Why does an error occur when calculating insurance premiums?

Typically, this error occurs when submitting the “Calculation of Insurance Contributions” report to the appropriate department of the tax office. The massive occurrence of errors in the submitted reports dates back to the beginning of 2022, which is associated with letters from the Federal Tax Service dated January 13, 2022 No. GD-4-11/ [email protected] and dated January 29, 2022 N GD-4 11/ [email protected] on the use of new controls ratios.

In addition to the above error text, the message text also contains an indication of the amount of the difference detected by the automatic complex of the Federal Tax Service, for example:

In this case, the amount in gr.1. line 030 (amount of payments to employees for the entire year) is automatically compared with the amount indicated in column 2 line 030 (amount of payments for the 4th quarter) + the value of column 210 for the previous period, usually 9 months. (usually pulled from the Federal Tax Service database). If the program detects a difference, the accountant receives error 0400400017.

If the value in column 1 is greater, then, probably, in previous periods the non-taxable benefit (benefits for employees who are on parental leave for up to one and a half years) was not shown in section 3, column 210. Previously, section 3 could not be filled out for the specified employees, since benefits up to one and a half years are not subject to contributions to the Pension Fund. When submitting this report in column 1, the mentioned non-taxable benefit can be taken into account.

Also, the description of the error can take a more abstract text form:

Let's figure out how to solve an error when submitting reports.

Write to 1C technical support

In order to solve any problems related to the 1C software product, you can write to the email address [email protected] In the subject line of the letter, write “Internet support” so that operators can determine the nature of the letter and respond to it faster.

If you have identified errors in the test version of the product, then you need to contact:

- for Ukraine -;

- for Kazakhstan –;

- for the Russian Federation –

Support for test releases of the program is provided only for partners within the framework of the conference. If you are using the standard version of the product and you have an error 0400300003 “Violation of the conditions for the mandatory presence of an element, depending on the value of another element,” write to the official address of the 1C company.

kod_oshibki_0400400007_v_rsv_-_kak_ispravit. jpg

Related publications

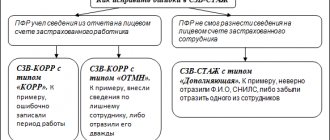

An error in the calculation of insurance premiums may lead to refusal to accept the report; it is also possible to accept the report with subsequent request for clarification or submission of an adjustment. Thus, changes will be required in situations where the cause of the error is a violation of equalities for similar indicators in different forms of reports that are checked during interdepartmental reconciliations, or incorrect entry of personal data on insured persons.

Errors identified by tax authorities in the DAM can be divided into several groups, including:

Error code 0400400007 (Calculation of insurance premiums)

When receiving electronic reporting, the contents of the document are automatically checked for the presence of incorrect information - a reconciliation is carried out using control ratios, filling in all required fields, and checking whether the submitted document complies with the current version of the report format. In the protocol for receiving reports, if there are comments, the coded content of the error is displayed. For example, error codes starting with “040” mean that the document did not pass logical control.

In RSV, error code 0400400007 may indicate that the report testing scheme in the program has not been updated. Current data on XSD format schemes are posted on the Federal Tax Service website and published in legislative databases as part of regulations. In 2022, it is necessary to follow the requirements of the Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11 / [email protected] (as amended on October 15, 2020).

Therefore, if error 0400400007 occurs, you need to update the associated software.

In this case, there is no need to generate adjustment reports, since if such an error occurs, the document is considered not submitted, and the data from it is not saved in the Federal Tax Service database. That is, after correcting the shortcomings in the delivery format, the RSV will be accepted with the “primary” attribute.

Mri POP help me understand

Svetlana, Tomsk

804 views

May 21, 2020

Please explain the MRI results.

