What is a tax deduction and why do you get it?

A tax deduction is a certain amount of income that is not subject to tax, or a refund of part of the personal income tax (PIT) already paid in connection with some expenses incurred. The types of these expenses are determined by the Tax Code of the Russian Federation. Any citizen of the Russian Federation or a foreign citizen can receive a tax deduction if he lives in Russia for more than 183 days a year and pays tax on the income received.

Example!

Let's say you earned 1 million rubles in a year. and 13% was paid in income taxes. In the same year, you spent 100 thousand on your child’s education at the university. These 100 thousand are deducted from income, and it turns out that you had to pay tax not 130 thousand, but 13% of 900 thousand, that is, 117 thousand. The overpayment amounted to 13 thousand rubles - so they will return it to you.

When initiative is not needed

Taking advantage of the innovation that gives you the right to deduct tax in a simplified manner, you do not need to do anything:

- nor collect documents;

- nor apply to the Federal Tax Service.

It is necessary on March 20 of the following year after the transaction remotely without reference to time and place:

- Go to the website nalog.gov.ru.

- Login to the personal account of an individual:

- by login (TIN) and password;

- through State Services.

- Receive a pre-filled application to receive tax deductions for personal income tax in a simplified manner.

- Sign the application.

It should be borne in mind that the joining of banks to information interaction with banks is carried out on a voluntary basis. Therefore, when concluding an agreement to purchase property or maintain an individual investment account, check whether the bank is included in the list of tax agents.

Cash loan up to 7.5 million.

Apply now

Leading regions in terms of the number of tax deductions provided (thousands)

Moscow

| 296,6 | |

| Sverdlovsk region | 294,4 |

| Tatarstan | 292 |

| Saint Petersburg | 254,1 |

| Moscow region | 248,3 |

Source: Federal Tax Service, data based on the results of 2022.

There are five types of personal income tax deductions:

- Standard (for children, veterans of the Great Patriotic War, disabled people, Chernobyl survivors, “Afghans”, Heroes of the USSR and Russia with state awards);

- Social (for charity, training, treatment, pension contributions to non-state pension funds, additional insurance contributions for funded pension);

- Property (sale, purchase, construction of housing, acquisition of land);

- Professional (for royalties, income of individual entrepreneurs, persons engaged in private practice);

- Investment (for the sale of securities).

It is permissible to claim a tax deduction for a specific year in several categories at the same time, for example, to receive it immediately for children, treatment, charity and sale of housing. You can apply for a deduction within three years after the tax period. That is, for example, in 2022 it will be possible to return the money for 2016, 2017 and 2022.

Deduction for the purchase of an apartment: documents, procedure for obtaining

Required documents:

- Identity card (passport of a citizen of the Russian Federation). If the tax return is submitted electronically, then an electronic signature (it can be easily obtained in your personal account on the website nalog.ru);

- Tax return in form 3-NDFL. The declaration template and instructions for filling out are available on the Federal Tax Service website;

- Application for tax refund. It can be drawn up when submitting a declaration to the tax office or taken a sample from the Federal Tax Service website. At the time of writing the application, you must choose a convenient option for returning a tax deduction - a one-time payment for the entire year, monthly payments or a reduction in the tax base in the future.

- Papers confirming the purchase of housing or expenses associated with it. This could be a purchase and sale agreement, an act of acceptance and transfer of premises, a loan agreement, a bank receipt, a check, a receipt;

- Papers confirming ownership of the purchased apartment. This could be an extract from the Unified State Register or a certificate of ownership;

- A document confirming the payment of personal income tax for the previous year (certificate in form 2-NDFL, it is obtained from the accounting department of your organization);

- Details certified by the bank to which your income tax refund will be transferred.

Important!

When submitting copies of papers confirming the right to deduction to the tax authority, you must have their originals with you for verification. Half of all problems when receiving money are due to the fact that the consumer does not have any documents.

