In the process of carrying out entrepreneurial activities, an organization may face the problem of a lack of finances to meet its needs. Under these conditions, it has to borrow money from other commercial firms or from its founders. Loans can be issued for use on interest-bearing terms or without them. It is important to know how to process transactions for a loan from the founder in 1C 8.3.

Accounting for interest-bearing and interest-free loans

Loans issued with or without the payment of additional income are accounted for in various ways. When applying for an interest-bearing loan, the company bears costs. In contrast, the founder of the company receives income. The amount of costs for paying interest commissions reduces the borrower's profit, so it can be classified as non-operating expenses. For a legal entity, interest is the income component, therefore they are subject to personal income tax at a rate of 13%. Withholding and payment of obligatory payments is carried out by the tax agent (borrower).

When a company takes out an interest-free loan, there are no income and expense parts.

Features of relations with company employees

An employee of an organization may receive material benefits when receiving funds for temporary use from an employer if:

- interest-free agreement;

- the established % rate for the use of money is below 2/3 of the refinancing rate of the Central Bank of the Russian Federation.

In these cases, the resulting material benefit is subject to personal income tax at a rate of 35% for residents and 30% for non-residents. In this case, the tax agent is the employer, who is obliged to calculate, withhold tax and pay it to the regulatory authorities. The date the employee receives income in this case is the last day of each month during the entire term of the agreement.

From the author! If an employee is provided with a targeted loan for the purchase of residential real estate or land for construction, then the material benefit received is not subject to personal income tax. As confirmation, he must provide a notice of the right to receive a property tax deduction.

Reflection of short-term loans

Many commercial firms use loans and borrowings, which should be correctly reflected in the accounting program 1C: Enterprise Accounting. These funds cannot be taken into account as income, since the organization incurs monthly expenses to repay these loan resources. At the same time, repayment of the loan reduces the amount of income on which the tax contribution is levied.

At the same time, you need to correctly calculate the share of interest for transfer to a banking organization. To ensure reliable accounting in 1C, you should have information about the amount, monthly interest charges, as well as the final date for transferring finances.

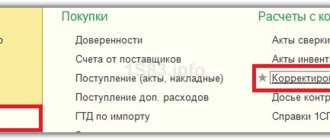

Registration of a loan in the program occurs according to the document “Receipt to the current account.” It also requires you to fill in all required fields:

- type of operation - Obtaining a loan from a bank;

- payer column - indicate the name of the bank where the loan funds were issued;

- contract - created in advance or in the process of generating data in electronic form. In this case, you need to go from the tabular form to the list of contracts and click on the “Create” button. After this, a new agreement will be formed. In the corresponding document window we indicate the numbers 66.01.

Interest-free loan from the LLC founder

According to legislative standards, a citizen who is the founder of an organization is obliged to replenish its current account with an amount equal to the authorized capital of the LLC within 4 months. Its value is determined by the company’s constituent documentation.

If the activity of a business entity has recently begun, then the funds in the account may be needed for settlement transactions. For example, transferring earnings to employees, fulfilling financial obligations to contractors, paying obligatory payments, purchasing raw materials and equipment, and so on. A business entity may not have enough available money to cover all expenses. In this case, the founder can provide a loan to his company without charging interest.

The founders can deposit the required amount of money into the company's current account. To do this, you will need to draw up an agreement for an interest-free loan and provide it to the employees of the banking organization where the account is opened. There is also the possibility of depositing the required amount into the cash desk of a business entity. In the future, when the financial situation improves, the loan amount can be repaid.

Getting a loan with interest

Let's look at a simple example. A commercial company received 200,000 rubles from the founder, Vyacheslav Yakovlevich Salimgareev. According to the terms, the money was issued at 8% per annum. The return period is 12 months.

It is required to reflect the corresponding loan acceptance transactions and interest calculations. In addition, you need to reliably show the withholding of personal income tax, payment of monthly fees and debt.

If a company took money based on certain requirements, the accountant must create a settlement order in 1C 8.3. First of all, select the “Receiving a loan from a counterparty” section. In the window that appears, you need to enter current information:

- name of the organization and the corresponding date;

- the name of the organizer who issued the money;

- total loan amount.

Important! It is necessary to reflect the information using settlement account 66.03, because in the above situation the loan was taken out for a short-term period.

The following is the accounting entry: Dt 51 Kt 66.03 (credit funds were credited to a commercial company).

The loan reflects the amount of the company's total debt to the relevant person. Registration of funds for personal needs is available to the company in cash. In such a situation, an electronic document is created in 1C 8.3 “Cash receipt”. To do this, select the item “Receiving a loan from a counterparty.”

Calculation and accrual of interest on the loan

There is no uniform documentation for calculating interest charges. For this reason, you can only create a manual entry:

- go to the Operations item, then Accounting - Operations entered manually.

- Then click “Create” with the mouse.