A series of T1- and T2-weighted MRI tomograms in two projections visualize the lumbar spine and central parts of the sacrum. lumbar lordosis is smoothed. Left-sided scoliosis. The height of the L3-S1 intervertebral discs is reduced. Signals along the T" intervertebral discs of the studied area are unevenly reduced, to the greatest extent at the level of L1/L2, L3-L5. posterior disc protrusions: -L1/L2, medial-paramedian right-sided, up to 0.3 cm in size, extending into the right intervertebral foramen without narrowing their lumen, slightly deforming the adjacent parts of the dural sac. -L3/L4, diffuse, up to 0.2-0.3 cm in size, spreading into the intervertebral foramina on both sides, with a moderate narrowing of their lumen to 0.1-0.2 cm. L4/L5, diffuse, 0.2- in size 0.3 cm, spreading into the intervertebral foramina on both sides with a narrowing of their lumen to 0.1-0.2 cm, slightly deforming the adjacent parts of the dural sac. -L5/S1 unevenly diffuse, up to 0.3 cm in size, spreading into the intervertebral foramina on both sides with a narrowing of their lumen to 0.3 cm, slightly deforming the adjacent parts of the dural sac. The ligamentum flavum is not thickened. There is a moderate deformation of the articular foreset of the facet joints L3-S1. Due to the changes noted above, the intervertebral foramina are deformed, moderately narrowed at the L4-S1 level. The lumen of the spinal canal is deformed, the sagittal size is narrowed at the L5/S1 disc level to 1.3 cm, and is preserved at other levels. The signal from the spinal cord structures (according to T! and T2) is not changed. In the L4 vertebral body, an area of change in signal intensity is determined (heterogeneously reduced in T1 and T2, increased in STIR, the vertebral body is not deformed, not reduced in height. Changes in the signal characteristics of the transverse and articular processes of the L5 vertebra on the right and the lateral masses of S1 on the right (heterogeneously reduced according to T1, increased according to T2 and STIR), probably due to edema (inflammatory changes?) The shape and size of the bodies of the remaining vertebrae of the studied area are normal, signs of dystrophic and reactive changes in the vertebral bodies (changes in Modic2 (fatty degeneration), Modic3 (sclerotic changes) Chronic diseases:

C56. from 2022, moderately differentiated ovarian cystadenoma. uterus, ovaries, omentum removed, 6 courses of chemotherapy. MRI OMT normal. CA 125 -10 (norm up to 35) May 2020

The question is closed

back

pain

vertebra

What does error 0400400011 mean in RSV

One of the most common errors in the DAM is protocol code 0400400011. This code indicates inconsistencies in the control ratios for insurance premiums within the document and discrepancies with other reporting forms. The reason for the error may also be the incorrect entry of personal data of employees.

To correct the violation you need to:

After checking the document, the necessary adjustments are made to it, and the report is again sent to the Federal Tax Service.

You can always view the full texts of regulatory documents in the current edition in ConsultantPlus.

Error code 0400400011 “The condition for equality of the value of the amount of insurance premiums has been violated”

It is usually pointless to ask a tax specialist about the specifics of the problem that has arisen, since the analysis of the statements is carried out by the corresponding program, and it is this program that produces the mentioned negative result. Specific causes of error 0400400011 may be as follows:

- Incorrect values of reporting indicators (mismatch in checksums, difference of a couple of kopecks, etc.); Individuals in the report have the same SNILS (Individual Personal Account Insurance Number), some individuals may have two SNILS, and so on; It can also occur (I described its corrections in the article at the link); The report contains discrepancies between full name and SNILS; The PFR authorities did not transmit the data necessary for checking the reporting to the tax service on time.

To get rid of error 0400400011, I recommend doing the following: Check your report carefully again, make sure that all the numbers “play” and there are no differences in kopecks;

Errors in calculating insurance premiums

If the inspector only indicates this error code, then corrections must be made in the third section of the form.

In the appendix to the notification, the Federal Tax Service Inspectorate lists the persons whose data identified personalized discrepancies (SNILS, full name, passport) and offers to clarify them. What should the policyholder do when receiving this document?

If the Federal Tax Service does not accept the Calculation of insurance premiums, and its compiler is confident that the data indicated is correct, it is worth sending the inspector a copy with a Pension Fund mark or a letter confirming the veracity of the information provided, confirming it with attached copies of identification documents. If the DAM compiler indicated incorrect personal data, then he will have to submit an updated version of the report, otherwise the insurance premiums of these employees will not go to their personal accounts.

After determining reliable information, the policyholder draws up an updated calculation, correcting the data in subsections 3.1 and 3.2.

Example 1. The tax office does not accept calculations for insurance premiums - SNILS was not found in the Federal Tax Service Inspectorate database.

Refusal to accept reports: how to act (continued)

If the document was not signed by the head of the organization, make sure that you provide the inspection with a power of attorney for the right to sign. If you are sure that you handed over a power of attorney, or the report was signed by the manager himself, use the instructions.

We wrote about issuing a power of attorney for reporting in the article. You can also download samples of powers of attorney for different cases there.

