How can a businessman save as much as possible on salary taxes and avoid getting fined or going to jail?

So, the average businessman hires an assistant. Indicates his desired salary - 50 thousand rubles “in hand”. It seems not so ruinous for a businessman. Let’s calculate what the actual amount of an employee’s salary of 50 thousand rubles will be.

Example #1

First of all, the businessman must accrue “dirty” to the employee:

50,000 rubles: 0.87 = 57,471 rubles.

Personal income tax at a rate of 13% - 7,471 rubles.

Let's calculate insurance contributions to the Pension Fund:

12,792 rubles x 30% = 3,837.6 rubles.

12,792 rubles is the minimum wage, which is valid from January 1, 2022. And this amount will be taxed at the full rate of insurance premiums.

For small and medium-sized businesses there is a reduced insurance premium rate of 15%.

The amount of wages exceeding the minimum wage level will be taxed at a reduced rate:

(57,471 rubles - 12,792 rubles) x 15% = 6,701.9 rubles.

It turns out that the entrepreneur must give the state 18,011 rubles, paying the employee a salary of 50 thousand rubles.

That is, a businessman spends almost 36% of his salary on “salary” taxes. And this does not even take into account “unfortunate” contributions, the minimum rate of which is 0.2%.

Of course, this state of affairs, and even with a decrease in business profitability, cannot please business. And if the business is not a small business, then the tax burden can be up to half the salary.

EXAMPLE No. 1.

First of all, the businessman must accrue “dirty” to the employee:

50,000 rubles: 0.87 = 57,471 rubles.

Personal income tax at a rate of 13% – 7,471 rubles.

Let's calculate insurance contributions to the Pension Fund:

12,792 rubles x 30% = 3,837.6 rubles.

12,792 rubles is the minimum wage, which is valid from January 1, 2022. And this amount will be taxed at the full rate of insurance premiums.

For small and medium-sized businesses there is a reduced insurance premium rate of 15%.

The amount of wages exceeding the minimum wage level will be taxed at a reduced rate:

(57,471 rubles – 12,792 rubles) x 15% = 6,701.9 rubles.

It turns out that the entrepreneur must give the state 18,011 rubles, paying the employee a salary of 50 thousand rubles.

That is, a businessman spends almost 36% of his salary on “salary” taxes. And this does not even take into account “unfortunate” contributions, the minimum rate of which is 0.2%.

Of course, this state of affairs, and even with a decrease in business profitability, cannot please business. And if the business is not a small business, then the tax burden can be up to half the salary.

ACCOUNTING SERVICES

1.1. Individual entrepreneur instead of a full-time director

The highest salary in a company is usually its director. This means the highest insurance premiums to the Pension Fund - until the limit reaches 1.465 million rubles per year. And if the director’s annual income exceeds 5 million rubles, then personal income tax on the amount of such excess will be calculated at a rate of 15%.

How can companies at least partially reduce “salary” taxes?

To do this, you can “make” the director of the individual entrepreneur a manager.

The law does not prohibit transferring the reins of the company to the manager. In this case, the company pays the individual manager not a salary, but a remuneration and, therefore, there are no “salary” taxes on these payments.

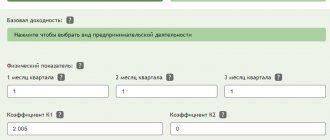

The individual entrepreneur applies the simplified tax system at a rate of 6% (object “Income”) or 15% (object “Income minus expenses”).

Tax savings can be greater if local authorities have reduced the “simplified” tax - from 1% to 6% (the “Revenue” object) and from 5% to 15% (the “Revenue minus expenses” object).

That is, the company does not transfer personal income tax for the employee, and the individual entrepreneur himself pays a “simplified” tax on the remuneration, which in some regions can be 1%.

But the company may face tax risks, because tax authorities may suspect a scheme to evade “salary” taxes.

In order to avoid such claims from tax authorities, you need to correctly draw up a company management agreement. Otherwise, tax authorities can reclassify the contract with the manager of the individual entrepreneur as an employment contract and, accordingly, additionally charge insurance premiums and personal income tax in full.

Of course, it is especially dangerous to enter into such agreements with a former director who recently quit and immediately registered as an individual entrepreneur.

1.2. Use of self-employed citizens

In some cases, a company can significantly optimize “salary” taxes with the help of self-employed people. Self-employed citizens pay only one tax and are completely exempt from insurance contributions for compulsory health, social and pension insurance.

