Payments for the first child in 2020-2021: complete list

What payments are due to parents at the birth of their first child?

This issue requires special consideration, since in 2022 there have been changes in the list of such payments. So, what payments do you receive at the birth of your first child this year? What is their complete set and who can receive it to the maximum extent?

Benefits for the first child in 2020-2021 are divided into two groups:

- that took place before 2022 and continue to be applied while maintaining the principles of their purpose;

- introduced from 2022.

Payments included in the first group are regulated by the Law “On State Benefits...” dated May 19, 1995 No. 81-FZ. These payments include:

- amounts paid in connection with pregnancy and childbirth;

- one-time payment on the occasion of birth;

- benefits provided to persons caring for a child in the first years of his life.

The second group consists of payments for the first child, which were not previously used in Russia. Their introduction (Law “On Monthly Payments...” dated December 28, 2017 No. 418-FZ) was due to the intention of stimulating the birth of children in families who do not dare to take this step due to insufficient income. That is, such payments will not be accessible to everyone, and this is their basic difference from payments of the first group, the right to which is always available to persons subject to social insurance, and in some cases also arises for the uninsured.

Registration of assistance

As a rule, to apply for one-time financial assistance in connection with the birth of a child at the place of work, you must submit:

- application for payment of funds; it is compiled in any form;

- a copy of the child's birth certificate.

The amount of payment assigned to an employee upon the birth of a child is established by the employer. Financial assistance is paid in a fixed amount established by the provisions of the collective agreement, or is determined by management individually in each specific case - it all depends on the financial condition of the enterprise and the content of internal documents governing the payment procedure.

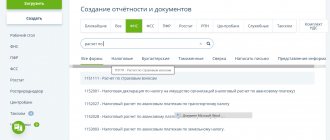

How to take into account financial assistance at the birth of a child in accounting and taxation can be found in the Ready-made solution from ConsultantPlus, having received free trial access to the system.

Payments in connection with pregnancy and childbirth

Benefits paid in connection with pregnancy and childbirth include:

- for pregnancy ending in childbirth;

- for registration with a doctor in the early (up to 12 weeks) stages of pregnancy.

These payments are intended only for mothers of newborns, however, the first benefit can also be received by women who have adopted children under the age of three months (Article 257 of the Labor Code of the Russian Federation). Women can apply for both types of benefits:

- Employed under an employment contract and having (or having had) income subject to contributions to the Social Insurance Fund for disability and maternity insurance. They are paid benefits at their place of work (and only at one of them, if there are several such places).

- Those who lost their jobs due to the employer losing this status no more than a year before they were officially recognized as unemployed. They will be able to receive payments from social security authorities.

- Those receiving full-time education, regardless of whether it is paid or free. They will be paid benefits at their place of study.

- Are contract military personnel. They will receive such payment at their place of duty.

The first of the benefits (maternity benefits) for those issued under an employment contract is a calculated value, depending on the income received by the woman in the two years preceding the birth. It is characterized by the existence of limit values (maximum and minimum possible). To initiate the calculation process, you will need to provide the employer with:

- application for such payment;

- a sick leave certificate issued in connection with the upcoming birth (for women working in military formations outside of Russia, it will be replaced by a certificate from a medical institution);

- certificates (about income for the last two years from other employers and non-receipt of such benefits from them).

The amount of this payment is calculated within 10 calendar days, and it is paid on the payday closest to the date of completion of the calculation (i.e., as with regular sick leave).

For other places where maternity benefits are received, its amount will be determined differently:

- for the unemployed - in the amount established by law (300 rubles), which is subject to indexation annually, due to which for 2019 (from 01.02) it is equal to 655.49 rubles;

- for students - in the amount of the scholarship;

- for military personnel - in the amount of monetary allowance.

In this case, it will be paid no later than the 10th calendar day from the date of submission of documents confirming the right to assign such a benefit (application, sick leave for an unemployed person, a certificate from a medical institution for a student or military personnel) and the presence (for an unemployed person) of circumstances allowing one to apply for it.

Payment for early registration also has a legally defined amount (300 rubles), indexed annually. For 2022 (from 02/01/2020 to 01/31/2021) it is 675.15 rubles. For 2022, the amount of the benefit has not yet been approved at the time of writing. It must be paid after submitting an application and documents confirming the fact of registration to the place of payment.

Note! From 2022, all child benefits are paid by the FSS as part of the FSS Pilot Project. The employer only transfers documents to the fund. Read more about direct payments here .

