Why do you need a primary?

Any fact of economic life must be recorded in the primary accounting document. This requirement is enshrined in Article 9 of the Law “On Accounting” No. 402-FZ. The primary document must be drawn up at the time of the transaction or immediately after its completion.

When tax specialists or auditors check the statements, they will first of all make sure that there is a primary document for each transaction. No document means no business transaction, which means the reporting is drawn up incorrectly and taxes are calculated incorrectly.

For each type of operation, its own primary documents are used. For example, services rendered are usually recorded in an act of provision of services, the sale of goods - in an invoice, the receipt of money - in a cash receipt order, and the write-off of materials for production - in a demand invoice. All these documents must be stored and presented to controllers upon their request.

Results

The organization has a choice: to independently develop primary documents or use their unified forms. But there is an exception: when carrying out operations involving the transportation of goods by road or the acceptance/issuance of funds, it is still necessary to use the form of the bill of lading approved in the regulatory documents and documents for processing cash transactions (receipt/expenditure cash orders, cash book).

Sources: Law “On Accounting” dated December 6, 2011 No. 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Forms of primary documents

Once upon a time, primary documents had to be prepared only according to the forms developed by the State Statistics Committee. But since 2013, there is no such requirement for commercial organizations, with some exceptions, which we will discuss below. Companies themselves can develop forms of documents and consolidate them in their accounting policies.

In the document database of the “My Business” service you will find all forms of primary documents and several options for accounting policies. And by becoming a user of the service, you will completely get rid of the hassle of filling out documents. The service itself generates documents, automatically pulling data and details from the database.

In practice, many organizations and entrepreneurs continue to use unified forms, modifying them if necessary: removing unnecessary fields or adding new ones.

Even independently developed or modified forms must contain the mandatory details listed in paragraph 2 of Article 9 of the Accounting Law:

- Title of the document;

- Date of preparation;

- name of the organization on behalf of which the document was drawn up;

- content of the fact of economic life;

- meters in physical and monetary terms - rubles and, for example, pieces;

- the names of the positions of the persons responsible for the transaction and the correctness of its execution;

- personal signatures of these persons with transcripts.

For some documents, laws may provide for other mandatory details that are not mentioned in the accounting law. When developing such documents, special requirements will have to be taken into account. For example, in relation to a waybill.

All forms of primary documents that the organization uses must be enshrined in the accounting policy and applied for at least a year - until the new policy is approved.

The primary document does not have to be paper. Law 402-FZ allows for the preparation of primary accounting documents in electronic form and signing them with an electronic signature. If this is a bilateral or multilateral primary document, then both parties to the transaction must sign it electronically. Replacing the signature of one of the parties with a handwritten one in this case is unacceptable (letter of the Federal Tax Service of Russia No. ED-4-15/7760 dated April 23, 2022). That is, if you signed the invoice with an electronic signature, your counterparty must do the same. If someone does not have this opportunity, they will have to draw up a paper document the old fashioned way.

If you draw up the primary document on paper, the signatures must be strictly “live”. You must sign with a pen with blue, purple or black ink. Facsimiles cannot be used (letter of the Ministry of Finance No. 03-01-10/8-404 dated October 26, 2005).

Digitalization concerns all areas of activity of institutions, including the organization and maintenance of budget (accounting) records (hereinafter referred to as accounting). Let us recall that since the beginning of this year, when maintaining accounting records, centralized accounting departments have been using unified forms of primary accounting electronic documents and electronic accounting registers (hereinafter collectively referred to as electronic documents).

| An important difference between an electronic primary document is that it is created electronically in an information system and its printing on paper is not mandatory |

The website of the Ministry of Finance of Russia published Order No. 61n dated April 15, 2021 “On approval of unified forms of electronic accounting documents used in maintaining budget accounting, accounting of state (municipal) institutions, and Methodological guidelines for their formation and application” (hereinafter referred to as Order No. 61n). The order has been sent for registration with the Russian Ministry of Justice, so changes are possible.

Order No. 61n introduces new unified forms of electronic primary accounting documents. Their list is given in Table 1:

In addition to electronic primary accounting documents, new electronic accounting registers are being added (see Table 2).

According to Order No. 61n, electronic document forms consist of 3 parts:

- Header

- Meaningful

- Designer

Each part contains the details provided by the unified forms and the corresponding codes. Codes are assigned according to all-Russian classifiers of technical and economic information for automated processing and exchange of information.

| Important! It is not allowed to exclude details from electronic document forms. |

The methodological recommendations approved by Order No. 61n detail the mandatory details for each part of the electronic document and the procedure for filling it out.

