From our article you will learn what an individual investment account is and why it is attractive, how to choose and receive the type of investment deduction. We will tell you what rules you need to take into account before opening an individual investment account and much more.

What is an individual investment account Investment tax deductions How to choose the type of deduction for IIS How to get a tax deduction for IIS

When does an investor have the right to an investment deduction?

Investment tax deductions are available to citizens who carry out certain activities in the stock market.

As a rule, these are securities trading operations or depositing money into an individual investment account (IIA). IMPORTANT! An individual investment account is a special account for carrying out transactions in the stock market.

A broker opens an IIS for a citizen. Both an individual and a management company can carry out transactions with securities on it. A special feature of IIS is the availability of tax benefits when using it. It was invented in order to stimulate the population to invest by reducing taxes. The question suggests itself: under what tax does the investment tax deduction apply? Since we are talking about the population, it is obvious that the investment tax deduction is applied under personal income tax.

Please note that not every citizen has the right to an investment tax deduction. Only residents of the Russian Federation can take advantage of the tax deduction for investments, and one of the types of deduction is available only to residents who received income taxed at 13% in a calendar year.

In what case do the designated persons have the right to an investment tax deduction for personal income tax:

- For tax residents of the Russian Federation:

- if there is income from manipulation of securities that the person has owned for more than three years;

- when profits appear on operations carried out on the IIS.

- For residents who received income taxed at a rate of 13% in a calendar year:

- when replenishing an IIS.

We will tell you below how to get an investment tax deduction.

article about how to calculate the tax on bonds in 2022 .

Who cannot receive a deduction

The payer's situation may fully meet all the conditions for using the deduction, but sometimes there are restrictions that prevent receiving the benefit. In particular, these persons cannot count on deductions:

- Persons participating in regional investment activities.

- Residents of special tax zones.

- Persons located in the free economic zone.

- Entities engaged in carbon mining at a newly discovered deposit.

- Residents of areas with accelerated economic development.

- Subjects participating in the Skolkovo center.

- Foreign entities.

The deduction cannot be used by a consolidated group of payers (based on clause 10 of Article 286.1 of the Tax Code of the Russian Federation).

Deduction for holding securities for more than three years

So, let’s talk about the conditions for investment deduction for personal income tax for long-term ownership of securities. To receive such a deduction, you do not need to open additional special accounts; it is enough to have a regular brokerage account and manipulate securities on it.

What securities may be included in this type of deduction:

securities admitted to trading by the Russian trade organizer;

investment units of mutual funds managed by Russian companies.

There are also the following restrictions for receiving a deduction:

- securities must be purchased after January 1, 2014;

- they must belong to the owner for more than three years;

- should not be counted in an individual investment account.

What is a deduction?

When receiving income, an individual generally must pay tax. This is the case with income from the sale of securities. A citizen bought securities, sold them at a better price and received a profit in the form of the difference in value, on which taxes must be paid. A deduction is a reduction in the tax base (profit) on which tax is paid.

The deduction in question is equal to the financial result (income – expense = profit) from operations with them. In other words, if you sold securities that met the above conditions and received a positive financial result, then your tax base is reduced to zero and you do not need to pay tax.

EXAMPLE: Fomin A.V. sold in 2022 100 shares of Sberbank for 270 rubles, which he bought in 2016 for 100 rubles. He received a positive financial result: 270 × 100 – 100 × 100 = 27,000 – 10,000 = 17,000. Moreover, having fulfilled all the conditions necessary for the deduction, Fomin A.V. has the right to it. The deduction is provided in the amount of the financial result: 17,000 (financial result) – 17,000 (deduction) = 0 - tax base. Accordingly, the tax payable is 0 rubles.

There is a maximum deduction threshold, that is, if the financial result exceeds the threshold, then you will have to pay tax on the excess. The threshold is equal to the product of 3,000,000 times the number of complete years of ownership of the securities. If securities with different tenure periods were sold during the tax period, then the coefficient by which 3,000,000 is multiplied is calculated using the formula:

Where:

— financial result from the sale of all securities with holding period i;

N — securities holding periods (calculated in full years), if income is received from the sale of securities with different holding periods

However, the deduction will not provide itself. We'll look at what you need to do to get it below.

Procedure for receiving a deduction

When trading on the stock market, personal income tax for an individual is paid by a tax agent - a broker or trustee who is engaged in trading on behalf of a citizen. It is the tax agent who calculates personal income tax. There are two ways to receive a deduction:

- A tax agent, who is a broker or person managing securities transactions, during the tax period - in this case, he will calculate the tax taking into account the deduction.

- On its own at the tax office branch at the end of the calendar year - in this case, the tax office will return the overpaid tax to the citizen.

You can receive this deduction every year.