And since in 2022 the self-employed regime covered all regions of our country, businessmen began to actively use self-employed workers instead of “ordinary” workers.

But the scheme - “let the employee resign of his own free will, and then become self-employed and we will conclude a civil contract with him” - was stopped in advance by legislators.

Indeed, according to the Law, a self-employed citizen does not pay preferential taxes if he receives income:

- within the framework of labor relations;

- from the provision of services and works under civil contracts, if the customers of services and works are their employers or persons who were their employers less than two years ago.

If a self-employed citizen works for a company under an employment contract or quit less than two years ago, then the employing company must pay insurance premiums and withhold personal income tax on income as from “ordinary” performers under civil contracts.

However, despite these obstacles, some employers still enter into contracts with former employees who are now self-employed. But tax authorities can easily identify such employees, because they have information in their database on all employees of the company.

Nevertheless, this method of optimizing “salary” taxes has a right to life. To mitigate such consequences, a civil contract with a self-employed person can be concluded not with the employing company, but with an interdependent person.

For example, it is convenient to do this within the framework of a holding company, which includes “our own” companies, and such agreements should not be of a mass nature.

As a result, the company's savings in insurance contributions amount to 30%: the Pension Fund - 22%, the Social Insurance Fund - 2.9%, the Mandatory Medical Insurance Fund - 5.1%.

In addition to saving on taxes, the company does not include a self-employed citizen in any report. That is, you do not need to submit certificates 2-NDFL, 6-NDFL. A self-employed citizen does not need to prepare any personnel documents or reports to the Pension Fund. And the amount of remuneration is taken into account in expenses based on the generated check in the “My Tax” application.

For self-employed citizens themselves, the tax rate for working with a company is 6%. At the same time, self-employed people can take advantage of a tax deduction in the amount of 10 thousand rubles once at the time of registration as self-employed citizens.

Types of personal income tax deductions

Article 210 of the Tax Code of the Russian Federation determines that the tax base for personal income tax takes into account all income of the taxpayer received both in cash and in kind, or the right to dispose of which he has acquired, as well as income in the form of material benefits, determined in accordance with Article 212 of the Tax Code of the Russian Federation.

The tax base can be reduced by the amount of tax deductions for personal income tax, which leads to a decrease in the amount of tax (clause 3 of Article 210 of the Tax Code of the Russian Federation).

In general, tax deductions can be used to reduce the income of residents, subject to personal income tax at a rate of 13% in accordance with paragraph 1 of Article 224 of the Tax Code of the Russian Federation, except for income from equity participation in organizations, winnings in lotteries and gambling (clauses 3, 4 of Article 210 Tax Code of the Russian Federation).

The Tax Code provides for 7 groups of personal income tax deductions depending on the purpose of their provision:

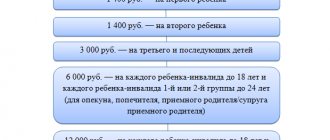

- standard deductions (Article 218 of the Tax Code of the Russian Federation):

- for preferential categories of individuals;

- for persons who support children;

- for treatment;

- for education;

- for additional pension measures;

- for other socially significant purposes;

- when purchasing housing and land;

- when selling certain types of property;

- in case of seizure of real estate from a taxpayer for state or municipal needs;

- provide services;

- perform work under civil contracts;

- receive royalties;

- open investment accounts;

- receive income from the sale (redemption) of securities traded on the securities market;

In addition, Article 217 of the Tax Code of the Russian Federation lists income that is exempt from taxation. Some income is exempt from taxation in an amount not exceeding RUB 4,000 received during the tax period. Such income includes, for example:

- the value of gifts received by taxpayers from organizations or individual entrepreneurs;

- value of prizes and winnings in cash and in kind received by taxpayers:

- at competitions and competitions;

- in ongoing events for advertising purposes;

- from participating in gambling and lotteries;

The conditions and amounts of application of these deductions vary significantly. When calculating the personal income tax tax base, the tax agent takes into account non-taxable income and provides the taxpayer with the following deductions based on an application and supporting documents:

- standard;

- property;

- social;

- professional.

It is impossible to provide standard deductions to an employee if he has no income, because the deduction is provided by reducing income subject to personal income tax. But in a situation where there was no income for the entire year or in some months the income was less than the deduction provided, the rules established by the organization’s accounting policies apply.

| 1C:ITS For more information about the types of personal income tax deductions and the procedure for their provision (both by tax agents and the tax authority), see the “Legislative Consultations” section. |

Example No. 2

Let's use the conditions of example No. 1.

