Principle of filling out 6-NDFL

In 6-NDFL for the 1st quarter of 2022, fill out:

- Section 1 - reflect in it the transactions that were performed in January-March 2022;

- Section 2 - indicate in it the income accrued for the 1st quarter of 2022, generalized for all individuals, as well as the amount of tax calculated and withheld from such income at the appropriate rate.

The new Appendix No. 1, which is part of the calculation, does not need to be filled out for the 1st quarter (only at the end of the year).

The main approach to reflecting transactions in the new calculation remains the same - transactions are reflected in the period in which they are completed, that is, in the period when the tax payment is due in accordance with clause 6 of Art. 226, paragraph 9 of Art. 226.1 of the Tax Code of the Russian Federation (Letter of the Federal Tax Service dated July 21, 2017 No. BS-4-11 / [email protected] ).

If during the 1st quarter of 2022 income was paid at different rates, sections 1 and 2 must be completed for each tax rate.

6-NDFL: example of filling out for 2022 in case of salary delay

Let’s assume that Alexandra LLC did not declare idle time to its employees, but from September 2022 it reduced wages by 20% (payroll amounted to 320,000 - 20% = 256,000 rubles per month), and did not pay it at all for October and November.

6-NDFL: sample of filling out for the year in case of salary delay

In such a situation, the report will be filled out like this:

| Line code | Value, rub. |

| Section 1 | |

| 020 | 3 584 000 (320,000 x 8 months + 256,000 x 4 months) |

| 030 | 43 400 (deductions provided) |

| 040 | 460 278 (3,584,000 – 43,400) x 13% |

| 060 | 10 (workers) |

| 070 | 393 718 (460,278 – 256,000 x 2 months x 13%), excluding December, because The deadline for paying personal income tax for December is January 2021 |

| Section 2 | |

| 100 | 30.09.2020 |

| 110 | 09.10.2020 |

| 120 | 12.10.2020 |

| 130 | 256 000 |

| 140 | 33 280 (256,000 x 13%) |

The remaining lines 100-140 of section 2 remain blank.

Filling out 6-NDFL for the 1st quarter of 2022

Title page

When registering 6-NDFL for the 1st quarter of 2022, enter the code “21” in the “Reporting period” field, and 2022 in the “Calendar year” field:

Provide tax agent information:

- in the “Tax Agent” field, enter the abbreviated name for the constituent document (if there is no abbreviated name, indicate the full name);

- fields “TIN” and “KPP” - fill in in accordance with the data from the tax registration certificate. Individual entrepreneurs do not have a checkpoint; they do not indicate it in the report.

In the “OKTMO Code” field, enter the code of the municipality in accordance with the All-Russian Classifier OK 033-2013 (OKTMO). If you changed municipalities during the reporting quarter, complete two calculations (Letter of the Federal Tax Service dated September 28, 2020 No. BS-4-11 / [email protected] ).

- with the old OKTMO - when submitting the form for the period before the code change;

- with the new OKTMO - when submitting the form for the period after the change.

If the 6-NDFL is submitted by a tax agent personally, in the section of the title page “Reliability and completeness of information...”, indicate code “1”; if submitted by a representative, code “2”. The lines below indicate the full name of the representative or the name of the representative organization.

Section 1

Fill out Section 1 “Data on tax agent obligations” in the following order:

- in field 010, indicate the BCC for tax;

- in field 021 - deadlines for transferring personal income tax;

- in field 022, show the amounts of tax withheld for January-March 2021;

- Fill in fields 031 and 032 if you returned personal income tax to the employee in the 1st quarter.

Let's look at an example of how to fill out section 1 of the 6-NDFL calculation for the 1st quarter of 2022. The data is presented in the table:

| date | Charges and payments in favor of individuals | Personal income tax, rub. |

| 11.01.2021 | The salary for December 2022 was paid, the bonus for the year totaled 860,550.12 rubles, personal income tax was withheld from it and transferred to the budget | 111 872 |

| 31.01.2021 | The salary accrued for January is RUB 336,893.25. Standard deductions RUB 10,000. | — |

| 05.02.2021 | The salary for January was paid, personal income tax was withheld from it and transferred to the budget | 42 496 |

| 05.02.2021 | Vacation pay was accrued and paid in the amount of RUB 49,318.47. | — |