EXAMPLE: Let's say Fomin A.V. From the previous example did not contact the tax agent for deductions. In this case, the profit from the transaction will be transferred to him without taking into account the deduction, that is, the tax agent will calculate the personal income tax and transfer the amount to Fomin without him. 17,000 × 13% = 2,210 – personal income tax. 17,000 = 2,210 (personal income tax will be transferred by the tax agent to the budget) + 14,790 (Fomin will receive it to his account). Personal income tax in the amount of 2,210 rubles is an overpaid tax.

If Fomin A.V. had approached the broker with an application for a deduction, he would have received 17,000 rubles.

Fomin A.V. can contact the tax office at the end of the tax period, and he will be returned 2,210 rubles.

List of required documents

To receive a deduction either yourself or through a broker, you need to prepare documents and give them to the person who will provide the deduction - a tax agent or tax office.

It is enough for the tax agent to provide an application in free form or specified by the tax agent. The tax agent has all the other data.

The tax office will require the following documents:

- 3-NDFL for the past calendar year;

- income certificate, which is obtained from the tax agent;

- documents confirming the right to deduction (for example, a broker’s report, which shows that the period of ownership of the securities exceeds 3 years);

- calculation of the deduction amount.

NOTE! A tax agent can be contacted during the calendar year. The permissible period for filing a claim with the tax office is 3 years from the year in which the right to deduction arose.

We wrote about currency taxation here .

What is INV?

Due to INV, the organization’s income tax obligations are reduced.

It is curious that this deduction is neither a new type of expense nor a new tax benefit for a specific category of taxpayers. This is a completely new mechanism with a large share of influence of regional authorities on the tax obligations of organizations. INV = Capex Expenses x 90%

So, INV makes up 90% of the costs for the acquisition of fixed assets and (or) for completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of relevant facilities and on other similar grounds.

Until now, expenses for the acquisition or completion of fixed assets were included in the calculation of the tax base by calculating depreciation over the entire useful life of the fixed assets and a one-time write-off (at the request of the taxpayer) from 10% to 30% of the original cost, the so-called depreciation bonus (applied to fixed assets 3 – 7th depreciation groups).

The INV mechanism was developed to replace the depreciation and depreciation bonus mechanism. For a specific fixed asset, only one of the options for accounting for its value for tax purposes is applicable. That is, if an organization decides that it is profitable for it to use INV, depreciation on fixed assets will not be accrued and the costs of their acquisition (additional equipment) cannot be recognized as tax expenses. Necessary provisions have been added to Art. 256 and 270 of the Tax Code of the Russian Federation.

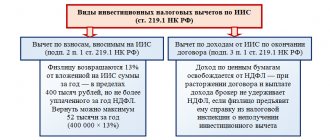

Deduction for depositing funds into IIS (type A deduction)

For the other two deductions, you need to open an IIS. This can be done with the same broker. You can have a simple brokerage account and an individual investment account in parallel, but it is prohibited to have two individual investment accounts at the same time.

The main condition for receiving both types of IIS deductions is that the account must be open for at least 3 years.

The deduction for depositing funds into an IIS is called a deduction for an IRA type A. Its essence lies in the fact that funds are deposited into an open IIS (no more than 1 million rubles per year). The deduction is equal to the deposit amount, but not more than 400 thousand rubles per year. This type of deduction can be received annually. But if the IIS is closed before three years, then the tax overpayments received will have to be returned.

Let us note that in order to receive a deduction, the law does not prescribe the presence of transactions with securities on an ISA as a mandatory condition. However, it is better to still buy and sell securities, otherwise the tax office may not provide a deduction, considering that the IIS is not opened for the purpose of investing, but only for the purpose of obtaining a deduction.

Type A deduction makes sense to apply if a citizen has income subject to personal income tax at a rate of 13% (as a rule, this is hired work or business income using the general taxation system).

EXAMPLE: Fomin A.V. opened an IIS in 2022 and deposited 250 thousand rubles into it. He also works at Priority LLC, where he received 300 thousand rubles (261,000 in hand + 39,000 personal income tax transferred by the tax agent to the budget). If you apply a deduction, the calculation will be as follows: 300,000 (tax base) - 250,000 (deduction) = 50,000 rubles - tax base taking into account the deduction.

50,000 × 13% = 6,500 - personal income tax payable. And the tax agent paid 39,000 rubles. Thus, the overpayment amounted to 39,000 – 6,500 = 32,500 rubles. Fomin will be able to receive this amount on his card.

Procedure for receiving a deduction

The tax agent does not provide a type A deduction; it can only be obtained independently at the end of the tax period from the tax office. That is, at the end of the year in which funds were deposited into the IIS, the citizen applies to the tax authority with a package of documents. After reviewing the papers, the regulatory authority makes a refund of the overpayment or refuses the refund if the right to it is not confirmed.