Particular attention should be paid to the design part of the electronic document. The formalizing part of the electronic document contains electronic signatures of officials responsible for the fact of economic life, for its execution as an electronic primary accounting document, for the data contained in the electronic document, as well as officials who are entrusted with maintaining accounting records (if these signatures are provided for in the form of the document) .

An electronic document is signed with a qualified electronic signature , but the guidelines provide for cases of signing with a simple electronic signature .

The use of a simple electronic signature allows you to organize internal legally significant electronic document flow in the conduct of the economic life of institutions without additional costs.

Some electronic documents, according to Order No. 61n, must be signed by several responsible persons (commission). In this case, an integral part of such a document is the voting sheet. The voting sheet is signed by the members of the commission with a simple electronic signature , and the chairman of the commission applies a qualified electronic signature .

An electronic document is accepted for accounting when all the details provided for in the unified form of the electronic document are filled out. An important point when accepting an electronic document for accounting is the presence on the document of a qualified signature of the manager or his authorized person.

Order No. 61n is mandatory for use by all budgetary organizations and other organizations in terms of their budget accounting, starting from January 1, 2023 . The use of electronic documents earlier than the specified period is possible if such a possibility is provided for by the accounting policy of the institution.

An authorized organization , to which, by decision of the Government of the Russian Federation, the powers to maintain budget records of individual federal executive bodies, their territorial bodies and federal government institutions subordinate to them have been transferred, use electronic documents approved by Order No. 61n from January 1, 2022 .

The use of new forms of electronic documents requires a number of activities to be carried out in institutions. First of all, it is necessary to provide all participants in information interaction with electronic signatures. The use of simple electronic signatures must be carried out in accordance with the Federal Law “On Electronic Signatures” dated 04/06/2011 No. 63-FZ.

The second important point when organizing electronic interaction is the document flow schedule: it will be necessary to make changes to it to reflect the norms of Order No. 61n. For example, we recommend using the document flow schedule approved by Order of the Federal Treasury dated January 11, 2021 No. 2n “On approval of the Document Flow Schedule for the centralization of accounting and the recognition of the Federal Treasury Order No. 41n dated December 31, 2022 as no longer in force.

When can only unified forms be used?

Organizations and entrepreneurs do not always have complete freedom in choosing the form of the primary document. Sometimes you need to use strictly unified forms.

Thus, when transporting goods by road, you can only use a consignment note approved by Decree of the Government of the Russian Federation No. 272 of April 15, 2011.

When carrying out non-cash payments, payment documents approved by banking legislation are used. In particular, by the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012.

Cash documents must be unified: receipt and expenditure orders, a book of accounting for funds accepted and issued by the cashier, a cash book, payment and settlement statements. This is a requirement of Bank of Russia Directive No. 3210-U dated March 11, 2014.

Using unified forms

From January 1, 2013, the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use (Information of the Ministry of Finance of the Russian Federation N PZ-10/2012).

Forms of primary accounting documents can be used (Information of the Ministry of Finance of the Russian Federation N PZ-10/2012):

- developed by an economic entity independently,

- provided for by the recommendations in the field of accounting adopted by non-state accounting regulatory bodies,

- other recommended forms (for example, unified forms of primary accounting documentation).

At the same time, forms of documents used as primary accounting documents established by authorized bodies in accordance with and on the basis of other federal laws continue to be mandatory for use (Information of the Ministry of Finance of the Russian Federation N PZ-10/2012).

Is it possible to issue a primary document in foreign currency?

There is no specific provision in the accounting law that primary documents must be drawn up in rubles. But the same law says that accounting objects must be reflected in rubles, and if their value is expressed in foreign currency, they must be converted into rubles. And you need to prepare reports in rubles. Therefore, the primary payment should also be in rubles.

If you need a primary document in a foreign language or currency for a foreign counterparty, you can do this:

- provide in the document several columns for rubles and other currencies;

- draw up two copies - one in foreign currency or in a foreign language, and the second - to confirm the completion of the transaction in accordance with the norms of Russian legislation;

- draw up an additional document (for example, an accounting statement) explaining the contents of the document drawn up in foreign currency (in a foreign language).

What is primary documentation in accounting

Primary is any accounting document that confirms the taxpayer’s transactions: purchases, sales, returns, payments. These must be operations that are aimed at making a profit and are related to the economic activities of the company or individual entrepreneur according to OKVED. Based on the primary data, postings are already made, the tax base is calculated, and then reports are generated.