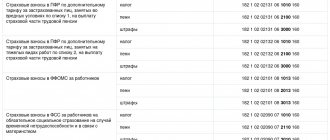

| Error code | What does the Federal Tax Service write? | What does this mean and what to do |

| 0100500001 | There is no information about the power of attorney with the tax authority | |

| 0100200009 | The file was sent to the tax authority, whose competence does not include receiving this information. | Check that you have correctly indicated the code of the Federal Tax Service to which the document was sent. If the inspection was listed correctly, make sure the details are filled out correctly |

| 0400300001 | Registration of a revised document without a primary one | Make sure that you submitted the primary document, the tax office accepted it, and the INN-KPP of the primary and corrective reports match. If the refusal came to 6-NDFL, check OKTMO. Also make sure that the reporting period is selected correctly and that the organization has not been transferred to another inspection. Read the instructions for how to proceed in each case. |

| 0300100002 | xsd schema file not found | The decision depends on the form of refusal. Instructions that will help you check whether the data is filled out correctly are collected on the page |

| 0000000002 | The declaration (calculation) contains errors and is not accepted for processing | If the refusal came on the DAM, we recommend sending it again. If the refusal came to another report, contact technical support. Please provide the organization’s tax identification number and checkpoint, the name of the report and the date it was sent, as well as the text of the error specified in the refusal notice |

There are dozens of times more refusals to accept reports - we have considered only the most frequent ones. Report through Extern to avoid mistakes, and if mistakes do creep in, correct them quickly. Try it - 3 months free.

ATTENTION! RSV 2022. Refusals from the Federal Tax Service

These errors indicate that the Federal Tax Service database does not contain the amounts specified in Appendix 1 to Section 1 (cumulative total from the beginning of the year)

Error code 0000000002 The declaration (calculation) contains errors and is not accepted for processing

Thus, if the payer does not submit a declaration within the specified time frame, he will be charged a fine of five percent of the amount that had to be paid, but not less than 1 thousand rubles.

The tax return can be provided by the payer in the form of mail with the described attachment, and also sent electronically through special communication channels using the payer’s personal account.

Reviews

Feedback from people who have encountered a similar problem can certainly be very helpful. Therefore, it is worth familiarizing yourself with them:

- Sergey. I encountered such a case for the first time in my practice. I checked everything, the amounts seem to match. What's wrong? Fortunately, I have a good friend who works in the tax office. I called him and outlined the essence. He immediately asked me if the company had employees with double tax identification numbers. It turned out that yes. I advised to use a more recent version. It really did help!

- Oleg. There was a similar situation. We entrusted this work to a young accountant. So he made mistakes there, and was embarrassed to contact more experienced employees. As a result, their entire department received a reprimand. We sat there after hours and double-checked everything. We found and corrected the discrepancy and accepted him into the Federal Tax Service the second time.

- Marina. As I understand it, the check is carried out by the program. That is, automatically. I have all the data entered correctly. But they return with this error. I've been racking my brains for three days. It turned out that in the new report I had rearranged the serial numbers of my employees. But the program did not pay attention to this, continuing to compare them according to the given algorithm. As a result, it turned out that the amounts did not coincide at all. I arranged it in the right sequence and everything went without additional problems.

- Anton. Innovations have been introduced to the Federal Tax Service. And somehow I missed them. As a result, they returned it back to me. It turned out that the report does not include employees who are not subject to insurance premiums. They must be entered. This is what an accountant friend from a larger company advised me to do. I followed his advice. Everything is fine.

- Olga. My subordinate has the “Tester” program on his computer. He always uses it and makes all the necessary adjustments before the first shipment. The reports are not returned to us, since this program perfectly finds places that do not correspond to each other.

As can be seen from the reviews, the reasons for this situation can be completely different. Therefore, it is very important to once again carefully read the letters sent by the Federal Tax Service, especially those dated January 13 and 29, 2017. They contain all the necessary information related to the beginning of the application of new control ratios.

Explanations on refusals of the Federal Tax Service on the RSV form

Error formulations. Refusals come from the Federal Tax Service with the following wording:

What do the errors mean? These errors indicate that the Federal Tax Service database does not match the amounts specified in Appendix 1 to Section 1 (cumulative total from the beginning of the year) with the sum of the values for 3 months from Appendix 1 and the corresponding values for all employees for previous periods. These checks were implemented on the basis of LETTER dated December 29, 2022 N GD-4-11/ [email protected] All checks listed in the letter were implemented in the service.

Analogues of errors. We have warnings similar to the indicated errors received from the Federal Tax Service:

How to check for errors

- Enter each 2022 draft one by one. Check that the information is up to date. Current data is considered to be the data accepted by the Federal Tax Service, taking into account all adjustments.

To download several reports (corrective) in succession without deleting previous data, we recommend importing reports through the “Actions” menu in Section 3.

- Enter the draft of the current period and update the data for the previous period using the button in the lower left corner “Update data for the previous period.”

- In section 3, switch all fields to auto-calculation mode using the “Actions” button.

