About legal entities

What is a tax deduction, why do you receive it? A tax deduction is a certain amount.

Article 80 of the Tax Code of the Russian Federation gives the following description of a tax return - this is a statement about objects

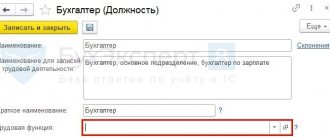

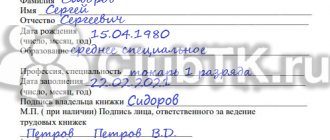

Regulatory framework The submission of the SZV-TD form is regulated by: Federal Law dated December 16, 2019 No. 436-FZ “On the Submission

Modern business conditions are characterized by the desire of many companies to overcome crisis phenomena and develop successful prospects

Who passes 2-TP (air) Who passes 2-TP (air) - legal entities and individual entrepreneurs operating in

Maintaining and storing work books: rules in the Russian Federation in 2021 A work book is

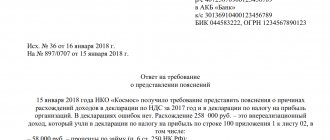

When explanations are required During an inspection, the inspector has the right to request written explanations. Situations in

Location and explanation of page 160 (previously 070) in the 6-NDFL report In the new form 6-NDFL

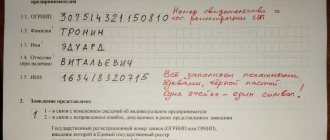

Almost every second entrepreneur during his activity is faced with the need to change some data in

Financial investments on the balance sheet: definition, list Contrary to the opinion of some accountants, the following assets cannot