Correct execution of such documents eliminates claims from the Federal Tax Service. Only correctly executed documents confirm income or expenses. Incorrect drafting makes the primary document invalid: it cannot be used to confirm the transaction, and you cannot rely on it in court. All rules for the preparation of primary documents are given in Federal Law No. 402-FZ “On Accounting”.

Primary documents are drawn up at the time of the transaction or immediately after it. This is usually the task of the supplier, but the buyer must carefully ensure that the documents are correct, since they confirm his expenses, and in case of errors, it is the buyer who will bear the losses.

The set of primary documents depends on the type of transaction, tax regimes of the parties and method of payment. For example, when providing services using the simplified tax system, the primary documents are a contract, an invoice for payment, a certificate of completion of work and a payment document - a payment order or account statement, a cash receipt order, a receipt from the bank. And when delivering goods to OSNO, the primary documents are a contract, an invoice for payment, a delivery note and an invoice or UPD and payment documents.

How to make corrections to primary documents

If, after a document has been accepted for accounting, an error is discovered in it, it is no longer possible to replace it with a new one, you can only correct the existing one. An exception is invoices and UPD. Correction forms are provided for them.

To make a correction to a paper document, you need to follow these steps:

- Cross out the incorrect text or amount with one line. So that you can read the corrected one.

- Above the crossed out text, write the corrected text or amount.

- Confirm the correct data with the entry “Corrected” and the signatures of the persons who compiled the document being corrected, indicating their last names and initials (other details that allow identifying these persons), indicate the date the corrections were made.

The organization can decide for itself how to make corrections to electronic primary documents. The chosen method must be recorded in the accounting policy.

Cancellation of unified forms: causes and consequences

What are the consequences of a broad interpretation of the optionality of unified forms of documents?

Firstly, accounting workers can understand Law No. 402-FZ as the possibility of refusing certain primary documents as such

. Such “savings” on maintaining primary records leads to the loss of some information and failure to ensure its proper storage. That is, some accountants no longer consider it mandatory to maintain all documents required by law!

Reason: Law No. 402-FZ (Part 4, Article 9) states that “the forms of primary accounting documents are approved by the head of the economic entity upon the recommendation of the official responsible for accounting.”

Let us explain how this should be understood: no one has canceled the composition of the primary documents, they have been preserved, as well as their mandatory use, the relaxations concern only the form

, which is associated with greater opportunities for creating primary documents. From January 1, 2013, forms of documents used as primary records continue to be mandatory for use if they are established by authorized bodies in accordance with federal laws (for example, cash documents or those that we are accustomed to using for personnel records:

- an order to hire an employee (previously, its unified form No. T-1 was used, it was approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1, along with the other forms listed in this list below);

- order on hiring employees (form No. T-1a);

- employee personal card (form No. T-2);

- personal card of a state (municipal) employee (form No. T-2GS(MS));

- staffing table (form No. T-3);

- registration card of a scientific, scientific and pedagogical worker (form No. T-4);

- order to transfer the employee to another job (form No. T-5);

- order to transfer employees to another job (form No. T-5a);

- order to grant leave to an employee (form No. T-6);

- order on granting leave to employees (form No. T-6a);

- vacation schedule (form No. T-7);

- order on termination (termination) of an employment contract with an employee (dismissal) (Form No. T-8);

- order on termination (termination) of an employment contract with employees (dismissal) (form No. T-8a);

- order to send an employee on a business trip (form No. T-9);

- order to send employees on a business trip (form No. T-9a);

- travel certificate (form No. T-10);

- official assignment for sending on a business trip and a report on its implementation (form No. T-10a);

- order (instruction) to reward an employee (form No. T-11);

- order (instruction) on incentives for employees (form No. T-11a);

- timesheet for recording working hours and calculating wages (form No. T-12);

- payroll statement (form No. T-49);

- personal account (svt) (form No. T-54a)).

Secondly, accounting workers can understand Law No. 402-FZ as the absence of responsibility of the persons who compiled and signed the primary documents for the accuracy of the data contained in them, as well as the optional compilation of consolidated accounting documents

.

Reason: there is no entry about this in Law No. 402-FZ, although there was one in the previous Law “On Accounting” dated November 21, 1996 No. 29-FZ.

Let us explain how this should be understood. Law No. 402-FZ does not contain a record of those elements that should be regulated by the internal regulatory documents of the organization itself

. It is in them that the composition of primary documents, their movement, those responsible for their creation and processing, as well as a list of consolidated accounting documents compiled on the basis of primary documents should be prescribed in order to control and organize data on the economic life of the organization.

