Reasons for overpayments on tax payments

A variety of circumstances can lead to overpayment of tax. Most often, these are trivial mistakes when preparing documents, which are made by both company accountants and tax inspectors themselves. For example, the current tax rates are incorrectly indicated, benefits are not applied, all necessary values are not taken into account when calculating the tax base, etc.

It happens that tax authorities write off taxes twice - this usually happens if one legal entity has several accounts. There may also be situations where excess tax payment occurs as a result of advance payments paid on time.

In any case, regardless of the reason that led to the overpayment of tax, the law provides for the possibility of returning the amount paid in excess of what is necessary. To do this, you just need to submit a corresponding application to the territorial tax office.

How does overpayment of taxes occur?

Overpayment occurs due to errors either by the organization itself or by the tax authority.

Taxpayers themselves are wrong:

- when calculating tax. Accounting may make a mistake when calculating the tax base, applying the wrong tax rate, or not applying tax benefits and deductions;

- when filling out payment orders for the payment of taxes, penalties, and fines. Any error in the BCC or tax amount results in an overpayment for one tax and an underpayment for another.

Overpayment may occur due to advance payments. For example, a company transferred advances for income tax during the year, but at the end of the year the tax turned out to be less than the amount of the transferred advances. So the company overpaid income taxes.

Tax inspectors may mistakenly collect taxes twice. This occurs when a tax, fine or penalty is unilaterally written off from a current account. For example, the taxpayer has already transferred taxes, but the money has not yet reached the tax office. And the Federal Tax Service writes off the amounts without acceptance. Then there may be an overpayment.

Note! Overpayment of taxes must be recorded on the organization’s front card with the Federal Tax Service. If, for example, a company transferred taxes through a problem bank, but they did not go to the budget, it will not be possible to offset or return them.

The courts believe that recognition of the obligation to pay a tax as fulfilled does not give rise to the taxpayer’s automatic right to return or offset the amount of such tax.

They confirmed that the taxpayer does not have the right to compensate for his losses at the expense of the budget (Determination of the Supreme Court of the Russian Federation No. 307-KG18-10845 of August 8, 2022).

Deadlines for refunding overpaid tax

There is a clearly limited period for filing an application for a refund of overpaid tax: three years.

If the fact of the overpayment was discovered later or the taxpayer for some reason was unable to apply for a refund within this period, it will hardly be possible to do anything in the future.

If the application is submitted on time and in accordance with all the rules, and the tax office did not have any questions and agreed with the taxpayer’s request, the refund must be made no later than a month after filing the application.

2022 Tuition Tax Refund

You can get back part of the funds spent on training thanks to clause 2, part 1, art. 219 NK. As in the previous case, the opportunity is available to officially employed people who pay personal income tax. You can reduce costs by 13% both for your own education (in any form) and for the education of your children, brothers, sisters and even wards (but only full-time).

You can take advantage of the deduction when paying for services from licensed educational institutions (university, technical school, etc.). The factor of having a license is not taken into account in the direct implementation of educational activities by individual entrepreneurs.

What is the amount

The refund amount is calculated for the calendar year and cannot exceed the amount paid by personal income tax. The maximum amount that can be reduced by 13% is RUB 120,000. (for your training). Thus, the maximum return amount is 120,000 × 0.13 = 15,600 rubles.

To receive a deduction for the education of your children, the following conditions must be met:

- the offspring is a maximum of 24 years old;

- he is a full-time student in kindergarten, school, university, etc.;

- the agreement for payment of educational services was drawn up for one of the spouses;

- receipts and bills must be drawn up in the name of the personal income tax payer (or a power of attorney for the transfer of funds has been issued).

The maximum reduction amount is RUB 50,000. per child, i.e. the return will be 50,000 × 0.13 = 6,500 rubles.

Similar conditions are necessary to receive a deduction for brothers and sisters, with the only difference being that the maximum refund in the latter case can be equal to 15,600 rubles.

Tuition tax refund (2020): documents

To provide the deduction in question, you will need to submit the following documents to the Federal Tax Service:

- declaration in form 3-NDFL (original);

- passport (notarized or personally signed copy of each required page);

- original income certificate in form 2-NDFL, which is obtained from the employer. If in the year for which the benefit is received the place of work has changed, certificates are obtained from each employer;

- a tax refund application with account details where the tax office will send the money;

- a certified copy of the agreement with the educational institution, as in the case of a passport, indicating the cost of training. If it changed during the training process, then you need to provide a proper copy of the agreement about this;

- a certified copy of the educational institution's license. It is not necessary to provide it when the contract contains licensing details;

- certified copies of payment orders, receipts or cash receipts.