When purchasing real estate, the tax base for deduction is limited to 2 million rubles. Thus, the tax benefit is 260 thousand rubles. Every citizen has the right to a benefit of up to 2 million rubles. just one time.

If it was fully used when purchasing the first property, then the benefit will not be provided when purchasing a second property.

If the apartment was purchased at the expense of the employer, maternity capital or the budget, then the deduction cannot be taken.

Property deductions can be used to pay off interest on a mortgage loan. In this case, the deduction limit increases from 260 thousand to 390 thousand rubles.

The deduction includes not only the purchase or construction itself, but also the finishing of the apartment, laying communications and developing the project.

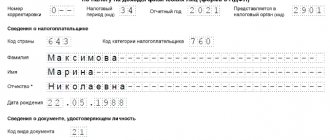

About filling out the 3rd personal income tax declaration in 2022

Features of filling out the 3-NDFL form in 2021

First of all, it is necessary to note the following: in 2022, taxpayers can fill out 3-personal income tax returns for the years 2020-2019-2018. Each declaration is filled out exactly on the form that was in force that year. For example, a declaration for 2020 can only be filled out on a 2022 form. The same rule applies to forms for other years.

Please note that not everyone has the right to fill out declarations for the last 3 years: this also depends on the date the right to deduction arose.

The following are common situations:

- Let's assume you had medical expenses (tuition, insurance, etc.) in 2016, 2022, 2022 and 2022. This means that in 2022 you will be able to fill out only 2 declarations: for 2022 and 2020. In the declaration for the selected year, you can reflect expenses and income only for the selected year (according to payment documents and 2nd personal income tax certificates). The expenses were in 2016 and 2022 - you can no longer get a deduction for them and fill out declarations. The deduction also does not carry over to subsequent years. There were no expenses in 2022, the declaration was not filled out. There were expenses in 2022 and 2022, so you can fill out 2 declarations in 2022.

- You bought an apartment in 2022. This means that you can only fill out returns for 2022 and 2022 (and not for the last 3 years), because your right to deduction arose only in 2019. You cannot fill out 3-NDFL for 2022, there is no right to deduction.

- You bought an apartment in 2015. In this situation, you have the right to fill out 3 declarations for the last 3 years: for 2018-2019-2020. The right to a deduction arose in 2015, the deduction does not expire (unlike social deductions in the above examples), but passes to the following years: for 2015 and 2022 it is no longer possible to fill out 3-NDFL, but for 2018, 2022 and 2022 it is possible.

Thus, the ability to fill out 3-personal income tax returns for the last 3 years does not automatically mean that every taxpayer has the ability to do so. It all depends on the year the right to deduction arose, that is, the right to fill out 3-personal income tax.

The deadline for filing a 3-personal income tax declaration depends on whether you declare income in it or not:

- If you filled out a declaration only for a tax refund (training, treatment, purchase of an apartment, etc.), reflecting in it the data from the 2-NDFL certificate (the tax on such income is withheld by the employer) - the deadline for filing 3-NDFL in this case is not limited some date in the current year. You can submit such declarations throughout the year.

- If the declaration reflects income that is subject to declaration (income from the sale of property, rent, etc.), such a declaration must be submitted by April 30 of the current year for income for the previous year. Otherwise, a fine of 1,000 rubles is possible. The tax calculated based on the results of the declaration is paid before July 15.

Thus, the deadline for filing a 3-personal income tax depends on whether you reflect in it the income that is subject to declaration (even if, according to the results of calculations, the tax is 0) or not.

Important rule:

For the selected year, the taxpayer always fills out and submits only one tax return in form 3-NDFL.

For example, in 2022 you had expenses for treatment in different clinics, paid for your child’s education, bought an apartment, sold a car... - you indicate everything in one declaration for 2022. You cannot fill out several declarations, one for this, another for that, this would be a mistake, you will have to redo everything, submit an updated declaration.

