade that are subject to a trade tax:

In this case, trade includes retail, small wholesale and wholesale purchase and sale of goods.

Here is what is considered to be the object of trade:

The capital law provides benefits for certain types of trade. Let's list some of them:

Sample notification TS-1

Initially, the issuance of notifications on the application of the trade tax was advisory in nature. However, soon the tax authorities approved the official form TS-1.

The Trade Fee Notification Form is available for download on our website.

You can also download a sample form for filling out a notification of a trade fee from us.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for registering vehicle payers

to register as a payer within 5 days If this is not done, the tax authority will still register the “silent one” - based on information received from the authorized body. In Moscow this is the Department of Economic Policy and Development of the City of Moscow.

In order for the tax office to deregister the payer of the vehicle, it must be notified of this within 5 days from the date of termination of use of the object of trade or conduct of trading activities.

The payer is deregistered by sending them a notification in the TS-2 form.

KEEP IN MIND

Previously, no deadlines were set. The 5-day limit was introduced in 2020 by Federal Law No. 325-FZ dated September 29, 2019.

Below you can find TS-2 for free, as well as learn the nuances of filling out this notification.

Notification of deregistration with the Federal Tax Service: nuances of filling out

Form TS-2 consists of a title page and is submitted in the event of termination of all types of business activities using trade objects in respect of which a trade fee has been established. Despite the simplicity of the structure of the TS-2 form, there are a number of nuances associated with filling it out. Form TS-2 can be filled out by the taxpayer in 2 ways - manually with a ballpoint pen or on a computer. In this case, all its fields must be filled in, unless otherwise provided in the regulatory legal acts. In cases where it is not necessary to enter data in any field (or there is none), dashes are placed in the corresponding fields. When filling out the form on a computer, there is no need to enter dashes, since the fields can be left blank.

You need to enter information into the TS-2 form by placing each character in a separate cell, starting with the very first one on the left. Characters must be entered in capital letters using a pen. When filling out the form on a PC, you must use Courier New font, size 16 or 18, in capital letters mode. The day, month and year that indicate the date the document was compiled are separated by a dot. It is unacceptable to correct errors in the TS-2 form using a proofreader.

In what cases should you use TS-2?

Form TS-2 is subject to application if the payer of the fee closes all retail outlets related to the tax office to which the notification is submitted. If only some of the facilities are closed, while others continue to function, then Form TS-1 should be submitted.

The situation is similar with the change in the taxation system. If an individual entrepreneur transfers all of his retail outlets to a patent, he must fill out form TS-2. If something remains on non-preferential taxation systems, use the TS-1 form.

If the organization is liquidated or the individual entrepreneur is closed , in this case there is no need to submit the TS-2 form. The tax office will deregister such an entity as a vehicle payer independently - based on the entry in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

The same applies to reorganization , during which the company actually ceases to exist in its previous form (accession, merger). But a company that appears again during such a transformation must register as a fee payer on a general basis.

How to fill out a payment order for payment of a trade fee

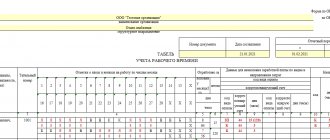

The tax service in the commented letter recalled that payment of the trade tax is made by payers of the trade tax no later than the 25th day of the month following the taxation period (clause 2 of article 417 of the Tax Code of the Russian Federation). The tax period is a quarter (Article 415 of the Tax Code of the Russian Federation).

The payment order must indicate:

— in the payer’s details – INN and KPP of the organization or individual entrepreneur (for individual entrepreneurs, the KPP field indicates zero “0”), reflected in the Notification;

- in the recipient's details - INN, KPP of the tax authority, at the place of registration as a payer of trade tax;

- to which account the fee is transferred - account number, name of the Federal Treasury body and in brackets the name of the tax authority at the place of registration as a payer of the trade fee;

— OKTMO code at the place of trading activity;

— budget classification code — Trade tax paid in the territories of federal cities:

collection - 182 1 0500 110;

penalties - 182 1 0500 110;

interest - 182 1 0500 110;

monetary penalties (fines) - 182 1 0500 110.

The Tax Service indicated that before the trade tax is extended to the territory of other constituent entities of the Russian Federation (municipalities), filling out the settlement document is carried out taking into account the following features.

When transferring the trade fee at the location of the real estate property (if the activity for which the trade fee is established is carried out using the real estate property), the following is indicated:

— INN, checkpoint of the Federal Tax Service of Russia for the city of Moscow, at the place of registration as a payer of trade tax;

- account number, name of the Federal Treasury Department for Moscow and in brackets the name of the Federal Tax Service of Russia for Moscow, at the place of registration as a payer of trade tax;

— OKTMO code for Moscow at the place of trading activities.