How to apply for benefits - required documents

Receiving a one-time benefit at the birth of a child is carried out by the competent authorities depending on the category of parents:

Category of citizens

| Category of citizens | Place to apply for payments |

| Employed persons receiving wages, provided that the employer makes contributions to the Insurance Fund | At the place of work |

| Employed in military formations without being assigned a rank | At the place of work |

| Persons performing military or civilian service | At the employer or at the Social Protection Center |

| Discharged persons who served in military formations | CSZN |

| Unemployed people | CSZN |

| Unemployed citizens who have officially received this status | Social protection of the population |

| Citizens studying full-time in any educational institution (no matter whether on a budgetary or contractual basis) | Social Security Center |

Credit "MTS Cashback" MTS Bank, Person. No. 2268

from 0.01%

per annum

up to 1 million

up to 3 years

Get a loan

Due to the fact that only one parent can receive benefits, in a situation where, for example, mother does not work and father is officially employed, you should contact the employer. You should go to the Center for Social Security only in a situation where both parents do not work or are not serving.

Regardless of who wants to receive benefits and who they apply to, it is necessary to collect all the documents. For the employer, this package looks like this:

- Completed application - just write that you are asking for a payment;

- Certificate, birth certificate of the baby from the civil registry office;

- Parents' passports along with copies;

- A certificate from the employer stating that the spouse did not receive payments. It must be obtained from the husband’s employer or from the Central Social Security Service at his place of registration.

Important! From 04/03/2021, not everyone needs to provide a child’s birth certificate issued by the civil registry office to assign and pay benefits. More information about who does not need to provide a certificate from the registry office can be found on the consultant.ru portal.

When both parents do not work and you apply to the Center for Social Protection, you will need to provide:

Credit Cash Gazprombank, Persons. No. 354

from 16.5%

per annum

up to 5 million

up to 7 years

Get a loan

- Statement;

- Birth certificate;

- SNILS of parents;

- A certificate of family composition indicating the child living at the same address with you;

- Parents' ID cards;

- An extract with the last completed page of the work book;

- A certificate stating that no payment has been made previously.

Such a kit must be collected if there is a complete family, that is, if the mother is legally married. When the family is incomplete, or the parents have not registered their relationship, the documents of the applicant and the child are sufficient.

Foreigners temporarily residing in Russia, as well as refugees who have received this statute in the country, can apply for benefits. They will therefore need a residence permit or a document confirming their status.

You can receive a lump sum benefit for the birth of a child to the father or mother. The money is transferred to a bank account or issued through the federal postal service or another organization. The territorial body of the Social Insurance Fund must do this within 10 days from the date of application.

By the way, there is an alternative way to receive funds - through the Government Services office or by contacting the MFC. This opportunity is provided in large cities. Also, if it is impossible to visit the employer’s office or the Social Security Center, a set of documents can be sent by mail. This must be done by registered mail to the legal address of the company or CSZN.

Credit “Cash” Post Bank, Person. No. 650

from 5.9%

per annum

up to 6 million

up to 7 years

Get a loan

Remember that in addition to the lump sum payment, which should be applied for within six months, there are other benefits that help parents raise their child. You should not refuse to receive them, because even a little help at this time will not be superfluous.

One-time payment on the occasion of birth

The birth payment is available to either parent, but only one of them. In the situation of the birth of a stillborn child, such payment is not made.

Its amount is set in the amount specified by law (8,000 rubles) and is subject to annual indexation, due to which for 2022 (from 02/01/2020 to 01/31/2021) it is equal to 18,004.12 rubles. For 2022, the amount of the benefit has not yet been approved at the time of writing.

To receive such a payment, you must submit an application to the place of issue, a document confirming the fact of birth, and papers certifying that such payments were not received at other places of work or by the second parent.

A sample from ConsultantPlus experts will help you write a competent application for benefits upon the birth of a child. Get free access and go to the material.

Documents for payment of child benefit

When applying for benefits, the employee must provide the following documents to the accounting department:

- information about the insured person. They can be requested from the employee upon employment or during work. They are submitted in the form approved by the Federal Social Insurance Fund of the Russian Federation and are drawn up on paper or in the form of an electronic document;

- original birth certificate of the child from the registry office in form 24;

- a copy of the child's birth certificate;

- details for transferring money;

- a certificate stating that the second parent did not receive benefits. It can be obtained from the accounting department at work or from the social security office if the spouse does not work.

In addition, the employee writes a statement addressed to the employer. We recommend the following form.

