Location and explanation of page 160 (formerly 070) in the 6-NDFL report

In the new form 6-NDFL (Federal Tax Order No. ED-7-11/ dated October 15, 2020), line 160 is called “Tax amount withheld” and is located in section 2. 15 cells are allocated for it, as for most of the total lines of this report.

In the previous form, this indicator was assigned to line 070 in section 1. The procedure for filling out 6-NDFL in line 160 prescribes:

- reflect the total amount of personal income tax withheld;

- determine this amount on a cumulative basis from the beginning of the tax period.

In line 160 you need to indicate the total amount of tax that was actually withheld since the beginning of the year. It should be taken into account that the date of calculation and withholding of tax, as well as the deadline for its transfer, do not always coincide. For example, tax on wages is calculated on the last day of the month, and is withheld when it is actually issued. In this case, the amount of income will be reflected in line 110, but the tax on it will not be reflected in line 160, since it will be withheld in a subsequent period.

For example, personal income tax, which is withheld from the March salary in April, is reflected in line 160 not for 1 quarter, but for half a year.

What are the errors when filling out field 070?

Often indicators appear in the column that should not be there. This usually happens when an accountant doubts how to calculate the amount of withheld tax in 6-NDFL if wages are accrued and paid in different months.

If company employees regularly receive money at the beginning of the next month, for example, on the 10th, the accountant, in order not to break the law, is obliged to indicate in the calculation that he paid wages, vacation pay and sick leave in the current month - on its last day. In this case, is it necessary to include in the total amount of tax withheld information about those funds that are yet to be withdrawn? The letter dated May 16, 2016 No. BS-4-11/8609, which provides explanations from the Federal Tax Service on filling out line 070 in 6-NDFL, emphasizes that this is not necessary. After all, 13% is allowed to be withheld exclusively from the funds of the individual recipient directly upon payment.

Thus, if wages for December 2022 are issued in January 2022, field 070 should not contain data on amounts withheld from December wages. They should be reflected in another column - 040 (the amount of calculated personal income tax). This is the answer to the question whether it is possible to change line 070 in 6-NDFL retroactively, which was provided by the Federal Tax Service in a letter dated November 29, 2016 No. BS-4-11/ [email protected]

If, nevertheless, field 070 includes information about funds that were allegedly withheld from the December salary, the company will be suspected of non-payment of income tax. After the inspection, inspectors have the right to punish for errors in the report and (or) for failure to comply with the duties of the tax agent, if a violation has occurred. But given that section 1 is filled in with a cumulative total, extra indicators will still appear in the report. But already in the next one.

Point 1: tax rounding for entry in line 160 (previously 070)

Line 160 is filled in in full rubles and does not contain cells for recording the kopecks received when calculating the tax (as is provided for some other lines: 110, 130, etc.). This circumstance is explained by the requirements of paragraph 6 of Art. 52 of the Tax Code of the Russian Federation, which prescribes rounding personal income tax when calculating to full rubles in compliance with the rule: you can discard kopecks only in 1 case: if their value is less than 50.

You can download a sample of filling out 6-NDFL for 2022 from ConsultantPlus, receiving free trial access:

Read more about the procedure for calculating personal income tax in the articles:

- “Calculation of personal income tax (personal income tax): procedure and formula”;

- “Personal income tax accrued (accounting entry)”.

The procedure for filling out Section 1 of form 6-NDFL

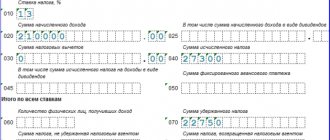

Section 1 of the calculation includes income, deductions and tax on them as a whole for the organization (OP) for a total of 1 quarter, half a year, 9 months, a year on a cumulative basis from the beginning of the year.

Section 1 can be divided into 2 blocks. Block 1 is lines 010-050 and Block 2 is lines 060-090. Block 1, namely lines 010-050, are filled out separately for each personal income tax rate (if there were payments taxed at different personal income tax rates). But Block - 2, namely lines 060-090, are filled out once, for the entire organization (OP), without detailing personal income tax rates.

Line 010 “Tax rate, %”

This line indicates the personal income tax rate.

Line 020 “Amount of accrued income”

This line reflects the amount of income received by individuals at the rate specified in “Line 010”, if their actual receipt falls on the corresponding reporting period for which the 6-NDFL calculation is made.

