When a baby arrives in the family, many parents are interested in the question of how to calculate parental leave, and whether payments are due to a family member caring for children before they reach 1.5 years of age. Monthly child care benefits are assigned and paid in accordance with Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children.” In this article, we will consider who is entitled to and how to calculate child care benefits in 2022 with calculation examples.

Who can count on child care benefits?

Child care benefits are assigned and paid in accordance with Federal Law No. 81-FZ dated May 19, 1995 “On state benefits for citizens with children”:

- citizens of the Russian Federation;

- foreign citizens permanently residing in the Russian Federation;

- foreigners temporarily residing in the territory of the Russian Federation and subject to compulsory social insurance in case of temporary disability and maternity.

The following have the right to a monthly allowance for child care up to 1.5 years:

- mothers, fathers, guardians (including full-time students);

- mothers are contract military personnel;

- relatives who actually care for the child - subject to mandatory payment of insurance contributions to the Social Insurance Fund;

- mothers dismissed due to the liquidation of the organization during pregnancy or maternity leave;

- other relatives of the child - if they were fired due to the liquidation of the organization during parental leave;

- relatives caring for the child who are not insured by the Social Insurance Fund - if the child’s parents have died or have been deprived of parental rights in relation to him.

Benefit for a child under 1.5 years of age is not provided if:

- the child is fully supported by the state;

- the applicant is deprived of parental rights to this child.

Besides:

- in the case of the birth of 2 or more children, the benefit is assigned for each child;

- are not paid for a stillborn child ;

- if a woman has 2 types of leave at the same time - for child care and for pregnancy and childbirth - she will not be able to combine them; she must choose one of these payments;

- If a woman is officially employed, a care allowance is assigned to her at the end of her maternity leave. If she does not work, then child benefits are due from birth ;

- If a woman is registered with an employment center, she needs to refuse unemployment benefits in order to receive child care benefits.

Calculation of child care benefits

Child care payments are calculated based on average daily earnings for the 2 previous calendar years.

That is, in 2022, benefits are calculated based on data on the employee’s salary in 2022 and 2022. Although a maternity leaver can also choose other years for calculating payments - if, for example, in the previous 2 years she was on maternity leave to care for an older child. In this case, she must write a corresponding statement.

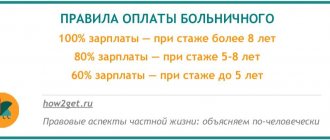

Child care benefits are assigned in the amount of 40% of average earnings, taking into account the minimum and maximum amount of benefits established by current legislation.

To calculate average daily earnings, use the following algorithm:

- We determine the amount of wages accrued to the employee for the 2 calendar years preceding the calculation.

- We calculate the number of days in the billing period. From this indicator, it is necessary to subtract periods of sick leave (including sick leave for pregnancy and childbirth), parental leave, and releases from work (if the employee’s average earnings were maintained and the employer did not pay his contributions to the Social Insurance Fund).

- We divide the amount of accrued wages by the number of days in the billing period.

Thus, we calculate the average daily earnings using the formula:

| Average daily earnings = SZ / (730 – Di) |

Where:

- SZ – the amount of the employee’s salary for the billing period;

- Di – the number of days excluded from the billing period.

The maximum allowable average daily earnings for calculating child care benefits in 2022 is RUB 2,434.25. in a day. We calculate it based on the limit for contributions to the Social Insurance Fund for 2022 and 2020. Respectively:

(865 000 + 912 000) / 730 = 2434.25 rub.

The minimum average daily earnings in 2022 is 420.55 rubles. in a day. We calculate it based on the minimum wage:

(12 792 × 24) / 730 = RUB 420.55

After calculating the average daily earnings, you can proceed to calculating the amount of the employee's benefit. For this purpose in Art. 14 of the Federal Law of December 29, 2006 No. 255-FZ provides the following formula:

| Amount of child care benefit up to 1.5 years = SrZ × 30,4 × 40% |

Where:

- SrZ - average daily earnings;

- 30.4 is the average number of days per month established for child benefits.