The child’s parents may be divorced and do not live together, then the mother may have difficulty obtaining a certificate of non-receipt of benefits by the father. In this case, a copy of the divorce certificate and a document confirming the fact that the child lives with the applicant are attached to the application. You can get it at the passport office after registering the child at the place of residence.

A new parent should not delay receiving the payment. If he does not have time to submit documents in 6 months , it will be very difficult to receive benefits: you will have to prove that you were seriously ill, you were prevented by natural disasters, it was a long and difficult move, or the employer is to blame for everything.

Benefits paid during maternity leave

At the end of the sick leave issued in connection with pregnancy and childbirth, the mother of a newborn or another relative (or guardian) actually caring for this child has the opportunity to take leave to care for him for up to three years, or more precisely, until the child reaches the age of three (Article 256 Labor Code of the Russian Federation).

The algorithm for documenting parental leave is discussed in detail in the Typical Situation from K+. You can view the recommendations of specialists by getting trial access to the system.

During this leave, there are two types of benefits, paid according to:

- Decree of the President of the Russian Federation dated May 30, 1994 No. 1110. The amount of this payment, applied to the entire three-year vacation period, is 50 rubles. It is carried out at the place of work of the applicant for payment (the place of the mother serving in military service) or by the social security authority (if an unemployed person who was fired due to the employer losing the status of providing work while on maternity leave and not receiving unemployment benefits applies for it) .

ATTENTION! Starting from 2022, employers will no longer be required to assign or transfer compensation payments to employees for caring for a child under three years of age. Presidential decree of 1994, according to which an allowance of 50 rubles is paid. per month will become invalid. Let us remind you that according to the current rules, compensation payments are assigned upon the application of the mother or another relative who actually cares for the child. The employer transfers it at his own expense. After January 1, the obligation to pay benefits will remain only in relation to those employees to whom it was assigned earlier (Decree of the President of the Russian Federation of November 25, 2019 No. 570).

- Law No. 81-FZ. This benefit applies only to the period until the child reaches the age of one and a half years. Its value is defined by law as calculated (for persons insured in the compulsory social insurance system), but takes a fixed value for uninsured persons (including students or the unemployed). The calculation option is limited by the minimum (calculated from the minimum wage) and maximum (determined by the maximum base for calculating contributions for persons who had earnings or a fixed amount, if we are talking about those serving or unemployed who are entitled to benefits) values.

The estimated amount of the benefit paid under Law No. 81-FZ is determined by the share (40%) of the average earnings of the person receiving it for the two years preceding the year of leave, and it is possible to replace these years with earlier two years (clause 1 of Article 14 of the law "On compulsory social..." dated December 29, 2006 No. 255-FZ). In a situation where there is no income or insufficient income, the minimum wage valid on the date of the event is used to calculate benefits. The maximum amount of benefit for child care up to 1.5 years is

- RUB 29,600.48 — in 2022;

- RUB 27,984.66 - in 2022.

You will find all amounts of child benefits in our table.

Minimum benefits are assigned taking into account the regional coefficient.

Special payments for children of military personnel

For children of military personnel called up for service, in addition to all the payments described above, special payments are also valid, the right to which arises regardless of the fact of receiving other benefits. These are the payments that can be received by:

- The wife of a conscript is pregnant for at least 180 days. The payment is a one-time payment. Its basic value is 14,000 rubles, which for 2022 (including indexation) corresponds to a value of 28,511.40 rubles. (from 02/01/2020 to 01/31/2021).

- The mother of a conscript's child or the person who replaced her, in the form of monthly payments for the period from the birth of the child until he reaches the age of three years, coinciding with the period of the father's conscription service. The basic amount of such a monthly amount is 6,000 rubles, and for 2022 (taking into account indexation) it is 12,219.17 rubles. (from 02/01/2020 to 01/31/2021).

The right to such payments does not arise in relation to children of cadets of military educational organizations.

Do I need to pay taxes and contributions on birth benefits?

Benefits for the birth of a child are not subject to personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated March 3, 2015 No. 03-04-05/11080).

Benefits for the birth of a child are also not subject to insurance contributions (subclause 1, clause 1, article 422 of the Tax Code of the Russian Federation, subclause 1, clause 1, article 20.2 of Law No. 125-FZ).

Thus, in 2022, with the transfer of correct information to the Social Insurance Fund for the assignment of benefits, the employer’s obligations to the employee end.

