When to Provide Explanations

When conducting an inspection, the inspector has the right to request written explanations. Situations in which taxpayers are required to explain the result of control are spelled out in paragraph 3 of Art. 88 Tax Code of the Russian Federation:

- Errors in submitted reports. For example, inaccuracies or inconsistencies are identified in the declaration. In this case, tax authorities require you to provide justification for these discrepancies or send a corrective report.

- In the adjusting statements, the amounts payable to the budget are significantly lower than in the initial calculations. In such a situation, the inspector will suspect a deliberate understatement of the tax base and payments and will demand an explanation for the changes.

- The submitted income tax return reflects losses. In any case, you will have to justify unprofitable activities to the Federal Tax Service, so prepare a letter with explanations in advance.

The inspection request must be responded to within 5 working days from the date of official delivery of the request - such norms are enshrined in clause 3 of Art. 88, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation. In special cases, the Federal Tax Service will have to notify the receipt of a tax request (letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071).

IMPORTANT!

Some requests from the Federal Tax Service do not have a stamp. You will still have to respond to such demands - such instructions are given in the letter of the Federal Tax Service of the Russian Federation dated July 15, 2015 No. ED-3-2 / [email protected]

Which days – working days or calendar days – should I take to fulfill the requirement?

As paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation tells us, a period defined in days is calculated in working days, if the period is not established in calendar days.

In this case, a working day is considered a day that is not recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

How to compose

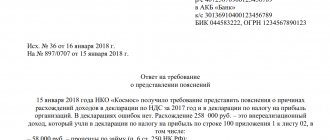

The general procedure for writing a letter to the tax office for clarification is as follows:

- We compose a response on the organization’s letterhead. If there is no such form, in the header of the document we indicate the full name of the institution, INN, KPP, OGRN and address.

- We indicate the number and date of the requirement for which the explanation is being drawn up. It is permissible to write a response to several tax requests at once.

- If there are errors or inconsistencies in the report, double-check the report to eliminate typos or typos.

- In the descriptive part of the response letter, we reveal in detail and consistently the circumstances of the situation that needs to be explained.

- When answering a request, rely on the facts and document the circumstances. Attach copies of documents to the answer, if any. For example, a copy of the additional agreement to the contract with the condition for increasing prices.

If the inspector requires an explanatory note regarding inconsistencies in the value added tax return, the response will have to be sent electronically. Exceptions to the rules are reserved for organizations that report VAT on paper. If the institution reported electronically, but provided a response to the request on paper, then the tax office will consider such explanations not provided. Such norms are prescribed in the letter of the Federal Tax Service dated January 27, 2017 No. ED-4-15/1443.

ConsultantPlus experts examined whether it is necessary to submit an explanatory note with accounting reports. Use these instructions for free.

to read.

Response to VAT return requirement

A sample response to a request for a VAT return is generated electronically if the organization, by law, must submit a report through electronic document management tools (clause 3 of Article 88 of the Tax Code of the Russian Federation). To respond to a VAT request, there is a specially approved form, therefore, based on clause 1 of Art. 129 of the Tax Code of the Russian Federation, the taxpayer is obliged to comply not only with the conditions for electronic submission, but also with the form of explanations submitted. As supporting documentation for VAT, the specialist will prepare copies of invoices and purchase and sales books.

What happens if you don’t respond to the Federal Tax Service’s requirement?

No matter how much the inspectorate threatens punishment, tax officials cannot fine or issue an administrative penalty for the absence of an explanatory letter:

- Article 126 of the Tax Code of the Russian Federation is not a basis for punishment, since the provision of explanations does not apply to the provision of documents (93 of the Tax Code of the Russian Federation);

- Article 129.1 of the Tax Code of the Russian Federation is not applicable, since a request for written explanations is not a “counter check” (93.1 of the Tax Code of the Russian Federation);

- Article 19.4 of the Code of Administrative Offenses is not an argument; punishment is applicable only in case of failure to appear at the territorial inspection.

Similar explanations are given in paragraph 2.3 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837.

Errors and discrepancies regarding VAT

Value added tax is the fiscal liability where accountants make the most mistakes. As a result, discrepancies and inaccuracies in reporting are inevitable.

The most common mistakes are when the amount of tax accrued is less than the amount of the tax deduction claimed for reimbursement. In fact, the reason for this discrepancy is the inattention of the person responsible for issuing invoices or a technical error when uploading data.

In the explanatory note, please include the following information: “We inform you that there are no errors in the purchase book, the data was entered correctly, timely and in full. This discrepancy occurred due to a technical error when generating invoice No.____ dated “___”______ 20___. Tax reporting has been adjusted (indicate the date the adjustments were sent).”

