About legal entities

Increased the amount of income for the transition to the simplified tax system Organizations and individual entrepreneurs can change their system

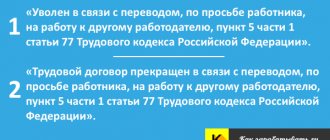

Contents Features of dismissal in the order of transfer to another organization In case of refusal of the manager to let go

Having founded a company and/or become its manager, it is important not to forget about a lot of issues related to how

Why do you need the document Book of Income and Expenses (abbreviated as KUDiR) is necessary for

Why does an error occur when calculating insurance premiums? Usually this error occurs when submitting a report.

To calculate UTII, the adjustment coefficient of basic profitability K2 is used. It is established by local regional laws.

Card of quantitative and total accounting of material assets in the form 0504041 Card of quantitative and total accounting, approved by order of the Ministry of Finance

Declaration under the simplified tax system income for 2022 More details Attention! You can generate payments for

Consequences of errors in a payment document When preparing payment orders for tax payments, you should:

May 17, 2022 #Accounting OKTMO, UIN, KPP, RSV - you won’t surprise a good accountant with this.