The most common mistake when filling out this line is the fact that many people use accounting data to fill out this line, but they need to focus on tax registers.

For example, income under PP is recognized in the period in which it is accrued, but income under civil and gas agreements is recognized in the period in which they are paid. Therefore, to correctly fill out “Line 020”, it is important to correctly determine the date of actual receipt of income. Below is a list of main incomes indicating the date of their actual receipt.

Accordingly, to fill out “Line 020” you need to focus not on the date of accrual of income, but on the date of its actual receipt, which does not always coincide.

Table 1

| No. PP | Type of income | Date of receipt of income | Tax withholding date | Tax payment deadline |

| 1 | 2 | 3 | 4 | 5 |

| 1 | Salary (salary) | Last day of the month | Day of actual salary payment | Next business day after payment |

| 2 | Advance paid on the last day of the month or later | The last day of the month for which the advance was paid | Day of actual payment of Advance | Next business day after payment |

| 3 | Monthly production bonus | Last day of the month for which the Prize is awarded | Day of actual payment of the Prize | Next business day after payment |

| 4 | Quarterly production bonus | Date of payment of the Prize | Date of payment of the Prize | Next business day after payment |

| 5 | Annual production bonus | Date of payment of the Prize | Date of payment of the Prize | Next business day after payment |

| 6 | Non-production bonus | Date of payment of the Prize | Date of payment of the Prize | Next business day after payment |

| 7 | Rewards under GPC agreements | Reward payment date | Reward payment date | Next business day after payment |

| 8 | Vacation pay | Vacation pay date | Vacation pay date | Last day of the month in which Vacation Pay was paid |

| 9 | Sick leave | Sick leave payment date | Sick leave payment date | Last day of the month in which sick leave was paid |

| 10 | Material aid | Income payment date | Income payment date | Next business day after payment |

| 11 | Income in kind, if there are other payments to this employee | Income payment date | The day of actual payment of any income | Next business day after payment |

| 12 | Income in kind, if no other payments were made to this employee | Income payment date | 00.00.0000 | 00.00.0000 |

| 13 | Compensation for unused vacation | Income payment date | Income payment date | Next business day after payment |

| 14 | Income in the form of material benefits from % savings | Last day of the month | The day of actual payment of any income | Next business day after payment |

| 15 | Dividends | Dividend payment date | Dividend payment date | Next business day after payment |

Line 025 “Including the amount of accrued income in the form of dividends”

In this line you need to indicate the amount of dividends that were paid in the current reporting period, taxed at the rate specified in “Line 010”. This amount is informationally highlighted as a separate line, but is included in the total amount of accrued income shown on “Line 020”.

Line 030 “Amount of tax deductions”

Here it is necessary to reflect all deductions that are presented to individuals for the reporting period for the income indicated in “Line 020”. These can be standard, property, social and investment tax deductions. Also, on “Line 030” you need to show amounts that reduce the tax base and non-taxable amounts for income exempt within certain limits. For example, 4,000.00 rub. from gifts received by employees.

Line 040 “Amount of calculated tax”

On “Line 040” you need to indicate the total amount of personal income tax, which was calculated from the income indicated in “Line 020” and at the rate indicated in “Line 010” for the corresponding reporting period.

Line 045 “Including the amount of calculated tax on income in the form of dividends”

For information, you need to indicate the amount of personal income tax that was accrued on the dividends paid specified in “Line 025” and at the rate specified in “Line 010” for the corresponding reporting period.

Line 050 “Amount of fixed advance payment”

This line is filled in only if there are foreign workers who work under a patent.

In this case, here you will need to indicate the total amount of fixed advance payments for personal income tax, by which you reduce the tax of all foreign workers working on a patent.

After you have filled out Block 1, namely lines 010-050 for all bets, you can start filling out Block 2, namely filling out lines 060-090.

Line 060 “Number of individuals who received income”

Here, indicate the total number of employees to whom you paid income during the corresponding reporting period.

Do not include employees who did not receive taxable income in this indicator. If during the reporting period the same person was admitted twice, i.e. was hired, then fired and then hired again, it must be indicated once.