| 28.02.2021 | The salary for February was accrued in the amount of 354,929.86 rubles, and standard deductions of 10,000 rubles were provided. | — |

| 01.03.2021 | Vacation pay paid in February is transferred to the personal income tax budget | 6 411 |

| 05.03.2021 | The salary for February was paid, personal income tax was withheld from it and transferred to the budget | 44 841 |

| 26.03.2021 | Sick leave was accrued and paid in the amount of 7,557.85 rubles, personal income tax was calculated and withheld from them | — |

| 31.03.2021 | The amount of sick leave paid in March is transferred to the personal income tax budget | 983 |

| 31.03.2021 | The salary for March was accrued in the amount of 364,141.11 rubles, standard deductions were provided - 8,600 rubles, personal income tax was calculated from the salary | — |

Let's fill out Section 1 using the example data:

In the new 6-NDFL calculation, you no longer need to indicate the date of actual receipt of income and the date of tax withholding. If the deadlines for paying personal income tax for several payments coincide, then in Section 1 they can be combined.

For example, sick pay and vacation pay paid in the same month. They have a single payment deadline - the last day of the month. The same goes for salaries and dividends that were transferred to the employee on the same day. They have one tax payment deadline - the next business day.

Section 2

Section 2 “Calculation of calculated, withheld and transferred amounts of personal income tax” reflects indicators generalized for all individuals.

To calculate 6-personal income tax for the 1st quarter, indicators for January-March are taken into account. Amounts must be shown cumulatively from the beginning of the year at the appropriate tax rate.

Let's fill out Section 2 using the example data:

If income paid is taxed at different rates, Section 2 must be completed separately for each tax rate.

Title page

The title page of form 6-NDFL is filled out by both the tax agent and the tax authority employee in specially designated cells. It contains:

- TIN of the organization's checkpoint (or only TIN for entrepreneurs or self-employed people) in accordance with the tax registration certificate.

- In the line “Adjustment number” indicate the serial number of the clarification. For the primary report, the value 000 is fixed.

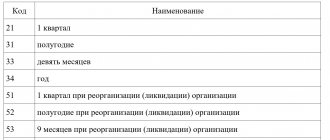

- In the “Representation period” field, enter the code designation of the reporting period:

| Reporting period | In general | Upon liquidation |

| 1st quarter | 21 | 51 |

| half year | 31 | 52 |

| 9 months | 33 | 53 |

| year | 34 | 90 |

For 9 months of 2022, code 33 should be indicated in this field. And in the tax period line, the code is indicated “2018”.

- In the “Submitted to the tax authority” field, indicate the code of the tax authority where we are submitting the form.

- In the line “at the location of the accounting” we indicate the code of the place of submission of the calculation in accordance with Appendix 2 to the Procedure for submitting the calculation. Russian organizations that are not large taxpayers, as a rule, indicate code 214 here, and entrepreneurs - code 320.

- Next, indicate the abbreviated name of the tax agent, the OKTMO code in accordance with the territorial division, the place of activity of the business entity, as well as the signatures of the responsible person and the date of generation of the document.

The Federal Tax Service employee enters information about the number of sheets, the form and date of submission on the tax agent’s form (if the calculation is submitted on paper in person or through a representative) and returns a copy with his signature and registration number.

A sample of filling out the main fields of the title page can be found below.

Deadline and methods for submitting 6-NDFL for the 1st quarter of 2021

As a general rule, the deadline for submitting 6-NDFL based on the results of the quarter is no later than the last day of the month following the reporting period (Clause 2 of Article 230 of the Tax Code of the Russian Federation).

6-NDFL for the 1st quarter of 2022 must be submitted to the INFS no later than 04/30/2021.

Methods for sending 6-NDFL (paragraph 6, clause 2, article 230 of the Tax Code of the Russian Federation):

- electronically via TKS using UKEP;

- on paper or electronically (your choice) - if the number of individuals who received income in the reporting period is up to 10 people inclusive (Letter of the Federal Tax Service of Russia dated December 9, 2019 No. BS-4-11 / [email protected] ).

You can submit a paper payment by visiting the inspection office in person, through a representative, or by sending it by registered mail with a list of the contents.