List of required documents

To independently obtain a Type A deduction, you must provide the following package of documents to the tax office:

- 3-NDFL for the past calendar year;

- income certificate, which is obtained from the tax agent - the employer;

- documents confirming the right to deduction (agreement on opening an IIS, payment slips or checks for depositing funds into an IIS).

The application period minus type A is within three years from the year of depositing funds into the IIS.

We also wrote about deductions for IIS in the article .

What to do if an OS object is sold?

If, before the expiration of the SPI, an object is sold or removed from the OS for another reason (other than liquidation), then the amount of income tax not paid in connection with the application of the INV in relation to this object is subject to restoration and payment to the budget with the payment of the corresponding amounts of penalties, which are accrued from the day the INV was applied.

| The property was sold after the expiration of the SPI | The object was sold before the expiration of the SPI |

| – | Restore the tax underpaid to the budget as a result of the use of INV |

| – | Pay penalties (accrued from the moment the INV is applied) |

| Income from sales cannot be reduced by the cost of purchasing the property | Income from sales can be reduced by the cost of purchasing the property |

Deduction for IIS type B

This type of deduction is also provided if an individual has an IIS. You can select only one type of deduction (A or B) to receive a deduction for one IIS. Type B deduction is equal to the financial result of transactions carried out on the account. That is, it is obvious that in order to obtain it, it is beneficial to actively conduct investment activities. The calculation of the financial result and deduction is similar to their calculation for obtaining a deduction for long-term ownership of securities, but in this case the period of ownership of shares does not matter.

If we operate in simple terms, then the profit received from transactions with securities through an investment account is not subject to tax at all. But we must not forget that you can only deposit 1 million rubles per year into an IIS.

Procedure for receiving a deduction

There are also two possible ways to receive a deduction:

- from a tax agent, which in this case is a broker or trustee;

- through the return of overpayments by the tax authority.

List of required documents

To obtain a Type B deduction from a tax agent, you will still first need to contact the regulatory authority. There they will issue a certificate stating that the IIS for which the citizen wants to claim a deduction is the only one for him and that he has not received type A deductions for it.

Next, a certificate from the tax office and an application for a deduction are sent to a tax agent, who calculates and transfers the financial result to the investor with the deduction already applied.

If a person wants to file a deduction independently at the tax office, then he collects a package of documents:

- 3-NDFL for the past calendar year;

- income certificate, which is obtained from the tax agent;

- documents confirming the opening of an individual account and the execution of transactions on it.

They independently apply for a deduction within three years from the moment the right to it becomes available.

We did a detailed analysis of all existing personal income tax deductions in our material .

Who must report and pay taxes?

According to the Tax Code of the Russian Federation, when income is paid to an individual, the source of income, with some exceptions, becomes a tax agent for personal income tax. This means that the source of income is obliged to calculate personal income tax, withhold it from the income it pays to the individual, and transfer it to the state budget. You cannot refuse the role of a tax agent. The same goes for shifting the burden of paying taxes onto individuals.

NOTE! In the case of trading securities on an individual investment account, a broker or trustee becomes a tax agent for a citizen.

The investor does not submit a 3-NDFL declaration and does not pay the tax on his own. This is the responsibility of his broker. However, there are a couple of exceptions, which we will discuss below.

Conclusion: the received coupon income or dividends come to the individual’s account without taxes.

At the end of the year, the tax agent reports to the regulatory authorities and provides them with a certificate of the individual’s income related to investment activities. This should be kept in mind when applying for various types of benefits where the amount of income is important.

Form for obtaining an investor deduction from the tax office

Find out how to fill out 3-NDFL when selling shares not through a tax agent in the ready-made solution “ConsultantPlus”. Sign up for a free trial and find out the filling algorithm.

Let us dwell on the procedure for filling out and submitting a declaration in Form 3-NDFL to receive an investment deduction.

Let us repeat that you can submit it for tax purposes and documents confirming the right to deduction within three years from the year in which you received the right to deduct.

Methods for sending a declaration:

- by mail by letter with a list of the contents and notification of receipt;

- personally take it to the tax authority;

- send your representative to the tax office, providing him with a power of attorney;

- through the tax website if you are registered on it.

- through the State Services portal

The declaration form for 2022 is presented in our article .

Download a sample of how to fill out an investment deduction of type A in 3-NDFL following the example from our article at the beginning of this material in the “Documents and Forms” section.

To claim deductions in the form of financial results from transactions with securities, fill out all the same sections of the declaration, except Appendix 5. Instead, fill out Appendix 8.

Results

An investor who is a resident of the Russian Federation can apply for an investment tax deduction.

There are three types of deductions. Two of them require an individual to have an IIS. The deduction represents the financial result from transactions with securities or funds contributed to the IIS. There are certain restrictions for each deduction. You can apply for a refund of the overpayment yourself to the tax office or apply for a deduction through a tax agent - a broker or manager. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.