- Bring the amounts in the appendices to section 1 into line with section 3. You can use the automatic calculation of sections.

- Please check your report before submitting.

Reconciliations of amounts between sections 3 and 1 occur only if the report is original (on the title “adjustment number = 0”). If the report is corrective, you can change its attribute during the check, and after checking, return the adjustment attribute.

- If the data is up to date in all periods, the checks have been passed, there are no errors or warnings within the service, but a notification of refusal (clarification) is received with the wording indicated above, the issue of discrepancies in the database must be clarified with the Federal Tax Service.

Error 0400400017 in the calculation of insurance premiums

Error 0400400018 in the calculation of insurance premiums

No. BS-4-11/14022. How to correct the unified calculation of insurance premiums. The company can receive from the inspection:

The Federal Tax Service gave instructions in case an error crept into section 3 of the calculation of insurance premiums.

An accountant has only two options. Error in individual information To clarify the personal data of individuals in section 3 “Personalized information about insured persons,” you need to fill out the calculation as follows:

Info So, the factors that cause errors in code 0400400011 may be different, but basically the reason lies in the discrepancy between the indicators indicated in the report.

Error code: 0400400017 in the calculation of insurance premiums - how to fix

Previously, section 3 could not be filled out for the specified employees, since benefits up to one and a half years are not subject to contributions to the Pension Fund. When submitting this report in column 1, the mentioned non-taxable benefit can be taken into account.

Also, the description of the error with code 0400400017 may have a more abstract text form: Let's figure out how to solve the error when submitting reports. This is interesting: The solution to error 0400400017 in the calculation of insurance premiums may consist of implementing a number of the points below: Once again, carefully and scrupulously check all the data you have submitted for relevance.

DAM for the 2nd quarter of 2022: sample of filling out a new form

The quarterly calculation of insurance premiums is submitted to the tax authorities no later than the 30th day of the month following the reporting period. If the established day for submitting the report falls on a weekend, then in accordance with the law it is postponed to the first working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

For 2022, the following deadlines for providing quarterly calculations have been established:

Entrepreneurs running peasant farms do not submit quarterly reports; the deadline for submitting the annual report is set, as for other organizations, no later than January 30 of the following year. But since the 30th falls on a Saturday, the deadline is moved to the next working day, February 1, 2021.

Error 0400400011 in the calculation of insurance premiums

These may be CHECKXML+2NDFL 2022, “TESTER”, “Taxpayer Legal Entity”, “Contour”, “” for users of the Buhonline website, and other tools; You can call the tax officer who accepts reports from your organization and ask for clarification of the reason for the refusal .

Tax officials themselves advise to wait a couple of days first, and only then submit the payment to the tax office. At the same time, the tax base is also not immune from errors in it, and it is quite possible that the employee appears in it with completely different data (TIN or SNILS).

Computer help

The first is general annual indicators; The second is the indicators for the first three quarters with the addition of the amount for the last quarter. And I found a discrepancy as a result.

For the first time, the calculation of insurance premiums began to lead to this problem en masse at the beginning of last year (2018), when the state tax service began to use completely new control ratios.

Typically, the automatic program used for reconciliation with the Federal Tax Service also sends the actual amount of the difference that was discovered during the process. For example, the reason why error 0400400017 occurs may be the absence of any non-taxable benefits in the corresponding line.

An employee of the organization simply forgot to include such benefits in quarterly reports, while they were taken into account in the general report.

Correction method

Fortunately, there are quite a few ways to answer the question - how to fix this error. Each of them can be effective, so it’s worth familiarizing yourself with all the possible options:

- Once again, scrupulously double-check each amount, figure, and their location in the required lines of the report. If the organization sending such reports to the Tax Service employs several accountants, then it is recommended to assign a similar task to all of them. And then – compare the results obtained;

- Pay special attention to the third section, where data adjustments may be required due to the lack of information on some employees;

- Try using specialized software. “Tester” is used for automatic verification. To do this, you will need to initially download the program and install it on your computer’s hard drive. Very often this method is the most effective, since the automatic search for inconsistencies leads to their visual display on the working screen;

- The last option is to call representatives of the Federal Tax Service and outline the situation. If the circumstances are favorable, the tax officer will point out the existing reasons and tell you how to get rid of them.

Of course, the question arises:

What will happen if, even after making all the changes and amendments, the Federal Tax Service still reports the same unpleasantness with code 0400400017?

There is no need to panic ahead of time. There is more than enough time for the next adjustments - five whole days. During this period, you can double-check literally every symbol, get all the necessary advice, and invite more experienced specialists.