The amount of benefit received must be compared with the minimum and maximum amounts established by law for this payment .

Individual entrepreneurs and persons engaged in private practice are entitled to allowance for a child up to one and a half years old in the amount of the established minimum . Currently, the amount of care benefits for this category of persons does not depend on the voluntary payment of contributions to the Social Insurance Fund.

The calculation of benefits for caring for a second child is no different from the calculation of benefits for the firstborn. Although previously different minimum benefit amounts were established depending on the birth order of children.

Maternity calculator

The employer no longer calculates the amount of benefits - this is done by the Social Insurance Fund. The calculator will help you find out in advance the amount of maternity benefits and the monthly child care benefit for up to 1.5 years.

How to use the calculator?

- In the first step, select the benefit type. For maternity benefits, you need to indicate data about the period from the employee’s application (based on a certificate of incapacity for work), and for child care benefits up to 1.5 years, also data about the child. Calculation years will be determined automatically. By default, this is 2 calendar years preceding the vacation. Since 2013, periods of sick leave or parental leave are excluded from them. If there were such periods, indicate them.

- In the second step, the employee’s earnings for 2 accounting years are indicated. These are all payments for the calculation period for which insurance contributions to the Social Insurance Fund are calculated. Indicate the regional coefficient, if provided. Check the box for part-time employment, if any. The insurance period is taken into account if it is less than six months. This is necessary to calculate the average daily earnings and compare them with the calculation of minimum wage benefits.

- In the third step, you will see the final calculation of the benefit amount.

Minimum and maximum amount of benefits for child care up to 1.5 years

From February 1, 2022, there was an increase in childcare benefits for children under 1.5 years of age. These benefits in the Russian Federation are usually indexed at the beginning of the year, which was done in 2022.

In 2022, various social benefits were increased due to the coronavirus pandemic. Thus, on July 8, 2022, Law No. 166-FZ was signed, which formalized the increase in minimum child care benefits retroactively - from June 1, 2020 .

The innovation concerned, first of all, non-working mothers - who receive not 40% of their earnings, but a minimum amount of benefits. And this minimum size has been increased significantly compared to the previous value.

If the benefit calculated on the basis of the minimum wage is less than the minimum benefit, then the minimum benefit is paid. So, in 2022 the minimum wage is 12,792 rubles. 40% of the minimum wage is 5116.80 rubles, which is less than the minimum amount established from February 1, 2022 - 7082.85 rubles.

Thus, in 2022, regardless of the birth order of the child being cared for:

- The minimum amount of child care payment is 7082.85 rubles. (established by law);

- the maximum payment amount is RUB 29,600.48. (2434.25 × 30.4 × 40%).

In the Russian Federation, these amounts must be indexed annually based on the forecast level of inflation.

EXAMPLE OF CALCULATION OF CHILD CARE BENEFITS UP TO 1.5 YEARS OLD

Accountant of Aktiv LLC Belaya M.V. is about to take leave to care for her first child. To calculate her benefits, we are interested in her income for 2022 and 2022.

For 2022, she received the following types of income:

- salary – 300,000 rubles;

- additional payment for overtime work – 20,000 rubles;

- bonus at the end of the year - 40,000 rubles;

- the amount of compensation for expenses for accounting courses is 25,000 rubles;

- bonus in connection with the company’s birthday – 3,000 rubles.

In 2022, Belaya received the following types of income:

- salary – 350,000 rubles;

- temporary disability benefit for 86 days – 47,000 rubles;

- additional payment for overtime work – 10,000 rubles;

- bonus at the end of the year - 40,000 rubles;

- bonus in connection with the company’s birthday – 3,000 rubles.

Let's calculate the amount of the employee's income for 2022 and 2022, which is taken into account when calculating benefits for a child under 1.5 years of age:

- income for 2022 = 300,000 rubles. + 20,000 rub. + 40,000 rub. + 3000 rub. = 363,000 rub.