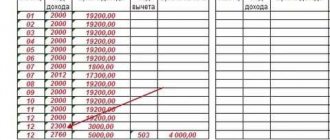

- Here is the necessary accounting entry: Dt 91.02 Kt 66.04, for the amount of interest expenses for the month.

Important! The credit reflects interest calculated to be paid over 30 days. It is necessary to indicate the founder and the agreement.

A similar method will be used to calculate income for other periods. For general accruals, it is necessary to timely withhold personal income tax from an individual at a rate of 13% per annum. In this case, we will create a transaction manually using the posting: Dt 66.04 Kt 68.01 for the amount of personal income tax from the founder.

The accountant must enter this entry every month.

At the same time, in order to reflect the personal income tax in the financial statements, it is necessary to create an electronic document “Personal Income Tax Accounting Operation”:

- While in the “Salaries and Personnel” menu, go to “Personal Income Tax - All personal income tax documents”;

- Click on “Personal Tax Accounting Operation”.

In electronic form, you must provide information about your income, as well as the amounts of calculated and withheld personal income tax. A similar document should be created in subsequent months.

Transfer of interest to the founder

To return to a legal entity the money that is owed to it, you need to create a “Write-off from the current account” order. In this case, the link “Return of loan to counterparty” should be used.

The reporting form should indicate:

- what is the name of the company itself (select from the list);

- the individual or legal entity who founded the company;

- contract number;

- income interest part minus calculated personal income tax.

You can enter the information in the table as follows: Dt 66.04 Kt 51 for the payment amounts under the loan agreement. The debit reflects expenses paid to the company.

In subsequent months, interest is paid in the same way. Any of the actions must be performed strictly within the specified time frame.

Repayment of the loan amount

At the end of the credit period, the principal amount of the debt must be transferred to the founder in full. For these purposes, it is important to make a document in the 1C 8.3 program “Write-off from a current account.”

When filling out the document we write down:

- name of the organization, date of compilation;

- parent company and contract number;

- the amount of the principal debt;

- In the Type of payment column, select “Debt repayment”.

Here is the current posting: Dt 66.03 Kt 51 for the amount of the repaid principal debt. The debit of the account reflects the paid loan to the founder.

Applying for an interest-free loan in 1C

Let's look at a simple example. The founder, Pavel Vladimirovich Ivanov, issued a loan to a commercial organization without interest in the amount of 100,000 rubles for a period of 1 year.

In this situation, it is necessary to reflect only two operations in the 1C 8.3 program: the fact of receiving borrowed funds and their subsequent return.

Receiving a loan from the founder

After the company accepts the funds, the accountant must formalize the transaction in the same way as described in the previous section. The program requires you to create an electronic transaction for the receipt of funds. The document “Receipt to the current account” indicates the following information:

- name of company;

- Full name of the lender;

- type of operation “Receiving a loan from a counterparty”;

- then click on the “Add” button;

- in the tabular part that appears, we indicate the agreement and the current item of income, for example, “Receiving a loan”;

- Next, we manually enter the amount received;

- settlement account 66.03, if the loan was issued for a short period of time.

To complete the operation you have started, you must click the “Perform and close” button. Let's make an accounting entry: Dt 51 Kt 66.03 the loan amount was received into the current account.

Repayment of debt to the founder

To reflect the debt repayment transaction, you need to create a “Write-off from the current account” document. It contains the following information:

- Company name;

- name of the lender;

- type of operation “Repayment of loan to counterparty”;

- then click the “Add” button;

- in the open sign you should indicate the Type of payment “Debt repayment”, as well as important information on contractual obligations;

- in the program, select the expense item “Loan repayment” from the list;

- in the required window, indicate the amount of funds to be returned;

- settlement accounts 66.03.

To finish the work and save the information, click the “Execute and close” button. In this case, the transfer of borrowed funds in 1C 8.3 is completed correctly.

Posting in the document: Dt 66.03 Kt 51 for the share of money paid under an interest-free agreement.

How to reflect it in accounting in 1C: UNF?

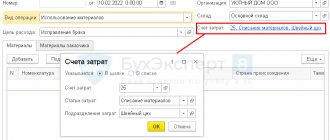

Let’s say the manager paid a janitor 500 rubles for clearing snow. Now we need to somehow display this in the program.

- We came up with the following scheme:

- The manager (or responsible employee) gives a loan to the company as an individual to his own management fund

- From your cash register, the amount is given to yourself as an account

- Then the sub-report is closed with an expense report, in which the required cost is posted (usually this is precisely the expense)

In this case, we try to keep a zero balance both in the personal cash register of the founder and in settlements with the accountable person - the founder. It turns out that all that remains is what is needed - a loan and expenses.

These operations are carried out in a special Management Organization, the documents for which are not transferred to 1C: Accounting.

- In 1C:UNF this can be reflected in two ways:

- Make all postings manually

- Use the extension and all transactions will be generated automatically