Almost every second entrepreneur in his activity is faced with the need to change some data in his official documents. The most common change that needs to be made to tax office documents is editing or adding OKVED codes.

Surely tax officials are not always willing to explain how to correctly fill out forms with new information. But you don’t have to hang your nose right away! The task ahead of you is not that difficult. True, if you use the clear step-by-step instructions that are attached below. But, as usual, first we place the necessary files:

- Form and sample

- Online viewing

- Free download

- Safely

FILES

In what cases is it necessary to make changes to the registry documents?

So, let's take it in order. When information about your last name, place of registration, series and passport number changes, it is not necessary to inform your tax inspector about this. An exchange of updated data has been established between the tax authority and the Federal Migration Service. Therefore, in the Unified State Register of Individual Entrepreneurs, a new surname and place of residence appears automatically , without your petition (according to the norms of RF Law No. 129-FZ, Chapter II, Article 5, Clause 4).

Of course, when changing the type of business activity, it is necessary to make amendments to the register of individual entrepreneurs. To do this, it is not necessary to use the services of a lawyer who will draw up the documents for you, but will ask for Bank of Russia tickets in return. It is quite possible to update information for the tax office on your own, especially since it is not at all difficult.

Contents of the application for amendments to the Unified State Register of Individual Entrepreneurs

Form p24001 consists of 8 sheets:

- Title page.

- Sheet “A” Information about the data of an individual entrepreneur.

- Sheet “B” Information about citizenship.

- Sheet “B” Information about the place of stay in Russia.

- Sheet “D” Information about the identity document.

- Sheet “D” Information about a document confirming the right of a foreigner or stateless person to stay in the territory of the Russian Federation.

- Sheet “F” (in the Order of the Federal Tax Service No. ММВ-7-6 / [email protected] dated January 25, 2012, it has no name).

Important!

The title page and Sheet “F” of form p24001 are filled out regardless of the reason for submitting the document. The remaining pages of the document need to be filled out only if the relevant data about the individual entrepreneur is changed.

Sample of filling out form P24001

Download the current form P24001 (links to files at the top of the page). Using Adobe Reader or any other program that can work with PDF files, open it and start studying. Then you need to print it out to fill out manually, or you can fill it out directly in the file and print out the finished document, which you only have to sign. The second option is easier to complete by downloading the application in .xls format and editing the document using Excel.

Note! The tax office accepts applications filled out only with a pen and black ink (this is if you chose to fill it out manually). Forms with blue, purple and other color spectrum entries will not be accepted!

Enter information in as legible handwriting as possible - in block capital letters. If you are an advanced PC user, try filling out the form using the editor. Tax authorities advise doing this using the Courier New 18 font.

You must sign a printed document with all the information manually in the presence of the inspector who will accept your application for consideration.

Below, in real photographs of the application for making changes to the individual entrepreneur in the Unified State Register of Entrepreneurs, a sample of filling out form P24001 is presented. Only those pages that need to be filled out by an individual entrepreneur - a citizen of the Russian Federation - are presented. All other sheets, accordingly, must be filled out by a citizen of another state and/or having a place of residence other than the Russian Federation.

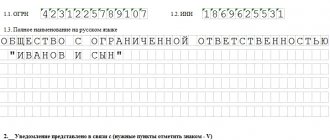

Stage 1

We enter OGRNIP (number of the certificate of registration of an individual as an individual entrepreneur). All cells in this field must be completed. Next - full name in block letters, in black ink. And Taxpayer Identification Number. We remember the basic postulate of manually filling out such documents: one cell - one character.

Stage 2

We fill out Sheet E, page 1 when the data of OKVED codes into the Unified State Register of Individual Remember, the OKVED code must contain a minimum of 4 digits, a maximum of 6. There is no need to put dots - they are already on the form.

Stage 3

Sheet E. Page 2. To be filled in if these OKVED codes are EXCLUDED The filling requirements are similar. Don't forget to number the page at the top.

Stage 4

Enter your full name in block letters in black ink and below the corresponding number:

- — if documents confirming changes in the Unified State Register of Individual Entrepreneurs or a refusal to do so are issued personally to the applicant;

- - a person acting on the basis of a power of attorney;

- - send to postal address.

Please fill out the “phone” field below. You can specify both a mobile number and a landline number. We don't sign! This is done in the presence of an official at the tax authority. If you do, there will be claims and the application may be refused!

Information about the applicant - Sheet E

Sheet E

Sheet E is completed by all applicants who submit Form P24001. Nationality and reason for filing this application do not matter. On sheet E, you must write your full name in your own hand and put a personal signature in the presence of a tax inspector, an MFC employee or a notary - it depends on the method of submission. When submitting online, the form is signed with an electronic signature.

Please include current personal and contact information on the sheet.

In paragraph 2

indicate the email address to which the Federal Tax Service will send the documents. Now in this paragraph you can enter the number “1” in a special field if the applicant wishes to receive documents in paper form. If there is such a mark, you will be able to receive a paper version of the finished documents at the place of their submission.

In paragraph 3

write your contact number.

Points 4 and 5

do not fill in.