- income for 2022 = 350,000 rubles. + 10,000 rub. + 40,000 rub. + 3000 rub. = 403,000 rub.

We do not include the amount of compensation for expenses for accounting courses and temporary disability benefits in income.

From the calculation period we exclude 86 days of the employee being on sick leave in 2022.

The number of calendar days included in the calculation is 644 days (365 days + 365 days – 86 days).

Next, we calculate the average daily earnings for the benefit.

Average daily earnings = (RUB 363,000 + RUB 403,000) / 644 days. = 1189.44 rub. /day

This is less than the maximum average daily earnings (RUB 2,434.25) and more than the minimum (RUB 420.56).

Allowance for a full month of care leave – RUB 14,463.59. (1189.44 rubles/day × 30.4 days × 40%), which is more than the minimum child care benefit (7082.85 rubles).

Thus, accountant of Aktiv LLC Belaya M.V. will receive a childcare benefit for a child up to 1.5 years old in the amount of 14,463.59 rubles. per month.

Calculation of child care benefits up to 1.5 years for less than a month

The procedure for calculating child care benefits for children under 1.5 years old for less than a full month is prescribed in Part 5.2 of Art. 14 of Federal Law No. 255-FZ.

To calculate you need:

- Determine the amount of child care benefits for a full calendar month.

- Divide the benefit amount for a calendar month by the number of days in the month.

- Multiply the resulting amount by the number of calendar days of parental leave per month.

In the form of a formula, the calculation of child care benefits for children up to 1.5 years for less than a full month can be presented as follows:

EXAMPLE

From the accountant of Aktiv LLC Belaya M.V. from our previous example, parental leave for a child up to 1.5 years old begins on July 24, 2021. July has 31 calendar days. Let's calculate the July child care benefit for her:

Benefit for July = 14,463.59 rubles. / 31 days × 8 days = 3732.54 rub.

Thus, Belaya M.V. when applying for care allowance, he will receive an allowance for July 2022 in the amount of RUB 3,732.54.

Calculation of minimum benefits when caring for several children

Part 3 Art.

15 of Federal Law No. 81-FZ provides for an applicant caring for several children under the age of 1.5 years to sum up the maximum amount of care benefits. For example, in June 2022, when caring for 2 children, the minimum benefit amount is 14,165.70 rubles. (RUB 7,082.85 × 2).

There is also a cap for officially employed applicants who care for multiple children. For this category, the summed care allowance for all children cannot exceed 100% of average earnings . But at the same time, the minimum benefit amount is again taken into account. You cannot pay less than this amount (justification - Part 2 of Article 11.2 of Law No. 255-FZ and Part 3 of Article 15 of Law No. 81-FZ).

EXAMPLE

The accountant of Horns and Hooves LLC sends his accountant colleague V.V. Zadorozhnaya. on parental leave to care for three children under 1.5 years old. Based on average earnings, her allowance for one child was 8,000 rubles. This means that for three children the benefit amount should be 24,000 rubles (8,000 × 3). However, the average salary of Zadorozhnaya V.V. is 17,500 rubles.

The amount of the total minimum benefit for three children in 2021 is RUB 21,248.55. (RUB 7,082.85 × 3).

We compare all the amounts received. The total amount of the calculated benefit (24,000 rubles), as well as the amount of the minimum benefit (21,248.55 rubles) is more than the average earnings (17,500 rubles). Therefore Zadorozhnaya V.V. will receive a benefit for caring for three children under 1.5 years old in the amount of 17,500 rubles.

One-time benefit for the birth of a child in 2022

One of the parents (adoptive parents) has the right to claim a one-time benefit at the birth of a child (Article 12 of Law No. 81-FZ).

In 2022, the benefit amount is:

- in January - 18,004.12 rubles;

- from February to December - 18,886.32 rubles. (see “Children’s benefits increased by 4.9%”).

IMPORTANT!

Since 2022, a lump sum benefit for the birth of a child will be paid directly by the Social Insurance Fund, bypassing the employer (see “From 2022, in all regions of Russia, benefits will be paid directly from the Social Insurance Fund”).