The company paid the employee 50 thousand rubles “in hand”.

The entrepreneur must give the state 18,011 rubles, paying the employee a salary of 50 thousand rubles.

Instead of a full-time employee, the company entered into an agreement with a self-employed citizen and transferred him 57,471 rubles.

A self-employed citizen will pay tax on this amount of 2,299 rubles (4% including tax deduction).

And the company will not pay any insurance premiums or personal income tax to the self-employed person from the transferred amount, but will take the remuneration amount of 2,299 rubles as tax expenses.

But it is not always possible to use the services of a self-employed person. It is necessary to constantly monitor the amount of income paid. If the annual income of a self-employed person exceeds 2.4 million rubles, then he loses his status.

EXAMPLE No. 2.

Let's use the conditions of example No. 1.

The company paid the employee 50 thousand rubles “in hand”.

The entrepreneur must give the state 18,011 rubles, paying the employee a salary of 50 thousand rubles.

Instead of a full-time employee, the company entered into an agreement with a self-employed citizen and transferred him 57,471 rubles.

A self-employed citizen will pay tax on this amount of 2,299 rubles (4% including tax deduction).

And the company will not pay any insurance premiums or personal income tax to the self-employed person from the transferred amount, but will take the remuneration amount of 2,299 rubles as tax expenses.

But it is not always possible to use the services of a self-employed person. It is necessary to constantly monitor the amount of income paid. If the annual income of a self-employed person exceeds 2.4 million rubles, then he loses his status.

1.3. Using IP

A still popular way to optimize “salary” taxes is an agreement with individual entrepreneurs. Individual entrepreneurs have no restrictions regarding the amount of transfers, as with self-employed citizens.

If an individual entrepreneur does not have employees, 6% tax according to the simplified tax system and fixed insurance premiums “for oneself” are paid to the budget.

But if the individual entrepreneur was previously connected with the employer, then there is a risk of reclassification of civil law contracts into employment contracts. Tax authorities may claim that wages paid to former employees:

- the amount of remuneration corresponded to the salary;

- standard, template forms of contracts were concluded with all individual entrepreneurs, independent of the individual specifics of the particular type of services provided;

- contracts were renegotiated on similar terms with the same individuals over a long period of time;

- payments were regular and coincided with the day of payment of wages.

If the employment relationship is not covered by a civil contract with an individual entrepreneur, then the company has the opportunity to legally reduce “salary” taxes.

1.4. Renting personal property

In the practice of organizations, there are often situations when the personal property of employees is used for official purposes. The most popular way to use an employee’s personal vehicle is through car rental agreements without a crew.

The attractiveness of these agreements, first of all, lies in the fact that payments made to an employee under a car rental agreement without a crew are not subject to insurance premiums. There are no benefits in relation to personal income tax - the employee’s income received is taxed in accordance with the general procedure.

1.4.1. A safe option for registering relations with employees

Back in 2022, senior judges confirmed that the entire amount of rent should be subject to insurance premiums, unless the cost of rental services is separately allocated.

Even if the company stipulates in the employment contract the traveling nature of the employee’s work and (or) the obligation to drive a car for business purposes, it is possible that the tax authorities will still prove that the lessor and the employee actually perform driving services simultaneously.

Today, the safest thing is to conclude two contracts: renting a vehicle without a crew and providing services for the management and technical operation of the vehicle. In the first case, no insurance premiums are transferred, and in the second - only on the cost of management, which, as a rule, is scanty.

And in conclusion, we note that there are ways to save one-time “salary” taxes - payments of a so-called social nature. But you cannot constantly replace an employee’s salary with financial assistance and similar payments.

Documents for receiving a deduction through an employer

If an employee decides to receive a deduction through an employer, he must provide the following package of documents to the accounting department:

- written application to receive a personal income tax deduction. It is drawn up in any form, but for convenience, the accounting department can develop a standard form. In addition, specifically for receiving a social deduction, there is a regulated application form contained in the Letter of the Federal Tax Service dated January 16, 2017 No. BS-4-11 / [email protected] ;

- notification from the Federal Tax Service confirming the right to receive a deduction. Without this official document, the accountant has no right to provide the employee with a deduction. The notice is issued for a specific calendar year, which means that the employer provides a deduction in this particular period. The employee should receive a new notice for the next calendar year.

To receive the notification, the employee must submit to the tax office an application and a package of documents confirming the fact of spending the funds. As a rule, a 2-NDFL certificate is not required, but it is still a good idea to obtain one from the employer.