Read more: Submitting documents for amendments for individual entrepreneurs. Step-by-step instruction

Nuances of entering code data

When filling in the numbers in the cells of the main activity code, keep in mind that there is only one. There are some nuances when filling out additional codes:

- the tax office will not accept a double-sided printed application from you - this is prohibited by law;

- if you only need one sheet of the form to fill out, you don’t have to print and number the blank pages of sheet E;

- record line by line from left to right;

- When adding codes in the cells of additional activities, do not enter existing ones.

So, to add new codes:

- We select the necessary digital codes with encoded information about the types of your activities according to OKVED.

- We enter them in the appropriate block of the application (sheet E page 1).

To exclude codes that have expired, in your case:

- We select individual entrepreneur activity codes from the Unified State Register of Individual Entrepreneurs (USRIP) extract.

- We enter them in the corresponding block on page 2 of sheet E.

If there is a need to leave the previous activity code, then enter it as additional on Art. 1 sheet E. in cells intended for additional codes.

Important point! Since July 11, 2016, updated codes for state registration of legal entities and individual entrepreneurs have been introduced.

How to change OKVED codes for individual entrepreneurs in an application

In the form, fill out page 001, sheet D and sheet E. To indicate activity codes, you will need two pages of sheet D. On the first you need to indicate new codes, on the second - unnecessary ones that you want to delete.

Sheet D. Page 1

Sheet D. Page 2

It is allowed to add groups of codes consisting of four digits, as well as individual codes of 5-6 digits. You can enter any number of codes. If one page of sheet D is not enough, print an additional one.

You can replace any code, even the main one. As the main one, you should choose the activity from which you receive the maximum income. In this case, be sure to include the old code on page 2 for removal.

Applying in person

When submitting documents in person to register new types of economic activity, you must present a passport. In this case, there is no need to certify the application with the help of a notary (according to Federal Law No. 129-FZ, Chapter III, Article 9, Clause 1.2). On sheet G of the form, in the presence of a tax officer, you need to manually fill in your full name and sign.

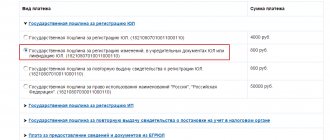

Important! You will not need to re-pay the state fee for changing individual entrepreneur data in the state register. If your inspector forgot about this, you should always remember this so as not to overpay extra money.

We submit documents ourselves

Just 3 steps:

- New forms do not need to be notarized. Print out all the necessary sheets of form P24001, sheet G is signed by the registration authority when submitting documents.

- Take copies of your passport, TIN, registration certificate and document confirming the change of surname (if it has changed). Now you can go to the registration office with your passport.

- Having accepted the documents, the inspector will give you a receipt, according to which in five days you will be able to receive documents on making changes to the Unified State Register of Individual Entrepreneurs.

We send application P24001 by mail

There are often situations when a businessman cannot personally appear to the inspector to enter new data into the register: long business trips, vacations and other important reasons.

Remote sending is possible. In this case, it is necessary to perform notarized confirmation of the signature on the application.

No problem! The completed form can be sent by mail. Although to do this you will still have to visit a notary office. Agree that it is better to pay this specialist for services than, for example, to change a ticket for an expensive airline flight abroad. The notary will sign and seal Form P24001, certifying the authenticity of the copy of your passport.

Submitting an application to the tax office

An individual entrepreneur must submit an application to change OKVED codes no later than seven days from the date of the start of a new activity. In 2022, this can be done in the following ways:

- Submit documents online using our service

. You will be able to notify the tax office of changes without even leaving your home. - Submit in person to the registering Federal Tax Service

(not to be confused with the territorial one). If you fill out form P24001 through our free service, your tax office will be determined automatically. - Submit in person to the MFC

. Whether your MFC provides such a service, check in advance. - Send through a notary

. He will sign application P24001 with his digital signature. Notary services are paid.

After 5 days you will receive a new USRIP sheet to your email. If there are errors or omissions, you will be sent a refusal, and you will need to submit the application again after it has been corrected.

How long will it take to wait for updates to documents?

The inspector undertakes to issue a receipt form for receipt of your documents. It is important not to lose this paper, because with its help you can track the progress of document readiness by using a special online tool on the official website of the Federal Tax Service.

According to the law, in a week (taking into account five working days and two weekends) you can come for a ready-made Unified State Register of Individual Entrepreneurs (USRIP) sheet. It will be issued upon presentation of your passport and that same receipt. As you can see, nothing complicated. Within just a few days, literally in two visits to the tax office, you will receive the necessary document without the help of a lawyer. Study your rights and save your time so as not to waste time standing in line for meaningless consultations with tax officials.

Adding a new type of individual entrepreneur activity

Before adding a new type of activity, an entrepreneur needs to decide on the OKVED code that he plans to add. The individual entrepreneur selects a code from OKVED that corresponds to the type of his business activity. We described in detail how to do this in this publication.

Note that in 2022 and 2022, the current OKVED classifier is the second edition. You can download it on this page.

In 2016, the new OKVED came into force. Accordingly, the previous version of the classifier will be considered invalid.

After the individual entrepreneur has chosen the required code, he fills out an application on form P24001, which will need to be submitted to the tax office.

In order to add new types of individual entrepreneur activities, all pages of the application will not be needed.