When transferring the trade fee in the case of using movable property, the following shall be indicated:

— TIN, KPP of the Federal Tax Service of Russia in the constituent entity of the Russian Federation, at the place of registration as a payer of trade tax (at the location of the organization or the place of residence of the individual entrepreneur);

- account number, name of the Federal Treasury Department for Moscow and in brackets the name of the Federal Tax Service of Russia, at the place of registration as a trade tax payer (location of the organization or place of residence of the individual entrepreneur);

— OKTMO code for Moscow, reflected in the Notification.

What happens if you don’t submit the TS-2 form?

Let us remind you that the TS-2 form must be submitted within 5 days from the date of termination of trading activities through the trade facility. If you are late with the date of submission of the notification, the tax office will deregister not from the date indicated in the notification, but from the date of filing the notification (clause 8 of Article 416 of the Tax Code of the Russian Federation).

If the actual date of termination of activity and the date of submission of the notice fall in the same quarter, then the delay is not so critical.

The collection period is quarterly. That is, if even 1 day in a quarter an activity that falls under the TS was carried out, then it must be paid in the full quarterly amount. But if trading was stopped in one quarter, and the notification was submitted late in the next, then you will have to pay the vehicle for the “extra” quarter.

If you do not submit a notification in the TS-2 form at all, then the fee will be charged full regardless of the actual conduct of the activity.

What does the notice include?

- TIN and KPP (organization);

- Federal Tax Service branch code;

- sales stop number;

- OGRN or OGRNIP;

- name of the enterprise, full name its directors; FULL NAME. FL or its representative;

- type of document certifying his rights;

- code indicating the status of the person submitting the application to the tax service;

- contact details of the person who submitted the notification (phone number, e-mail);

- date of completion of the form and signature of the person who compiled it.

- TIN and KPP (organization) of the taxpayer;

- trade stop number;

- activity code;

- enterprise code according to OKTMO;

- object code and its name;

- full address of the property (postal code, region code, district, city or other locality, street, house, building and office room);

- cadastral number of the building where the trade facility and premises are located;

- permission number for its use;

- area of a retail facility;

- data on vehicle size.

A separate form must be filled out for all used retail items (pages 003, 004, 005, etc.). If the application for termination of vehicle payments is not submitted to the tax office on time, then the tax will continue to be charged, even if the trading activity is no longer carried out. Therefore, be careful and punctual so as not to incur unnecessary financial expenses.

Form TS-2: fill it out correctly

Form TS-2 was approved by order of the Federal Tax Service of Russia dated June 22, 2015 No. ММВ-7-14/249. In the same order you can find the procedure for filling out the notification and the format for submitting it electronically.

Next, you can download the TS-2 form for free from our website using a direct link:

NOTIFICATION FORM TS-2

The TS-2 form is simple and contains a minimum of information:

| Payer identification data (TIN, KPP, name of organization/full name of individual entrepreneur) |

| Code of the tax authority to which the notification must be submitted |

| Date of deregistration as a fee payer |

It is very important to indicate the date correctly so as not to accidentally add an extra quarter. For example, let trading activity end on the last day of the 1st quarter of 2022. It is necessary to set the date of termination of activity - 03/31/2020 (and not 04/01/2020).

Then you can fill out the TS-2 form for free:

EXAMPLE OF COMPLETING THE TS-2 NOTIFICATION FORM

When deregistered for trade tax

The TC must be paid by all legal entities and individual entrepreneurs (in those cities of the Russian Federation where the corresponding fee has been introduced, and this is only Moscow for now) that make sales through:

- retail facilities that are not trading floors and are not used at gas stations;

- objects of retail chains classified as non-stationary;

- objects of retail chains with the corresponding type of halls, classified as stationary.

How many times to pay the vehicle if a retail outlet stopped and resumed work in one quarter, read here .

The tax legislation of the Russian Federation also provides for the collection of TC from companies trading from warehouses and in retail markets, but so far in practice this norm has not been applied anywhere in Russia.

In turn, the right to deregister the trade tax is provided for companies that:

- are not engaged in retail trade (stop engaging in it);

- work in the form of individual entrepreneurs on the patent taxation system (switched to PSN);

- represent the agricultural industry and work under the Unified Agricultural Tax.

At the same time, sellers who initially work as individual entrepreneurs on the PSN and farmers may not even register as TS payers.

Let's consider how the procedure for deregistration at the initiative of a trading company using the TS-2 notification is carried out in practice.