Line 070 “Amount of tax withheld”

On “Line 070” you need to indicate the amount of tax withheld during the reporting period at the time of payment of income. The fundamental difference between the indicators of Lines 040 and 070 is that “Line 040” indicates the amount of personal income tax on income received but not paid, and “Line 070” indicates the amount of personal income tax on transferred income. Those. these indicators may take unequal values. For example, personal income tax, which is withheld from the salary for December in January, is not reflected in “Line 070” of the calculation of 6-NDFL for the year, but is included in “Line 070” of the calculation of 6-NDFL for the 1st quarter of the next year.

Line 080 “Amount of tax not withheld by the tax agent”

On this line you need to indicate the amount of personal income tax that has been calculated but not withheld. For example, if the income was paid in kind and no other payments were made. Those. These are the tax amounts for which you must submit Certificate 2-NDFL with sign “2”.

You do not need to show income that you will retain in subsequent reporting periods on this line. For example, “Line 080” of Report 6-NDFL for the 1st quarter does not indicate the amount of personal income tax from the salary for March, which will be withheld in the 2nd quarter.

Line 090 “Tax amount returned by the tax agent”

Here we indicate the total amount of tax returned to the individual by the tax agent.

Nuance 2: when the personal income tax amount on line 160 (formerly 070) is equal to the tax on line 140 (formerly 040)

The data reflected in line 160 of 6-NDFL and line 140 (personal income tax calculated, previously line 040) coincide extremely rarely, since the main part of payments is salary, and it is accrued on the last day of the month (including the month ending the reporting period) , and is usually paid in the next month (which for the accrual month that ended the reporting period will fall into the next quarter).

Test: cooperation with a self-employed person Completion time: about 5 minutes. Take the test

For example, report 6-NDFL for the 1st quarter in line 140 contains data on personal income tax from wages accrued for March. The tax calculated from it will be included in line 160 only at the time of salary payment. For March earnings, this event will most likely occur in the next month - April. For 6-NDFL this is a different reporting period.

The tax amounts reflected on lines 160 and 140 may be the same if, for example:

- earnings are regularly issued to employees on the last day of the month for which they are accrued, and the dates of accrual and payment of income/calculation, withholding and payment of personal income tax coincide;

- In the reporting period, only income accrued at the time of payment was paid, and there were no situations forcing the postponement of dates to another reporting period.

About the features of reflecting salary advances in 6-NDFL, read the material “How to correctly reflect an advance in the 6-NDFL form (nuances)?”

Understanding the filling rules

With the transition to the new 6-NDFL form, there was a slight adjustment in the line number, its name and location in the calculation form. Has anything changed in the rules for filling it out?

A comparison of the rules for filling out the previous line 070 of 6-NDFL and line 160 of the current calculation form shows the following:

There are changes, although not significant:

- the previous rules deciphered line 070, and according to the current rules, the withheld tax is reflected in field 160;

- the description of the procedure for filling out the indicator “Amount of tax withheld” in the current rules for filling out 6-NDFL has moved from Chapter III to Chapter IV.

At the same time, the wording of the rules for filling out field 160 remained unchanged, i.e., the meaning of the indicator remained the same.

The developers of the rules did not bother themselves too much, prescribing in detail the algorithm for filling the line and limited themselves to one sentence. However, the text of the rules contains scattered other important information, without knowledge of which it is difficult to correctly fill out the line. Check it out in the next section.

Nuance 3: relationship between lines 160 (formerly 070) and 170 (formerly 080) of the 6-NDFL report

If during the year the tax agent was unable to withhold accrued personal income tax from income paid to an individual, then for such tax, instead of line 160 (previously 070) in the 6-NDFL report, line 170 (previously 080) will be used, intended to reflect the personal income tax not withheld by the tax agent.

The inability of a tax agent to withhold personal income tax from the income of individuals may arise, for example, in the following cases:

- The employee received in-kind income from the company and then quit. At the same time, the dismissal amount was not enough to withhold personal income tax from the value of natural income.

- Former retired employees were given anniversary gifts (worth more than 4,000 rubles). At the same time, no other monetary income was paid.

- A company employee received an interest-free loan, but is on long-term leave without pay. At the same time, he receives monthly income from interest savings (material benefits), with which the employer is unable to withhold personal income tax due to the lack of income paid to the employee.