Results

Requirements for the list of information that must be reflected in the tax register for filling out 6-NDFL are listed in Art. 230 Tax Code of the Russian Federation. A taxpayer can be held liable for failure to maintain a personal income tax register only if the register does not contain the required details, or if the register provided for by the accounting policy is not compiled.

You will find all the nuances of filling out form 6-NDFL in our section “Calculation of 6-NDFL” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to take into account in 6-personal income tax if an individual’s income exceeds 5 million rubles.

With the introduction of a progressive personal income tax rate from 2022, an accountant may have additional responsibilities. If your employee’s income exceeds 5 million rubles, personal income tax must be calculated in a special manner.

Moreover, the Tax Code of the Russian Federation describes only the general rule by which the personal income tax rate is determined (clause 1 of Article 224 of the Tax Code of the Russian Federation):

- 13% - if the amount of tax bases specified in clause 2.1 of Art. 210 of the Tax Code of the Russian Federation, for the tax period is less than 5 million rubles. or equal to this amount;

- 650 thousand rubles. and 15% of the amount of tax bases specified in clause 2.1 of Art. 210 of the Tax Code of the Russian Federation, exceeding 5 million rubles. - if the amount of tax bases for the tax period is more than 5 million rubles.

This procedure will only apply from 2023. In 2022 and 2022 There is a transition period during which the progressive personal income tax rate is applied to each tax base separately, and not to the totality of bases specified in clause 2.1 of Art. 210 of the Tax Code of the Russian Federation (clause 3 of article 2 of the Federal Law “On Amendments...” dated November 23, 2020 No. 372-FZ).

Examples of filling out 6-NDFL when applying an increased tax rate can be found in Letter of the Federal Tax Service dated December 1, 2020 No. BS-4-11/ [email protected]

To transfer personal income tax to the budget, which exceeds 650 thousand rubles. and applies to part of the base in excess of 5 million rubles, a separate BCC 182 1 01 02080 01 1000 110 is provided (Order of the Ministry of Finance dated October 12, 2020 No. 236n).

If, based on the results of the 1st quarter of 2022, you make a mistake with the calculation of personal income tax at the combined rate (650 rubles, 15% for excess of 5 million rubles), there will be no punishment if you independently transfer the missing amounts to the budget before July 1 of the next year (clause 4 of Art. 2 of Federal Law No. 372-FZ).

Algorithm for preparing a report when paying bonuses, vacation pay and sick leave

accrued to 30 employees:

| Month | July | August | September |

| Salary | 750 000 | 710 000 | 780 000 |

| Monthly bonus | 15 000 | 10 000 | |

| Leave compensation upon dismissal | 17 000 | ||

| Vacation pay | 32 000 | ||

| Hospital benefits | 12 000 | ||

| Remuneration under the GPC agreement | 20 000 |

Leave compensation upon dismissal was paid to the employee on September 10, 2018, vacation pay on August 20, 2018, and sick leave benefits on July 16, 2018.

On August 15, remuneration was paid to the individual who carried out the installation of equipment under a civil contract in the amount of 20,000 rubles. (Personal income tax - 2,600 rubles). The advance payment date is the 20th of each month, the salary date is the 5th of the month following the month of income accrual.

The date of receipt of income in the form of salary, including bonuses based on the results of the month (letter of the Ministry of Finance of Russia dated April 4, 2017 No. 03-04-07/19708), is considered to be the last day of the month, and not the day of actual payment of funds to the employee (clause 2 of Article 223 Tax Code of the Russian Federation). Therefore, the monthly salary can be included in one block of lines 100-140. The tax withholding period is the date of actual payment of funds to employees, the deadline for transferring personal income tax to the budget is the day following the payment.

When paying bonuses for a quarter or a year, the date of receipt of income is the day of actual payment of funds to the employee (letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115). Consequently, such a payment is recorded in a separate block of lines 100-140.

The date of receipt of income in the form of vacation pay and sick leave is the day of their payment, the tax withholding period is the day following the payment of income, the deadline for tax transfer is the last day of the month in which payments were made.

The employer is prohibited from transferring the tax not withheld from the taxpayer from his own funds (letter of the Ministry of Finance of Russia dated August 30, 2012 No. 03-04-06/9-263).