Also note that in declarations only for declaring income (sale, rent, etc.), the reflection of data from 2-personal income tax certificates is not necessary (the tax on such certificates has already been withheld).

Tax refund declarations reflect data from 2nd personal income tax certificates. A tax refund is essentially a refund of previously withheld tax by obtaining deductions (social, property, etc.).

Not all declaration sheets need to be filled out. Only the pages you need are filled in, depending on what you want to include in the declaration. But in any case, the following pages must be filled out:

- First page of the declaration or Title page: general information about the taxpayer;

- Section 1 of the declaration, final: it reflects the result of the completed declaration - tax refund, payment of tax or no tax;

- Appendix to Section 1 – tax refund application: when filling out a tax refund declaration;

- Section 2 – tax calculation. Based on Section 2, Section 1 is completed. Sections 1 and 2 are always completed last, based on the remaining sheets of the declaration;

- Appendix 1: information about the sources from which the taxpayer received income.

- The remaining sheets of the declaration are filled out as necessary and contain information about deductions, etc.

You should also pay attention to the following:

The declaration is always submitted at the place of registration in the passport. The tax office code is also indicated at the place of registration. Only in the absence of registration - at the place of registration with mandatory registration with the tax authority.

It is not uncommon for tax authorities to refuse to accept a return because the taxpayer is trying to submit it to the “wrong” tax office. And when submitting online, if the tax code is entered incorrectly, also some time after sending the file, acceptance will be refused.

Additional Information:

Legal cases of refusal to accept a declaration

About the updated declaration in form 3-NDFL

How the volume of tax deductions received in Russia grew (billion rubles)

| 170,8 | 11 | |

| 2014 | 121,9 | 7,4 |

| 2011 | 56 | 6,1 |

Russian tax legislation provides two ways to obtain a tax deduction:

- through the tax office;

- through the employer.

First way

involves the return of tax paid in the past to the person’s bank account.

In the second option

the tax deduction is repaid by canceling income tax deductions from the employee’s salary. Which one is more convenient is up to you to decide.

Procedure:

- Fill out a tax return (form 3-NDFL).

- Obtain a certificate from the accounting department at your place of work about the amounts of accrued and withheld taxes for the year in form 2-NDFL.

- Collect copies of papers confirming the right to housing (see above).

- Collect copies of payment documents (see above).

- When purchasing an apartment in joint ownership, collect copies of the marriage certificate and a written statement about the agreement of the parties involved in the transaction on the distribution of the amount of the deduction between the spouses. The deduction distribution agreement does not need to be notarized.

- Submit a completed tax return with copies of all documents to the tax authority at your place of residence. The tax office will let you fill out an application (request two copies, one will be left for you) and send the documents for a three-month audit. It is convenient to monitor the result in your personal account on the Federal Tax Service website - information about overpayment of tax will appear there. After this, you can wait for the money to arrive in your account - no more than a month.

Innovations

Innovations have been introduced into the Tax Code of the Russian Federation, providing for a simplified procedure for obtaining tax deductions for personal income tax:

- Property.

- Investment.

Those wishing to take advantage of the innovation will not need to:

- fill out a declaration in form 3-NDFL;

- collect supporting documents.

The tax office, having received information from banks performing the function of tax agents:

- Notify you of your right to receive a deduction.

- Will offer to approve the application.

Previously, until the taxpayer independently applied for a deduction and collected a package of supporting documents, the state did not return the money to him.

Low interest cash loan

Apply now

Deduction for treatment: documents, procedure

General list of required documents:

- Copy of Russian passport;

- Tax return in form 3-NDFL (to be completed by the taxpayer);

- Certificate of income from the main place of work (form 2-NDFL), certificates of part-time income (if any, issued by employers);

- An application to the Federal Tax Service with details (on bank letterhead with a stamp) to which the tax will be refunded.