When returning children's tuition fees, they must additionally submit:

- a certified copy of their birth certificate;

- certificate from the educational institution about the form of study. Needed only if the contract does not specify the named form;

- a certified copy of the marriage certificate. It is necessary when the contract was drawn up for one spouse, and the other applied for a deduction.

Refund of personal income tax paid for the education of a brother or sister means additional provision of:

- copies of the birth certificate of the deduction recipient;

- copies of the birth certificate of the brother, sister;

- the original certificate of the form of study, if the relevant data is not in the contract.

The process of obtaining such a deduction is similar to the case of obtaining a deduction when purchasing an apartment; it takes up to four months.

How long does it take to get your money back?

You can only get a refund for years directly paid for. Moreover, this can only be done in the next 12 months following the payment year. Therefore, if the tuition was paid for in 2022, then you can receive a deduction only in 2022.

If the benefit was not issued immediately, then this can only be done for the last three years. If your studies took place in 2013-2018, you will be able to return the tax in 2022 only for 2022, 2022 and 2022. You can receive such a deduction either through the tax authorities by transferring money to your account, or through your employer in a manner similar to receiving a deduction when purchasing an apartment. Moreover, receiving through an employer means that, unlike receiving a deduction through the tax authority, you do not have to wait until the end of the current year, however, the money can only be received for the current 12 months.

This measure of social support will not be available if tuition is paid for using maternity capital.

If you don't write a return request

In the absence of a requirement for a refund of overpaid tax, tax inspectors have every right to offset this amount against the taxpayer’s future tax payments or to cover any of his arrears, penalties and fines with it.

There are situations when the application is received after the tax authorities have already disposed of the overpaid money - in such cases, only the difference between the covered arrears (penalties, fines) and the overpaid amount will be returned to the taxpayer’s account.

Four innovations in the procedure for offset or refund of overpayments

Article 78 of the Tax Code of the Russian Federation on the offset or return of amounts of overpaid taxes, fees, insurance premiums, penalties, and fines has been amended.

So, from 01.10.2020 the following amendments come into force. The provision that the offset of overpayments is made exclusively against a tax of the same type: federal against the federal, regional against the regional, local against the local, is completely invalidated. This innovation will allow taxpayers to rationally manage their funds.

It turns out that from October 1, 2020, it will be possible to offset, for example, an overpayment of income tax against the arrears of transport tax, despite the fact that the transport tax is regional, and the overpayment arose for federal tax. That is, it will be possible to offset overpayments of taxes of any type. It can also be offset against penalties and fines related to any type of tax.

Another positive innovation is the amendment that allows offset or refund of overpayments by any tax authority, and not just at the taxpayer’s place of registration (subclause “b”, paragraph 22, article 1 of the law). This innovation will simplify the offset procedure, however, the application for offset and return will have to be submitted, as before, to the inspectorate at the place of registration, clause 22 of Art. 1 law).

The listed positive innovations entailed stricter requirements for tax refunds. It will be possible if there is no arrears of any tax and corresponding penalties and fines. Today, it is sufficient that there is no arrears for a tax of the same type (subclause “e”, paragraph 22, article 1 of the law). Thus, with the adoption of the amendment, it will become even more difficult to return overpayments from the budget.

In addition, as of October 29, 2019, a new provision came into effect regarding the deadline for making a decision on offset or refund of overpayments during a desk audit. This period will depend on:

- from the completion date of the inspection;

- from the entry into force of the decision on it.

This period will be counted:

- after 10 days have passed from the day following the day the inspection was completed, or the day on which it should have ended;

- from the day following the day of entry into force of the decision on the inspection that revealed violations (subparagraphs “and” paragraph 22 of Article 1 of the law).

Federal Law of September 29, 2019 No. 325-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation” Subparagraphs “a”, “b”, “g”, “e”, “i”, paragraph 22, art. 1

Return procedure

- Before you run to the tax office with an application for a refund, you need to ensure that you have documents confirming the overpayment.

- Once the evidence is in hand, the taxpayer writes a corresponding statement, which he submits to the tax office.

For example, if there was an oversight on the part of the company’s accountant, which was subsequently discovered, an updated declaration must be prepared and submitted to the tax authorities. Or you can simply draw up a reconciliation report with the tax office - if it reveals an overpayment, then you will no longer need to submit a “clarification”.

Sometimes the fact of tax overpayment is revealed as a result of on-site tax audits - in this case, the tax office sends a written notification to the organization.

Sometimes, in search of the truth, taxpayers are forced to go to court, but as a rule, this is a last resort. However, if in court , this will also serve as the basis for a refund.

Tax officials are required to consider the application within 10 days of receipt.

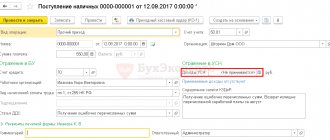

The procedure for returning an overpayment of personal income tax to an organization

The procedure for returning personal income tax depends on the reason for the overpayment.