Thirdly, there is another misconception in the interpretation of the new law on accounting: supposedly there is now no ban on making corrections to cash and banking documents

.

Reason: in the old Law No. 129-FZ there was a direct ban on this, but it was “removed” from the new Law No. 402-FZ.

As you should understand: this circumstance does not mean that from January 1, 2013, such corrections are allowed, because a similar prohibition remains in other regulatory documents:

- clause 2.1 of the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation (approved by the Bank of Russia on October 12, 2011 No. 373-P) and

- clause 2.4 of the Regulations on the rules for transferring funds (approved by the Bank of Russia on June 19, 2012 No. 383-P).

Is it necessary to certify the primary document with a seal?

The seal is not mentioned in the mandatory details of the primary documents. Therefore, organizations have no such obligation. But there are exceptions.

- Stamping is required in some documents, the form of which is approved by regulations not related to the field of accounting. For example, settlement (payment) documents.

- If you decide to use previously used unified document forms without making any changes to them, a seal is needed because these forms contain seal details.

If the documents that you developed yourself and secured in your accounting policies contain seal details, it should always be affixed to such documents.

It is advisable for organizations to certify executed documents with a seal. This minimizes the possibility of its falsification and allows for the most reliable identification of the organization and the powers of its authorized representatives.

What primary education is required in accounting in 2022

The execution of transactions for different individual entrepreneurs and companies may differ significantly. This is affected by the tax regime, payment method and much more. But there is a minimum list of primary items that are required in accounting. The list can be expanded if the accounting features of the company require it:

- transaction agreement;

- an invoice for payment;

- payment documents: bank statement, BSO, cash receipts, PKO;

- act of services rendered or work performed;

- invoice.

The forms of primary documents that the organization works with must be fixed in the accounting policies. If new primary forms are added in the course of activities, they also need to be included in the accounting policy. This becomes the basis for using the form in business, and during audits, the tax office checks whether the company works with the documents that are specified in its UP.

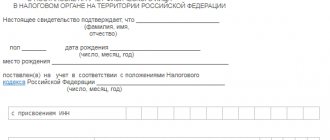

Documents can be drawn up using standardized forms or those developed independently by the company (Article 9 No. 402-FZ). At the same time, the primary document must contain all the required details; without them, the document has no legal force:

- document's name;

- date of registration;

- name of the company or full name of the entrepreneur - supplier;

- description of a business transaction in physical and monetary terms;

- reference to the contract - the basis document;

- names of persons responsible for the transaction;

- signatures of the parties.

How to organize the storage of primary documents

According to clause 6 of the Regulations of the USSR Ministry of Finance dated July 29, 1983 No. 105, primary documents that are used in current activities, before being transferred to the archive, must be stored in the accounting department in special rooms or locked cabinets under the responsibility of persons authorized by the chief accountant.

After documents are no longer used in current activities, they are placed in an archive for storage. You can use your own archive or use the services of specialized third-party organizations.

You can also store the primary document in electronic form, but only if it is certified with an electronic signature. At the same time, it is necessary to store means for reproducing electronic documents and verifying the authenticity of an electronic signature.

It is better to specify the procedure for storing documents and the procedure for transferring documents to the archive in the internal documents of the organization.

We described in detail the storage periods for documents with the latest changes in this article. For most accounting and tax documents, the retention period is 5 years, and for documents on personnel and information that affects the calculation of pensions - 50/75 years.

Unified forms of primary accounting documents - what does this mean?

For many years, until 2013, only documents compiled according to specially approved forms could be used as primary documents for accounting and tax accounting purposes.

These forms are called unified. It was allowed to draw up in free form only those documents for which there was no unified form. With the entry into force of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, economic entities received the right to develop document forms independently, subject to compliance with certain requirements for them.

However, many companies continue to use unified forms, because... they comply with all legal requirements. ConsultantPlus experts have collected all the forms into a single material. Get trial access to the system and go to Help information for free.

After this, most of the unified forms of primary documents became recommended, but some remained mandatory. We will talk about them further.

What to do if documents are lost

It is necessary to investigate the reasons for the loss and find or restore documents. A special commission is appointed to investigate. If necessary, with the participation of government agencies. Based on the results of the investigation, a report is drawn up.

If the documents are not found, you need to send written requests to counterparties, banks and the tax office to provide duplicates.

If some part of the documents cannot be restored, you need to draw up a report about this and indicate the reasons.

All documentation supporting the investigation and document recovery work must be retained. These are acts, requests, correspondence, etc.