When treated in a hospital or clinic:

- Agreement with a medical institution (there must be an exact amount paid for treatment) - original and copy;

- A certificate from the hospital/clinic/medical center confirming payment under the contract (must contain the patient’s medical card number and TIN, as well as the treatment category code: “1” - ordinary, “2” - expensive);

- A copy of the medical institution's license.

When purchasing medications:

- The original prescription with the stamp “For tax authorities”, issued by a doctor or the administration of a medical institution;

- Checks, receipts, payment orders confirming payment for drugs;

- If a patient purchased expensive medications necessary for treatment because they were not available at the medical institution, a certificate about this must be drawn up from the administration of the medical organization.

When concluding a voluntary health insurance agreement by an individual:

- A copy of the voluntary insurance agreement;

- A copy of the insurance company's license;

- Receipt for payment of insurance premium.

Procedure (when contacting an employer):

- Write an application to receive a notification from the tax authority about the right to a social deduction.

- Prepare copies of papers confirming the right to deduction (see above).

- Submit an application to the tax authority at your place of residence for notification of the right to a social deduction.

- After 30 days, obtain a notification from the tax authority about the right to a social deduction.

- Submit a notice issued by the tax authorities to the employer; it will become the basis for non-withholding of personal income tax from the amount of paid income until the end of the year.

Child deduction: documents, procedure

To receive a “children’s” deduction, it is not necessary to go to the tax office. It is enough to contact the accounting department at your place of work with a corresponding application. The simple procedure makes this deduction the most popular among the population. Usually the employer is asked to apply for this deduction from the beginning of the year, but you can also claim it retroactively through the Federal Tax Service.

The deduction for a child (children) is provided up to the month in which the taxpayer’s income, taxed at a rate of 13% and calculated on an accrual basis from the beginning of the year, exceeded 350 thousand rubles. The deduction is canceled from the month when the employee’s income exceeds this amount.

For the first and second child, a deduction of 1,400 rubles is allowed; for the third and each subsequent child - 3,000 rubles. For each disabled child under 18 years of age, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II - 12,000 rubles. parents and adoptive parents (RUB 6,000 for guardians and trustees).

General list of required documents:

- A written application addressed to your employer requesting a tax deduction for the child(ren);

- Birth certificate of the child (or children). This also applies to adopted children; here you need a copy of the adoption certificate;

- Certificates of child disability, if the child is one;

- Certificates from the child’s place of education (subject to receiving a deduction for a child over 18 years of age studying full-time at an educational institution);

- Marriage certificate.

Procedure:

- Write an application for a standard tax deduction for a child (children) addressed to the employer.

- Prepare copies of papers (see above).

- If the employee is the only parent, the kit must be supplemented with a copy of a document confirming this fact (perhaps the death certificate of the second parent).

- If the employee is a guardian or trustee, the kit must be supplemented with a copy of the document on guardianship or trusteeship.

- Contact your employer with an application for a standard tax deduction and copies of all papers.

Important!

If the taxpayer has several employers, he will have to choose. If there is only one parent, he is entitled to double the deduction. One of the spouses can also receive a double amount if the other refuses the deduction in writing. However, if the second spouse simply does not have taxable income, and therefore no right to deduction, then the first spouse cannot count on double the amount.

When to report

The deadline for submitting a tax return is set for all categories of taxpayers. Thus, the declaration should be submitted to the Federal Tax Service no later than April 30 of the year following the reporting period. Moreover, if the last date falls on a weekend or holiday, then the deadline for submitting tax reports is postponed to the first working day.

Let us note that if a citizen applies for a personal income tax refund by applying for a tax deduction, then the fiscal report can be submitted at any time, that is, regardless of the deadline. For example, you can submit 3-NDFL for property or social deductions after April 30.

Submission of tax reports in 2022: deadline - 04/30/2020. There are no transfers for reporting 2022, since the last date falls on Thursday (working day).