1. An organization (tax agent) erroneously transfers its own funds using personal income tax details, which were not withheld when paying income to individuals. This could happen, for example, due to an accountant's error or a program glitch.

2. The tax agent made a mistake precisely when withholding personal income tax from the employee’s income, that is, he unlawfully withheld more from him than he should have, or paid out “extra” income from which he withheld personal income tax.

The tax refund procedure will be different in these two cases.

In the first case, overpayment of personal income tax is not recognized at all - the general rules of Art. 78 Tax Code of the Russian Federation. To return or offset money, the company must submit an application to the Federal Tax Service at the place of registration using the KND form 1150058, approved by Order of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. ММВ-7-8 / [email protected] (Appendix No. 8). It is necessary to confirm that the funds transferred using personal income tax details are not personal income tax.

The application must be accompanied by:

- an extract from the tax register for the corresponding tax period;

- payment order on the basis of which the excess amount was deposited.

In the second case, as a general rule, a tax agent who has excessively withheld personal income tax from an individual’s income is obliged to make a refund independently (clause 14 of article 78, clause 1 of article 231 of the Tax Code of the Russian Federation, clause 34 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57 ). The tax authority can return erroneous payments only if the company has ceased to exist (letter of the Federal Tax Service of the Russian Federation dated March 11, 2021 No. SD-3-11 / [email protected] ) We will tell you how a company or individual entrepreneur should return an overpayment of personal income tax to an employee We'll tell you below.

Rules for completing an application

The application should be completed according to a special form developed and approved by the Federal Tax Service. When filling out the form, you must adhere to certain standards.

It is best to write in block letters in the document so that all information is as legible as possible, while you should try to avoid inaccuracies and errors, and if they do happen, it is better not to correct them, but to write a new application.

The document is drawn up in two copies , one of which, after being endorsed by the inspector, remains in the hands of the taxpayer, the second is transferred to the tax office.

Sample application for refund of overpaid tax

First, in the upper right part of the document, information about the addressee of the application and its author is indicated. Here is the name and number of the specific tax service, as well as information about the taxpayer:

- If we are talking about an individual entrepreneur or any other citizen of the Russian Federation, then it is enough to indicate his personal data:

- surname-first name-patronymic,

- TIN,

- residence address (according to passport)

- and a contact phone number (in case the tax officer needs any clarification).

- If the application is made on behalf of an organization, then you need to write:

- its full name,

- TIN,

- Checkpoint (in accordance with the constituent documents),

- legal address

- and also a telephone number for communication.

The main part of the document concerns overpaid tax.

- First, there is a link to the article of the law that allows the return of overpaid amounts.

- Then you should note the nature of the overpayment: was the money paid voluntarily or collected, as well as the name of the tax levy.

- After this, the tax period for which the overpayment occurred is entered and the tax code according to the KBK (budget classification code) is indicated - it has periodically changing individual indicators for each tax and the OKTMO code (depending on the territory in which the tax payment was made).

- Next, in numbers and in words, the amount that the taxpayer considers overpaid and the account details for the refund are entered into the form:

- name of the bank servicing the account,

- his correspondent check,

- BIC, INN, KPP,

- taxpayer's current account number.

- After this, in the line “Recipient” the last name, first name and patronymic name of the individual entrepreneur or citizen or the name of the organization submitting the application are indicated.

- Finally, the form must be dated and signed.

From what point does interest accrue for late repayment of overpayments?

In April 2022, the company applied to the Pension Fund for a refund of the overpayment of contributions, but did not receive a response to its application.

The court ordered officials to return the money to the company, which they did in January 2022.

The company demanded to collect interest from the offenders for the time that passed from the month following the application to the fund until the transfer was made. Officials countered that since there was no decision to refuse the return, interest should be accrued from the entry into force of the court verdict.

Three authorities, including the district cassation, recognized the company’s calculation as justified. Themis indicated that relations with insurance premiums for periods before 01/01/2017 are regulated by Federal Law No. 212-FZ dated 07/24/2009. According to its provisions, the overpayment is refunded within one month from the date of receipt of the policyholder’s application, and if this period is violated, interest is charged. Therefore, the date of the judgment in this matter is not relevant.

Resolution of the Arbitration Court of the Volga District dated August 28, 2019 No. F06-51354/2019

Editor's note:

From 01/01/2017, the administration of insurance premiums is carried out in accordance with the norms of the Tax Code of the Russian Federation.

Article 78 of the code contains provisions similar to those applied by the judges in the decision under review. According to paragraph 1.1 of this article, they also apply to the return of overpayments on insurance premiums. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up