Regional coefficients when calculating care benefits

In accordance with Part 2 of Art. 15 of Law No. 81-FZ, if regional coefficients are applied to wages in a region or locality, they must be taken into account when calculating the maximum amount of child care benefits.

However, if the care allowance is calculated based on average earnings , then there is no need , since it has already been taken into account when calculating the employee’s wages (Article 5 of Law No. 81-FZ).

Support no longer applies during the coronavirus epidemic

Due to the spread of coronavirus infection, an unfavorable economic situation has developed in the country. Russian families with children turned out to be the most vulnerable. To support the population, the Russian President introduced new social payments for children. In 2020, the following types of financial assistance were provided to families:

- One-time social payment for children aged 3 to 16 years. The amount of one-time support was 10,000 rubles. Material assistance has been issued since 06/01/2020.

- The minimum amount of child care benefits has been doubled. Social support is provided only to unemployed Russians. The amount was 6752 rubles.

- A monthly social supplement has been introduced for children under 3 years of age. The benefit amount was 5,000 rubles. per month. The period for assigning child benefits is April-June 2022. Money was received only by those citizens of the Russian Federation who had the right to receive maternity capital, as well as citizens whose first child was born or adopted in the period from 04/01/2017 to 01/01/2020.

The deadline for applying for social supplements due to coronavirus has been limited. The application should be submitted no later than October 1, 2020. After this period, applications were not accepted and payments were not assigned.

Documents for applying for child benefit

The benefit is assigned if a written application for its appointment is made no later than 6 months from the date the child reaches the age of 1.5 years.

Citizens subject to compulsory social insurance in the Social Insurance Fund must apply for benefits at their place of work (service) in case of taking parental leave to care for a child under 3 years of age.

It is important to understand here that care leave is given up to 3 years , and benefits are paid only until the child reaches the age of one and a half years .

Citizens who are not subject to compulsory social insurance (i.e., unemployed) apply for the assignment of this benefit to the social protection authorities at their place of residence.

When applying for benefits at your place of work, you need the following documents:

- Information about the insured person. They can be filled out once, and if there are no changes in them, then used for each subsequent assignment of benefits from the Social Insurance Fund;

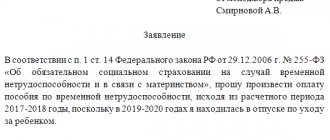

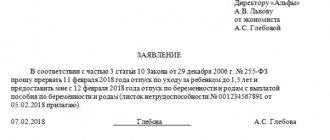

- application for benefits - in free form;

- birth (adoption) certificates - for all children of the applicant;

- certificate of non-receipt of benefits by the second parent (issued at the place of work or at the social security department);

- a certificate of the amount of salary for calculating benefits from the previous place of work (if you have been working for this employer for less than 2 years);

- certificate of non-receipt of benefits at the second place of work (for part-time workers).

When applying for benefits to social security authorities, you may need the following documents:

- parents' passports;

- birth certificates of all children;

- work record (certificate, diploma, military ID);

- an extract from the work book about the last place of work (certified by a specialist upon presentation of the work book);

- certificate of non-receipt of benefits and non-use of care leave by the second parent;

- a document confirming the fact that the child lives together with one of the parents;

- a certificate from the employment center about non-receipt of payments;

- bank details addressed to the applicant - for transferring benefits;

- an order for the appointment of parental leave at the place of former work and a certificate of payment and period of assignment of benefits (if the child’s mother was dismissed due to the liquidation of the organization during parental leave or while on sick leave for pregnancy and childbirth);

- certificate of study and certificate of granting (non-granting) maternity leave at the place of study (if the applicant is a full-time student);

- certificate of registration as an individual entrepreneur and a certificate from the Social Insurance Fund confirming the absence of registration with the Social Insurance Fund as an insurer and the non-receipt of the monthly benefit of the individual entrepreneur at the expense of compulsory insurance funds (individual entrepreneurs not registered with the Social Insurance Fund as an insurer);

- other additional documents.