Deduction for training: documents, procedure

The standard package for applying for a tax deduction for education includes:

- Copy of Russian passport;

- Tax return in form 3-NDFL;

- A certificate of income for all places of work in the reporting year where the employer paid income tax for you (form 2-NDFL) is issued by the accounting department of the organization where you worked;

- A copy of the agreement with the educational institution addressed to the payer;

- A copy of the license of the educational organization, certified by its seal (if there is information about the license in the contract, this copy does not need to be attached);

- Copies of receipts, checks or other payments confirming payment for educational services;

- An application to the Federal Tax Service with a request to return the tax amount and details where it should be transferred.

Procedure:

- Fill out a tax return (form 3-NDFL) at the end of the year in which tuition was paid.

- Obtain a certificate from the accounting department at your place of work about the amounts of accrued and withheld taxes for the year in form 2-NDFL.

- Prepare a copy of the agreement with the educational institution for the provision of educational services, which specifies the details of the license to carry out educational activities. If the cost of training increases, a copy of the document confirming the increase in cost, for example, an additional agreement to the contract.

- Prepare copies of payment receipts confirming funds paid for training (cash register receipts, cash receipt orders, payment orders).

- Submit a completed tax return with copies of all collected papers to the tax authority at your place of residence.

Important!

The deduction is due only when paying for full-time education. You will be able to reimburse expenses for your education, the education of your children, including those under your care, as well as brothers and sisters. But for grandchildren, nephews, spouses - it’s impossible.

Evgeny Kozichev

Tax calendar for LLC

| Tax | 1st quarter | 2nd quarter or half year | 3rd quarter or 9 months | 4th quarter or year-end | NPA |

| simplified tax system* | Advance payment for the first quarter - no later than April 25 | Advance payment for half a year - no later than July 25 | Advance payment for nine months - no later than October 25 | Annual declaration under the simplified tax system and payment of tax no later than March 31 | Art. 346.21, 346.23 Tax Code of the Russian Federation |

| Unified agricultural tax | — | Advance payment of agricultural tax for the half-year - no later than July 25 | — | Annual declaration under Unified Agricultural Tax and payment of agricultural tax no later than March 31 | Art. 346.9, 346.10 Tax Code of the Russian Federation |

| VAT** | Submit your declaration no later than April 25 and pay tax by June 25 inclusive | Submit your declaration no later than July 25 and pay tax by September 25 inclusive | Submit the declaration no later than October 25 and pay tax until December 25 inclusive | Submit your declaration no later than January 25 and pay tax by March 25 inclusive | Art. 174 Tax Code of the Russian Federation |

| Income tax for organizations whose reporting period is quarterly (with quarterly income of no more than 15 million rubles) | Advance payment and declaration in a simplified form for the first quarter - no later than April 28. | Advance payment and declaration in a simplified form for the six months - no later than July 28. | Advance payment and declaration in a simplified form for nine months - no later than October 28. | Payment of tax for the year and declaration at the end of the year - no later than March 28. | Art. 285, 286, 287, 289 Tax Code of the Russian Federation |

| Organizational property tax | No later than April 30. | No later than July 31st. | No later than October 31st. | Tax at the end of the year - no later than March 1. Annual declaration – no later than March 30. | Art. 383, 386 Tax Code of the Russian Federation |

| Annual financial statements | No later than March 31 for the previous year | — | — | — | Art. 18 Federal Law No. 402 dated December 6, 2011 |

| Single simplified declaration*** | Submit no later than April 20 | Submit no later than July 20 | Submit no later than October 20 | Submit no later than January 20 | Art. 80 Tax Code of the Russian Federation |

*STS payers who have no income in the reporting period do not pay advance payments in the corresponding period.

**VAT is paid in a special order: 1/3 of the amount for the expired quarter no later than the 25th day of each of the three months following the expired quarter. For example, VAT accrued for payment for the first quarter is paid in equal installments no later than April 25, May 25 and June 25.

***A single simplified declaration is submitted for several taxes at once, provided that during the reporting period there was no movement in accounts and cash and there were no objects of taxation.