For information on how to reflect bonuses, gifts, vacation pay and other various payments in the calculation of 6-NDFL, see the Ready-made solution from ConsultantPlus. Get trial online access to K+ for free right now.

Examples of atypical situations

It is not difficult to reflect the withheld tax on usual regular income (salaries, bonuses, etc.) in 6-NDFL. But there are rare situations when the formation of a field indicator of 160 in 6-personal income tax requires a special approach.

Example 1

The chief livestock specialist of PJSC Tarasovsky Agroholding Kulikova T.I. went on a business trip to Belgium as part of an experience exchange program. For foreign business trips, the company has established a daily allowance amount of ─ 3,200 rubles. in a day.

For six days on a business trip, Kulikova T.I. was given a daily allowance in the amount of 19,200 rubles. In March, the advance report was approved by the general director of the agricultural holding. Personal income tax on excess daily allowance in the amount of 546 rubles. ((3,200 rubles – 2,500 rubles) × 6 days × 13%) was withheld from the March salary issued on April 12.

When filling out the 6-personal income tax for the 1st quarter in section 2, the accountant of the agricultural holding showed excess daily allowances and the salary of T. I. Kulikova (the employee’s total income for March) ─ these amounts supplemented the indicators of lines 110 and 112 of section 2, and the income tax on the specified amount was included in line 140.

Since the tax was withheld in April upon the actual payment of income to Kulikova T.I., it will not be included in line 160 of the 6-NDFL calculation for the 1st quarter, but will be reflected in the calculation for the six months, with the date for transferring the tax 12 indicated in line 021 of section 1 April.

Results

Line 160 in the new 6-NDFL is located in section 2 (previously it was line 070 of section 1) and is used to reflect the total amount of personal income tax actually withheld for the reporting period.

If during the year it was not possible to withhold personal income tax from income paid to individuals, then the amount of tax related to such income will appear in line 170 instead of line 160. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Instructions: how to generate and prepare data

We invite you to familiarize yourself with the instructions, the text of which is compiled from individual points of the rules for filling out the current Form 6-NDFL and the norms of the Tax Code of the Russian Federation. It contains the necessary information on the general procedure for filling out field 160:

This instruction will help you cope with the intricacies of filling out field 160 in 6-NDFL (round the arithmetically calculated tax amount according to established rules, place it correctly in the cells), but will not fully answer the main question ─ what is included in field 160? Let's look at examples.

You can check whether you filled out the report correctly with the help of explanations from experts "". Get trial demo access to the K+ system and switch to the Ready-made solution for free.

When forming line 070, pay special attention

- The amount is entered only in whole rubles (without kopecks). This rule is also provided for other lines in which the amounts of personal income tax are indicated. As for the lines for displaying the income part, the values should be indicated in them without rounding, that is, with kopecks.

- In most cases, the values of the indicators on lines 040 and 070 do not coincide due to different periods of tax calculation and withholding. However, sometimes the values for these lines may coincide, for example, when wages at the end of the month are issued exactly on the last day of the same month.

- If the amount of personal income tax cannot be indicated on line 070 because the tax has not been withheld, then it is indicated on line 080, which is intended specifically to reflect the amount of tax not withheld.

See also:

“Line 070 of the 6-NDFL report: cumulative or not?”

Errors in calculating 6 personal income taxes

Let's look at each error in more detail.

Error 1. The amount of accrued income on line 020 of Section 1 of the 6-NDFL calculation is less than the sum of the lines “Total amount of income” from the certificates in form 2-NDFL.

Why did this error occur?

When filling out the form, the accountant did not check the control ratios of the calculation indicators using Form 6-NDFL and Form 2-NDFL.

What is broken?

Tax Code of the Russian Federation, Article 226, Article 226.1, Article 230.

How to correctly fill out the calculation on Form 6-NDFL.

The amount of accrued income (line 020) at the corresponding rate (line 010) must correspond to the sum of the lines “Total amount of income” at the corresponding tax rate of 2-NDFL certificates of information on the income of individuals in form 2-NDFL with sign 1, presented for all taxpayers, and lines 020 at the corresponding tax rate (line 010) of appendices No. 2 to the DNP, submitted by organizations to the tax office. The ratio is applied to the calculation in Form 6-NDFL for the year. Letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/ [email protected] clause 3.1.