Monthly payments - 2020-2021 for the first child: who is entitled to and at what expense

The rules introduced by Law No. 418-FZ establish the possibility of additionally receiving child benefits from 2022 - both for the first and for the second - in the form of monthly payments until the child reaches 3 years of age. However, not everyone can use this opportunity. However, the rules for assigning benefits to the first and second children differ.

The mother or father of the child, as well as the person who replaced them (adoptive parent or guardian), are entitled to apply for benefits for the first child in 2020-2021.

It becomes available if:

- a person permanently residing in Russia applied for him;

- the child was born after 2022 and is registered as a citizen of the Russian Federation;

- the per capita income of the family in which the child was born is a value that does not reach the value of 2 times the subsistence level of the population capable of working, established in the constituent entity of the Russian Federation for the second quarter of the year preceding the year of application for payment;

- the appeal occurred no later than the child reaching the age of one and a half years;

- the child is not fully supported by the state.

The amount of payment by Law No. 418-FZ is defined as the minimum subsistence level established in a constituent entity of the Russian Federation for children for the second quarter of the year preceding the year of application for benefits.

Thus, to determine the amount of benefit for the first child in 2020-2021, two values of the cost of living, determined quarterly in the region, have a special role:

- for the population capable of working;

- for children.

When calculating income per capita of a family (it is determined for the 12 months preceding the month of application for benefits, by dividing the total amount of income by 12 and by the number of members in the family, excluding persons on state support), the following are used:

- remuneration for labor;

- pensions, benefits, scholarships:

- payments received by legal successors;

- payments for the performance of government duties;

- monetary allowances for people employed in the service.

Payment for the first child in 2020-2021 should be made by regions (municipalities), but at the expense of targeted revenues from the federal budget. You should apply for it to the social security authorities in person or through the MFC by submitting an application. It is not necessary to attach the necessary supporting documents from among those that can be obtained by the body making the decision on payment in the manner of interdepartmental interaction. However, some documents will form attachments that are required for the application to be accepted. Their complete list is contained in Appendix No. 2 to the order of the Ministry of Labor of Russia dated December 29, 2017 No. 889n.

One application will be valid for one year. To continue receiving benefits, you must apply again.

Read more about Putin's payments here.

The amount of benefit for the first child from the moment of introduction and for 2020-2021

Due to the established rules for determining the specific amount of payment for the first child in 2020-2021, it will vary by region. Accordingly, when you change region, the amount of the benefit will also change. The recipient of the payment will have to independently notify the social security authority of the change of residence within a month from this event. Changes in other grounds giving the right to receive benefits also oblige him to take similar actions.

Payments are made in full (from the date of birth) if the application for benefits occurs no later than six months from the date of birth. If the six-month period is exceeded, then the period from the moment of application until the child turns one and a half years old will be paid. Upon reaching this age, the benefit payment automatically stops (from the day following this event). Other grounds for termination of payment are:

- moving to another region;

- refusal to receive;

- death of a child;

- death of the recipient, his unknown absence or deprivation of parental rights.

Payments in these cases will stop from the month following the month of notification of change of residence (refusal to receive) or the month of death (entry into force of the court decision). In situations of refusal to receive and cancellation of a decision made by the court, payment may be resumed.

Results

The birth of the first child gives his parents the right to receive payments, which are also assigned for the birth of other children in succession. This:

- one-time benefits for pregnancy and childbirth, for early registration with a doctor, upon birth;

- monthly payments during parental leave.

Special (in addition to the generally established) payments are provided for children of military personnel called up for service.

Since 2022, the possibility of receiving benefits for the first and second children under the age of one and a half years has been introduced for the low-income population, focused on the subsistence level (of the working-age population and children), determined in relation to specific regions of Russia.

Sources:

- Federal Law of May 19, 1995 No. 81-FZ “On state benefits for citizens with children”

- Federal Law of December 28, 2017 No. 418-FZ “On monthly payments to families with children”

- Decree of the President of the Russian Federation of May 30, 1994 No. 1110

- Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

List of documents for assigning benefits at the birth of a child

The composition of the package of documents that the employer must submit to the Social Insurance Fund in order to assign a lump sum payment when an employee has a child is established in clause 28 of the Procedure and conditions for the assignment and payment of state benefits to citizens with children.

If data is submitted on paper, a paper inventory of the entire collection should be attached. If the transfer occurs electronically, only a register is created, similar to registers for other benefit payments from the Social Insurance Fund.

The nuances of filling out and a sample register are given in the article “Procedure for paying maternity benefits in 2022 from an employer.”