How to approve document forms within the organization?

The office management service, which strives for the status of a document management service and the main center of competence in this area, can now consider the legislative “strangeness” and this unexpected “democraticism” in the issue of using unified forms of documents in a positive aspect

.

Unification of an organization's documents in composition and form in order to optimize document flow and document collection can become a priority function of the office management service: it should be included in the regulations on this service and reflected in the relevant work plans.

GOST R ISO 15489-1-2007 recommends that the rules for creating documents and their metadata, the rules for including documents in information systems should be implemented in all procedures governing all business processes that require proof of actions (clause 7.1). The records management service can initiate (even prepare a short draft based on GOST R ISO 15489) the development of a Document Management Policy with the distribution of areas of responsibility of departments and officials

for documents reflecting one or another “business process” of the organization.

The responsibility of officials for the creation, use, storage and destruction of documents within the framework of their assigned duties should be reflected in the Regulations on departments and job descriptions

, and also regulated in

the Regulations on the system of delegation of powers

. The concept of document management involves establishing flowcharts for each process (or activity area):

- types and varieties of documents created,

- forms of their presentation,

- shelf life,

- signing authority,

- responsibility for storage, destruction, etc.

To fulfill this requirement, the office management service must become an authority for mandatory approval.

all organizational and administrative documents in order to be able to optimize the forms of documents, ensure their uniformity and compliance with the corporate style, develop them as “input” forms into information systems, etc.

By performing the function of unifying document forms, the office management service actually increases the efficiency of the organization. The company's top management needs to explain

that drawing up a document according to a unified standard form (template) takes

3–5 times less time

than drawing up an individual document in free form, as the executive employee is used to.

And finally, the office management service, the accounting department, and all departments of the organization need to remember that the unification of document forms consists of:

- in the selection and consolidation (taking into account the material medium) of indicators and details that best

reflect the purpose of creating the document, ensure its legal force, and also - in establishing uniform requirements for their preparation and execution,

- development and application of electronic templates for draft documents based on their approved standard unified forms.

The main tools for document unification and management remain:

- Classifier of unified forms of documents;

- Sheet of unified forms of documents

of the organization (or Sheet of applicable document forms); - Album of unified document forms

(or Album of document forms approved and used in the organization).

The Classifier, Sheet and Album of Forms can be maintained both electronically and in paper form

.

Since documents are subject to updating and fix the “version” of the forms used, the Album must provide for accounting of both existing forms and canceled ones

. If the Album and the Timesheet are maintained in electronic form, then they can have 2 parts: current and “archive”.

When maintaining electronically, it is also necessary to provide for the form of presentation of the original document. If a document must additionally be printed as a paper copy of an electronic original or created exclusively in paper form (for example, an order for the main activity or a personal card of form No. T-2), then the Album of Forms includes printouts of document forms created electronically and approved standard forms of paper documents.

To implement the function of unifying document forms, it is advisable for office management service employees to undergo advanced training and update their professional knowledge taking into account the requirements of previously existing standards (for example, GOST 6.10.5-87 “Unified documentation systems. Requirements for the construction of a sample form”) and modern standards for document management.

Responsibility for lack of documents

The absence of primary documents is considered a gross violation of accounting rules. Tax authorities may fine you for this:

- by 10,000 rubles for a violation in one tax period;

- for 30,000 rubles for violation in several tax periods;

- by 20% of the unpaid tax or contributions, but not less than 40,000 rubles, if the violation led to an understatement of the tax base.

Failure to submit primary documents for tax control will result in a fine of 200 rubles for each document. Plus there is administrative liability, which can reach 50,000 rubles depending on the type and consequences of the violation.

Become a user of the “My Business” service, and you will be able to automatically generate primary documents, fill out reports, calculate taxes and receive expert advice.

How long should primary documents be stored?

The shelf life of the primary document is 5 years from the date of preparation. During this entire period, the tax office can conduct an audit at any time and request documents from the taxpayer, and a primary report is also needed in court. If a company cannot provide upon request a primary product that has not yet expired, a fine of 10-30 thousand rubles is possible. There is one more problem: without a primary document, it is impossible to take into account expenses when calculating the tax base, and then the Federal Tax Service assesses additional tax, and the company pays it additionally.

If a company works with paper originals of primary documents, they have to be stored in racks and office space must be allocated for this. To simplify storage, you can work with electronic legally significant documents: in this form, the primary document is easy to systematize and search in the electronic archive, it is easier to see missing documents, because acts, invoices, UPD, etc. are attached to the corresponding transactions in the accounting service.