Reporting discrepancies

Quite often there are situations when the same economic indicator has different values in the provided fiscal reporting forms. Such discrepancies are caused by the fact that for each tax, fee, contribution, individual rules for determining the taxable base are established. And if tax authorities require clarification on this issue, provide clarification in free form. In the text, indicate specific reasons why the discrepancies arose.

Also, the reason for this inconsistency is the different norms and rules of tax accounting in relation to a number of specific situations. Write down the circumstances in a letter.

It is welcome to provide explanations with references to the norms of the current fiscal legislation. Even if the company is wrong (incorrectly interpreted the norms of the Tax Code of the Russian Federation), the Federal Tax Service will provide detailed explanations, which will help avoid larger mistakes and fines in future activities.

What is a requirement to pay a tax, fee, penalty or fine?

According to the Tax Code of the Russian Federation, the taxpayer has an obligation to pay taxes and fees on time and in full. The timing of transferring payments to the budget depends on the type of tax or fee, the nuances of local or regional legislation, and the category of taxpayer.

Individuals pay taxes according to Federal Tax Service notifications sent by Russian Post or received through the “Taxpayer Personal Account” service on the Federal Tax Service website. For the convenience of citizens, such notifications contain not only the size of the tax base and rate, but also the deadline by which the tax must be transferred. For example, for 2022, a citizen must pay personal property taxes by December 1, 2018. According to paragraph 2 of Art. 52 of the Tax Code of the Russian Federation, a letter from the inspection must arrive no later than 30 days before the payment is due.

Personal property entrepreneurs pay taxes according to the rules established for ordinary citizens. But for business taxes, they independently calculate the amounts payable in accordance with the chosen tax regime. The payment deadlines for each tax and special regime are established by the Tax Code. For example, if an individual entrepreneur works for the OSN, then he needs to submit his annual income tax return for the past year by April 30 of the next year. During the same period, he must pay personal income tax on business activities.

Legal entities also report on taxes and fees independently: they submit reports to the tax authority and pay taxes and fees. In addition, for some taxes, the company must transfer advances within a specified period and, taking them into account, then calculate the amount of the annual tax payment.

Thus, timely payment of taxes and fees is the direct responsibility of each taxpayer and is enshrined in clause 2 of Art. 44 and paragraph 1 of Art. 45 of the Tax Code of the Russian Federation. Violation of the deadlines for transferring taxes and fees to the budget or their incomplete payment is the basis for the tax authorities to send a tax payment request to the payer.

According to Art. 69 of the Tax Code of the Russian Federation, the requirement to pay tax is a notification to the payer of the unpaid amount of tax and the obligation to pay it within the prescribed period. Inspectors send a tax payment request if a citizen or organization has arrears identified as a result of an audit. For more information about the mandatory compliance with the audit conditions, read the material “The tax office has no right to demand payment of tax outside of an audit .

From what date the updated payment request form is applied (approved by order of the Federal Tax Service of Russia dated February 13, 2017 No. ММВ-7-8 / [email protected] ), find out from the publication.

The tax payment request contains the following information:

- amount of tax debt;

- the amount of penalties accrued at the time of sending the request for tax payment;

- debt repayment period and tax collection measures - in case the taxpayer ignores the requirement.

For individuals, tax authorities also provide information about the initial tax payment deadline. In addition, in the request for payment of tax, inspectors must provide references to legislative acts regulating the payment of overdue tax. For organizations and entrepreneurs, the requirement to pay tax also contains the KBK and OKTMO for each type of unpaid tax.

Reducing the tax burden

This issue is of particular interest to tax authorities. Thus, representatives of the Federal Tax Service constantly monitor the volume of revenues to the state budget. If they decrease, the reaction is immediate: demands with explanations, an invitation from the manager to a personal meeting with a representative of the Federal Tax Service, or an on-site desk audit (a last resort).

In such a situation, you cannot hesitate; you must immediately provide explanations to the Federal Tax Service. In your response letter, describe all the circumstances and facts that influenced the reduction in tax payments. Confirm the facts with documents or provide economic justification. Otherwise, the Federal Tax Service will initiate an on-site inspection, which will take several months.

What to write in an explanatory note:

- Reduction of salary taxes. Reasons: staff reduction, enterprise restructuring, reduction in wages.

- A decrease in profits usually occurs due to the termination of contracts with customers. A copy of the additional agreement on termination of the contract should be attached to the written explanations.

- Increased costs as a result of decreased profits. Justification: expansion of activities (increase in production volumes, opening of a new branch, division, outlet), change of suppliers or increase in prices for inventories and raw materials (attach copies of contracts).

There are many reasons for reducing the tax burden. It is necessary to understand each specific case in detail.