Sec. 2 calculations of 6-NDFL will be filled out as follows:

| Line | date | ||||||

| 100 | 30.06.2018 | 16.07.2018 | 31.07.2018 | 15.08.2018 | 20.08.2018 | 31.08.2018 | 10.09.2018 |

| 110 | 05.07.2018 | 16.07.2018 | 03.08.2018 | 15.08.2018 | 20.08.2018 | 05.09.2018 | 10.09.2018 |

| 120 | 06.07.2018 | 31.07.2018 | 06.08.2018 | 16.08.2018 | 31.08.2018 | 06.09.2018 | 11.09.2018 |

| 130 | 752 000 | 12 000 | 765 000 | 20 000 | 32 000 | 710 000 | 17 000 |

| 140 | 97 760 | 1 560 | 99 450 | 2 600 | 4 160 | 92 300 | 2 210 |

| Decoding | Salary for June 2018 | Hospital benefits | Salary for July 2018 | Payment under the GPC agreement | Vacation pay | Salary for August | Leave compensation upon dismissal |

Section 2 - continued:

Zero 6-personal income tax for the 1st quarter of 2022

If in the 1st quarter of 2022 you did not accrue or pay income to individuals, you do not have to submit zero 6-personal income tax. But it is better to inform the tax authorities about this with an explanatory letter within the same time frame as the 6-NDFL.

Get access to 35 online courses for HR and accounting professionals. Connect "Clerk.Premium". You will be able not only to take courses and receive Russian IPB certificates, but also to ask Clerk experts an unlimited number of questions . We will respond within a day. It's definitely cheaper than having third-party consultants. You will be able to collect questions from all your colleagues and even give them your username and password, and they will also be able to ask questions.

Additional positions

An organization can make filling out the tax register for 6-NDFL even more detailed. The following information may be included in the document:

- date of actual receipt of income;

- personal income tax amount;

- the amount of tax calculated and withheld from an individual separately for each type of income;

- the amount of advance payments that are fixed in nature (indicated in the case of foreigners who work at an enterprise using PSN and make income tax deductions on their own);

- the amount of personal income tax that was not withheld;

- the amount of personal income tax that was returned by the tax agent;

- the period within which income tax must be transferred by law to the treasury.

A detailed data register will allow you to fill out a report on Form 6-NDFL quickly and efficiently: this document will reflect all the necessary data, which will greatly simplify the task for accountants.

Here's what the tax register for 6-personal income tax might look like:

Let's sum it up

- 6-NDFL for the 1st quarter of 2022 is submitted on a new form, approved. By Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected]

- In the calculation, you need to fill out the title page, sections 1 and 2. Appendix No. 1 for the reporting quarter is not completed.

- The deadline for submitting 6-NDFL is no later than 04/30/2021.

- Methods for submitting 6-NDFL - electronically via TKS using UKEP or on paper (for up to 10 people).

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

General information about the report

Form 6-NDFL is relatively new. It was introduced in the 1st quarter of 2016 by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ (hereinafter referred to as order No. 450). The main features of the form that distinguish it from the “usual” 2-NDFL report:

- Periodicity. A new report must be submitted more often - quarterly, i.e. control over tax agents for personal income tax has increased.

- Lack of personalization. Report 6-NDFL contains information on the accrual and payment of tax as a whole for the tax agent, without distribution by individual recipients of income.

How to correctly reflect carryover payments

Studying the above example of filling out form 6-NDFL, you may wonder whether the accountant of Alliance LLC made a mistake by reflecting the salary for June in the document for 9 months and not recording the data for September. How to correctly display the rolling salary on the form? The answer to this question was given by the Federal Tax Service in its letter dated February 25, 2016 No. BS-4-11/3058: in section. 2, only indicators are recorded on those incomes on which tax was calculated, withheld and transferred during the last 3 months for which the report is generated.

That is, in the example conditions, income for September is considered received, but the deadline for tax withholding and transfer will occur only in October (on the day of salary payment), i.e. already in the 4th quarter of 2018. Consequently, this information should be recorded in the report for 2022 (Letter of the Federal Tax Service dated January 25, 2017 No. BS-4-11/1249). At the same time, on page 020 section. 1 reflects the generalized amount of employee income from January to September.

Salaries for June 2022 are displayed in a similar manner. Since the tax was withheld and transferred to the budget already in July 2018, information about the June earnings of employees is recorded in the report for 9 months.