It is better to clarify the list of documents for social protection before applying directly, as it may differ.

List of documents for payments

One application for social benefits is not enough. Citizens need to confirm their rights to receive government money. Each situation will require a special package of documents. Let's denote the key list:

- application of the established form. The form will be issued at the place of application for social benefits;

- passport or other form confirming the identity of the applicant;

- TIN and SNILS;

- details of the current account where state benefits should be credited.

Additional papers and certificates for child benefits:

- child's birth certificate;

- birth certificate;

- a certificate from the spouse’s place of work stating that similar payments were not assigned;

- certificate of registration in the early stages of pregnancy;

- sick leave for pregnancy and childbirth;

- marriage certificate;

- certificate of family composition;

- certificate stating that the child lives with his parents;

- decree on guardianship, guardianship or adoption.

Low-income and unemployed:

- certificate from the last place of work;

- salary certificate;

- a certificate of wages of the spouse and all able-bodied family members to establish the average income for each family member;

- certificate of family composition;

- utility bills;

- agreements with companies supplying energy resources;

- certificates from the place of study of minor children.

Additionally you will need:

- death certificate and death certificate - to assign funeral payments;

- certificate of disability - for a disability pension, including for a disabled child;

- IDs of a pensioner, veteran, hero, etc. - for social payments by category.

The list of documents is individual in each case. Please check at the place of application whether all necessary documents have been provided. If something is missing, submit certificates immediately, otherwise government payments will be denied. Please note that regional authorities have the right to establish additional requirements for supporting documentation. They will have to be followed.

Benefit payment

Child care benefits are paid in full if the application is made no later than 6 months from the date the child reaches 1.5 years of age.

Since 2022, in all regions of Russia, the payment of child care benefits is carried out by the FSS by transferring funds to the bank account of the benefit recipient or by postal transfer. The method of receiving funds must be indicated when applying for benefits (either to the employer or to social security).

From July 1, 2022, it will be possible to receive child care benefits only on a MIR card or by postal order.

However, working persons still need to submit documents to the employer. Within 5 days transfers the information to the Social Insurance Fund, which checks it and, if there are no errors, transfers the first payment to the recipient within 10 days . Payments for the following months are made by the FSS - until the 15th day of the month following the month in which benefits were calculated.

Benefit for registration in early pregnancy

Starting from July 1, 2022, the benefit for women who registered in the early stages of pregnancy became monthly (previously it was a one-time payment).

The new benefit amount is 50% of the regional subsistence level for the working population in the corresponding constituent entity of the Russian Federation. Not everyone has the right to benefits. Women for whom two conditions are simultaneously met are eligible for payments:

- the pregnancy period is 6 or more weeks, and registration with a medical organization occurred before 12 weeks;

- The average per capita family income is not more than the subsistence level per capita in a constituent entity of the Russian Federation on the date of application for benefits.

In general, benefits are paid from the month of registration with a medical organization (but not earlier than 6 weeks of pregnancy) until the moment of birth or termination of pregnancy. This follows from the new Article 9.1 of Federal Law No. 81-FZ dated May 19, 1995 (see “Benefits for registration in the early stages of pregnancy will be paid according to the new rules”).

IMPORTANT

Since 2022, benefits for registration in the early stages of pregnancy are paid directly by the Social Insurance Fund, bypassing the employer (see “Starting from 2021, in all regions of Russia, benefits will be paid directly from the Social Insurance Fund”).

Generate and submit documents for payment of benefits to the Social Insurance Fund Submit via the Internet

Results

Parental leave is given until the child reaches the age of three. At the same time, a monthly child care allowance is assigned and paid only up to the age of 1.5 years.

It is permissible to use parental leave in full or in part to divide into periods between the mother, (guardian) of the child and other relatives actually caring for him.

The amount of benefits for employed and unemployed citizens may differ significantly . However, there are legally established maximums and minimums, which are indexed annually.